Reports

Pulse of the industry-2023

The 17th annual edition of EY’s Pulse of the Industry-2023 medical technology report finds the industry in a state of flux. Although the report makes more mention of the MedTech industry in US and Europe, it has relevance for India too.

In recent years, the medical technology (MedTech) industry has performed very strongly, driven by the Covid-19 pandemic and the associated need for new non-imaging diagnostics and research-related equipment.

Last year’s report celebrated the industry’s surge of public company revenue to more than a half trillion US dollars, as well as a third consecutive year of double-digit R&D growth. However, there were early indications of more challenging conditions ahead, signalled by a muted M&A market and decreasing public market valuations for companies in the sector, as well as a 30 percent decline in overall industry financing. This financing slump included the disappearance of special-purpose acquisition company (SPAC) deals, a sharp decline in initial public offerings (IPOs), which were down 99 percent in total value; and venture capital (VC), which saw a 21 percent drop in funding.

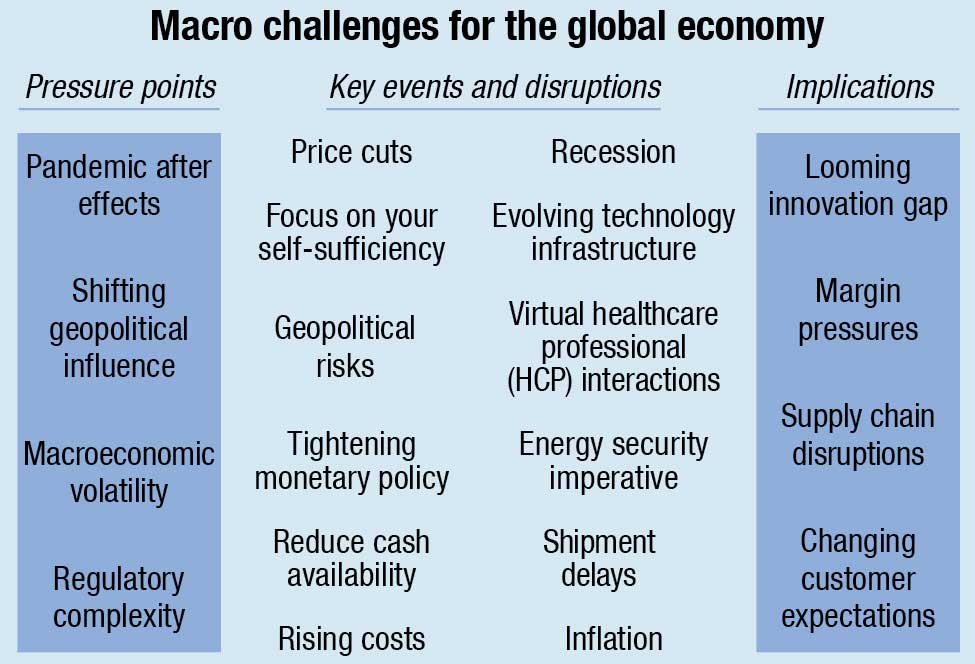

One year later, the headwinds that were becoming evident have further intensified. Geopolitical upheaval, slow commercial and supply chain disruption recovery, a shifting regulatory environment and stubborn global inflation all have contributed to the uncertainty affecting the industry. Adding to these factors, questions are emerging around how the rise of GLP-1 (glucagon-like peptide 1) therapies might impact aspects of the sector over the longer term. However, the aging global population and the associated rise in the number of underserved chronic disease patients provide strong fundamentals for long-term growth. Moreover, the acceleration of digitalization across the industry with new advances in the power of data analytics (most notably demonstrated by the rise of artificial intelligence (AI), including the breakthrough generative AI models in 2023) opens new possibilities for the industry’s future.

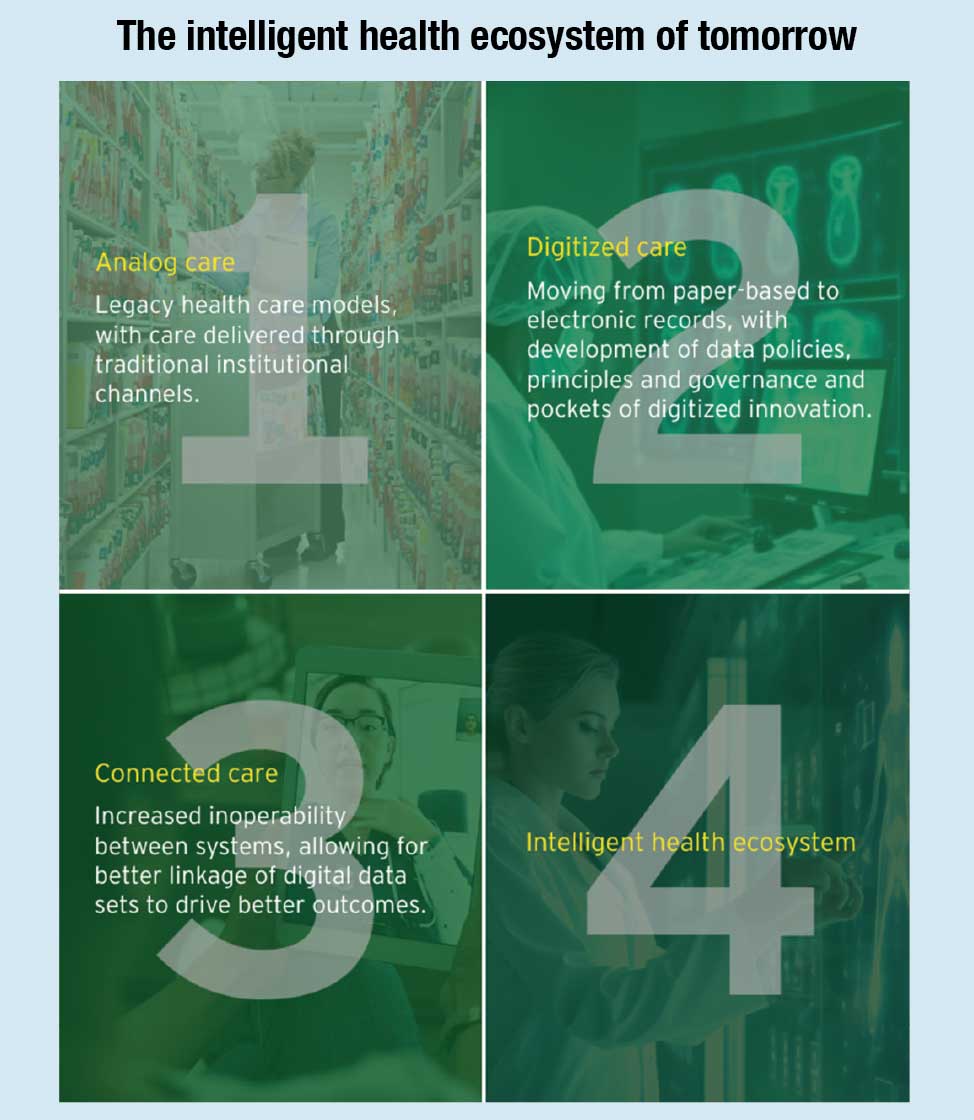

The convergence of these technological advances with a heightened demand for personalized, flexible approaches to care, forms the basis for a new vision of healthcare for the future, termed here as the intelligent health ecosystem (IHE). But ultimately, amid the shifting forces affecting the industry and the challenges and opportunities they offer, MedTech has undergone a year of reset, with its performance largely returning to pre-pandemic norms. This reset leaves MedTech with key strategic questions to answer.

How can MedTech restore its growth trajectory?

Total revenue for MedTech reached USD 573 billion in 2022, as growth fell from a post-pandemic high of 16 percent in 2021 to just 3.5 percent in 2022, the lowest level since 2015. This slowing trend continued into the first half of 2023, with commercial leader (public pure-play MedTechs with at least USD 500 million in annual revenue) revenues essentially flat at 0.4 percent growth compared to the previous year. This continuation of 2022’s pattern suggests that the industry’s strong performance in 2021 could be an outlier; a one-time post-Covid-19 correction rather than a return to the trajectory of the period from 2000 to 2007, when MedTech averaged 15 percent annual revenue growth rather than the 5 percent average seen from 2008 to 2020.

What can the industry do to increase its attractiveness to investors, particularly in a period of continued uncertainty?

MedTech’s public valuations have fallen in parallel with the sector’s top-line growth. Stock prices for MedTech, as with broader indexes, peaked toward the end of 2021. But by midyear 2022, roughly half of the stock price gains the industry made during the pandemic had been wiped out. As of the end of July 2023, growth had flatlined and MedTech valuations were just 22 percent higher than they were in January 2020, in line with the broader indexes. In parallel with this reset, MedTech trading multiples also fell back from a pandemic-era peak of 16.3x in September 2021 to 7.3x by the end of H1 2023 (for context, the 10-year average trading multiple for the industry was 8.4x). And according to one recent report, MedTech is trading at the lowest sentiment levels seen since the financial crisis in 2008 and 2009.

How can MedTech effectively invest in activities that will drive strategic growth?

In 2022, MedTechs rewarded their investors with substantial cash returns to shareholders in the form of dividends and buybacks. The USD 27.8 billion returned to shareholders represents the highest level of returns since EY began publishing Pulse of the Industry. At the same time, MedTech’s investment in growth-oriented activities looked less secure in 2022. Though the industry’s R&D investment reached a record USD 24.7 billion, this represented a dip in the three-year uptick in the industry’s R&D spending growth, which reached an all-time high in 2021 but reverted to historical norms in 2022. M&A expenditure, on the other hand, fell 44 percent, a steep decline in investment in inorganic growth.

How can MedTech enable healthy ongoing investment in the broader innovation ecosystem?

From the onset of the pandemic up through the third quarter of 2023, MedTech was the beneficiary of an investment spree driven by the Covid-19 pandemic across the entire healthcare ecosystem. As the crisis eased and relative normalcy returned, investment in MedTech displayed its traditional cyclical pattern, with generalist investors retreating from the sector while rising inflation and other macroeconomic factors hindered growth for many companies. This shift was reflected in a marked tightening in industry financing in 2022.

Though total MedTech financing rose 9 percent to USD 32.8 billion last year, this activity largely derived from a 71 percent jump in industry debt, which rose to USD 19 billion; and unlike in previous years, the largest debt offerings did not fund acquisitions, but rather went to repay and refinance existing debt, working capital, stock buybacks and other capital expenditures. Equity financing fell 27 percent to USD 13.8 billion, its deepest point in seven years. This drop reflects a 21 percent fall in venture financing to its lowest levels since the period from 2015 to 2016, with only 106 venture rounds of USD 5 million or higher executed in the 12 months preceding June 2023. In addition, the industry witnessed a near-total disappearance of the IPO market. This fundraising hit will impact the industry’s broader ecosystem of smaller MedTechs, which drive innovation but are reliant on financing from the industry’s leaders or from external investors to support their R&D activities.

As financing levels dip, these companies will feel pressure to make an exit via acquisition. However, as noted, M&A in the sector also fell in 2022, with the negative trend continuing into 2023. In the 12-month period ending June 2023, deal values were down 44 percent, and only the USD 16.6 billion Johnson & Johnson acquisition of Abiomed kept values from hitting a 10-year low.

As the MedTech industry seeks to answer the aforementioned questions, it should consider its approach in light of the broader changes that are affecting healthcare and the life sciences sector, bringing the possibility of transformative innovation for the industry in the near future. Rapidly evolving technologies, increasingly sophisticated consumer demand for more personalized and convenient health care, pressure to change payment models due to aging populations and a rise chronic disease incidence are all long-term trends that have unavoidable and significant implications for the industry and will ultimately lead health leaders to rethink how care should be delivered in the future. EY’s vision for the future direction of life sciences is the technology-driven reinvention of the sector, termed as the intelligent health ecosystem (IHE). The IHE is a blueprint for a smart, connected, personalized, patient-centered healthcare model for the future. Within this new model, healthcare will be:

- Built on ecosystem-wide collaboration and frictionless data sharing between parties;

- Delivered by a seamless integration of virtual and digital care channels; and

- Enabled by the convergence of new technologies and data, and capable of delivering value for all stakeholders.

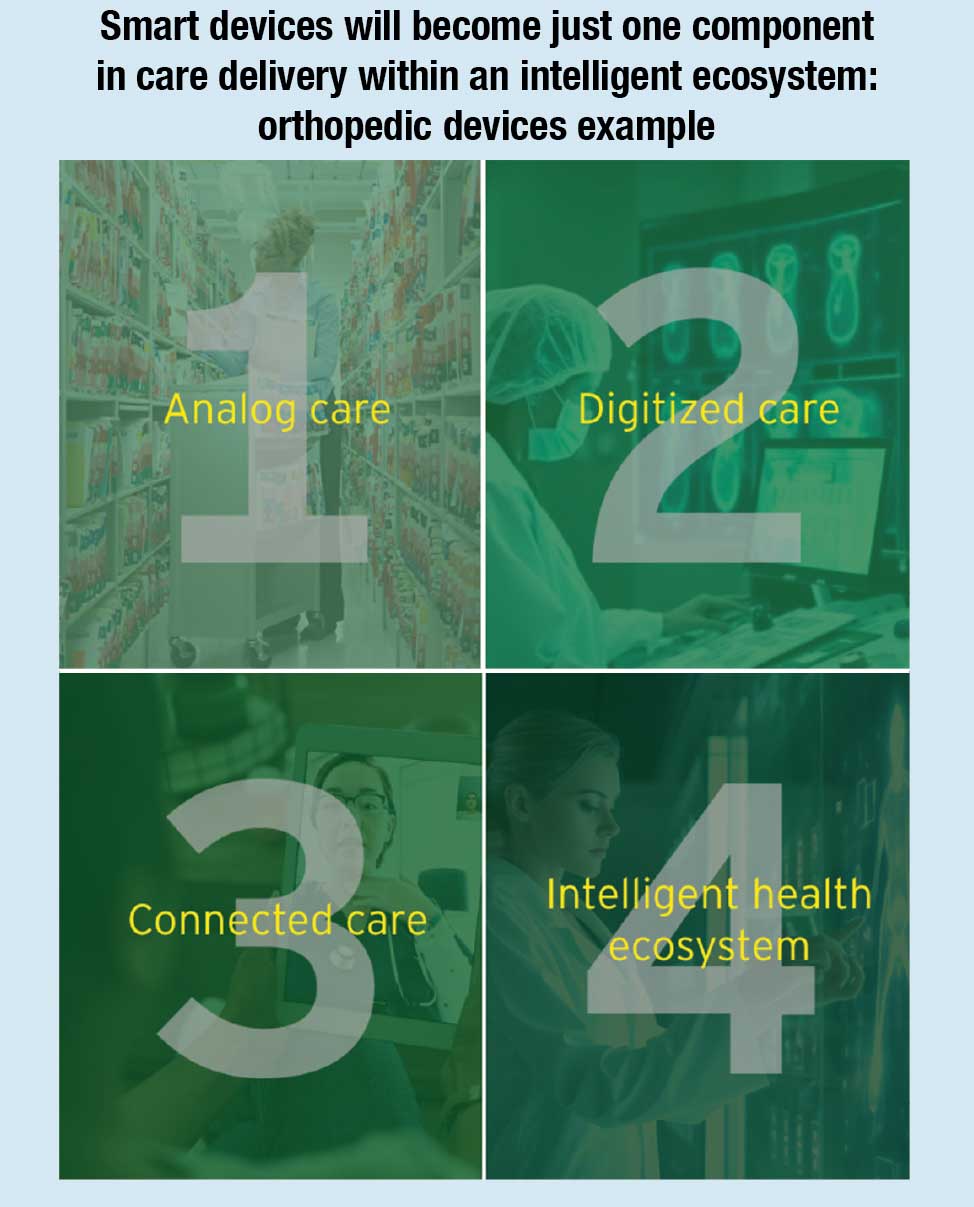

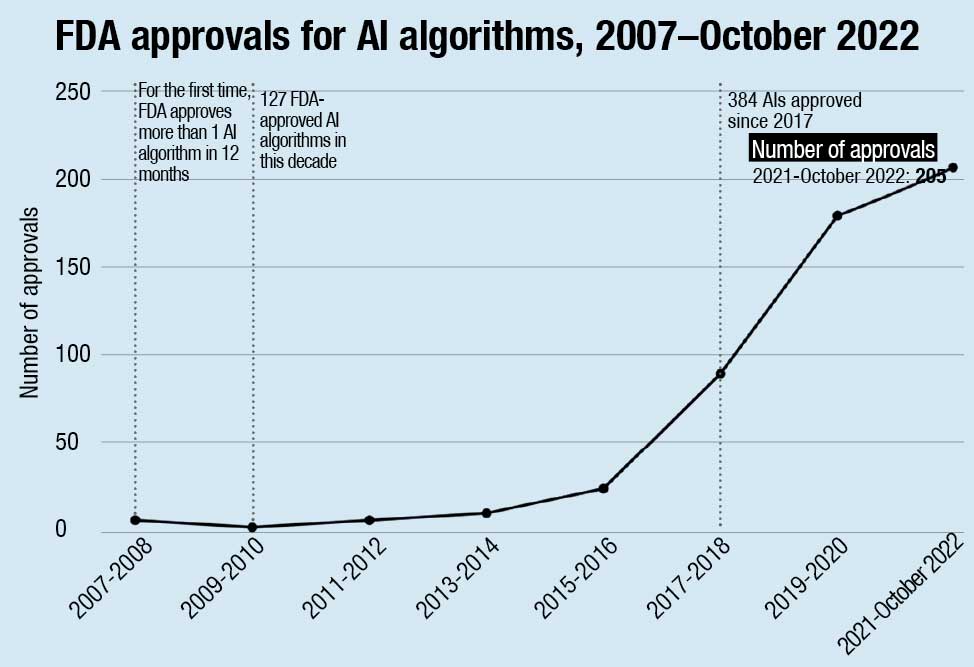

The rise of these new technologies in the MedTech industry is widely reported, with big data, artificial intelligence (AI), cloud computing, sensors, virtual and extended reality systems, and fifth-generation broadband all recognized as future drivers for the industry. Amid a generally slow year for the industry, the pace of innovation for these cutting-edge technologies continued to accelerate. One example of this growth was in the applications of AI in the sector, with at least 91 new algorithms gaining FDA approval in the first 10 months of 2022, making an immediate impact in the diagnostics and imaging diagnostics markets. And while venture financing dropped during this period, some potentially transformative new innovations were attracting capital, including Alphabet’s Verily Life Sciences, which raised an additional USD 1 billion in September 2022 to support its efforts in real-world evidence generation and healthcare data platforms. In addition, the cardiac diagnostic developer HeartFlow attracted USD 215 million for AI-powered software that maps the coronary arteries and any potential blockages through a 3D CT scan.

Innovations like these — a few examples among many across the MedTech ecosystem — bring the prospect of new breakthroughs and new approaches to care in the sector, driven by advances in data and technology. MedTechs need to continue to embrace these innovations, seeing them not as potential bolt-ons to existing offerings, but instead as keys to unlock a bolder strategic vision. Within the IHE, these rising technologies will ultimately converge, forming a smart infrastructure for care delivery anytime and anywhere, beyond legacy institutional care channels. As MedTechs seek to adapt to this changing operating environment, they must evaluate and redesign their business models on an ongoing basis.

Some opportunities and challenges that deserve special mention

- The rise of digitalization across the value chain and the opportunities it unlocks for MedTechs;

- The emergence of powerful new technological modalities, focusing on generative artificial intelligence (GenAI) and its implications for the industry (including the potential administrative and other operational efficiencies the technology could help deliver);

- The opportunities to use digital technologies and data to improve supply chains and other business functions;

- The changing nature of customer demands with a growing emphasis on ambulatory care and other care delivery outside the traditional institutional channels;

- The complex geopolitical situation, particularly the challenges in China, one of MedTech’s key markets and a geography in which a fast-evolving operational landscape is driving the industry’s push to rethink its operations and processes.