MB Stories

Technologies shaping a new era of innovation and growth

It is no exaggeration to say that 2021 was a year of enormous challenges for clinical laboratories – and the broader healthcare industry – as well as one of opportunity. With the worldwide Covid-19 epidemic eclipsing 2021 and 2020, what does 2022 hold for the industry? Is it going to be the same again or something quite different?

Clinical laboratories throughout the world processed more files and data in 2021 than ever before, and systems are continually rearranging to achieve a critical mass for profitability. The goal is to minimize the amount of time it takes to create reports, speed up the workflow, and increase the overall sensitivity of the findings. This year, a dozen significant operators, including the top five IVD companies in the world – Thermo Fisher Scientific, Abbott Laboratories, Roche Holdings, Becton Dickinson Life Sciences, and Siemens Healthineers – have business divisions in this industry.

The abrupt turn toward meeting the demands of the pandemic both sidelined a range of routine medical procedures and testing, and demanded investment in SARS-CoV-2 technologies, reagents, and other supplies no one anticipated. That affected companies in different ways, though representatives from major IVD companies had a strong 2021 and anticipate the same to be true for 2022.

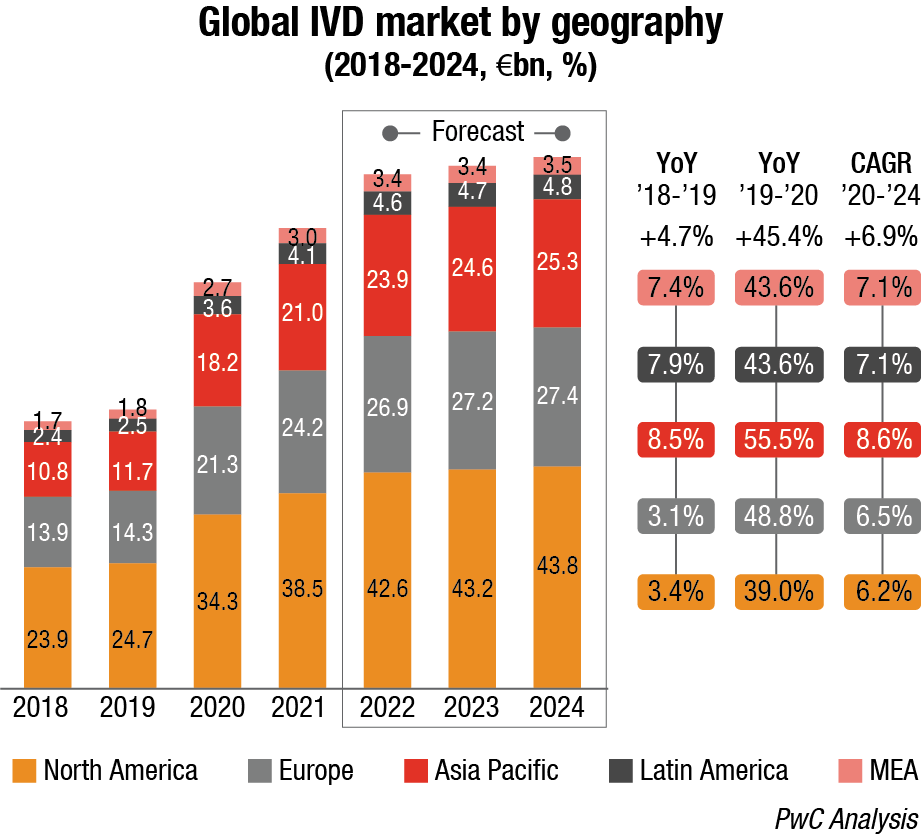

Covid-19 pandemic is expected to continue to positively impact the IVD market in 2022, which is forecast to grow at a higher pace comparing to pre-pandemic levels (ca. 11%–13%) due to a progressive reduction of swab tests, but an increase in serological ones to map antibodies presence after vaccination.

As regards technology segmentation, Covid-19 has positively impacted immunoassay and molecular diagnostics and genetics with a +49.9 percent and 230.9 percent YoY 2019-20 growth respectively, while there has been a negative impact (ca. 3%–5%) on other segments due to decline in the number of installed bases and routine testing.

The same happened considering the application segmentation with infectious diseases recording a +166.2-percent YoY 2019-20 growth, and others impacted negatively.

Major IVD corporations expect their innovations from the pandemic to play a key role in the future, along with a renewed focus on better processes and moving testing closer to patients – whether that is at the hospital bedside or at home. The amount of money put into diagnostic testing during the pandemic from private capital, governments, and nonprofits will bring forward the next generation of testing to market.

The crisis had uneven effects on research and development budgets as the world raced for Covid-19 solutions. While this may have momentarily pulled work away from other projects, it has led to process improvements that will benefit all development moving forward.

The pandemic also has underscored the value of laboratory data and insights, as well as the need for clinical laboratorians to contribute to population health initiatives. There has been a push within the hospital environment for Lab 2.0 for a while now. The pandemic just reinforced the need for that evolution.

It is hardly an exaggeration that 2021 was both a time of significant challenges for clinical laboratories – and the entire health enterprise – and also one of the opportunities. And while 2021 like 2020 is overshadowed by the global Covid-19 pandemic, what will 2022 have in store for the industry? More of the same or something significantly different?

With the pandemic, guaranteeing faster turnarounds has also become a priority, increasing demand for automated liquid handling, microplate readers, and robotic equipment. Immunology and serology testing have gained importance during this pandemic, now in its third year. There has been significant deployment of polymerase chain reaction and quantitative polymerase chain reaction techniques in laboratories and hospitals, to improve Covid-19 testing capacity. This unprecedented increase in testing volumes presented a great opportunity to ramp up automation in immunology diagnostics, clinical chemistry, and hematology labs.

Clinical chemistry analyzers have been undergoing constant changes, with fully automated devices now available in the market. These analyzers can perform functions, such as recognition of sample and reagent bottles, tube sampling, cap piercing, automatic re-run, and dilution. Value-based outsourcing is one of the major trends in the market, where the laboratory tests are outsourced to clinical reference laboratories. Small hospitals lacking basic infrastructure for clinical diagnosis have agreements with clinical laboratories. The hospitals outsource the patients to these labs for undergoing various diagnostic tests.

In the past years, the market has been moving from fee-for-service to value-based-care model to shift laboratory services to outsourcing diagnostic vendors. The shift from hospital outsourcing services to reference laboratories will be a major driver for the clinical chemistry analyzer market in coming years.

Demand for automated clinical chemistry analyzers is growing as laboratories work to improve operational efficiency and lower total cost of ownership. Today’s automated instruments must meet accuracy and throughput goals while also providing remote management and diagnostics services to minimize downtime and provide a better customer experience.

Analyzers are leveraging increasing CPU performance to consolidate multiple functions onto a reduced, standardized CPU footprint. This is helping to increase functionality and introduce new features while lowering bill of materials costs and streamlining the development and deployment of new applications.

In an effort to reduce equipment downtime and support a better customer experience, remote management and diagnostics solutions are migrating to incorporate computer vision systems. Computer vision systems enable better support for diagnostics by providing technicians a view inside the instrument. These systems can also be combined with artificial intelligence (AI) algorithms to identify and circumvent possible issues before they occur.

In the coming years, there is potential for labs to improve throughput and efficiency by taking advantage of more powerful compute, computer vision, robotics, and AI to drive autonomous workflows. This would enable dynamic routing of complex testing workflows based on real-time data analysis, freeing clinicians to focus on high-value work.

The clinical chemistry business has seen a significant shift in favor of automation. Although this trend is not limited to the scientific industry, with the majority of the world preferring contemporary technology over old techniques and processes, automated systems bring a number of advantages to both laboratories and the professionals who work in them. As a result, less preparation time, faster throughput, and less human error imply that testing is now more efficient than ever before, producing better findings in shorter periods of time and, as a result, making testing a more lucrative endeavor owing to greater production. While some regard the emergence of robotic assistants as a danger to jobs, it is believed that laboratories will never be totally capable of functioning without human input. As a result, the extra helping hand will minimize weariness and physiological strain among people working in the laboratory, allowing for more time to conduct new research, which will lead to new discoveries and further development capabilities in the future.

Today’s hematology analyzers not only must deliver more clinical data than ever before but also are easier to operate, relieving overburdened laboratory staff of cumbersome tasks.

The persistent growth of the hematology market is attributed to the increasing incidences of blood disorders and increased prevalence of other diseases and infections. Rapid technological advances in hematology analysis and the emergence of high throughput hematology analyzers with novel parameters have also contributed to rapid growth.

Hematology analyzer manufacturers have responded to these needs with technological evolution in the areas of new product developments, workflow improvisation, analytical advancements, and clinical information management. Further revolutionary advancements in computing along with AI-enabled algorithmic tools, electronics, and manufacturing, and with continuous innovation in the areas of biotechnology, fluidics, and mechanics, have led to a reduction in the size of analyzers and increase in the speed of analysis. Many of the technologies like innovative flow cytometry analysis, genomics testing, advanced automated imaging processing and microfluidics are at the early stages of development and exist outside the routine core workflow, but it will not be long before they become standard hematology workflow.

All these developments have resulted in accelerated overall treatment regimen with improved accuracy and elimination of human error. This evolution is providing the clinicians a plethora of information that was not available earlier. Technological advances are also allowing pathologists access to additional parameters and more cellular information and minimizing unnecessary manual reviews. Additional parameters have a great potential to identify changes in cell morphology that typically occur in several acute medical conditions. As a result, hematology analyzers are gaining trust as a powerful tool for the management of any medical condition and assisting pathologists in clinical decision-making.

New tools and parameters will continue to emerge as the market competition increases and technology evolves. Indeed, this is an exciting time to be in the field, and the next five years should promise to bring better patient care and more options for laboratory professionals.

Immunochemistry is becoming ever more popular. Direct detection of SARS-CoV-2 viral proteins (antigens) in nasal swabs and other respiratory secretions using lateral flow immunoassays (also known as rapid diagnostic tests, RDTs) is a faster and less expensive method of testing for SARS-CoV-2 than nucleic acid amplification tests (NAATs), which are the standard method. Immunoassay is finding new markets, thanks to advances in genetic knowledge. Rapid diagnostics, point-of-care, biomarkers, and consumer sectors are all rising, while traditional immunoassay remains a prominent player in the clinical diagnostics business. Chemiluminescence immunoassay (CLIA) systems are gaining traction, which leads to a decrease in enzyme-linked immunoassay (ELISA) testing.

Though the latest emerging technology, i.e., the multiplex proteomic array platform is rapidly replacing ELISA, its market continues to grow since it is being preferred as a secondary validation tool to confirm the results of multiplex proteomic platform.

With the development of signal-generation methods, the attention has shifted to the development of immunochemical methods and instruments to provide convenient, high-performance systems. Important advances have been made in the design of immunochemical approaches that allow small molecules, such as metabolites and toxins, to substitute dynamic format assays with non-competitive formats, bringing advantages previously seen only with large molecular analytes. Further, the continuous development of new biomarkers, cost-benefit, and growing adoption of automated platforms for ELISA are expected to increase this technology’s adoption.

Lab automation now enters a new phase. Laboratories are investing heavily in total lab automation (TLA) systems supplied by IVD companies. These systems combine to form an integrated system for total automation of pre-analytics, processing, clinical chemistry, and post-analytics immunochemistry workstations. The aim is for specimens to be processed, analyzed, and even stored with minimal user intervention. According to the American Association for Clinical Chemistry (AACC), 4000+ laboratories worldwide have now installed automated systems.

On the one hand, mid-sized facilities (1.5 to 6 million tests annually) are often equipped with only the latest-generation compact systems, combining clinical chemistry and immunoassay activities, taking up around 2 m2, allowing a through-rate for tests of 870/hour. Larger laboratories tend to invest in bigger systems, or even in several systems in parallel, integrating the hemostasis and hematology sections.

All stages of analysis can ultimately be combined under TLA – provided, crucially, that the analysis instruments can work at the same speed as the tube conveyor. However, one issue looks big for full lab automation – equipment upgrades. For suppliers of diagnostic instruments, the opportunities associated with TLA innovation have been quickly overshadowed by the urgent need to upgrade. The choice of upgrade instruments for immunology, clinical chemistry, hemostasis, and hematology is now frequently reliant on their compatibility with TLA systems.

The current need for automation is increasing largely owing to the dramatic growth in internet-based processes. Connecting devices to the internet enables remote patient monitoring, alerts, management, etc. Digital transformation is driving growth in this market. As manual systems still expose the process to the risk of error, implementing Internet of Things (IoT) systems helps to collect data both digitally and accurately, which has been shown to reduce the time needed by 60 percent. IoT also offers IVDs the ability to interact directly with the support layer, allowing events to be captured electronically.

As connected technology and cloud-based laboratory information management system platforms evolve, new tools emerge. These help companies to reap the rewards of digital transformation. The internet-based tools provide labs with a secure means for organizing data, allowing quick and easy access to information, while allowing companies to exercise control over data sent to third-party instrument providers.

Systems implementing IoT will be able to deliver server control and monitoring of various sensors, and can easily be configured to handle further hardware integration modules. Sensors fitted to devices can assist with data collection and communication with the cloud and other devices.

With digital pathology and AI FDA cleared to aid in the primary diagnosis of prostate cancer, greater adoption of these technologies in 2022 is expected. In 2021, Quest Diagnostics and Paige formed a collaboration to advance AI-generated pathology insights to improve cancer diagnoses and care. After a recent FDA authorization, Paige’s software now has the potential to lay the groundwork for accelerated adoption of AI in digital pathology. By enhancing the role of the pathologist, digital pathology capabilities with AI can increase access to critical subspecialized expertise, improving accuracy, quality, and, ultimately, patient care. In addition, as the pandemic delayed diagnosis of cancers and other diseases, it is likely pathologists will experience an increase in cases requiring their diagnostic expertise in 2022 and beyond. Being forward-thinking, adopting cutting-edge technology like AI is just one way to address both patient and pathologist needs. With advancements in medicine only getting more complex, this technology has the promise to capture the nuances of an individual pathology case via AI pattern recognition of thousands of previous cases to provide better diagnostic insights in areas, such as immuno- or biologic-based therapy selection.

Machine learning will also help laboratories meet future and ongoing challenges.

Machine learning will be an important technology in developing effective molecular diagnostics now and in the future. Machine learning-based diagnostics will be the key to simplifying and automating the R&D process, allowing scientists to respond rapidly to testing needs.

Regulatory agencies are, surprisingly, ahead of the curve and are setting guidelines for how technologies need to be developed.

Expecting a surge in these technologies, the FDA has published 10 guiding principles for Good Machine Learning Practice (GMLP) in the development of medical devices with its regulatory counterparts around the globe.

At-home testing will continue to grow and be widely accepted. The pandemic has changed the testing dynamic, taking it out of traditional hospital or physician office venues, and into pharmacies and consumers’ homes. The experts see this trend continuing and even accelerating into 2022.

The Covid pandemic opened the door to widespread use and acceptance of pharmacies as critical, convenient, and rapid testing and vaccination centers. The expansion of healthcare services by pharmacy clinics could be an opportunity for IVD companies to provide point-of-care, CLIA-waived tests for rapid, on-site testing at the clinics, and for local laboratories to partner with the pharmacies to provide more comprehensive and esoteric testing services.

The range of tests available in the home, whether as prescription-only test or without a prescription, will also continue to increase, further decentralizing the testing process.

At-home collection has emerged from the current pandemic to become an important tool beyond Covid-19 detection. Traditionally, diagnostic tests need to be administered by a healthcare provider. At-home collection will allow users the flexibility to perform diagnostic testing from the comfort of their homes. A few existing tests, like Cologuard, require a prescription, but the at-home collection market will expand, and several exciting new tests will become available without a prescription and purchased online or over the counter. Novel at-home sample collection and stabilization kits, containing optimized media that function beyond simple saline and PBS, will be developed for a range of new diagnostic molecular tests.

Significantly, this trend is probably a genie-out-of-the-bottle moment in which at-home and other non-traditional forms of testing will not go away once the pandemic enters its endemic phase.

Covid ushered in mobile, point-of-care, and at-home diagnostics, along with the growth of telemedicine. These will continue to greatly impact the future of testing. At-home diagnostics has made it easier, and more accessible for people to test and receive quick, accurate results. Moving forward, with high-sensitivity molecular tests, people will be able to test themselves, before they even start exhibiting symptoms, with high-sensitivity molecular tests.

Decentralizing testing, either in a neighborhood pharmacy or in a patient’s home, will have benefits across the healthcare enterprise. There is an increasing demand for more patient-centric healthcare, to not only deliver better clinical outcomes but also more cost-efficient healthcare solutions. For example, decentralized testing aims to bring testing out of the hospital laboratory and closer to the patient, and ultimately to point-of-care diagnostics and patient self-testing, to enable the delivery of healthcare where and when it is required. With faster turnarounds, test results will be delivered in clinically meaningful timeframes to truly inform clinical and treatment decisions, improving outcomes for patients. Presently, many tests done in the laboratory take time to process, and results are often returned after clinical decisions have already been made. Key applications would be in the rapid prescription of appropriate antibiotics, by quickly knowing that the pathogen is bacterial and its antimicrobial resistance profile, and in wider population screening for early detection of disease, which can make a huge difference in cancer outcomes.

Further, decentralized testing will democratize the process, taking it out of the hands of specialists. This decentralized approach requires simple, accurate tests that require little specialist training to use – recent developments with Covid testing and the increased adoption of lateral flow tests for diagnosis, for example, have proven that the technologies are available to deliver these solutions. The increased awareness and use of these diagnostics have also shown the capability of non-healthcare specialists to successfully run them. This will lay the groundwork for the adoption of decentralized testing for many other diseases, and potentially fuel the development of self-testing, to enable patients to take more control of their healthcare.

The menu of pathogen and genomic tests will increase. Home testing will give birth to a growing menu of pathogen and genomic tests.

Experts anticipate at-home testing to couple with ongoing advancements in molecular pathogen testing and genomic screening/susceptibility tests for cardiac, diabetes, and cancer detection. A growing menu for biomarker and genomic-based tests is expected in 2022. Users of at-home and over-the-counter tests will be able to monitor and manage chronic conditions before they emerge. The cost of long-read next-generation sequencing continues to become more cost efficient. Thus, at-home genetic testing will expand in 2022 and beyond, opening attractive markets in bioinformatics where an individual’s genome, obtained from at-home collection can be stored and re-assessed prospectively as new genomics/genotyping tests are developed.

New test types will proliferate. New tests are being researched all the time, and while many show promise, few are brought to market. Several new tests will be introduced throughout 2022.

Liquid biopsy in advanced cancer is likely to increasingly supplement tissue biopsy in 2022, becoming an important tool for patients where ensuring a large enough tissue sample for molecular testing is key, especially for cancers like that of lung. At the same time, breakthrough innovations like liquid biopsy for cancer detection raise new challenges. If liquid biopsy can identify signals for more possible cancers than current screening methods, what is the best way to help make sure patients, particularly in underserved communities, have access to appropriate work up and confirmatory diagnostics and treatment? In 2022, the medical community, including laboratory professionals, will need to create more solutions to deliver liquid biopsy as part of a care pathway, involving multidisciplinary care that connects patients, their primary care team, and specialists at each stage of the journey to aid in early diagnosis and potential curative treatment.Labs will also have an increasing number of biomarkers at their disposal. The number of actionable biomarkers will continue to increase, with a concomitant increase in multi-gene panels using a variety of test platforms. It will be important for us to communicate the clinical validity of these biomarkers to clinicians and payers.

Syndromic assays will also be an important tool in the future of accurate diagnostics. High-multiplex, syndromic assays available at affordable pricing will allow people to test for more than one pathogen and disease at a time, making testing and follow-up care more efficient, timely, and effective. Because these assays are developed through data-driven logic and automation, they are often remarkably accurate and provide a complete picture of a patient’s health status in a clinically meaningful timeframe to reach therapeutic decisions.

Collaboration will become the industry norm. The past two years have seen increased collaboration among researchers, government agencies, and providers. This trend is expected to continue into 2022.

Covid-19 has forced scientists to work more creatively and collaboratively than ever before. For decades, public-private partnerships have demonstrated tremendous value in the areas of newborn screening, food, and water testing. Today, and for years to come, such foundational collaborative efforts will be critical in the fight against forces that pose a threat to global health. As Covid-19 transitions to an endemic disease, we will see a concerted effort within and across scientific communities, governments, and other vested parties to prevent future pandemics. A global surveillance model for timely identification, tracking, and mitigation of future outbreaks is an eagerly expected outcome in 2022.

Collaboration will not just end with managing Covid-19.

Beyond pandemic management and prevention, collaboration will further propel important discoveries in the field of personalized medicine. Using next-generation sequencing, scientists are learning more each day about the human genome and how certain genetic variants may make a person more likely to develop certain diseases or conditions. This advancement has already armed clinicians with information to improve patient care, including recommendations that have proved to be lifesaving.

A collaborative approach will also be a means to fulfill many of the other predictions for 2022. A collaborative mentality also has high potential to accelerate vast improvements in operational aspects, including availability, accessibility, ease-of-use, and automation to maximize the impact of healthcare solutions.

Will all of the aforementioned predictions come true as predicted by the experts? Perhaps. Possibly not. Some will surely be realized, while others may not be completed at all next year or the year after.

Clinical laboratories will, without a doubt, continue to be affected by Covid for many years to come, posing both obstacles and opportunities for innovation.