Industry

IVD industry – At the crossroads of innovation and expansion

Driven by technological advancements, a growing demand for personalized medicine, and the exploration of new markets, the IVD sector is poised for remarkable growth.

Diagnostics has transitioned and is more about preventing diseases from breaking out and maintaining and improving health levels. In the last couple of years, there has been an influx of new technologies, equipment, materials, and applications – ongoing and underway, and on all fronts like the genomics, the molecular diagnostics, the technology, instrumentation, materials used, or the software solution levels.

New technologies are making it possible to develop more accurate and sensitive IVD tests

Technological advancements are enabling the industry to move beyond just the diagnosis stage. The IVD space now plays a key role in not only identifying symptoms and diagnosis, but also in patient monitoring, personalized medicine, hospital management, and supporting physicians, clinicians, and patients.

When it comes to sensitivity and specificity improvement, there is no one-size-fits-all approach – some tests may have low sensitivity, whereas others may have low specificity. While latest technologies, such as molecular diagnostics, have a high specificity and sensitivity, for other types of rapid tests there is scope for improvement especially tests used for confirmatory purposes. Some recent advancements include:

NGS is being used to develop new tests for genetic disorders and cancer. Over the past decade, the price of next-generation sequencing has decreased roughly 100-fold. At the same time, new lower-cost players are entering the market, and the consolidation of health systems and group purchasing organizations are driving down net prices.

POC tests can be performed outside of a laboratory setting, and are becoming increasingly popular.

Precision medicine is on the rise, as it takes into account individual variability in genes, environment, and lifestyle.

AI is being used to develop new IVD tests and to improve the performance of existing tests. AI is also being used to develop new algorithms for data analysis.

Automation is at the forefront of technological advancements in the IVD sector. The increasing adoption of automation in instrument workflows promises enhanced efficiency and accuracy.

Moreover, the industry is witnessing a shift toward data-driven insights, with a focus on leveraging information generated by IVD instruments for personalized diagnostics and healthcare management.

Digital health platforms allow patients to access healthcare services and information remotely, reducing the need for in-person visits and improving patient outcomes. Digital health platforms can also be used to collect patient data and monitor patients remotely, allowing for more personalized care. Examples of digital health platforms include telemedicine platforms and mobile health apps.

Digitization and connectivity are also on the rise, with the development of remote diagnostics, data sharing, and telehealth applications, marking a transformative era in healthcare delivery.

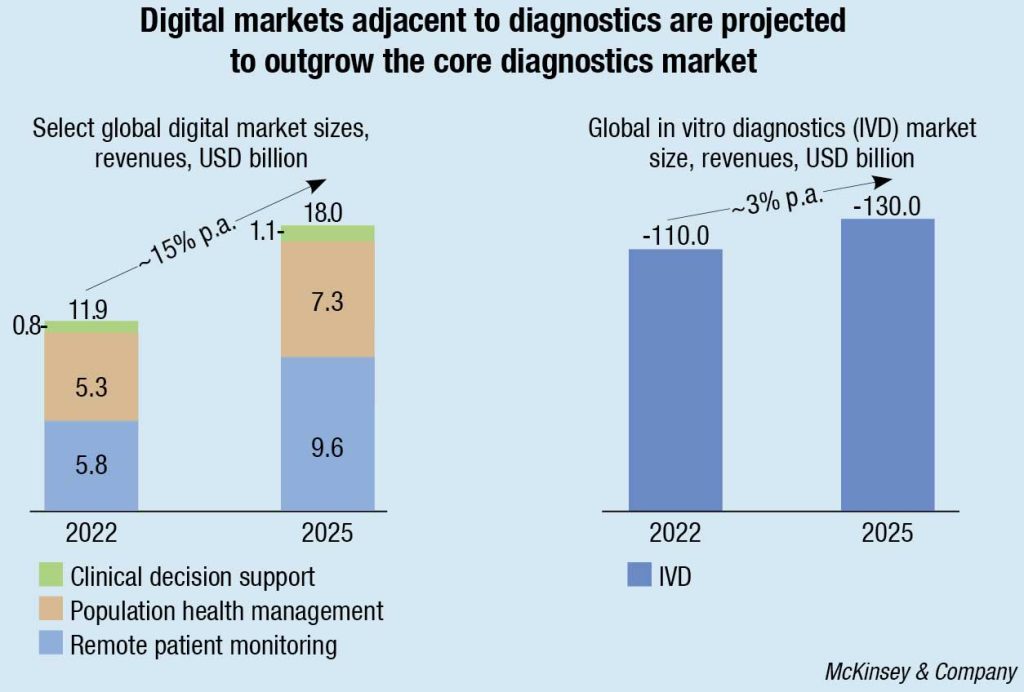

McKinsey research shows that select digital markets, adjacent to diagnostics, including clinical decision support, remote patient monitoring, and population health management, are projected to outgrow the core diagnostics market over the next several years. Of course, this value is not only for IVD players to capture. Other players, such as healthtech and data companies, are also eyeing the space. However, as developers of data-generating equipment are already being integrated into key clinical workflows, IVD companies have a right to play and could potentially use their position to become key stakeholders in the healthcare delivery ecosystem.

Addressing data privacy concerns, and ensuring cyber-security in an era of increasing threats are key hurdles for market players. Additionally, the ever-changing reimbursement landscape for IVD tests across different regions poses a challenge that requires adept navigation.

Innovation areas where opportunities exist

Leaders and pioneers in IVD are focused to accelerate advancements across several key innovation areas, including genomics, point-of-care and at-home testing, advancements in multiplex testing, and the complementary use of IVD alongside other diagnostic tools like imaging. Opportunities exist in established diagnostics categories, such as respiratory, sexual health, and hospital-acquired infections, as well as areas like oncology, neurology, emergency medicine, infectious disease, and DTC IVD.

As the respiratory testing market recovers from the effects of the Covid-19 pandemic and adjusts to a new normal, manufacturers must pivot and reset in a highly fragmented market with provider and patient needs that go well beyond the mainstay testing targets.

As this market is unlikely to reach the sales peaks seen during the height of the pandemic, manufacturers need to identify paths to effectively pivot their respiratory portfolios. As supply chain woes ease, it is reasonable to expect that labs and practices may streamline the number of manufacturers and individual devices maintained in their labs. As these decisions are made, it will be increasingly critical for diagnostics manufacturers to have a strongly differentiated portfolio, including a varied test menu and unique analyzer capabilities to justify continued placement in any given facility.

Test barriers, such as invasive and difficult sample collection and a long-standing sole focus on reportable disease testing, have resulted in a sexual health diagnostic market that is ripe for innovation. The current diagnosis and treatment process is onerous for patients, relying on invasive and potentially outdated methods and technology. Limited appointment availability increases the difficulty of obtaining treatment, all while patients are dealing with the general sense of embarrassment and stigma that often accompany (sexually transmitted infections) STI screening. Improving the testing process through speed, less invasive sample collection methods, expansion of STI test menus or multiplex testing, etc., offer the potential for an even more dramatic impact on testing and, ultimately, a substantial positive impact on a longstanding public health initiative.

Reducing HAIs with pre-emptive testing

Increased transparency and accountability requirements have incentivized hospital investment in devices and diagnostics that aim to prevent, diagnose, and treat hospital-acquired infections (HAIs). While early identification is key, hospitals today must make risk assessments based on need, speed, and associated expense to patients, payers, and health systems.

While post-infection diagnosis has been the focus of much IVD innovation and development, an opportunity exists to deploy diagnostic testing for infection prevention. To enter this category, diagnostics manufacturers will need to fully understand the healthcare journey from the perspective of both the patient and the physician to identify strong initial use cases that encourage uptake that can help manufacturers innovate to meet a need and to solve a problem with the goal of easing current challenges, rather than introducing another step that may further complicate an already complex process. In addition to overall cost, sample collection, contamination avoidance/identification, and workflow integration will likely be key to HAI diagnostic adoption. Ultimately, cost-effective innovations that provide improvements in HAI prevention or increased speed of detection could pay for themselves in saved hospital costs and improved patient outcomes.

Containing the spread of infectious diseases

Though emerging markets offer the most obvious and immediate area of impact for solutions around emerging infectious diseases, the pandemic has proved that the developed markets are not immune to the challenges of infectious diseases. As the human population shifts locations and travel increases, so do the diseases of population and vectors of infectious diseases. By anticipating these shifts early through expanded IVD offerings and complementary services, manufacturers can help to ease the burden of emerging infectious diseases across the globe.

In addition to simply developing individual and multiplex assays necessary to conclusively diagnose disease, manufacturers may need to consider innovations in reagent/sample stability, device durability and transportability, and automated reporting to maximize the applicability of solutions; for emerging markets, additional focus on balancing such feature innovation with cost will be necessary to enable widespread uptake.

Utilization of IVD in conjunction with other diagnostic tools

Recent innovations point toward a future of boundary-breaking in non-communicable diseases where diagnostic tools may increase the speed to diagnosis in time-critical or complex areas. Pairing IVD with traditional methods of diagnosis (e.g., CT scan and patient-reported symptoms, patient history, monitoring, etc.) may prove to be a game changer in reducing the amount of non-necessary medical interventions while improving patient outcomes and experience in emergency settings. Ultimately, time to result and ease of workflow could be the make-or-break for these types of diagnostic developments.

Navigating the market is not without challenges

Regulatory changes play a crucial role in shaping the landscape of various industries. Adapting to regulatory changes is vital for optimizing industry trends.

India underwent a significant transformation in its medical landscape through a series of regulatory changes in 2023. These changes, geared toward fostering innovation, ensuring patient safety, and facilitating market access, have set the stage for a dynamic 2024 in the MedTech sector.

One crucial development is the National Medical Devices Policy, 2023, designed to reduce import dependence and boost domestic production. Aligned with Atmanirbhar Bharat and Make in India initiatives, the policy aims to position India as a global manufacturing hub, targeting a 10–12 percent share in the global devices market over the next 25 years. It specifically addresses the manufacturing of advanced devices, laying out missions for access, affordability, quality, patient-centered care, health promotion, security, research, innovation, and skilled manpower.

Another game-changing initiative is the National Policy on Research and Development (R&D) and Innovation in the Pharma-MedTech Sector, introduced alongside the Scheme for Promotion of Research and Innovation in the Pharma-MedTech Sector (PRIP).

With a substantial budget of ₹5000 crore over five years, PRIP focuses on establishing centers of excellence, fortifying research infrastructure, and tackling healthcare challenges through interdisciplinary collaborations. Precision medicine, new entities, medical devices, and antimicrobial resistance are key areas of emphasis. The scheme aims to strengthen the regulatory framework, incentivize innovation, and foster a conducive ecosystem, with a vision to reach ₹4.02 lakh crore (USD 50 billion) by 2030, transforming India’s industry through R&D, indigenous manufacturing, affordable healthcare, skill development, and job creation.

These regulatory shifts have ignited a surge in investments and collaborations within the Indian MedTech landscape. Startups, concentrating on innovative, low-risk devices, are attracting venture capital, while established players are diversifying their portfolios to align with evolving regulations. Increased funds are expected to fuel R&D, giving rise to cutting-edge medical technologies tailored to India’s unique healthcare challenges.

The industry is also witnessing a growing demand for regulatory compliance expertise, prompting companies to invest in robust quality management systems and regulatory affairs teams to navigate the evolving regulatory requirements effectively.

With the onset of 2024, the implications of these regulatory changes are multifaceted. The sector is positioned for continued growth, driven by innovation, expanded market access, and a heightened focus on quality. However, challenges persist, especially for companies dealing with high-risk devices navigating increased regulatory scrutiny. Striking a balance between fostering innovation and ensuring patient safety emerges as a key challenge for both regulators and industry stakeholders.

The regulatory changes in India’s MedTech landscape in 2023 have ushered in a new era of opportunities and challenges. The sector is experiencing a wave of innovation and investments. As the industry adapts to these changes, 2024 promises to be a pivotal year, shaping the future of medical technology in India.

Significant FDA initiatives are set to reshape the landscape for IVD manufacturers in 2024. The pending Quality System Regulation Amendments – to be referred to as the Quality Management System Regulation, the proposed Laboratory Developed Tests rule, the Diversity Action Plan for clinical trials, and the 2024 New Guidance Agenda – have major relevance.

QMSR. Regulatory expectations for a quality management system (QMS) have evolved since the current part 820 was implemented over 20 years ago. By proposing to incorporate ISO 13485 by reference, FDA is seeking to explicitly require current internationally recognized regulatory expectations for QMS for devices subject to FDA’s jurisdiction. FDA proposes a one-year transition period from the date that the final rule is published in the Federal Register. So, assuming it is published in January 2024, it will be effective January 2025, giving manufacturers a year to update their QMS to incorporate the QMSR terminology and references.

LDTs. The comment period for the proposed rule Medical Devices; Laboratory Developed Tests closed on December 4, 2023. According to FDA’s unified agenda, the final rule publication date is in April 2024. The proposed rule would alter the way LDTs are regulated, effectively bringing these products under FDA purview to be regulated as medical devices with very limited exemptions. Along with this amendment, the FDA proposes a policy under which FDA intends to phase out its general enforcement discretion approach for most laboratory developed tests (LDTs). This rule will amend 21 CFR 809.3(a) by adding the phrase “including when the manufacturer of these products is a laboratory” in the definition of “in vitro diagnostic products.”

Diversity action plan. FDA plans to revise their approach to race and ethnicity diversity plans for clinical trials that will be laid out in guidance documents. FDA expects to release the final guidance in early 2024. What to expect in the guidance will be information on enrolment targets based on the intended use of the device, strategies to enroll clinically relevant population, assessment of how race or ethnicity could have different safety or effectiveness profiles, and how those risks will be mitigated.

2024 new guidance agenda. The Center for Devices and Radio Health (CDRH) posts two lists of guidance documents each year that it intends to publish during the fiscal year. The A-list is a list of prioritized device guidance documents that FDA intends to publish during FY2024. The B-list is a list of device guidance documents that FDA intends to publish as resources permit during FY2024.

The FDA, a government body overseen by the Congress and the FDA Commissioner and appointed by the President, is expected to be impacted by the election outcome and the party that comes to power. That will in turn affect efficiency to the vendors with 510(k) and PMA clearances/approvals and post-market activities.

The European Commission on January 23, 2024, announced proposals to extend the transitional periods for certain IVD medical devices under Regulation (EU) 2017/746 (IVDR). This follows similar action taken by the Commission in early 2023 to extend the transitional provisions under Regulation (EU) 2017/745 (the MDR). The rationale applied for the latest proposal is the same as before – it aims to ensure availability of safe devices, essential for healthcare systems, and protect patient care. Specifically, the latest IVD proposals are intended to address the ongoing concerns regarding the availability and readiness of notified bodies to perform IVDR conformity assessments and the high number of IVDs that have yet to transition to IVDR. The new proposals (once adopted) will provide manufacturers with more time to comply with the new requirements of IVDR. Relatedly, manufacturers will be required to give notice if they foresee interruption of supply of their devices.

In addition, to improve the transparency and coordination, the Commission has proposed to accelerate the roll out of the European database on medical devices (EUDAMED) so that certain modules are mandatory as from late 2025.

The proposals will now be forwarded to the European Parliament and the Council for adoption. Separately, the Commission will in 2024 start its preparatory work for a targeted evaluation of MDR and IVDR to assess how the legislation is affecting the availability of devices across the EU.

Overall, the IVD market is a growing and dynamic sector with a lot of potential. We can expect to see continued innovation, as manufacturers strive to develop new technologies and products.