Coagulation Instruments and Reagents

Analyzing coagulation through a novel lens

Manufacturers are looking forward to cost-effective, multi-parameter, portable, novel, and pocket-sized analyzers, with a specially trained workforce in clinics and hospitals backed by less training cost, to handle them.

The future of coagulation analyzers is currently undefined and no sixth sense can accurately predict it. Manufacturers are looking forward to cost-effective, multi-parameter, portable, novel, and pocket-sized analyzers, with a specially trained workforce in clinics and hospitals backed by less training cost, to handle them. High-throughput results, increasing adoption of automation, and development of high sensitivity and specificity of coagulation instruments will drive the market growth in the years to come.

Technology trends

Currently available conventional coagulation tests include the activated partial thromboplastin time (aPTT), prothrombin time (PT), and international normalized ratio (INR). These in-hospital tests are performed on blood plasma and require a central laboratory with trained personnel. However, access to specialized coagulation testing in a central laboratory is often limited in community hospitals as well as at point-of-injury in remote battlefield or civilian conditions, and the long delay associated with such tests means that results are obtained at time points much later than the onset of hemostatic imbalance.

On the other hand, several handheld, point-of-care (PoC) coagulation devices are currently commercially available. Year 2018 witnessed the increasing trend of diagnostic testing steadily moving out of the central laboratory and into testing sites closer to patients, thus making technological innovations in hemolysis management patient-centric. With the advent of novel strategies, there are high expectations arising amongst the manufacturers. They are increasingly focusing on the devices’ distinct features, including rapid results, reduced patient discomfort, simplicity, cost-effectiveness, enablement of early diagnosis and accessibility in remote areas, and making these technologies affordable and available to medical professionals.

Some of the ongoing technologies expected to impact the market in the coming years include:

Dielectric spectroscopy (DS) is a fully electrical, label-free, and nondestructive measurement technique that can enable a simple and easy-to-use PoC device for extracting information on the physiologic properties of blood in real time. It is a well-established method to study the molecular and cellular composition of a variety of biomaterials. However, this technique has been restricted to studies using laboratory-based benchtop measurement equipment and >100µL blood-volume samples.

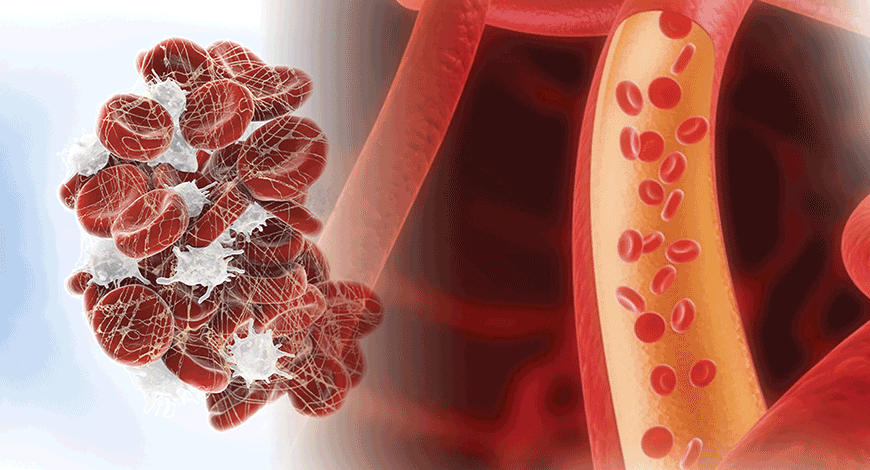

T2 magnetic resonance (T2MR) is a new technology that is able to detect clot formation based on partitioning of red blood cells and proteins, which occurs during fibrin formation and platelet-mediated clot contraction. This device can be used to measure clotting times, individual coagulation factors, and platelet function. T2MR also reveals a novel hypercoagulable signature that needs further study to determine if it can be used to predict patients at higher risk of thrombosis. This helps medical professionals determine the diagnosis without compromising with the accuracy of the diagnosis.

Microfabricated sensors have been successfully developed for PoC blood coagulation monitoring, which utilize blood viscosity by monitoring a frequency shift when the blood sample is in direct contact with a microfabricated resonant structure. Nonetheless, the force applied when blood is in direct contact with a mechanical transducer can potentially interfere with the natural coagulation process. Non-contact methods have also been developed; however, they require the use of discrete ultrasonic transducers or laser illumination and optical microscopy, and require a regular blood sample.

The manufacturers are actively pursuing novel analyzers, which more specifically assess the role of platelets in human pathologies, including bleeding and thrombotic disorders, cancer, sickle cell disease, stroke, ischemic heart disease, and others. There are several analyzers like acoustic waves that are already commercially available, and their ability to assess platelet contractile forces. These analyzers are utilized in a miniaturized PoC device capable of using only a small amount of citrated whole blood, measuring the time required for fluorescent microspheres to cease motion due to clot formation. The result provided is a clotting time in seconds. Also, this system may be useful for assessing anticoagulant effects. All things considered, the ongoing novel strategies based on microfluidics and nanotechnology may enable potential for self-testing and self-monitoring but a great reduction in sample volume is needed. There are important mechanical parameters that relate to coagulation but are not measured, and finally they do not evaluate, monitor or mitigate acute bleeding or thrombosis risk. These drawbacks demand for the development/standardization of novel strategies that can improve the clinical diagnosis process. A continuous quest is ongoing to discover new methods of clot detection, or other novel types of coagulation analyzers are in development or will soon be ready for prime time for use in routine diagnostics of hemostasis disorders. However, these require more standardization and more clinical studies to assess and exploit their potential before they are made available in the market.

Outlook

The global coagulation analyzers market is expected to exceed USD 5 billion by 2024 from USD 3.7 billion in 2018, at a CAGR of 10 percent from 2018 to 2024. The rising demand for coagulation analyzers is anticipated due to increasing population base suffering from lifestyle-associated diseases, and chronic blood disorders. Furthermore, increasing awareness about these conditions is expected to improve the diagnostic rate and preventive-care management, which is predicted to substantially increase the testing volume.

Consumables held over 65 percent of the share and are further segmented into reagents and stains. All tests require the presence of reagents; hence, large inventory or repeated orders of these products are placed by hospitals, leading to higher demand. Increasing volume of testing and development of new assays is expected to boost sales of these consumables.

In India, the coagulation market is expected to grow steadily. The lower- and mid-segments are growing at twice the pace with the introduction of new products every year. Specialized tests are being added to the higher segment to cater to the needs of the high-end customers. In the coming years, numerous diagnostic centers will be established in rural areas, propelled by improved diagnostic tools, enhanced treatment monitoring, increased availability of over-the-counter tests, easy availability of coagulation solutions at affordable prices, and high investments from the private sector.