Company News

Azenta reports first quarter results for fiscal 2024

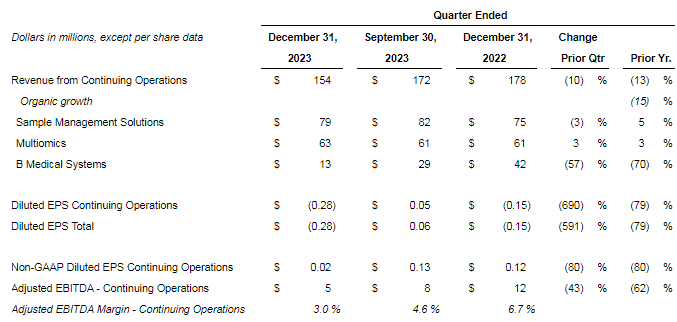

Azenta, Inc. reported financial results for the first quarter ended December 31, 2023.

Management comments

“First quarter results came in ahead of expectations as we continued to deliver against our objectives on the top and bottom line,” stated Steve Schwartz, President and CEO. “We have made good progress on our cost reduction initiatives and are seeing the benefits of these actions. This quarter marked our third consecutive quarter of positive free cash flow. Even in a softer market environment, we remain positive about our position as we move through fiscal 2024, and we believe that the actions we have taken over the past several months will allow us to continue to outgrow the market.”

First quarter fiscal 2024 results

- Revenue was $154 million, down 13% year over year. Organic revenue declined 15% year over year, which excludes the impacts of foreign exchange tailwinds of 1% and a 1% contribution from acquisitions. The year-over-year revenue decline was mainly attributable to lower B Medical Systems (“B Medical”) revenue. The combined Sample Management Solutions and Multiomics business segments grew 2% on an organic basis. In addition, the Consumables and Instruments (“C&I”) business remained a headwind to growth in the first quarter on a year-over-year basis. Excluding B Medical and C&I, revenue grew 5% on an organic basis.

- Sample Management Solutions revenue was $79 million, up 5% year over year.

- Organic revenue, which excludes the impacts from foreign exchange and revenue from acquisitions, grew 1%, driven by continued strength in large-automated Store Systems and Sample Repository Solutions, partially offset by a year-over-year decline in the C&I business. Excluding the C&I business, the segment grew 9% on an organic basis.

- Multiomics revenue was $63 million, up 3% year over year.

- Organic revenue grew 2% year over year, primarily driven by growth in Gene Synthesis and Next-generation sequencing services, partially offset by a year-over-year decline in Sanger sequencing revenue.

- B Medical Systems revenue was $13 million, down 70% year over year.

- Organic revenue declined 71% due to lower order volume in the quarter compared to the prior year, primarily attributable to timing of orders.

Summary of GAAP earnings results

- Operating loss was $27 million. Operating margin was (17.3%), down 180 basis points year over year.

- Gross margin was 39.9%, down 160 basis points year over year primarily due to product mix in B Medical, as well as increased amortization costs.

- Operating expenses were $88 million, down 13% year over year, driven by the impact of cost reduction actions implemented in fiscal year 2023, lower bad debt expense, decreased corporate expenses related to the accelerated share repurchase and governance-related costs, and lower commissions expense in B Medical.

- Other income included $10 million of net interest income versus $11 million in the prior year period.

- Diluted EPS from continuing operations was ($0.28) compared to ($0.15) in the first quarter of fiscal year 2023.

Summary of non-GAAP earnings results

- Operating loss was $9 million. Operating margin was (5.6%), down 560 basis points year over year. Excluding B Medical, operating margin was (3.0%), up 160 basis points year over year.

- Gross margin was 43.5%, down 190 basis points year over year, primarily due to product mix in B Medical.

- Operating expense in the quarter was $76 million, down 6% year over year, primarily driven by the impact of cost reduction actions implemented in fiscal year 2023, lower bad debt expense, and lower commissions expense in B Medical.

- Adjusted EBITDA was $5 million, and Adjusted EBITDA margin was 3.0%, down 370 basis points year over year.

- Diluted EPS was $0.02<, compared to $0.12 one year ago.

Cash and liquidity as of December 31, 2023

- The Company ended the quarter with a total balance of cash, cash equivalents, restricted cash and marketable securities of $1.1 billion.

- Operating cash flow was $26 million in the quarter. Capital expenditures were $12 million, and free cash flow was $15 million.

Share repurchase program update

- In the first quarter, the Company repurchased 2.3 million shares for $113 million under a 10b5-1 trading program.

- In fiscal year 2024, the Company intends to repurchase an additional $500 million in shares, which will complete the full capacity of the $1.5 billion share repurchase authorization announced in November 2022.

Guidance for continuing operations for full year fiscal 2024

- The Company is reiterating revenue and earnings guidance for fiscal year 2024:

- Total revenue is expected to be in the range of $696 to $718 million, reflecting total organic revenue growth in the range of 5% to 8% relative to fiscal year 2023.

- Adjusted EBITDA margin expansion is expected to be approximately 300 basis points.

- Non-GAAP diluted earnings per share is expected to be in the range of $0.19 to $0.29.

MB Bureau