Company News

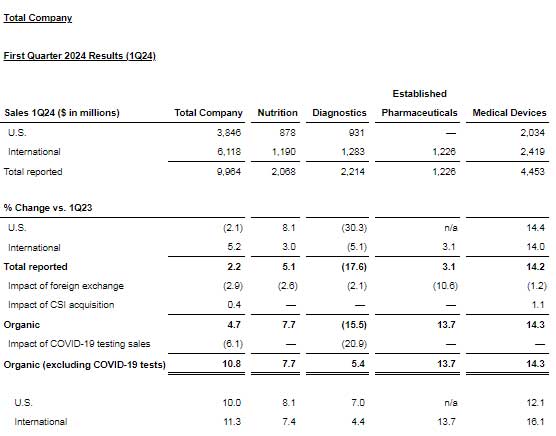

Abbott Q1 revenue hit USD 9.96 billion, a 2.2% increase YoY

Abbott announced financial results for the first quarter ended March 31, 2024.

- First-quarter GAAP diluted EPS of $0.70 and adjusted diluted EPS of $0.98, which excludes specified items.

- Abbott narrowed its full-year 2024 EPS guidance range. Abbott projects full-year diluted EPS on a GAAP basis of $3.25 to $3.40 and projects adjusted diluted EPS of $4.55 to $4.70, which represents an increase at the midpoint of the range.

- Abbott narrowed its full-year 2024 organic sales growth guidance range, excluding Covid-19 testing-related sales, to 8.5% to 10.0%, which represents an increase at the midpoint of the range.

- In January, Abbott launched the Protality™ brand, a new high-protein nutrition shake to support the growing number of adults interested in pursuing weight loss while maintaining muscle mass.

- In February, Insulet’s Omnipod® 5 Automated Insulin Delivery System received CE Mark approval to be offered as an integrated solution with Abbott’s FreeStyle Libre® 2 Plus sensor for treating diabetes.

- In March, Abbott completed enrollment in the company’s Volt CE Mark clinical study, which is designed to evaluate the Volt™ Pulsed Field Ablation (PFA) System for treating patients with heart rhythm disorders such as atrial fibrillation (AFib). Enrollment in the company’s VOLT-AF IDE clinical study was initiated in April.

- In April, Abbott announced U.S. Food and Drug Administration (FDA) approval of TriClip™, a first-of-its-kind, minimally invasive treatment option for patients with tricuspid regurgitation, or a leaky tricuspid heart valve.

- In April, Abbott announced FDA approval of the i-STAT® TBI test, which helps assess a suspected traumatic brain injury (TBI) or concussion in just 15 minutes. This new test can be performed outside of traditional hospital settings, making it more accessible and convenient for patients.

“Our first-quarter results reflect a strong start to the year, and we are raising our full-year sales and EPS guidance,” said Robert B. Ford, chairman and chief executive officer, Abbott. “This was the fifth consecutive quarter that we delivered double-digit organic sales growth in our underlying base business, which included particularly strong results in Medical Devices and Established Pharmaceuticals.”

First-quarter business overview

Management believes that measuring sales growth rates on an organic basis, which excludes the impact of foreign exchange, and the impact of the acquisition of Cardiovascular Systems, Inc. (CSI), is an appropriate way for investors to best understand the core underlying performance of the business. Management further believes that measuring sales growth rates on an organic basis excluding Covid-19 tests is an appropriate way for investors to best understand underlying base business performance as the Covid-19 pandemic has shifted to an endemic state, resulting in significantly lower demand for Covid-19 tests.

Refer to table titled “Non-GAAP Revenue Reconciliation” for a reconciliation of adjusted historical revenue to reported revenue.

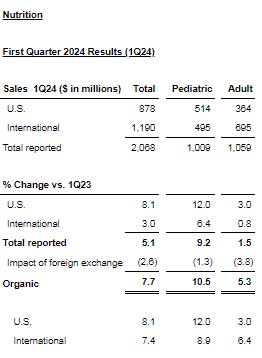

Worldwide Nutrition sales increased 5.1 percent on a reported basis and 7.7 percent on an organic basis in the first quarter.

In Pediatric Nutrition, global sales increased 9.2 percent on a reported basis and 10.5 percent on an organic basis. In the U.S., sales growth of 12.0 percent was primarily driven by market share gains in the infant formula business. International sales increased 6.4 percent on a reported basis and 8.9 percent on an organic basis, which was led by strong growth in Canada and several countries in Asia Pacific and Latin America.

In Adult Nutrition, global sales increased 1.5 percent on a reported basis and 5.3 percent on an organic basis, which was led by growth of Ensure®, Abbott’s market-leading complete and balanced nutrition brand.

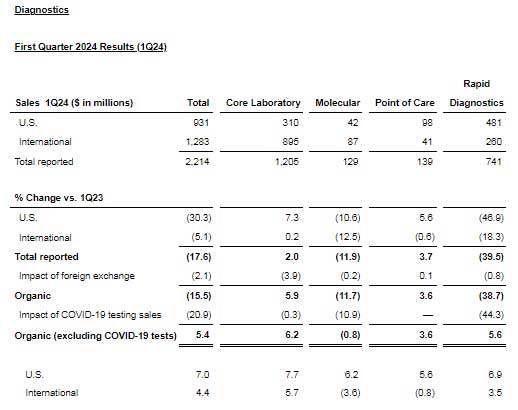

As expected, Diagnostics sales growth in the first quarter was negatively impacted by year-over-year declines in Covid-19 testing-related sales3. Worldwide Covid-19 testing sales were $204 million in the first quarter of 2024 compared to $730 million in the first quarter of the prior year.

Excluding Covid-19 testing-related sales, global Diagnostics sales increased 2.7 percent on a reported basis and 5.4 percent on an organic basis.

Excluding Covid-19 testing-related sales, global Core Laboratory Diagnostics sales increased 2.2 percent on a reported basis and 6.2 percent on an organic basis, led by continued strong adoption of Abbott’s Alinity® family of diagnostics systems and testing portfolios.

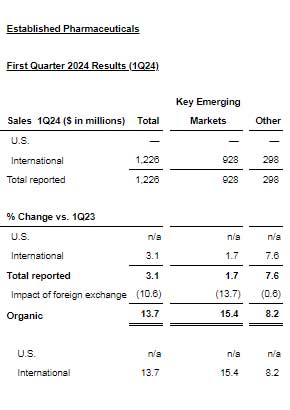

Established Pharmaceuticals sales increased 3.1 percent on a reported basis and 13.7 percent on an organic basis in the first quarter.

Key Emerging Markets include several emerging countries that represent the most attractive long-term growth opportunities for Abbott’s branded generics product portfolio. Sales in these geographies increased 1.7 percent on a reported basis and 15.4 percent on an organic basis, led by growth in several geographies and therapeutic areas, including respiratory, women’s health, and central nervous system/pain management.

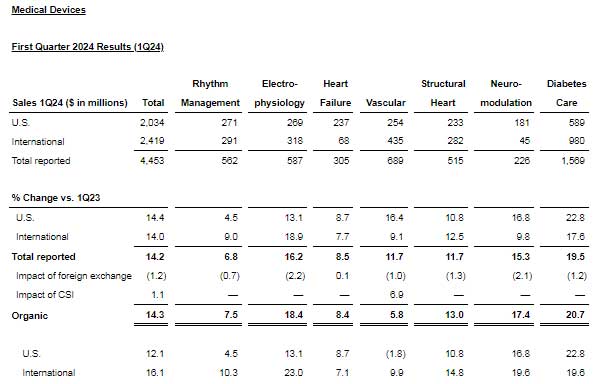

Worldwide Medical Devices sales increased 14.2 percent on a reported basis and 14.3 percent on an organic basis in the first quarter, including double-digit growth in both the U.S. and internationally.

Sales growth was led by double-digit growth in Diabetes Care, Electrophysiology, Neuromodulation, and Structural Heart. Several recently launched products and new indications contributed to the strong performance, including Amplatzer® Amulet®, Navitor®, TriClip®, and AVEIR®.

In Electrophysiology, internationally, sales grew 18.9 percent on a reported and 23.0 percent on an organic basis, which included organic sales growth of 20.4 percent in Europe.

In Diabetes Care, FreeStyle Libre sales were $1.5 billion, which represents sales growth of 22.4 percent on a reported basis and 23.3 percent on an organic basis.

Abbott’s earnings-per-share guidance

Abbott projects full-year 2024 diluted earnings per share under GAAP of $3.25 to $3.40. Abbott forecasts specified items for the full-year 2024 of $1.30 per share primarily related to intangible amortization, restructuring and cost reduction initiatives and other net expenses. Excluding specified items, projected adjusted diluted earnings per share would be $4.55 to $4.70 for the full-year 2024.

Abbott projects second-quarter 2024 diluted earnings per share under GAAP of $0.69 to $0.73. Abbott forecasts specified items for the second-quarter 2024 of $0.39 per share primarily related to intangible amortization, restructuring and cost reduction initiatives and other net expenses. Excluding specified items, projected adjusted diluted earnings per share would be $1.08 to $1.12 for the second quarter 2024.

Abbott declares 401st consecutive quarterly dividend

On February 16, 2024, the board of directors of Abbott declared the company’s quarterly dividend of $0.55 per share. Abbott’s cash dividend is payable May 15, 2024, to shareholders of record at the close of business on April 15, 2024.

Abbott has increased its dividend payout for 52 consecutive years and is a member of the S&P 500 Dividend Aristocrats Index, which tracks companies that have annually increased their dividend for at least 25 consecutive years.

MB Bureau