MB Stories

A steady market

The adoption of POCT blood gas and electrolyte analyzers is surpassing that of laboratory-based analyzers. This transition represents a significant advancement in critical care and emergency medicine.

The blood gas analyzer market in India is witnessing a significant growth. Prevalence of chronic disorders, a higher number of patients being treated in NICUs, emergency departments, and ICUs, as well as government initiatives like Ayushman Bharat Yojana and National Rural Health Mission have kept this market alive.

In the Covid-19 pandemic period too, the demand did not go down. During the pandemic, several surgeries were postponed, and non-emergency hospitalization was canceled, which impacted the market initially. In July 2020, National Syndromic Surveillance Program (NSSP) found that emergency department (ED) visits declined 42 percent during the early Covid-19 pandemic, from a mean of 2.1 million per week (March 31–April 27, 2019) to 1.2 million (March 29–April 25, 2020), with the steepest decreases in persons aged ≤14 years, females, and in the Northeast. The proportion of infectious disease-related visits was four times higher during the early pandemic period. However, there was a rise witnessed in the hospitalization rate of people suffering from Covid-19 that in turn increased demand for blood gas and electrolyte analyzers in hospitals, clinics, and point-of-care (POC) centers.

The Indian blood gas analyzer market was valued ₹385 crore in 2022, and is expected to reach ₹710 crore by 2030 at a CAGR of 7.1 percent. This includes benchtop, portable, and handheld analyzers and demand from both the direct tenders and retail sale distributors. End-users primarily are hospitals, clinical laboratories, research and academic institutes, and home setting.

Some of the major players include Roche Diagnostics Limited, Abbott Laboratories, Beacon Medicare, Transasia, Snibe Co. Limited, Instrumentation Laboratory, Siemens Healthcare, Radiometer Medical, Alere, Nova Biomedical, and Medica Corporation.

The commercialization of advanced technology-based analyzers has also contributed to their increased adoption among consumers in India. However, the market does face challenges, such as a shortage of skilled professionals and rising costs of components due to extensive research.

Global market scenario

The global blood gas and electrolyte analyzer market was valued USD 4.26 billion in 2022, and is expected to reach USD 7.25 billion by 2030 at a CAGR of 6.88 percent.

The market has undergone significant development and broadened its scope in recent years. This expansion is driven by global trends, such as the rising incidence of metabolic diseases like diabetes, as well as respiratory illnesses, such as chronic obstructive pulmonary disease (COPD) and asthma. The routine monitoring of blood gases and electrolytes is essential for managing these conditions, fuelling the demand for analyzers.

There has been continuous improvement in the speed, accuracy, and user-friendliness of blood gas and electrolyte analyzers. Advancements in technology, such as point-of-care testing (POCT) and miniaturized analyzers, have made these instruments more accessible to healthcare practitioners. Additionally, the world’s geriatric population, aged 60 years and older, is growing rapidly, further contributing to the need for these analyzers.

Streamlining clinical chemistry workflows with the ISE module

Prof. Praveen Sharma

Prof. Praveen Sharma

Scientific Consultant,

Snibe India

Electrolyte testing is important in clinical diagnosis because electrolytes are minerals in the body that help regulate various bodily functions, including nerve and muscle function, blood pH balance, and hydration. Imbalances or electrolyte deficiencies can lead to serious health problems, such as dehydration and irregular heart rhythms. Therefore, the detecting of electrolyte imbalances can aid in the diagnosis and treatment of these conditions.

Advances in medical technology enable professionals to provide accurate and timely diagnosis. Among the notable breakthroughs is the integration of electrolyte detection into the clinical chemistry detection workflow, made possible by the innovative ISE (ion-selective electrode) module. This technology has transformed the way electrolyte levels are measured, enhancing efficiency and precision in patient care.

The ISE module is a compact electrolyte detection device that can be seamlessly integrated with the existing IVD analyzers, such as the Cobas 8000 and Biossays C8. Its primary function is to measure the concentration of specific ions, such as Na+, K+, iCa2+, Cl+ in samples. Incorporating the ISE module into the detection workflow will assist in the rapid and precise acquisition of vital electrolyte information, enabling prompt decision making and effective treatment strategies.

Key advantages of the ISE module are:

Ease of use and operation. With its automated features, the ISE module eliminates the need for manual operations and calculations, saving valuable time and resources.

Software will minimize the need for operator training with the blessing of a one-click operation design. The module’s intuitive interface allows for seamless integration into the existing laboratory systems, streamlining the testing process and reducing the risk of errors.

The ISE module uses an all-metal enclosure design to prevent electromagnetic interference. Accuracy is paramount in medical diagnostics. No cross-contamination will ensure reliable and consistent results, enabling healthcare professionals to make informed decisions based on accurate data.

Today, the ISE module is a useful tool for healthcare practitioners due to its remarkable accuracy and versatility. The IVD analyzer can streamline the detection workflow by incorporating the ISE module, improve diagnostic capabilities, and ultimately enhance patient care.

Furthermore, the increase in the number of patients requiring blood sample testing has also driven the activity in this market. Technological advancements and government funding in research activities and the healthcare sector have played a significant role in the market growth. According to data released by the World Health Organization (WHO), the global incidence of cancer (excluding non-melanoma skin cancer) is projected to reach 23.6 million by 2030. This anticipated rise in cancer cases is expected to further accelerate the demand for blood gas and electrolyte analyzers.

However, high cost of equipment and technological limitations are expected to impede the market growth and competition from alternative technologies like biosensors and microfluidics devices that can limit the demand for blood gas and electrolyte analyzers.

Regional insights. North America held the major share of the global market in 2022. The reasons are many but the most important being good healthcare infrastructure. A growing patient population suffering from respiratory diseases and the presence of key market participants is also a reason for the region holding the largest chunk of the market share.

The blood gas and electrolyte analyzers market in the Asia-Pacific region is expected to grow at a significant rate in the coming years due to the growing healthcare awareness, increasing number of healthcare infrastructure, and rising incidence of respiratory diseases.

Also, in Asia-Pacific, benchtop blood gas analyzer market is dominating due to the factors like user-friendliness, better throughput, and more complete test menus that make them appropriate for high-volume facilities.

Visual blood

Interpreting blood gas analysis results can be challenging for the clinician, especially in stressful situations under time pressure. To foster fast and correct interpretation of blood gas results, the University of Zurich developed visual blood. This computer-based, multicenter, non-inferiority study compared visual blood and conventional arterial blood gas (ABG) printouts. Six scenarios were presented to anesthesiologists, once with visual blood and once with the conventional ABG printout. The primary outcome was ABG parameter perception. The secondary outcomes included correct clinical diagnoses, perceived diagnostic confidence, and perceived workload.

To analyze the results, the scientists used mixed models and matched odds ratios. Analyzing 300 within-subject cases, it was observed that non-inferiority of visual blood compared to ABG printouts concerning the rate of correctly perceived ABG parameters (rate ratio, 0.96; 95 percent CI, 0.92–1.00; p=0.06). Additionally, the study revealed two times higher odds of making the correct clinical diagnosis using visual blood (OR, 2.16; 95 percent CI, 1.42–3.29; p<0.001) than using ABG printouts. There was no or, respectively, weak evidence for a difference in diagnostic confidence (OR, 0.84; 95 percent CI, 0.58–1.21; p=0.34) and perceived workload (Coefficient, 2.44; 95 percent CI, −0.09–4.98; p=0.06). This study showed that participants did not perceive the ABG parameters better, but using visual blood resulted in more correct clinical diagnoses than using conventional ABG printouts. This suggests that visual blood allows for a higher level of situation awareness beyond individual parameters’ perception. However, the study also highlighted the limitations of today’s virtual reality headsets and visual blood.

POC analyzers

Notwithstanding their longstanding use in clinical settings for over four decades, there is an ongoing surge in the popularity of a novel generation of portable and maintenance-free blood gas analyzers.

Point-of-care (POC) blood gas and electrolyte analyzers have emerged as valuable tools for critically ill patients, enabling prompt medical intervention and improving clinical outcomes. These analyzers provide fast turnaround time for results, offering advantages over central laboratory testing, which often involves much longer processing times.

These analyzers, available as highly automated, stand-alone instruments, can be conveniently placed at the point of patient care in areas, such as respiratory, emergency, neonatal care, and intensive care units. They are designed to be small, compact, and mobile, with features, such as liquid crystal displays and keypads for data entry.

The introduction of newer blood gas analyzers has further enhanced their capabilities, allowing for the measurement of both blood gases and electrolytes in arterial and venous blood samples. These analyzers offer rapid results, often within five minutes, facilitating timely clinical decision making. They have proven to be as accurate as automated analyzers when measuring potassium levels, making them reliable when urgent potassium results are required. Additionally, they are cost-effective and can be conveniently available at the patient’s bedside.

POC blood gas and electrolyte analyzers not only expedite analysis but also enable blood sample analysis near the patient’s bedside, leading to accelerated clinical decision making compared to traditional hospital laboratories. Moreover, the incorporation of the latest technologies in these systems allows for blood analysis with minimal sample quantities, reducing the discomfort for patients and improving overall efficiency.

The blood gas analyzers, utilized to measure blood gas, electrolyte, pH, and some metabolites in the whole blood specimen, offer various advantages for critical care patients and are ideal in the (POCT) segment.

A large number of basic and complicated parameters are now being carried out for patients suffering from life-threatening respiratory disturbances and acid-base imbalances.

The ageing population is more at risk of contracting infectious diseases, and they require continuous monitoring of their vital signs while undergoing treatment to avoid any health complications.

According to the World Population Ageing Highlight 2020 report published by the United Nations, the global geriatric population is increasing rapidly around the world and in 2020, about 727 million people of age 65 years or more were living across the world, which was about 9.3 percent of the total global population and also, the same report projected that the population of people of age 65 years or more will be about 1.5 billion by 2050, which will be about 16 percent of the global population. Similarly, According to the October 2021 update of the World Health Organization, the percentage of people of age more than 60 years in the global population will increase from 12 percent in 2015 to 22 percent by 2050, of which, about 80 percent of the older people in 2050 will be living in the low- and middle-income countries. This data shows a significant rise in the geriatric population and where the majority of the older population would be residing. Thus, the increasing incidence of blood cancers, diabetes, and other blood-related disorders in the ageing population is also expected to drive demand for electrolyte machines, blood glucose analyzers, and other blood gas analyzer equipment through 2027.

Al these factors will drive the demand for blood gas electrolyte analyzers. Some of the major restraining factors in the market include the cost of the analyzer, reimbursement issues, and complicated regulations.

Blood gas and electrolyte analyzers

Sameer Arora

Sameer Arora

National Sales Manager,

Vector Biotek Pvt. Ltd. (A Beacon Group Company)

Blood gas and electrolyte analyzers are used to measure blood gas and some metabolites from the blood sample. These analyzers are used to determine abnormal levels of electrolytes, oxygen-carbon dioxide exchange rates, acid-base balance, oxygen concentration, as well as hydrogen ion concentration in patients with diabetes, blood vassel hemorrhage, shock, and drug overdose condition. The global blood gas and electrolyte market, which was at USD 3.57 billion in 2019, is expected to reach USD 6.24 billion by 2030 with a CAGR of 5.2 percent during this period.

The continuous rise in geriatric population leads to the upsurge in number of patients in emergency departments, critical care units, and operation rooms, and is a major driving factor for the growth of this product segment. According to WHO, the global population with age above 60 is estimated to rise from 12 percent in 2015 to 22 percent in 2050. This escalating population group will be the key target consumer for blood gas and electrolyte. Technological advancements with launch of plethora of new products will also contribute to the growth of this market.

From primitive technology like flame photometry to the latest development of using miniaturized biosensors with microfluidics has offered ease of use, simplicity, accuracy, and precision of reporting to the end user. Since these products are majorly used in emergency department and critical care setup, there has been a growing demand for portable/handheld analyzers for blood gas and electrolytes. The forerunner of these developments includes compact sample preparation, automatic calibration, and other associated features that enhance the accuracy and productivity. In addition to these advanced features, LIS, automated maintenance, real-time monitoring, and use of modern-day IT solutions help in reducing the turnaround time as well as human input errors.

Integration of artificial intelligence and machine learning algorithms is also under way for blood gas and electrolyte analyzers. This will help in improving result interpretation with greater accuracy. The algorithms in artificial intelligence can identify patterns, predict outcomes, and thereby effectively assist healthcare professionals for better patient outcome. These changes will have significant impact on the market in coming years.

Long-term product developments

The development of technologically advanced instruments, and use of miniaturized sensors to measure critical parameters, such as pH level and electrolyte concentration are among the key long-term developments in the blood gas and electrolyte analyzer market. Companies continue to work on improving the existing technologies and creating more convenient sample processing methods in order to make these devices even more accessible for healthcare professionals. Miniaturized sample preparation systems, automated calibration procedures, and other features which offer improved accuracy and efficiency are at the forefront of these advancements. Furthermore, continued integration with connected healthcare ecosystems is positively influencing the deployment of these devices in medical settings.

Automation and IT advancements

The development of automated blood gas and electrolyte analyzers has enabled professionals to save time, costs, and effort. These automated devices are equipped with advanced features, such as laboratory information system (LIS), automated maintenance, digital cabins, and real-time monitoring capabilities. Automation offers improved speed and accuracy by eliminating the need for manual recalibration after every test, reducing turnaround time per sample, and limiting errors due to human input.

The use of IT support in these instruments also enables healthcare providers to securely store data from correlated tests within their facility or networked activities. This allows quick access across departments or even hospital networks, saving on costs for outsourced software solutions and streamlining support functions such as billing processes.

Co-oximetry – A parameter to be considered for ABG at POC

Preetish Gangopadhyay,

Preetish Gangopadhyay,

Associate Manager – Marketing & Channel Management,

Radiometer India

Arterial blood gas (ABG) analysis is done for patients treated in intensive care units, neonatal intensive care units (NICUs), and emergency departments to understand vital parameters, such as pH, oxygenation, ventilation, electrolytes, and metabolites.

The analysis allows clinicians with information about a patient’s pulmonary function and acid-base status, both of which are required to make diagnosis, allow treatment, and monitor progress.

The increase in prevalence of chronic diseases, geriatric population, and the number of patients treated are the main factors driving the growth of blood gas market.

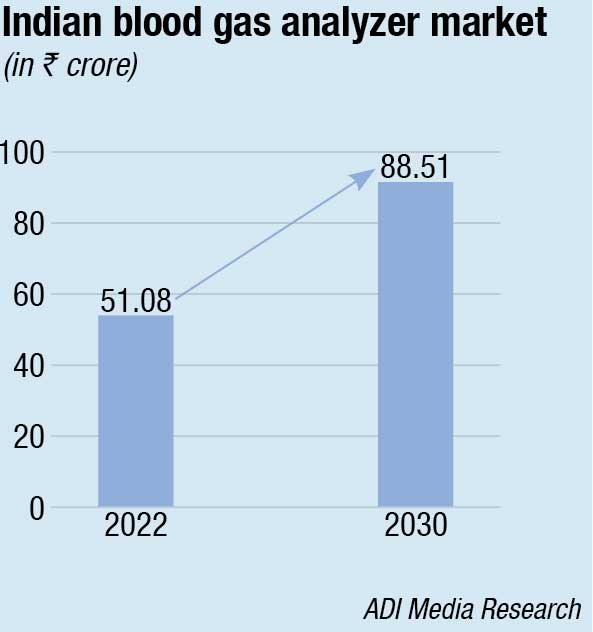

According to the recent study, the Indian blood gas market is approximately USD 50 million with a compound annual growth rate (CAGR) of 6.8 percent; additionally a significant increase in the healthcare spending has further stimulated the market.

Blood gas analysis is typically used in hospital point-of-care (POC) settings, where easily and accurate results are required. Unlike other blood-based diagnostic tests, the effectivity of ABG tests lies greatly in the sample quality and the range of measured/derived results from the sample.

Apparently overlapping, but such parameters add all the specific information for more precise decision making and suitable clinical intervention. A small but significant addition is co-oximetry, by which the availability of oxygen-carrying hemoglobin derivatives at any given point in the patient’s blood can be identified.

The availability of co-oximetry at point-of-care (POC) not only helps complete the patient’s health profiling but also can alter the course of intervention suitably.

In addition to the range of parameters measured, what makes the important difference is the amount of blood drawn per test, as it directly as well as indirectly affects the healing and recovery procedure. So, the efficiency of any system in this segment lies in not only cleverly using the sample but also simplifying the procedure itself.

At Radiometer, we provide acute diagnostics solutions based on the belief that a seamless relationship between people and technology is crucial. We promise that, whatever comes next, we make sure life comes first.

Outlook

The market is projected to expand further, and despite challenges, such as equipment costs and technological limitations, the market is experiencing thriving growth with new advancements. Overall, the adoption of blood gas and electrolyte analyzers is bridging gaps in laboratory testing and transforming healthcare delivery.

Hence, starting the therapy according to the blood gas analyzer results may be beneficial to the patient and improve the outcome.