MB Stories

Raising the bar for HPLCs

Improvements in HPLC systems are sure to continue, but perhaps not from the direction one would assume. New HPLC systems seem to be more focused on regulatory compliance, and fitting into a more automated laboratory environment, and less on specific performance improvements.

Chromatography may have been around for decades, but by no means has the technique and its applications stopped evolving. In 2022, the approach will be further refined to satisfy new and challenging applications. Since its conception, high-performance liquid chromatography (HPLC) has seen technological breakthroughs in every element, including detector refinements, column and pump technology advancements, accuracy, and automation. These developments have aided in the performance of high-quality analyses that deliver more accurate results in less time, while also improving user ease.

As the industry changes, pharmaceutical companies are focusing more on novel biologic medicines. The pharmaceutical and biopharmaceutical industries, in particular, have benefited from advancements in columns, stationary phases, detectors, injection devices, and chromatography procedures, which have resulted in an unprecedented number of applications. This has increased the use of ultra-high-performance liquid chromatography (UHPLC) in bioprocessing applications, particularly for the characterization of monoclonal antibodies, antibody-drug conjugates, quality control, and analytical technologies. These systems were designed to satisfy the demands of drug development procedures, which can be lengthy and require extensive data collection, organization, analysis, exact findings, and speedy separation.

HPLC systems that can assess operational readiness through routine and automated system health checks have also been developed in recent years. As a result, early warning signals of poor performance can be identified in a timely manner, ensuring that any possible issues are addressed quickly and reducing unscheduled downtime or the need to re-run samples. Some of the most advanced LC devices provide easy-to-use diagnostic features for swiftly identifying and resolving problems. These systems can also show step-by-step maintenance films on intuitive touch-screen displays, assisting analysts in quickly resolving issues and getting workflows back up and running.

As scientists’ analytical demands for working with challenging analytes in complex sample matrices evolve, advanced instrumentation and innovations will play an increasingly important role in meeting those needs and ensuring scientists can conduct their work without being hampered by their instrument capability and capacity.

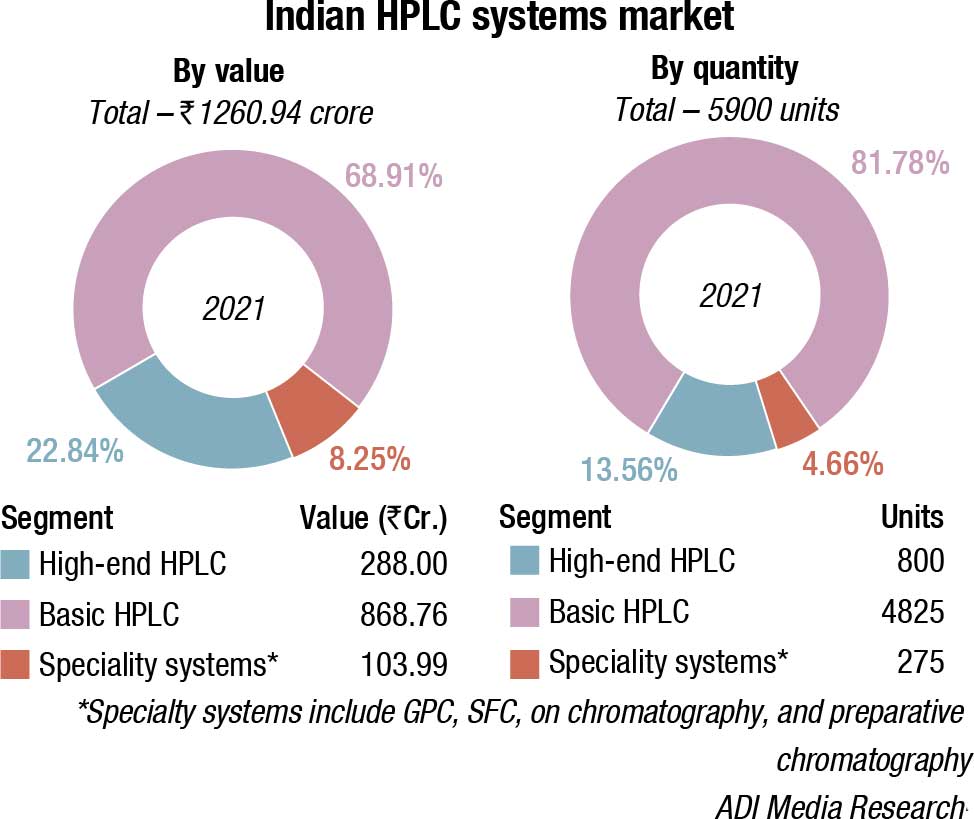

The Indian HPLC market is estimated at ₹1260.94 crore in 2021 by value, and 5900 units by quantity. This is a 9.95-percent increase over 2020 and a 6.68-percent increase over 2019, by value. By quantity, it is an 11.59-percent increase over 2020 and a 7.27-percent increase over 2019. The market had declined in 2019, largely because of FDA approvals pending for most vendors.

Shimadzu and Waters continue to dominate, with Agilent and Thermo Fisher also aggressive in this segment. The other brands, Trivitron, PerkinElmer, Hitachi, Tosoh, Knauer, Young Ling, and Jasco have a miniscule presence.

2022 is expected to be a better year, with pharma, food, and chemical sectors showing traction. The global movement to de-risk from China has presented opportunities for India for building sustainable businesses that can cater to the global and local demand for medicines well into the future. In 2020, over 70 percent of India’s key starting materials (KSM), intermediaries, and APIs came from China. Coupled with the global healthcare crisis from the pandemic, strengthening India’s pharma sector is now a national security imperative. With the Food Safety and Standards Authority of India (FSSAI) stiffening rules, the HPLC industry is expected to get the requisite impetus too.

|

Indian HPLC systems market |

||

|

Leading vendors* – 2021 |

||

|

Tier I |

Tier II |

Others |

| Waters and Shimadzu | Agilent and Thermo Fisher | Trivitron, PerkinElmer, Hitachi, Tosoh, Knauer, Young Ling, and Jasco |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian HPLC systems market. | ||

| ADI Media Research | ||

The focus of the government buying that was diverted to addressing issues from Covid is now back to procuring HPLC systems. The replacement market is also gaining momentum.

New products have been introduced in 2021. Shimadzu Scientific Instruments announced the new i-Series LC-2050/LC-2060 integrated high-performance liquid chromatographs (HPLC). Building on the exceptional performance of previous versions, the i-Series LC-2050/LC-2060 models incorporate analytical intelligence functions, enable complete automation from start-up to analysis preparations, and allow remote monitoring and data processing.

Waters Corporation launched the next generation in liquid chromatographs solution, that leverages HPS to vastly improve analytical data quality and eliminate the need for time-consuming and costly passivation. It is designed to alleviate the problem of analyte/metal surface interactions when analyzing organic acids, organophosphates, oligonucleotides, phosphopeptides, acidic glycans, and phospholipids by reversed phase and hydrophilic interaction chromatography.

HPLC – Unlock the full potential for clinical testing

BHAUMIK TRIVEDI

BHAUMIK TRIVEDI

Assistant Manager – Clinical & Diagnostic Business Development,

Shimadzu Analytical (India) Pvt Ltd

Ever since the 1970s liquid chromatography, gas chromatography, and thin layer chromatography have provided analytical solutions in diagnostics laboratories. HPLC (high-performance liquid chromatography) is an advanced type of chromatography. It is given prominent importance due to its attributes like high sensitivity, i.e., the ability to evaluate samples of very minute concentrations, detect precisely chemically similar molecules like monoamines, and ability to identify compounds with complex chemistry. This is possible in HPLC due to efficient separation under pressure over a large surface area. The HPLC system is also connected to detectors like UV-visible, fluorescence, mass spectrometers, etc.

HPLC system is a mandatory tool in most labs. In the fields of medical, biological, chemical, biochemical, and phytochemicals (plant chemical research) it finds its application to analyse and quantify the molecules. Components with complex chemistry and properties are easily distinguished by this technique. Due to the principle of separation in HPLC, similar molecules get separated, and hence their detection, identification, and quantification become easier.

HPLC has played a significant role in clinical laboratories for the separation and quantitation of biomarkers in different body fluids. HbA1c and hemoglobinopathy testing have been the biggest example of the use of HPLC in a diagnostic lab. Many disorders related to body metabolism, those related to endocrine and exocrine gland secretion, and alteration in body fluids are diagnosed by HPLC analysis of concerned fluids. For example, estimation of metabolites of porphyrins, amino acids, biogenic amines, toxic substances, or other metabolites from plasma, cerebrospinal fluid, and urine samples in patients can be achieved using an HPLC. Because of the time and high capital investment, most of the diagnostic methods are performed by Elisa, electrophoresis, and RIA methods. But still, for any new or rare diseases, the HPLC method is preferred to pinpoint the cause of disorders (i.e., any change in some biochemistry).

Today HPLC has made a cutting edge over other methods such as immunoassay for routine estimation of vitamins, hormones, and other biomarkers. The cost of such advanced analytical techniques is prohibitive but due to the advantages of ultra-high sensitivity, capability to handle heavy workloads, control of operational cost, and the returns on investment are recovered easily by clinical laboratories through high profits, higher confidence, and efficient services to patients.

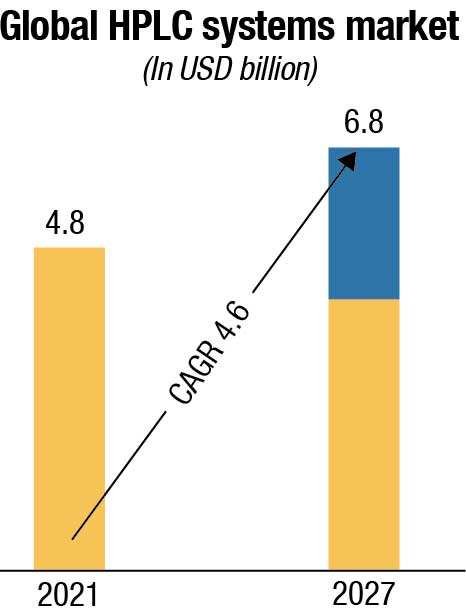

With a wide range of applications of HPLC tests and techniques, the global HPLC systems market is projected to reach USD 6.2 billion by 2027 from USD 4.8 billion in 2021, at a CAGR of 4.6 percent. The chromatography consumables market is expected to grow at a CAGR of 6 percent from 2020 to 2027 to reach USD 3.64 billion by 2027. The growth in this market is driven by high sensitivity and accuracy of the HPLC technique, the rising importance of HPLC tests in drug approvals, the growing popularity of hyphenated techniques, and increasing pharmaceutical R&D spending.

The increasing demand for reliable HPLC systems for the purification of monoclonal antibodies is also driving the market growth. Various advancements in the column and pump technologies and the development of miniaturized, automated, and computerized HPLC devices are acting as growth-inducing factors. These advancements have assisted in conducting high-quality analyses that provide more accurate results in lesser time and enhance the overall convenience for the user.

HPLC instrument manufacturers are also developing innovative column designs that can withstand high pressure from smaller, superficially porous particles, which is acting as another major growth-inducing factor.

The emerging trend of bio-banking and extensive research and development (R&D) activities in the field of life sciences are some of the other factors that are anticipated to drive the market further. However, high cost of the instrument and lack of expert analysts are factors restraining the growth of the global HPLC market.

Adoption of HPLC will continue to grow, owing to their higher accuracy and sensitivity in contrast to conventional chromatographic techniques. Collectively, diagnostic laboratories and pharmaceutical and biotechnology remain key end-users of HPLC. Demand from these two channels is likely to grow at 6 percent through 2030.

North America is expected to account for the largest share of the global HPLC market by 2027. Market growth in this region is driven primarily by the increase in the funding for R&D, a growing number of preclinical activities by CROs and pharmaceutical companies, and the increasing food and agricultural industry in Canada. On the other hand, Asia-Pacific is projected to have the highest growth rate during 2022 to 2027.

The high growth rate of the Asian region can be attributed to factors, such as extensive sales of biosimilars and generics in Japan, and the growth in the pharma and biotech sectors in India and China are some of the major factors driving the growth of the HPLC market in this region.

Europe is anticipated to capture a substantial chunk of the global HPLC market, attributed to increasing investment by key players into the pharmaceutical and biotechnology industry, as well as government intervention in the field of environmental control and food safety. The European HPLC market is poised to capture nearly one-third of the overall market share, expanding at a CAGR of 4.4 percent.

The global HPLC systems market is well established owing to the dominance of prominent market players, such as Thermo Fisher, Waters, Agilent, Shimadzu, PerkinElmer, GE Healthcare, Bio-Rad, Merck Millipore, Showa Denko, Gilson, Phenomenex, Jasco, Hamilton Company, SIELC, Orochem, YMC Co. Ltd., Restek, Trajan Scientific, Sartorius, and Tosoh Bioscience LLC.

To maintain a significant position in the global HPLC market, key players are following strategies, such as developing user-friendly and cost-effective products, mergers and acquisitions, robust research and development, and geographical expansion.

In March 2022, Thermo Fisher Scientific announced its plans to invest USD 97 million to expand its bioanalytical laboratory operations into three new locations in Virginia’s Greater Richmond region, adding nearly 150,000 square feet to its existing operations in the area. Thermo Fisher acquired the laboratories with the purchase of PPD, Inc., a provider of clinical research services to the biopharmaceutical industry, in December 2021. Longer term, the company plans to continue to invest in and connect the capabilities across the combined company. The bulk of the expansion will occur in immunochemistry and chromatography functions, as well as subsequent enhancements in biomarker and vaccine sciences.

In March 2022, Novasep and Sartorius announced the completion of the sale of Novasep’s chromatography equipment division to Sartorius. Novasep’s chromatography equipment division comprises resin‑based batch and intensified chromatography systems and focuses on low and high pressure for small and large molecules, such as monoclonal antibodies, oligonucleotides, peptides, and insulin.

In October 2021. Waters Corporation introduced the Acquity Premier Solution, the next generation in liquid chromatographs featuring Waters’ breakthrough MaxPeak high-performance surface technology.

The solution leverages high-performance surface to vastly improve analytical data quality and eliminate the need for time-consuming and costly passivation. Acquity Premier is designed to alleviate the problem of analyte/metal surface interactions when analyzing organic acids, organophosphates, oligonucleotides, phosphopeptides, acidic glycans and phospholipids by reversed phase, and hydrophilic interaction chromatography.

In October 2021, Tosoh Bioscience acquired Semba Biosciences, a privately held company located in Madison, Wisconsin. Semba is a developer in the field of multicolumn chromatography instrumentation and technology for downstream purification of biologics. Tosoh plans to expand the current Semba team in Madison to create a global center of excellence for continuous chromatography.

For more than a century, chromatography has been indispensable as a separation method for both analytics and purification. Among the variety of chromatographic techniques, liquid chromatography has a special status owing to its efficiency and versatility, and its status is further enhanced by the continuous improvements of analyzers, materials, methods, and understanding, all supported by computational approaches. With product safety and reliable decision-making on the line, these laboratories must balance productivity with the highest standards of analytical accuracy. Yet, for laboratories operating at or near capacity, or planning to grow their market share, scaling-up workflows without compromising on quality can be challenging.

Routine analysis laboratories may face several potential productivity challenges with regards to their LC workflows. One of the most common sources of inefficiency is the process of transferring LC methods between instruments, where unforeseen complications and delays can divert time away from testing and have a major impact on productivity.

Routine analysis laboratories may face several potential productivity challenges with regards to their LC workflows. One of the most common sources of inefficiency is the process of transferring LC methods between instruments, where unforeseen complications and delays can divert time away from testing and have a major impact on productivity. This is true not only when transferring methods between laboratories, such as from analytical development to quality control (QC) settings, or when outsourcing to contract laboratories, but also when scaling-up methods across multiple instruments within the same laboratory or transferring workflows from legacy to new systems.

The ease and speed of method transfer often depends upon several factors, including the robustness of the method to be transferred, as well as the instrumental deviations of the systems involved. Here, the technical characteristics of the platform, such as gradient delay volume, pump-mixing mode, hydrodynamic behavior, choice of column and eluent thermostatic options, can all affect critical performance outcomes, such as peak resolution or retention times.

The complexity of method transfer is also determined in large part by the requirements of the analytical outcome and defined limits of acceptable deviation from the original system. Ideally, method transfer should occur with no method modifications to avoid spending large amounts of time and resources re-validating methods.

Other important causes of low productivity often stem from small yet critical oversights during routine laboratory processes, which can have major consequences for operational success. Compromised HPLC systems are also a key source of laboratory inefficiency, leading to unreliable and out-of-specification results that take valuable time out of routine workflows and prevent laboratories from achieving optimal productivity. Equally, recognizing these performance issues too late can result in extended instrument downtime due to unscheduled maintenance.

With productivity now a key focus point for analysis laboratories across all sectors, instrument vendors have responded by developing HPLC technologies designed to overcome these challenges. One of the main reasons why method transfer can be so time-consuming is that success is often not defined by a single instrumental parameter – factors, such as gradient delay volumes, column thermostatting and system dispersion effects all play important roles. Poor system configurability through rigid instrument design can, therefore, be a major stumbling block. Fortunately, recent years have seen a heightened focus on increasingly flexible HPLC technologies that can help laboratories streamline method transfer through the application of highly customizable parameters.

Modern instruments now offer a wide range of customizable features to facilitate the precise replication of existing methods. Highly flexible platforms allow gradient delay volumes to be seamlessly adjusted to match the analyte retention time and separation profiles of other instruments.

Modern instruments now offer a wide range of customizable features to facilitate the precise replication of existing methods. Highly flexible platforms allow gradient delay volumes to be seamlessly adjusted to match the analyte retention time and separation profiles of other instruments. Other innovations, such as a choice of still-air and forced-air thermostatting techniques within the same instrument, can help analysts more easily mimic legacy HPLC systems to achieve the desired results faster.

Another key issue associated with method transfer relates to system-dispersion effects. While lower system dispersion benefits overall separation power, it can lead to undesirable peak shapes when samples with high organic content are injected. Flexible systems that use custom injection programs to perform in-needle dilutions have enabled analysts to inject high-organic samples, while maintaining exceptional chromatographic efficiency.

As such, custom injection programs are increasingly seen as a powerful tool when it comes to rapidly transferring methods between systems. Innovative productivity tools are also being built into instruments themselves. These simple yet effective features are designed to ensure instruments never run dry and waste will not run over, enabling laboratories to minimize the potential for human error, avoid lost time and, ultimately, run large sample sets with confidence.

HPLC has been utilized in a wide range of applications for decades, offering robust and straightforward testing and analysis capabilities for expert and novice users alike. However, as the demand for faster separations, better peak resolution, and lower detection limits has increased in a number of industries, many labs have begun to transition their HPLC methods to UHPLC instruments. As this evolution continues from HPLC to UHPLC, led initially by pharmaceutical laboratories with others in various industries starting to follow suit, it is helpful to understand the basic differences between the two techniques, the key benefits UHPLC can bring, and best practices and factors to be considered when transferring methods to ensure consistency and data quality.

The configuration of the pump and column are primarily what differentiates an HPLC system from a UHPLC system. HPLC pumps typically deliver solvent at consistent pressures between 6000 and 10,000 psi (413–689 bar). It is imperative that the pump pressure be maintained at a constant rate, even with the backpressure created as the mobile phase interacts with the stationary phase. A constant flow rate, along with built-in solvent degassers to remove dissolved gasses in the mobile phase, ensure reproducible and accurate results.

HPLC columns typically contain particles that are 3–5 µm in size, and vary in length and diameter, depending upon the intended application. Although not always the case, longer column formats typically yield better separations, as non-target compounds are exposed to the column for longer periods of time. Longer columns, however, slow down the analytical process, and it is thus important to balance separation efficiency with the need for fast separations.

UHPLC columns, on the other hand, utilize smaller particles, typically 2 µm or less. As the particle size is reduced, so is the size of the column itself. UHPLC columns are often half the size of HPLC columns in terms of both diameter and length, increasing the efficiency of the separation, and thus the speed of the analysis. Studies have shown that it is possible to achieve an equivalent level of chromatographic efficiency, utilizing a 150-mm HPLC column packed with 5 µm particles, and a 50-mm UHPLC column packed with sub 2 µm particles1. The sample analysis time, however, is improved 9-fold using UHPLC1. The smaller particles used in UHPLC columns also yield narrower chromatographic peaks, improving resolution and sensitivity.

However, it is important to note that to accommodate UHPLC columns with smaller particle sizes, UHPLC pumps must be able to operate at a higher pressure to propel the mobile phase through the more tightly packed stationary phase. UHPLC pumps commonly offer solvent delivery at pressures in the 12,000–18,000 psi (827–1241 bar) range.

The higher pressures associated with UHPLC pumps can cause column degradation owing to the pressure shock on the column, experienced during sample injection as the valve switches. Recent technology, such as intermediate loop decompression injection valve, reduces these pressure fluctuations, thus increasing column lifetimes, even at the higher pressures generated by UHPLC columns.

Cost is often a major concern for commercial laboratories, and the initial cost of a UHPLC system is often higher than an HPLC system. This cost, however, can often be quickly balanced by the increased throughput labs can achieve by using UHPLC. That being said, labs running a smaller number of samples may not be able to appreciate this cost savings – although, if the analytical results are time-sensitive, UHPLC can provide a much faster time to decision turnaround, so a cost-benefit can be produced in other ways.

The cost savings and benefits associated with UHPLC do not end there. Owing to the increased efficiency of smaller-particle-size columns and the higher back pressure, solvent flow rate is reduced, resulting in less solvent consumption during analysis. Reducing solvent consumption not only lowers the cost of each sample analyzed, but also minimizes the waste generated during analysis, which can help companies work toward their corporate social responsibility goals.

Once the decision to transfer methods from HPLC to UHPLC has been made, a number of factors should be considered to ensure method transfer is efficiently and effectively completed.

Not all analytical methods are inherently good candidates for method transfer to UHPLC, and may not yield sufficient financial or efficiency gains to support the inherent costs associated with implementing new methods. Good candidates for migration to UHPLC are methods with long run times (≥20 minutes), those that use reverse-phase columns, as well as methods or labs with heavy sample loads.

When transferring a method to UHPLC, ideally, the same type of column should be utilized to maintain the analyte retention order and ensure consistency over time. The optimal inner diameter of a UHPLC column is around 2.1 mm, as this column size reduces mobile phase consumption and frictional heating, which can lead to column degradation. Taking time to choose the right UHPLC column will simplify the migration from the HPLC method.

The transfer of a method from HPLC to UHPLC can yield significant productivity improvements and cost savings, owing to a reduction in run time and solvent consumption. These cost savings and throughput improvements can quickly balance the increased cost of capital associated with UHPLC instrumentation.

Analytical laboratories in a variety of industries are turning to the newest LC technologies to improve productivity as workloads increase and firms strive to expand. Forward-thinking laboratories are expediting the mobility of both analysts and samples thanks to contemporary LC systems, resulting in significant capacity and efficiency advantages. Improvements in HPLC are sure to continue, but perhaps not from the direction one would assume. New HPLC systems seem to be more focused on regulatory compliance and fitting into a more automated laboratory environment, and less on specific performance improvements.