Company News

Illumina reports financial results for Q4 and fiscal year 2023

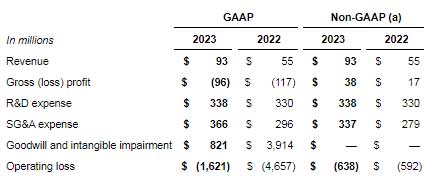

Illumina, Inc. announced its financial results for the fourth quarter and fiscal year 2023, which include the consolidated financial results for GRAIL.

“I’m pleased that in the fourth quarter, my first full quarter with the company, Illumina delivered results ahead of our expectations, driven by NovaSeq X instrument and consumables sales,” said Jacob Thaysen, Chief Executive Officer. “While our customers generally remain constrained in their purchasing, we are well-positioned for growth as market conditions improve. Illumina is focused on three key priorities to accelerate value creation: driving our top line; focusing on operational excellence, including boosting productivity, cost savings, and customer-focused innovation; and working to resolve GRAIL as quickly as possible.”

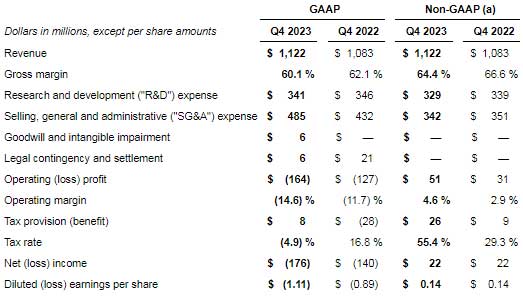

Fourth quarter consolidated results

Capital expenditures for free cash flow purposes were $51 million for Q4 2023. Cash flow provided by operations was $224 million, compared to cash flow provided by operations of $147 million in the prior year period. Free cash flow (cash flow provided by operations less capital expenditures) was $173 million for the quarter, compared to $59 million in the prior year period. Depreciation and amortization expenses were $109 million for Q4 2023. At the close of the quarter, the company held $1,054 million in cash, cash equivalents and short-term investments.

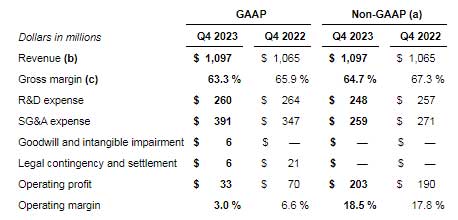

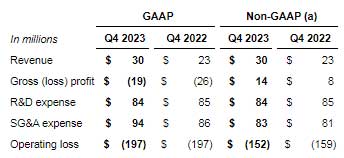

Fourth quarter segment results

Illumina has two reportable segments, Core Illumina and GRAIL.

Core Illumina

GRAIL

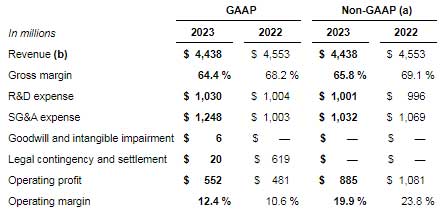

Fiscal year 2023 consolidated results

Capital expenditures for free cash flow purposes were $195 million for fiscal year 2023. Cash flow provided by operations was $478 million, compared to $392 million in the prior year. Free cash flow (cash flow provided by operations less capital expenditures) was $283 million for the year, compared to $106 million in the prior year. Depreciation and amortization expenses were $432 million for fiscal year 2023.

Fiscal year 2023 segment results

Core Illumina

GRAIL

Financial outlook and guidance

For fiscal year 2024, the company expects Core Illumina revenue to be approximately flat compared to fiscal year 2023 and Core Illumina non-GAAP operating margin to be approximately 20%. While Illumina continues to move as quickly as possible to resolve GRAIL, the company is focusing its financial outlook on Core Illumina, as the specific timing and impact of the GRAIL divestment remains uncertain.

The company provides forward-looking guidance on a non-GAAP basis. The company is unable to provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP reported financial measures because it is unable to predict with reasonable certainty the financial impact of items such as acquisition-related expenses, gains and losses from our strategic investments, fair value adjustments related to contingent consideration and contingent value rights, potential future asset impairments, restructuring activities, and the ultimate outcome of pending litigation without unreasonable effort. These items are uncertain, inherently difficult to predict, depend on various factors, and could have a material impact on GAAP reported results for the guidance period. For the same reasons, the company is unable to address the significance of the unavailable information, which could be material to future results.

MB Bureau