Immunochemistry Instruments and Reagents

Workhorse of the diagnostic industry

Advances in genetic knowledge are creating new markets for immunoassay, while traditional immunoassay maintains a strong position in the growing market for clinical diagnostics.

The workhorse of the diagnostic industry is finding new legs. The pandemic has created a new demand for rapid easily available diagnostics. Immunoassay is stepping up. Direct detection of SARS-CoV-2 viral proteins (antigens) in nasal swabs and other respiratory secretions using lateral flow immunoassays (also known as rapid diagnostic tests, RDTs) offers a faster and less expensive method to test for SARS-CoV-2 than the reference method, nucleic acid amplification tests (NAATs).

Advances in genetic knowledge are creating new markets for immunoassay. Rapid diagnostics, point-of-care (POC), biomarkers, and consumer markets are all areas of expansion, while traditional immunoassay maintains a strong position in the growing market for clinical diagnostics.

With chemiluminescence immunoassay (CLIA) systems are gaining momentum, this in turn results in a decline in ELISA tests. RIA and fluorescence immunoassay (FIA) are age-old procedures, which over time have been replaced by ELISA. Rapid tests can reveal the test results in less than 30 minutes; hence, these are preferred for screening. ELISA, on the other hand, continues to be trusted as a gold standard, owing to its extremely high sensitivity, specificity, precision, and throughput.

The global immunochemistry market is projected to reach USD 39.0 billion by 2026 from USD 28.4 billion in 2021, at a CAGR of 6.6 percent. The advancing technology of immunoassay and the increasing adoption of the immunoassay products are thrusting the growth of the market. The rise in demand for POC testing devices, and the increasing adoption rate of these devices, boost the growth of the immunoassay market. The availability of adequate and sensitive diagnostics tests is also fueling the growth rate of the immunoassay market. The increasing adoption rate of companion diagnostics, which can assist professionals in making decisions by analyzing the patient response to the therapy, is presumed to offer growth opportunities for the market stakeholders in coming years.

Reagents and kits account for the largest share of the immunoassay market and is expected to grow at the highest CAGR. The large market share is attributed to their repetitive purchase and high consumption for the diagnostic purposes.

Based on technology, ELISA accounts for the largest share of the immunoassay market. The large market share is attributed to high use of immunoassay tests to diagnose cancer, infectious diseases, and other chronic complications.

The stringent regulatory procedures for approval of the immunoassay products, and the technological hurdles of the immunoassay kits and reagents, have impacted the market. The immunoassay market in several countries has witnessed massive growth amid the pandemic, owing to the mass-scale diagnosis of COVID-19.

The prominent players operating in global immunoassay market include Danaher, Thermo Fisher Scientific, Abbott Laboratories, and Roche.

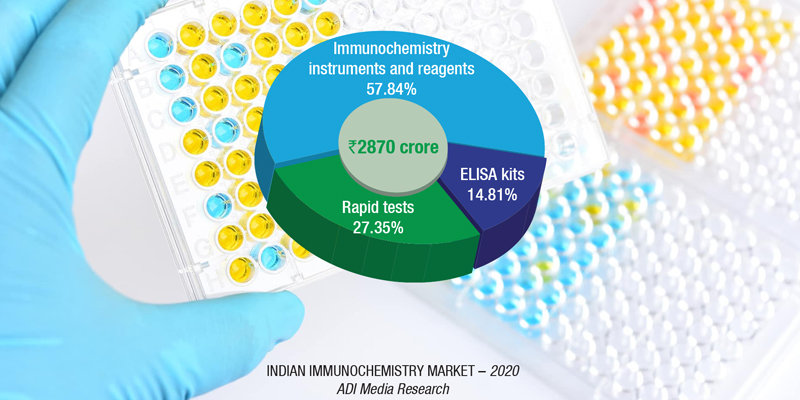

The Indian immunochemistry instruments and reagents market, in 2020, sans the COVID-19 rapid antigen tests is estimated at ₹1660 crore, a significant drop from ₹1912 crore in 2019. Reagents continue to dominate the segment, with an 89-percent share at ₹1480 crore.

The 22-percent decline, with the setback from COVID-19, hit the entire industry. There was some respite from the antibody tests conducted, but they only picked up pace later in the year. The serosurveys, conducted on a large number of people, by the government in several parts of India, testing the presence of antibodies, led to demand for the product.

|

Major vendors* in immunochemistry |

|

| Tier I | Roche |

| Tier II | Abbott and Siemens |

| Tier III | Beckman Coulter and OCD |

| Tier IV | bioMérieux, Transasia, Mindray, and Agappe |

| Others | Tosho, Bio-Rad, Maglumi (SNIBE and Immunoshop), and CPC |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian immunochemistry instruments and reagents market. | |

| ADI Media Research | |

In fact, the first quarter of 2021 has also been slow. It is only in May that the industry began to see some momentum. The government and the private sector started placing orders again, with a distinct bend toward automation. The incidence of COVID-19 has changed the mindset, and now all laboratories have automation high on the agenda. However, with mandatory accreditation still not enforceable, the unorganized segment continues to thrive, and with it the inefficiencies in the system.

Roche dominates this market, followed by Abbott and Siemens, each at a 12–13 percent market share. Beckman Coulter and OCD are at around a 10-percent share, with bioMérieux estimated around 7 percent. Agappe, Transasia, and Mindray are also aggressive.

The market in 2021 is expected to see 25–30 percent increase over the 2019 sales figures.

An increase in the incidence of target diseases is a major driver for the immunochemistry instruments and reagents market. The incidence rate of diseases, such as viral infections, cardiovascular diseases, cancer, or hormonal disorders is increasing worldwide, mainly due to poor lifestyle choices. There is a rising focus on biomarker development across the globe as they help in detection of various diseases in their initial stage. Immunochemistry plays a crucial role in the development of biomarkers; thus, with the growing demand for biomarkers, the market for immunochemistry instruments and reagents will also flourish. Furthermore, government support in terms of funds and grants has also provided much needed impetus to this market. Moreover, increasing focus on drug monitoring and growing incidences of various diseases are other factors driving the growth of the market. In addition to this, technological advancements due to which automated and more accurate instruments are present in the market is another major factor propelling the growth of the market.

Considerations when buying. When buying an immunoassay analyzer, lab personnel keep in mind that they will benefit from selecting instruments that require minimal human intervention and training for sample processing, while also allowing them to scale up as needed to meet future needs. Lab personnel save time, standardize processes, and eliminate errors by using automated immunoassay analyzers. Lab leaders also examine the support and service options offered by various manufacturers, since the one they choose will play a key role in ensuring that vital assays are processed without interruption. Professionals in the laboratory always consider what the future may hold for them.

If the analyzer in issue enables the laboratory to operate at a faster or more efficient rate, the laboratory will be able to boost production and, as a result, profit. When comparing an older product to a modern analyzer with the newest technology, the newer software will almost certainly allow for more exact results, which will increase the validity of output data inside the laboratory.

Considerations when upgrading. Some of the examples when a lab may consider upgrading their immunoassay analyzer, listing a financial reason first.

Alternative products offer a better return on investment. If a new product is on the market which offers features that would enhance the laboratory’s testing capabilities, then it would be beneficial for the lab to invest in an upgrade in order to further improve its productivity.

Increased wear and tear. If the analyzer has been used over a long period, and is now suffering from increased wear and tear, resulting in growing downtime, which negatively impacts performance, then a laboratory should consider an upgrade to prevent this downtime and constant maintenance requirements from impacting their performance.

Outdated software. Many older analyzers will not have the software available in more modern analyzers. Outdated software may increase processing time and act only to negatively impact throughput time. Generally laboratories tend to upgrade analysers.

Buying for today’s needs may not be the best way to position the laboratory for future development and expansion.