Industry

IVD Industry Looks Promising!

It will be fascinating to keep track of how the clinical laboratory evolves and how its operations impact the practices of medicine and healthcare delivery.

It is now established that 70 percent of medical decisions are driven by diagnostic testing. As the industry enters the era of mainstream application of precision medicine, tailored therapeutics, wearables, and artificial intelligence, the importance of diagnostics’ role in medicine will continue to grow and the definition of what constitutes a diagnostic test will continue to evolve. This is encouraging news as the earlier almost any medical condition is detected, the better the outcomes for that patient and their family and the greater the potential for savings to the healthcare system. Recent changes in the nature of laboratory services, promoted by innovation and introduction of more complex tests in emerging diagnostic fields, more advanced diagnostics along with other internal and external drivers, will promote a paradigmatic transformation of current scenarios.

It is now established that 70 percent of medical decisions are driven by diagnostic testing. As the industry enters the era of mainstream application of precision medicine, tailored therapeutics, wearables, and artificial intelligence, the importance of diagnostics’ role in medicine will continue to grow and the definition of what constitutes a diagnostic test will continue to evolve. This is encouraging news as the earlier almost any medical condition is detected, the better the outcomes for that patient and their family and the greater the potential for savings to the healthcare system. Recent changes in the nature of laboratory services, promoted by innovation and introduction of more complex tests in emerging diagnostic fields, more advanced diagnostics along with other internal and external drivers, will promote a paradigmatic transformation of current scenarios.

As the modern clinical laboratory becomes more connected, it becomes increasingly difficult to efficiently exchange and manage data. This is especially true with regard to interoperability, where data is exchanged among several clinical systems. Laboratories have long stressed efficiency, safety, and quality in the management of diagnostic data; however, the focus has primarily been on the analytical phase. But the trend toward lab automation and increasing testing requires that laboratories constantly adapt to ever-changing data-management requirements in all phases of the testing process. To meet expectations, laboratories have implemented laboratory information systems as well as demanded analytical instruments with more powerful and sophisticated data management solutions. Integrated instruments can help coordinate various processes, from managing test orders to monitoring samples, to validating final test results.

Development of sophisticated and specialized tests for early disease detection and disease management and increasing demand for lab automation will likely drive the growth of in-vitro diagnostics (IVD) market. The rapidly rising use of point-of-care (PoC) diagnostic products has introduced a decentralization trend in the healthcare industry. Patients and healthcare facilities, in an attempt to encourage early diagnosis, to cater to medical facilities remotely, and curb costs are now decentralizing their facilities. A wide array of clinical tests facilitates healthcare specialists with the ability to detect disease progression, which also includes blood and urine test ranging from simple to complex, molecular expression genetic analysis, and various medical chemistry panels. Moreover, the growing rate of chronic diseases such as diabetes, heart failure, and colon cancer; increasing demand for personalized medicine; expanding geriatric population base; and growing patient awareness toward disease diagnosis will also lead the IVD market growth.

Indian market

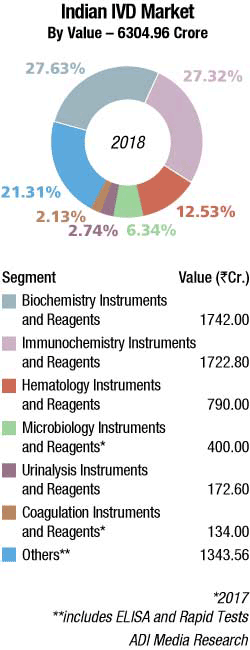

The Indian IVD instruments and reagents market is valued at Rs 6305 crore in 2018 and is expected to have a compounded annual growth rate (CAGR) of 7 percent from 2019 to 2023. IVD has witnessed several changes and additions to its gamut of offerings in the recent past. There has been a paradigm shift from traditional diagnostics to a new-generation diagnostic that operates on the gene level. This change was possible only because of the inclusion of advanced technology, such as genetic testing, molecular diagnostics, PCR, and NGS. Fast turnaround, reliability, user-friendliness, and predictability of predisposed diseases are a few significant qualities that are making these technologies attain their share in major offerings of diagnosis providers around the world.

By segment. In 2018, the Indian biochemistry instruments and reagents market is estimated at Rs 1742 crore, with reagents continuing to dominate at Rs 1450 crore, at an 83.24-percent market share. The floor-standing analyzers are estimated at Rs 85 crore and 1610 units; benchtop analyzers at Rs 82 crore and 1580 units; and semi-automated analyzers at Rs 125 crore and 15,100 units. In 2018, the outbreak of dengue, jaundice, and malaria were controlled. The effect of demonetization had faded. The MNCs found it challenging to maintain their respective shares and the segment saw growth in the vicinity of 12 percent as against some of its counterpart segments in the diagnostics industry, which saw a growth of 20–25 percent. The size of the segment in 2018 has been calculated on assigning a monetary value to all the instruments installed, whether placed or sold. The ratio of sold to placed instruments depends on the strength of the brand, and the type and price points of instruments. Over the last couple of years, the traditional ratio of 40 percent sold to 60 percent procured has transitioned to 25 percent sold and 75 percent placed.

By segment. In 2018, the Indian biochemistry instruments and reagents market is estimated at Rs 1742 crore, with reagents continuing to dominate at Rs 1450 crore, at an 83.24-percent market share. The floor-standing analyzers are estimated at Rs 85 crore and 1610 units; benchtop analyzers at Rs 82 crore and 1580 units; and semi-automated analyzers at Rs 125 crore and 15,100 units. In 2018, the outbreak of dengue, jaundice, and malaria were controlled. The effect of demonetization had faded. The MNCs found it challenging to maintain their respective shares and the segment saw growth in the vicinity of 12 percent as against some of its counterpart segments in the diagnostics industry, which saw a growth of 20–25 percent. The size of the segment in 2018 has been calculated on assigning a monetary value to all the instruments installed, whether placed or sold. The ratio of sold to placed instruments depends on the strength of the brand, and the type and price points of instruments. Over the last couple of years, the traditional ratio of 40 percent sold to 60 percent procured has transitioned to 25 percent sold and 75 percent placed.

The Indian immunochemistry instruments and reagents market in 2018 is estimated at Rs 1722.8 crore, with reagents dominating at Rs 1551.2 crore. Elisa kits clocked an additional Rs 342 crore and rapid tests, an additional Rs 315 crore in 2018. As GST implementation in 2017 gained momentum, it had a negative impact on the instruments market, which in turn translated to a slowing in demand in the reagents business in 2018. Total lab automation has somewhat lost pace over the last couple of years, with a tussle for supremacy among the leading brands. The customers find the business requires too much space, and with low ROIs perceive it to be an expensive proposition, not always worthwhile increasing investing in.

The Indian hematology instruments and reagents market in 2018 is estimated as Rs 790 crore. Reagents constitute 63.3 percent of the market at Rs 500 crore, and instruments the balance at Rs 290 crore. The hematology instruments market may be segmented as 5-part and 3-part analyzers. By quantity, in 2018, the 3-part analyzers dominated with an estimated 85 percent market share, albeit the margins continued to come from the 5-part analyzers. Within the 3-part analyzer segment, the single-chamber is a dying breed and the laboratories are opting for its double-chamber counterpart. Within the 5-part analyzers, the entry-level analyzers are more popular. The maximum growth is being seen by the 5-part entry-level analyzers.

The Indian market for urinalysis analyzers and reagents in 2018 is estimated at Rs 172.6 crore. Reagents continue to dominate with an 81-percent share, valued at Rs 139 crore. The reagents may be further segmented as 75.5 percent being used by semi-automated instruments, catered to largely by Dirui and Transasia, and also by Roche and Siemens and 24.5 percent by fully automated ones catered to largely by Sysmex, Iris, and Dirui (Rapid). The overall market has seen an increase in all segments, albeit there is a very slow transition to fully automatic analyzers, which are almost 95 percent placed. The semi-automatic instruments are also now increasingly being placed, with major revenue anticipated from reagents. The urinalysis market continues to be dominated by semi-automated instruments with a 97-percent share, by volume. However, the customers opt for high-throughput instruments. The fully automated analyzers segment is estimated at Rs 15.6 crore, with integrated analyzers seeing maximum growth. The urine sediments fully automated instruments and urine-chemistry instruments each contribute about 16 percent to the market, by value. By quantity, urine-chemistry instruments have a 28.5-percent share, and urine-sediment instruments 21.43 percent. The integrated fully automated instruments are the most popular with a 50-percent share by quantity, albeit the share by value is 67.3 percent.

The Indian market for urinalysis analyzers and reagents in 2018 is estimated at Rs 172.6 crore. Reagents continue to dominate with an 81-percent share, valued at Rs 139 crore. The reagents may be further segmented as 75.5 percent being used by semi-automated instruments, catered to largely by Dirui and Transasia, and also by Roche and Siemens and 24.5 percent by fully automated ones catered to largely by Sysmex, Iris, and Dirui (Rapid). The overall market has seen an increase in all segments, albeit there is a very slow transition to fully automatic analyzers, which are almost 95 percent placed. The semi-automatic instruments are also now increasingly being placed, with major revenue anticipated from reagents. The urinalysis market continues to be dominated by semi-automated instruments with a 97-percent share, by volume. However, the customers opt for high-throughput instruments. The fully automated analyzers segment is estimated at Rs 15.6 crore, with integrated analyzers seeing maximum growth. The urine sediments fully automated instruments and urine-chemistry instruments each contribute about 16 percent to the market, by value. By quantity, urine-chemistry instruments have a 28.5-percent share, and urine-sediment instruments 21.43 percent. The integrated fully automated instruments are the most popular with a 50-percent share by quantity, albeit the share by value is 67.3 percent.

The Indian coagulation instruments and reagents market in 2017 is estimated at Rs 134 crore. The year showed a 9-percent growth over 2016, having received a setback from the lingering impact of demonetization and teething issues with the GST rollout. It is poised to return to its normal 12-percent growth from 2018 onward. The installed base in 2017 is estimated at 4215 instruments, with semi-automated instruments at 3650 units, and fully automated ones at 565 units. As a ballpark figure, 5 percent instruments are sold and balance are placed by the vendors in quantity terms, contributing 10 percent to revenues. In the Rs 118.8-crore reagents market, 80 percent of value is attributed by routine parameter tests (PT and APTT), while the remaining 20 percent is by specialized coagulation parameter tests. This number in volume terms is translated to 95 percent for routine parameter tests and 5 percent to specialized coagulation parameter tests, the market for which is growing rapidly. In routine parameter tests, 70 percent are PT while 30 percent are APTT.

The Indian market for microbiology instruments and reagents in 2017 is estimated at Rs 400 crore. The market is moving toward automation. However, the classical microbiology analyzers continue to be popular in selected government and municipal hospitals. Blood culture tests, which have now been completely automated, are the exception. The identification and antibiotic susceptibility analyzers and reagents have a 50-percent market share in their respective segments. The blood culture and tuberculosis analyzers and reagents combined have a 50-percent share in their respective segments.

Global market

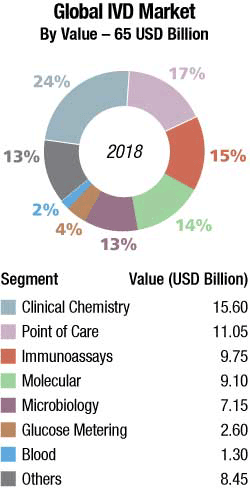

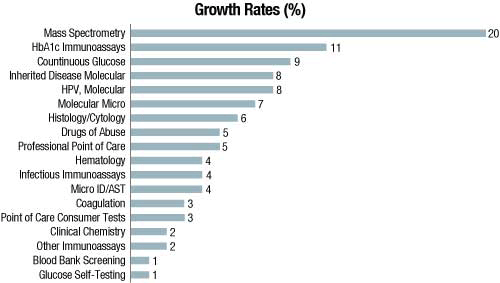

The global IVD market is estimated at USD 65 billion in 2018 and is expected to grow 4 percent annually to USD 77.8 billion by 2023, predicts Kalorama. Increase in incidence of chronic and infectious diseases and growth in geriatric population drive the global IVD market. In addition, growth in the number of public and private diagnostic centers and PoC testing centers is expected to fuel the market growth in coming years. Furthermore, rise in investment for the advancement of healthcare sector by government is anticipated to boost the market growth. However, stringent government regulations for the manufacturing of IVD products and inadequate reimbursement policies are expected to hamper the growth of IVD market. Ongoing R&D activities related to IVD are anticipated to provide new opportunities for the market growth.

Based on product type, instrument segment is expected to grow at a CAGR of 6.1 percent from 2019 to 2025. The growth of the instrument segment is attributed to the recent advancements in IVD instruments. Further, there is a growth in demand for fully automated instruments in the market as they simplify the task and provide more accurate and reliable results.

In 2018, reagents and kits commanded the largest share in the global IVD market. They are also expected to witness a rapid growth during 2019 to 2025 mainly because of incessant product launches, number of on-going research activities, and growing prevalence of various acute as well as chronic infectious diseases.

On the basis of technique, immunoassays commanded the largest share with their greater adoption attributed to advantages, such as inherent specificity, high throughput, high sensitivity, low cost, and rising demand for immunoassay-based tests. Moreover, molecular diagnostics is expected to witness the fastest growth over the next 6 years. Automation is an emerging trend observed in clinical testing. Availability of easy-to-use portable devices enables self-testing, which is expected to fuel the market growth in near future.

Based on application, infectious-disease segment commanded the largest share with large volume of IVD tests performed for infectious diseases, high incidence of various infectious diseases, and incessant technological advancements in the tests used for the detection of such diseases. Oncology is expected to witness the fastest CAGR of 8.93 percent by 2025. Increasing demand for self-care devices and PoC diagnostics for the treatment of chronic diseases can boost the growth in the forthcoming years.

On the basis of end user, hospital laboratories commanded the largest share, primarily because of high volume of diagnostic tests being performed in the hospitals and high incidence of hospital-acquired infections. Homecare segment, on the other hand, is expected to register the fastest CAGR of 8.48 percent by 2025.

Geographically, Asia-Pacific will be the fastest growing regional market because of improving healthcare infrastructure; growing accessibility to healthcare services; increasing incidence of infectious and non-communicable diseases with aging population; growing income levels and insurance penetration; and rising number of hospitals and clinics. However, North America commands the largest share of the global IVD market, followed by Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Major players operating in the global IVD market are Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Siemens Healthcare, Thermo Fisher Scientific Inc., Sysmex Corporation, bioMérieux S.A., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., DiaSorin S.p.A., Qiagen N.V., and Agilent Technologies, Inc., among others. Key players focus on strategies, such as mergers and acquisitions, collaborations, and new product developments. In addition, they are aiming at expanding their businesses across developing regions to boost their market share.

Potential disruptors

Skipping the pathogen, syndromic testing. Infectious disease tests most companies produce detect a single pathogen, or an antibiotic resistance gene. However, if a patient presents with general symptoms of a respiratory infection, or with symptoms of a gastrointestinal infection or some other type of infection, there are several different pathogens that may have caused the infection. This has led to the development of syndromic panels that include a panel of pathogens and often also resistance genes commonly found with the targeted type of syndromic infection.

Immunoassay point-of-care pushes back. With all the attention on molecular PoC systems, it is worthwhile noting that there are also improvements in immunoassays. Few technologies in the PoC diagnostics market pit molecular against immunoassays in an interesting way. As molecular diagnostics enter PoC settings, cost becomes a key issue in comparison to predominantly used and cheaply performed rapid immunoassays. In routine testing applications, such as screening, test cost is often prioritized over performance, especially in low-resource health systems. High-burden tropical diseases in the developing world, such as malaria, represent a significant opportunity for molecular tests in the PoC diagnostic market, but must displace or compete against rapid immunoassays in the established screening programs or future initiatives. The sensitivity and specificity of nucleic acid analytes provide molecular diagnostics key advantages in clinical practice, particularly in critical health situations.

Nucleic acid amplification, or molecular tests, is now open to routine and distributed use in healthcare, thanks to advancements in microfluidics and molecular reagents. Emblematic in terms of where the infectious disease PoC testing market is heading and the competitive challenges awaiting molecular PoC products, rapid test specialist Chembio Diagnostics recently announced plans to develop a single test for nine febrile illnesses. Multiplex testing of infections with similar symptoms or syndromic panel testing is increasingly used in healthcare to quickly diagnose patients during admission and initiation of care.

Emerging microbiome diagnostic companies. The human microbiome consists of trillions of microbes (bacteria, fungi, archaea, and viruses) that exist symbiotically within the human body. These organisms are important as they perform essential functions that human cells cannot do. There is growing interest and research activity in the microbiome. Bacteria in the gut, mouth, and plaque (biofilms) have been implicated in a number of diseases. Thousands of species of microbes – bacteria, viruses, fungi, and protozoa – inhabit every internal and external surface of the human body. The microbiome’s complicated relationship with its human host is increasingly considered crucial to health. Imbalances in the microbiome’s diverse microbial communities, which interact constantly with cells in the human body, may contribute to chronic health conditions. Researchers have evaluated specific diseases associated with disturbances in the microbiome, including gastrointestinal diseases, such as Crohn’s disease, ulcerative colitis, irritable bowel syndromes, and obesity, as well as urogenital conditions, those that involve the reproductive system, and skin diseases like eczema, psoriasis, and acne, diabetes, autoimmune disorder, acute diarrhea, cancer, mental disorder, and others.

Many diagnostic companies have traditionally not shown interest in the microbiome, and diagnostic companies in this field have primarily been small. Examples of companies offering microbiome diagnostic products or services include Genetic Analysis SA, IS diagnostics, Metabiomics Corporation, Proderm IQ, and Epibiome. uBiome markets the SmartGut test directly to consumers, although the individual’s doctor must order the collection kits. The direct-to-consumer company Arivale’s focus is on wellness. Meanwhile, several pharmaceutical companies are active in the therapeutic microbiome market. These include large multinational companies such as Abbvie, Janssen Biotech (one of the Janssen Pharmaceutical Companies of Johnson & Johnson), Merck, Pfizer, and Roche as well as emerging therapeutic companies. Some therapeutic companies have developed the diagnostic tests that are needed for use with their therapies since the diagnostic industry has not met their needs.

The microbiome in-vitro diagnostics market is likely to continue to emerge. Meanwhile, consumer-focused microbiome testing companies are also continuing to attract investments.

Multiple-target liquid biopsy. Liquid biopsy will see gains in acceptance, but there are challenges. The difficulty with collecting enough relevant samples from patients, error correction, and magnitude of interpretation are the main ones. Still, their usefulness in some cancers has been shown, and there is much development devoted to the non-invasive concept to make clinical routine closer to reality. One point of entry, in 2019, an interesting usage for CTCs and ctDNA-based testing will be in assisting other tests. For instance, imaging studies and liquid biopsy have been shown to reduce false negatives when used in conjunction with some imaging tests. A 2018 study published in Translational Oncology demonstrated that a combination of liquid biopsy and radiological imaging enabled visualization of the occurrence of clonal redistribution after discontinuation of anti-EGFR mAb therapy, as well as emerging RAS mutations during therapy with anti-EGFR mAb, indicating resistance.

Rare diseases testing. Though a large amount of testing occurs, there are many conditions undetectable by current testing and, therefore, a need for further diagnostics products. A consortium of researchers called Solve-RD, funded with USD 18.8 million from an EU healthcare medical research booster, plans to use clinical knowledge and genomics to assist patients with unsolved rare diseases obtain a molecular diagnosis. The consortium involves participants from 21 organizations in Germany, the UK, the Netherlands, France, Italy, Spain, Portugal, Belgium, the Czech Republic, and the US. The project is coordinated by Olaf Riess and Holm Graessner, both at the University of Tübingen in Germany, with co-coordinators Han Brunner from the Radboud University Medical Center in Nijmegen, the Netherlands, and Anthony Brooks from the University of Leicester in the UK. According to Graessner, an estimated 30 million Europeans suffer from a rare disease, and about 80 percent of these likely have a genetic cause. Of those patients, about 12 million do not have a molecular diagnosis yet and might thus benefit from the initiative. Despite the fact that exome and genome sequencing has helped researchers find many novel rare disease genes, 30 and 80 percent of patients who receive such a test do not get a diagnosis from it, according to Alexander Hoischen, an assistant professor of immunogenomics at Radboud who leads one of the sub-projects of Solve-RD. Solve-RD aims to change that. Initially, the consortium plans to reanalyze more than 19,000 patient cases, collected by the four partner ERNs, where exome sequencing did not reveal a disease-causing mutation but where the disease is believed to be genetic in origin. Overall, Solve-RD hopes that the reanalysis could solve at least 3 to 5 percent of the unsolved exome cases, and could uncover a number of novel disease genes. In addition to reanalyzing exomes, the consortium plans to explore whether whole-genome sequencing can solve additional cases in selected patient cohorts totaling a few thousand, using both short-read and long-read sequencing technologies. Solve-RD also plans to move beyond sequencing and employ other omics technologies, depending on the availability of affected tissue samples from patients. For example, the consortium has muscle biopsies for some patients with neuromuscular disease phenotypes that will be analyzed by RNA-seq, using mostly short-read, but in selected cases, long-read technologies. For other groups of patients, the consortium wants to employ mass spectrometry-based proteomics, metabolomics, or epigenomics.

AI will be seen as a team player, not a job replacer. Artificial intelligence (AI) was novel in the past few years; in 2019, the abstract concept fades and real products/software will be the focus. Talk of replacing doctors (or other workers) should, by at least the end of 2019 be less of the discussion surrounding artificial intelligence. The demand is there: diagnostic errors contribute to approximately 10 percent of patient deaths, and also account for 6 to 17 percent of hospital complications.

Outlook

In the last five decades, incredible innovations and technological developments have shaped how modern clinical laboratories are equipped, staffed, and operated. It is expected that this trend will continue and will be driven by technological developments in disciplines, such as micro-engineering, advanced robotics, micro-fabrication, microfluidics, nanotechnology, advanced materials, and particularly molecular diagnostics. It will be fascinating to follow how the clinical laboratory of the future will evolve and how its operation will impact the practices of laboratory medicine and healthcare delivery.