ECG Equipment

Year after year, ECG remains a vital tool

ECG will remain a vital tool in the diagnostic cardiology toolbox, and its presence is expanding across inpatient, outpatient, and home settings.

The twenty-first century has seen the convergence of medicine and technology to bring once dedicated, cumbersome, single-function machines to a mobile, compact, and multifunction platform.

There has been a trend over the past decade toward smaller, more compact, mobile ECG monitoring systems. These can be used either inside a hospital or clinic, or on the road with a visiting nurse, or on a cart for mobility between patient rooms. While the traditional 12-lead ECG system will remain a mainstay in cardiac diagnostics in the clinical or hospital setting, the future of cardiac assessment may shift to patients triaging themselves before requiring analysis by these more complex systems.

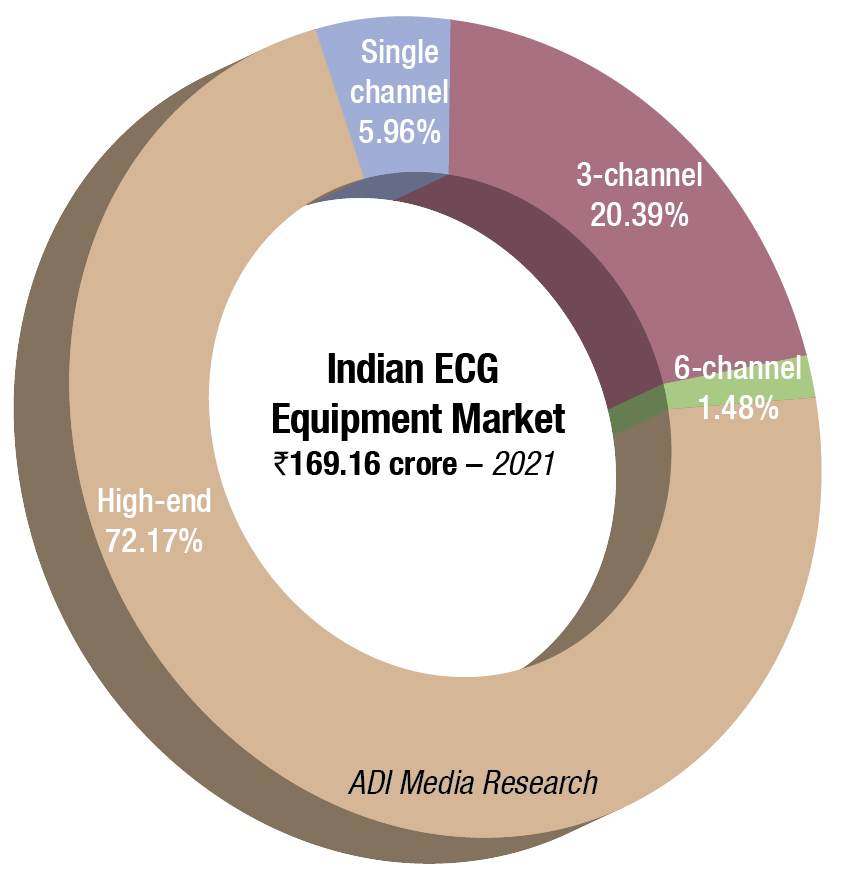

The Indian ECG equipment market in 2021 is estimated at ₹169.16 crore, at 30,500 units, a 12.4-percent increase by value and an 18.7-percent increase by quantity over 2020. With a limited number of vendors offering single channel, it is the very price-conscious buyers in selected geographical areas as New Delhi and East Gujarat that are buying single-channel machines. The price differential between 6-channel and 12-channel has been narrowing. As a result, the majority of customers are opting for the 3-channel models, while the discerning customers for the 12-channel systems. The combined share of 3-channel and high-end systems is 92.56 percent by value and 81 percent by quantity.

The high-end segment saw a 12-percent increase by value and quantity, and the market is estimated at ₹122.08 crore and 14,963 units. Within this segment, it is the 12-channel that dominates with a 71.6-percent share by value and 89.8-percent share by quantity.

|

Major vendors* in Indian ECG equipment market – 2021 |

|

| Tier I | BPL and GE |

| Tier II | Schiller, Philips, and Contec |

| Tier III | Mindray, and Edan |

| Tier IV | Nidek, Allengers, Bionet, Mortara, and RMS |

| Others | Skanray, Nihon Kohden, Nasan, Medikit, Forest, Silverline Meditech, and regional brands, Omron (recent launch) |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian ECG equipment market. | |

| ADI Media Research | |

The Covid-19 outbreak not only brought the economy to a standstill, but also brought to light inadequacies in health systems, thereby energizing interest in technologies that could accelerate patient outcomes where physical initiatives alone would not suffice. The pulse of the digital health ECG has dramatically picked up since 2019 across key areas like AI, telehealth, medical devices, mental health, digital therapeutics, Omics, and health IT, with funding surpassing the 2020 total by 27 percent as per CBInsights data. India’s digital health ECG showed a 41-percent increase in funding year-on-year. With key funding in digital health having grown, the overall India digital healthcare market is expected to reach USD 5 billion by 2023, growing at a CAGR of 39 percent.

The biggest advancement in ECG systems in recent years has been the movement to greater interoperability and digital formats. But other technologies are beginning to be integrated into ECG systems, such as aids to properly place leads, artificial intelligence, and a way to extract additional information from ECG to increase diagnostic value.

Market-leading vendors move toward vendor-neutral interfaces. One of the big issues for larger hospitals or healthcare systems several years ago was the lack of interoperability between ECG systems and ECG management systems, because many operated using proprietary programing. In the last few years, many vendors have moved toward using open-platform standards that are easier to interface with other vendors’ technology, including use of DICOM format waveforms and HL7 IT interfaces.

The main diagnostic ECG market is made up of 12-lead resting ECG systems. This is followed by stress ECG systems and then the remote cardiac monitor segment, which included Holter monitors and cardiac event monitors. Today, all of these devices should be able to integrate into a central ECG management system or they will face replacement.

ECG systems moving to full digital formats. In the past decade, ECG systems have moved from technology that was largely not compatible with different vendors’ cardiology reporting systems or electronic medical record (EMR) systems. The main focus of older-generation systems was on a paper printout, but today’s systems now require easy IT interface, compatibility, and digitally stored waveforms to be compatible with increasingly paperless hospitals that use the EMR to access patient reports and data, such as ECGs.

Many of the major vendors in the ECG market sell multiple types of systems that are aimed at different markets, from smaller and less sophisticated versions, to premium systems. This is to address the different needs of a large, busy, urban hospital, which are not the same as those of physician offices or small remote sites.

Wavelet ECG in development may offer new data for cardiac diagnostics. Start-up company HeartSciences has been developing a new type of ECG system that may offer a new way of looking at the heart. Rather than the basic electrical activity waveforms standard ECG has used for a century, the MyoVista Wavelet ECG (wavECG) system uses continuous wavelet transform signal processing to provide new frequency and energy information. These colorful waveforms offer more data and can be used to detect cardiac relaxation abnormalities, associated with left ventricular diastolic dysfunction.

Integration of AI into ECG. Like many facets of healthcare, artificial intelligence is being developed to aid ECG interpretation. AI can examine ECG waveforms to pinpoint patients at higher risk of developing a potentially dangerous arrhythmia or of dying within the next year. The AI can take a deeper dive to extract more information out of the waveforms that may not be apparent, even for an experienced reader. Several such studies have been presented at the American Heart Association meeting over the past two years and published in cardiology journals. These types of algorithms will likely be seen appearing as options on the next generations of ECG systems.

The need to record and interpret consumer-grade ECGs in the future. In the past 5 years, there has been an explosion in wearable and handheld ECG-enabled devices and smartphone apps that allow anyone to record a 1–6 lead ECG. There also has been a lot of interest by cardiologists in these systems, like the AliveCor Kardia device or the Ekos ECG-enabled stethoscope. These systems are seen as a fast and easy way to better triage patients and get immediate information before sending a patient for more involved exams.

The Kardia device allows iPhones, or directly through the Kardia watch, to record a 30-second ECG strip and AI algorithms, then automatically assess the waveforms for various arrhythmias.

These waveforms and interpretation can then be e-mailed to the person’s doctor.

The newer generation of implantable cardiac monitors like the Medtronic LINQ, and numerous wearable, clinical-grade, stick-on cardiac monitors now offer interfaces with patients’ mobile devices so they can mark events. This data also is transmitted to a physician’s office or automated ECG remote-monitoring

system.

In the coming years, all of these types of ECG data will likely need to be integrated into ECG management systems to allow for a complete picture of the patient’s cardiac history. This is part of a larger movement that was included in the Affordable Care Act requirements that look to get patients more involved as a participant in their own care. Now that the technology exists and is proliferating, the question is how and where to integrate this data into the patient record.

2021 ushered in many new developments and discoveries, and 2022 will undoubtedly bring additional insights concerning wearables, remote care, and Covid-19. ECG will remain a vital tool in the diagnostic cardiology toolbox, and its presence is expanding across inpatient, outpatient, and home settings.