Reports

Updating the post Covid-19 playbook for M&A

M&A could help the MedTech industry boost value creation, but only if companies can adapt their dealmaking approaches to changing macroeconomic conditions, says a McKinsey report.

A decade of growth acceleration has paradoxically left MedTech companies in a difficult position. The industry has grown by 50 percent since 2012, making it harder for companies–particularly larger ones–to organically improve their performance. This presents a challenge for companies eager to create value in an industry that has not outperformed the public market since 2019.

M&A–mergers, acquisitions, and divestitures–can reliably and rapidly improve a company’s performance outlook. M&A can help organizations serve more patients in more ways, enabling them to access new patient pools, scale for better commercial operations, divest distracting and underfunded businesses, and add new capabilities in digital or R&D.

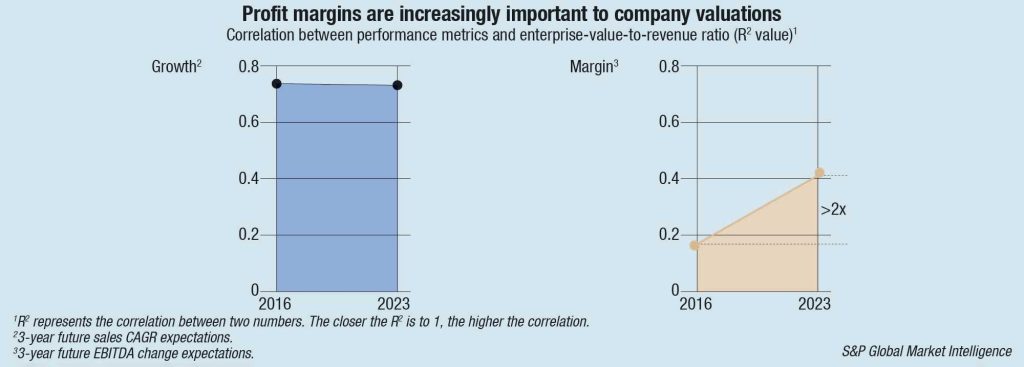

But reconfiguring a corporate portfolio is a daunting task. Companies eyeing M&A will have to negotiate overarching macroeconomic uncertainties and tightening capital markets. Notably, earnings growth–rather than simply top-line growth–is increasingly important to company valuations. This shrinks the pool of attractive potential targets to companies that have the right combination of growth and profitability.

In this context, MedTech companies can adjust their approach to M&A. They can reconsider the value of large deals, adjust their priorities in programmatic M&A, increase investments in early-stage companies, and proactively pursue divestitures. MedTech companies that do these things well could fast-track value creation.

A promising environment for M&A

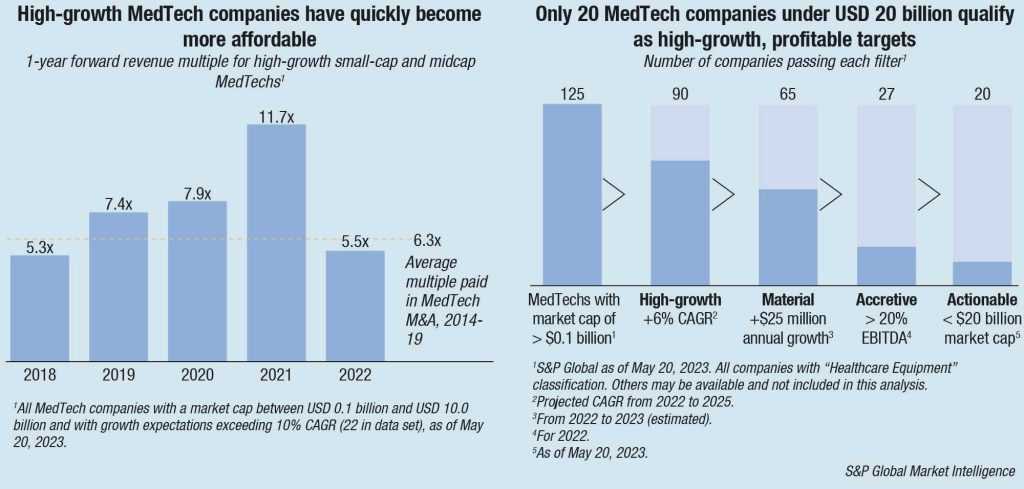

Despite macroeconomic volatility, market conditions for MedTech M&A are positive. First, prospective acquisitions are getting cheaper after years of ballooning valuations. Valuations for the highest-growth targets have retreated to their lowest point since 2018.

Conversely, divesting companies are likely to attract many willing buyers in both private and public equity markets because of a sedate IPO market. Only five MedTech companies debuted in the public markets in 2022, compared with 23 per year, on average, in each of the five previous years.

To be sure, the specter of a recession may dampen M&A activity: MedTech M&A dropped by 20 percent during the recessions of 2001 and 2008, and US interest rates now sit at their highest level in 15 years. However, these factors are not the same barriers they may have been in the past. Recent McKinsey research shows that fewer than 10 percent of MedTech CEO respondents would defer M&A because of a recession. In addition, the 30 largest MedTech companies currently hold more than USD 200 billion of dry powder in cash or cash equivalents.

Despite the likely high demand for M&A activity, willing buyers may discover that the supply of attractive assets is lower than they had imagined. This is a recent change and is driven by a new equation for value creation; margin expansion is now more than twice as important to company valuations as it was in 2019. As a result, profitability (or the ability to increase it) has risen in importance to prospective buyers.

McKinsey analysis of the 125 largest US- and EU-based MedTech companies by market capitalization shows that weighing profitability more heavily culls the number of viable targets.

More than half of the companies (65) boast high growth rates in addition to significant revenue bases, but less than a quarter (27) are high growth and offer potentially accretive margins. Capping the size of the target at USD 20 billion shrinks the hypothetical target list to 20.

A shift toward profitability and selectivity in MedTech M&A

MedTech companies can continue to use M&A as a tool to create value; however, decision makers should adjust their approaches to potential transactions.

Reconsidering the value of large deals

McKinsey research has shown that big deals have also historically involved big bets and big risks. They offer significant upside potential but with a risk of distraction, customer confusion, and slowing revenue growth. In an environment that rewarded organic growth more, large transactions seemed less appealing than simply growing the existing business.

But two factors may change the importance and role of large deals. First is the rising importance of margin improvement relative to valuations. Large deals can provide scale, which can improve companies’ cost positions: the 20 largest MedTech companies by revenue boast a median EBITDA margin of nearly 11 points more than the next largest 20. Companies can especially benefit when a particular geography or business unit is underperforming on profits, with the merged business offering an opportunity for new scale, capabilities, and cost synergies.

The second factor is the evolving relationship between MedTech companies and their customers. Because of the increasing adoption of value-based care and the rise of new digital ecosystems, health systems consider MedTech companies to be end-to-end partners rather than simply providers of devices. Large deals can help MedTech companies integrate offerings across portfolios, making it more likely that a health system will designate a MedTech company as a partner of choice.

Although the higher cost of debt may hamper bigger deals in the near term, more companies should consider these opportunities as a way to respond to new conditions in the industry. Indeed, some MedTechs have already taken action. Two midsize orthopedics companies recently merged, in part to use their newfound scale to provide higher service levels to customers. If done right, such M&A deals could transform companies, improve their ability to partner with customers, and create cost efficiencies that facilitate value creation.

More-selective targeting in programmatic M&A

Programmatic M&A–to achieve specific corporate objectives through a strategic series of deals–is evergreen.As approaches to value creation shift, prospective buyers should be more selective.

Of course, though margins have become more important, innovation will continue to be paramount for value creation. In acquisitions that target specific innovations or new capabilities, acquiring companies will likely want to prepare strategies that mitigate potential margin dilution. Growth-focused acquisitions that expand the core might also be more valuable than those that help the parent company access adjacencies. Consider how the public markets reacted favorably to a 2023 programmatic acquisition in AI imaging equipment and software that boosted the combined entity’s growth trajectory and its ability to use its scale to forge and maintain customer relationships.

More capital dedicated to digital offerings

In earlier chapters, we discussed the momentum of software innovation and the value of digital health ecosystems. M&A can help companies transform their digital innovation prospects and “short-circuit” years long development cycles. Consider Stryker’s acquisition of Vocera in 2022 and GE HealthCare’s 2023 announcement to acquire Caption Health; both deals will help the acquiring companies expand their value propositions beyond the benefits of their physical products.

More-creative transaction structures

As profitability and cash management continue to gain importance, companies will likely explore transaction types outside of traditional M&A or divestitures–including co-acquiring companies alongside private equity firms or raising external capital to fund R&D programs–in exchange for product royalties. These deal structures offer a lower-risk way for companies to participate in M&A or innovation, reducing their own profit-and-loss or capital constraints by sharing costs with or shifting them to outside partners. For M&A, companies can increasingly select this option if the cost of debt proves to be too much of an impediment. For R&D, companies should consider external capital as a way to fund programs or studies that would otherwise not receive sufficient funding from internal sources. These types of deal structures are increasingly common in the pharmaceutical sector. For example, Royalty Pharma has made 15 investments since the beginning of 2021. In MedTech, Blackstone Life Sciences announced a USD 337 million product investment in Medtronic to expand development of diabetes technologies.

More divestitures

As the MedTech industry has grown over the past decade, many companies now find their portfolios large, diverse, and unwieldy. Compared with the assets of a smaller company, a large portfolio size makes it more difficult for these companies to find strategic moves that materially alter their trajectories. A company with USD 10 billion in annual sales would need to generate USD 500 million to USD 600 million of new revenue and USD 100 million to USD 180 million of new profit–equivalent to creating a new midsize MedTech business every year–just to keep pace with market growth.

Divestitures allow companies to adjust their portfolios and reset the valuation trajectory for the remaining company and the divested business unit, which may have received insufficient funding and attention under its former parent. Divestitures can relieve companies of segments with lower strategic or financial value, freeing management to concentrate on the core business. Meanwhile, divested businesses are better positioned to dedicate leadership attention and resources to their own performance. The proceeds from divestitures can also fund potential acquisitions or growth initiatives, allowing the company to forgo the need to raise the now more-expensive debt. Divestitures are already on the rise. In 2022, MedTech companies sold off almost three times as much business (as measured by value) as they had in 2019. The trend does not show signs of slowing: three of the top 15 MedTechs have announced plans to divest businesses worth more than USD 9 billion in revenue as of May 2023.

MedTechs’ challenges with value creation amid current economic conditions suggest that an acceleration in M&A could be beneficial. Leaders should explore possibilities—and act—while the pool of growing and profitable assets and keen buyers is still relatively plentiful.

Based on MedTech Pulse: Thriving in the next decade, McKinsey & Company