Industry

What lies ahead for manufacturing

In 2023, can expect a rising volume of deals, and a surge in mergers and acquisitions

2022 was an extraordinarily challenging year. Russia’s invasion of Ukraine in February jolted the global economy, fuelling inflationary pressures as energy prices spiked and international supply lines were disrupted. That was followed in March by the start of a series of interest rate hikes from the US Federal Reserve that were among the steepest in history. With potential acquisition targets still expecting the high valuations that had prevailed in 2021, investors became quite selective in their pursuits. Although the volume of M&A in healthcare and life sciences subsectors fluctuated through the remainder of 2022, few subsectors got back to the high point of the first quarter.

Yet, the extraordinary challenges of 2022 could not slow rapid innovation and strategic repositioning by companies in many subsectors. Deal making continued, often in the form of smaller acquisitions, partnerships, and licensing agreements. In many cases, these deals were designed to increase investment as research, development, and marketing milestones were achieved. Inflation, high borrowing costs, and an impending recession affected various subsectors and companies, depending on their resilience to economic downturns, and the availability of cash for acquisitions.

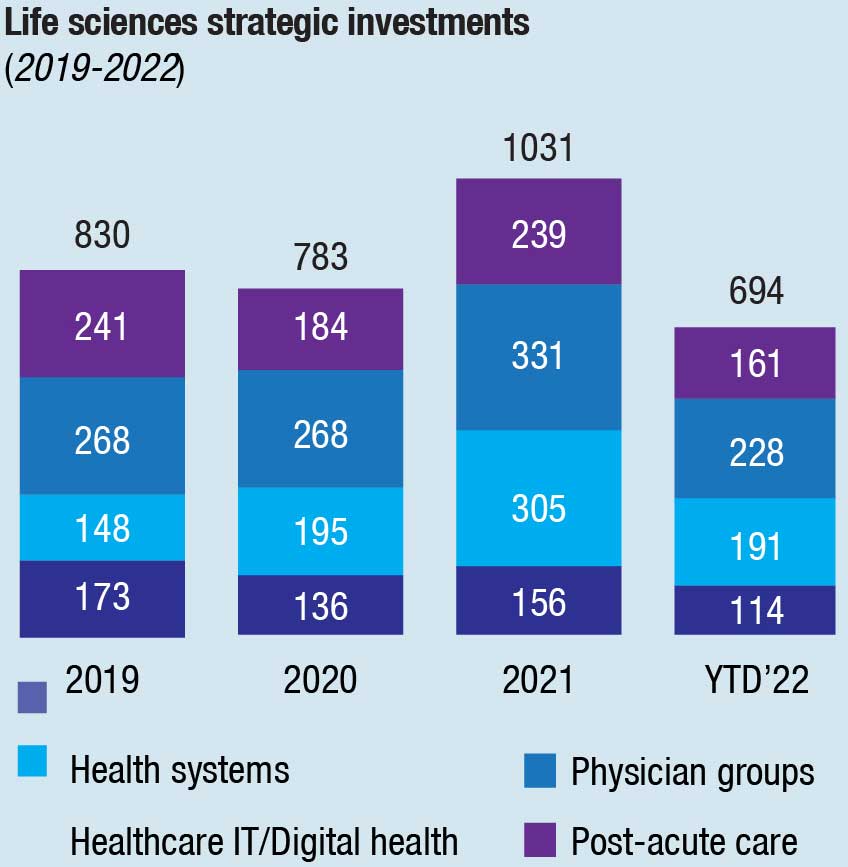

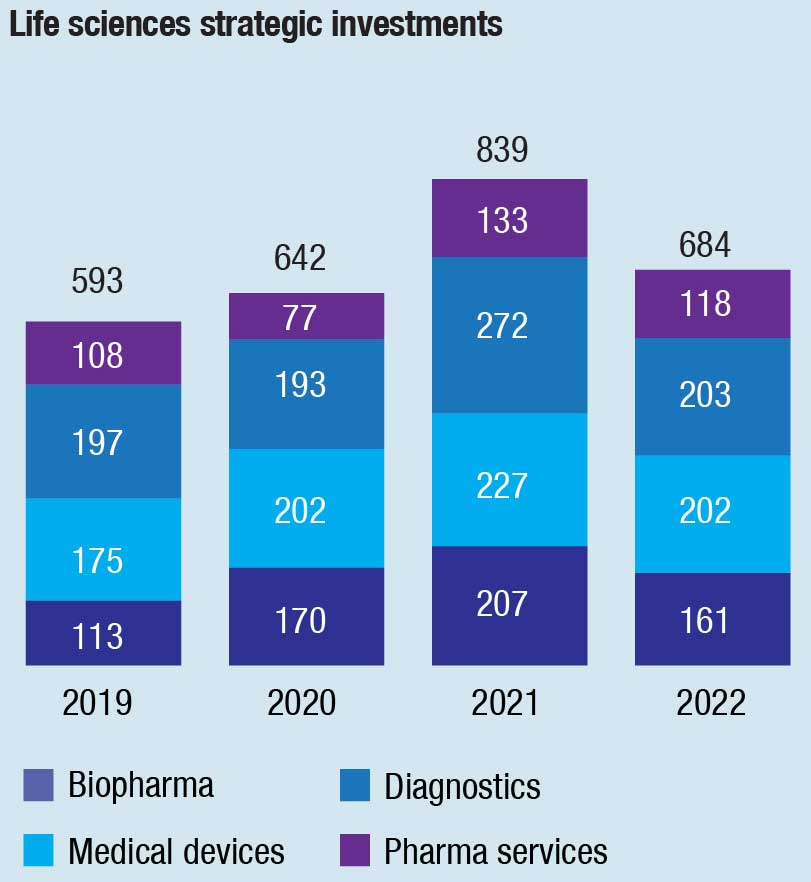

There was a sharp drop in the number of announced healthcare and life sciences deals in 2022 from the heady levels of 2021. Some large deals in HCLS still took place. Overall, there were 1307 deals in healthcare, compared with 1859 in 2021 and 1370 in 2020. In life sciences, the number fell from 1330 in 2021 to 1074 in 2022. The numbers for life sciences remained above pre-pandemic levels, and healthcare deals in 2022 were about the same as in 2019. In terms of strategic investments, those deals for life sciences companies dipped below the highs of 2021 but remained above 2019’s pre-pandemic levels. In healthcare, strategic deals fell even more, dropping below figures for 2019, 2020, and 2021.

KPMG expects deal volumes to grow in 2023 even as economic conditions become more challenging and other industry headwinds remain. Investors cannot ignore the challenges ahead. Concerns about inflation and rising interest rates, competition for the most valuable targets, and other factors will likely impact deal plans and activity throughout the year ahead.

Diagnostics Manufacturing

New paths to growth

The waning of the Covid-19 pandemic has brought a sharp decline in demand for Covid-19-related testing, forcing the diagnostics industry to explore other paths to growth. Some of that will involve a return to other kinds of physician-ordered testing as in-person patient visits have rebounded to pre-pandemic levels. The long-term legacy of the Covid-19 response, however, will be more decentralized testing, moving testing from reference labs to hospital labs, urgent care centers, pharmacies, and at-home testing.

Rapid innovation, with changes in the kinds of tests that are offered, where they can be conducted, and the speed and accuracy of results, is changing the face of diagnostic testing, and fueling transactions throughout the industry. Companies are making acquisitions and forging partnerships to position themselves for this new future.

How diagnostics fared in 2022

In 2022, the volume of diagnostics company deals was about 23 percent lower than in a very robust 2021. In 2021, there were 272 strategic investments, compared with 203 in 2022. Deals by financial investors also declined from 110 in 2021 to 90 in 2022. Overall, diagnostics deal volume was about 7 percent higher than in 2019, before the pandemic.

As in other life sciences subsectors, diagnostics companies experienced lower deal volume in 2022 after the boom year of 2021 amid the slump in the value of public companies. Another factor was the gap between the expectations of sellers and what buyers were willing to pay. Deal volume for diagnostic companies dropped from 272 strategic investments and 110 financial investments in 2021 to 203 and 90, respectively, in 2022.

KPMG analysis

While diagnostics companies have largely gone through the cash generated by peak Covid-19 testing, most companies are still generating adequate revenue to fund deals. Small deals and partnerships aimed at innovation were also completed and announced.

Decentralized testing. The migration of Covid-19 testing out of care facilities has spurred consumer demand for the same convenience for other kinds of tests. Early in the year, Labcorp announced a partnership with Getlabs, a diagnostics start-up to which it had contributed Series A funding. Getlabs operates by sending a phlebotomist to patient homes to collect blood, saliva, urine, or stool, then delivers samples to Labcorp for testing. And Wellfleet, a student health insurer, has partnered with binx health, a technology and diagnostics company that provides in-dorm HPV testing.

Speed, accuracy, and convenience. Covid testing often required a trade-off between PCR accuracy and the speed and convenience of antigen testing. Now companies are looking to move past that compromise as they build on the Covid-19 experience. Sorrento acquired Virex Health, which provides high-sensitivity home testing for Covid-19 as well as an early liver cancer biomarker and testing for other diseases while utilizing the manufacturing infrastructure for diabetes glucose strip tests and glucometers. Sherlock Biosciences seeks to provide antigen-test convenience with PCR-like accuracy for molecular diagnostics for potential applications that include infectious diseases, early detection of cancer, treatment monitoring, and precision medicine. The company has licensed CRISPR-Cas13 technology from Harvard’s Wyss Institute, and in 2022 signed a licensing agreement with Shanghai-based Tolo Biotech that will expand the diagnostic company’s markets beyond the United States and into China. Visby Medical, supported by USD 100 million in PE funding, offers STD testing and other rapid, highly accurate at-home tests.

Notable deals of 2022

PerkinElmer announced in August the planned divestiture of three non-core businesses to New Mountain Capital. These sales advance the company’s goal to focus on developing and commercializing innovative diagnostics and life science research tools and services.

Quidel’s USD 6-billion deal to acquire Ortho Clinical Diagnostics, announced in 2021 but closed in 2022, expands access to clinical chemistry, immunoassay, immunohematology, donor screening, and point-of-care diagnostics.

Thermo Fisher has been actively broadening and deepening its diagnostics capabilities. In 2021, it acquired Mesa Biotech, whose powerful testing platform uses PCR technology for molecular testing of Covid-19, flu, and respiratory syncytial virus. In 2022, Thermo acquired The Binding Site, which develops diagnostic products to detect and monitor protein-based blood disorders, such as multiple myeloma.

South Korea-based SD Biosensor and SJL Partners acquired Meridian Bioscience, an in-vitro diagnostics company, to facilitate SD Biosensor’s entry into US markets, utilizing Meridian’s distribution network and expertise in the regulated US market.

Investment considerations –2023

The top three areas for M&A activity in 2023 are expected to be digital pathology, liquid biopsy, and apps and digital. That is a departure from the previous two years, when the top three were point-of-care testing, driven by the pandemic, next-generation sequencing (NGS), and liquid biopsy.

Interest in digital pathology is not new. It has been on slow burn for the last 20 years given its obvious practicality because cloud storage uses much less space and is less expensive than keeping blocks in an Iron Mountain storage unit like some hospital systems must do. However, its execution has been more challenging due to acquiring and adopting digital pathology systems with the speed and connectivity needed.

As investors and diagnostic manufacturers prepare for long-term sustainable growth in areas with high unmet needs, one path forward is to deploy resources gained from Covid-19 in technologies, such as oncology genomics that aid in early screening. In contrast to the past few years, when most capital was deployed for molecular diagnostic tests for Covid-19, and other infectious diseases, there may be more emphasis now on diagnostic testing used for cancer screening, risk assessment, and monitoring for minimum residual disease (MRD) detection and relapse. Those are areas in which additional innovation is required at a time when oncology is expected to be a huge driver of revenue growth for biopharmaceutical companies.

Smaller companies played a key role in developing and commercializing several rapid, easy-to-use molecular testing platforms during the pandemic, and partnering with academic labs and diagnostic start-ups will continue to be an important approach for large diagnostic manufacturers.

Investments in disease surveillance, monitoring, real-world data, analytics, artificial intelligence, and machine learning could also help fuel new growth in diagnostics. The FDA’s creation of the Covid-19 diagnostics evidence accelerator is one example of how real-world evidence can be used to facilitate real-time monitoring of diagnoses and provide clinical data to inform public health decision making. PathAI’s multiyear collaborations with BMS and other pharmaceutical companies, which focus on translational research in oncology, immunology, and fibrosis23, demonstrate how capital may increasingly be deployed in these areas. Post Covid, diagnostic manufacturers and investors should consider investing in monitoring and surveillance of other pathogens that have the capacity to cause future disease outbreaks. The WHO recently convened a workshop outlining the objectives for effective genomic surveillance of pathogens worldwide, and a key component of that work will require genomics tools, such as sequencing technologies and analysis software as well as the training of personnel in genomics and bioinformatics in countries around the world.

The take-away

The impact of post-pandemic demand for innovative, decentralized diagnostic testing appears to be in its earliest stages and is likely to have a lasting impact on deal making in this subsector. This is leading to a surge in M&A and partnerships, including between reference laboratory stalwarts and start-ups that send tests and technicians into the home. Investments in wide-ranging areas – from digital pathology to liquid biopsy – will help shape diagnostics manufacturing. In 2023, we expect a rising volume of deals, especially if buyers and sellers become more realistic about valuations, even as companies grapple with recession, inflation, and the high cost of capital.

Medical devices – Questions remain over rise in demand

Where there’s innovation there is opportunity in the year ahead for makers of medical devices. In interventional cardiology, robotic surgery, and some other areas, rapid innovation is improving the outlook for devices companies, and is likely to lead to additional deal making as industry leaders look to bolster and shape their portfolios. But areas, in which there are few new products or technologies, including orthopedics, may lag amid tepid demand for their products and questions about future growth.

Overall, demand improved in 2022, as more patients saw their doctors in person again, and scheduled elective procedures that had been delayed by the pandemic. This benefited companies in several devices areas, including general and plastic surgery, endoscopies, orthopedics, and cardiology. Yet, even now, there are questions about how robust and sustainable that demand may be as patients consider whether certain procedures are really needed or are safe to undergo amid lingering Covid-19 infection risks. Further complicating this bounce-back are labor shortages at many hospitals, which have resulted in difficulties for patients trying to schedule backlogged elective procedures.

In addition, supply chain bottlenecks have continued to affect manufacturers of medical devices. In 2022, there were shortages of devices for anesthesiology, cardiac care, plastic surgery, radiology, testing, and ventilation, as well as shortages of personal protective equipment. Supply problems have driven up costs and put pressure on margins, while inflation and rising interest rates have added to the headwinds for many devices companies.

Innovation has been a boon for companies in diabetic care, robotic surgery, and interventional cardiology. But as the number of M&A transactions in the subsector dropped this year, smaller add-ons have largely replaced big mergers, and devices companies are focusing on product improvements or expansions to capture more patients, such as Insulet’s 2022 launch of the Omnipod 5 for automated insulin delivery for the Type-2 diabetes patient population. In addition, MannKind Corporation acquired the V-Go once-daily insulin delivery device to expand its mealtime insulin delivery solutions.

How medical devices fared in 2022

Even during a difficult 2022, 288 medical devices company deals were announced. That was down from 337 in 2021, but close to deal volumes in 2019 and 2020.

These innovations and advances drove the medical devices industry in 2022:

Innovations in cardiac care. Leading devices companies moved to bolster their capabilities in cardiology. In a USD 16.6-billion deal announced during the fourth quarter, Johnson & Johnson’s growing Medtech division acquired Abiomed, a leading maker of cardiac care technology. In a USD 946-million deal, Medtronic acquired Affera, whose cardiac mapping and navigation platform is used in ablation, a minimally invasive treatment for atrial fibrillation. Boston Scientific completed its USD 1.75-billion acquisition of Baylis Medical Corporation, which makes advanced components for catheter-based heart procedures; and it also acquired privately held Obsidio, manufacturer of a technology recently approved by the FDA to stabilize blood vessel malformations.

Advances in other devices areas. Advances in insulin pumps, continuous glucose monitoring, and hopes for an artificial pancreas are transforming diabetic care, and the market for diabetes-related devices is projected to grow at a double-digit annual rate. Deals in this area in 2022 included Tandem Diabetes Care’s acquisitions of AMF Medical, which makes a patch pump for insulin delivery, and Capillary Biomedical, a maker of wearable infusion sets for connecting to insulin pumps. Innovations in robotic surgery, minimally invasive surgery, and interventional cardiology devices are also buoying some devices makers, and there is also strong interest in 3D printing. In a 2022 deal to add devices for minimally invasive endoluminal surgery, Boston Scientific entered into an agreement to acquire Apollo Endosurgery, while Aspen Surgical Products, owned by Audax Private Equity, acquired Symmetry Surgical, a maker of devices for minimally invasive surgery. Wearable tech for remote monitoring of blood pressure, oxygen saturation, falls, and other vital signs continue to gain popularity, and the use of virtual reality for training, pain management, and other applications is increasing.

In 2022, the FDA authorized 91 AI- or machine-learning enabled medical devices. With more and more devices connected to the internet, the need for cyber security is also getting attention from medical devices companies, with blockchain technology expected to be a crucial resource.

Investment considerations–2023

Looking ahead to 2023, some segments of this industry subsector appear particularly promising. A surge in demand for some devices makers could help shape the medical devices deal-making outlook.

What are acquirers looking for in 2023? Elective-procedure devices manufacturers are looking at targets based on their underlying technology, while some will be focused on tuck-in acquisitions to expand market share or are interested in large-scale acquisitions or mergers.

Tailwinds

Resurgence of demand. The resumption of elective surgery and procedures across most medical specialties that began in 2021 continued in 2022 and should encourage deal making for medical devices manufacturers in 2023.

Pursuit of early-stage innovation. Major devices companies, including Stryker, Olympus, and J&J, have established their own innovation labs and venture capital arms to help develop next-generation technology. In July 2022, for example, Olympus Innovation Ventures completed its first investment, providing Series A funding to Virgo Surgical Video Solutions, whose AI-powered platform records endoscopic procedures and identifies patient candidates for inflammatory bowel disease clinical trials.

Possible normalization of valuations. If public markets trend upward while potential sellers become more realistic about valuations, it could release pent-up demand for M&A.

Headwinds

Pressure on margins. The need to reshore supply chains, among other changes made to improve manufacturing efficiency, is increasing expenses for medical devices companies, which have a limited ability to pass along those costs.

Uncertainty about how much elective procedures will rebound. An emphasis on low-touch non-invasive care could slow the return to pre-pandemic levels of elective procedures.

The ongoing shift to value-based care. This change in reimbursement forces providers to assume more financial risk and could negatively affect markets for new devices that do not have a clear benefit.

The take-away

After a challenging year, in which the market value of leading medical device companies fell sharply, this subsector could continue to face headwinds in 2023. As hospitals and other purchasers demand discounts, company margins are pressured by the high costs of reshoring supply lines, and other changes to improve manufacturing efficiency. But in this environment, M&A is likely to increase as companies focus on product improvements or expansion and look to consolidate their positions in cardiology, diabetic care, and robotic surgery.

Outlook

After a year marked by historic upheavals and great uncertainty for HCLS companies, the outlook of industry leaders for 2023 is optimistic – if tempered with realism about the scale of ongoing challenges. Although much of HCLS has proven to be recession-resistant, strong economic headwinds are likely to impact company balance sheets and valuations, adding to the need for strategic adjustments and clear-eyed deal making. Identifying M&A targets that will repay substantial acquisition costs in a fluid marketplace will be more important than ever.

If, after holding off on deals during an exceptionally turbulent year, buyers and sellers can negotiate terms that benefit both sides, pent-up demand for portfolio shaping, consolidation, and strategic partnerships could lead to a resurgence of M&A in 2023.

Concerning obstacles include heightened regulation, valuation uncertainty, fluctuating demand for goods and services, and labor shortages.

But the appetite for identifying and executing the right deals remains strong. As 2023 gets under way, KPMG report concludes that companies in HCLS subsectors will prosper. With vision and diligence, these companies will find the resilience and strength to move forward in an uncertain world.

Based on KPMG report, 2023 Healthcare and Life Sciences Investment Outlook.