Reports

Double-digit medical trend rates are here to stay

Near double-digit global medical costs projected in 2024, despite decline from 2023 highs.

The cost of medical care globally reached a historic high in 2023, with the medical trend rate climbing into the double digits for the first time. However, while longer-term challenges persist, an improvement in trend is perceived. After surging from 7.4 percent in 2022 to a high of 10.7 percent in 2023, the medical cost trend for 2024 is projected to decrease to a global average of 9.9 percent.

Several factors are contributing to this decline. The spike in elective procedures, consultations and other medical care resulting from delayed or postponed care due to the pandemic is starting to ease. In addition, global inflation, which was a significant factor in driving up healthcare costs, is expected to continue to fall in 2024.

But while medical trend is projected to decline, it remains elevated, partly due to the high cost of new medical technologies. Furthermore, in some regions, ongoing geopolitical conflicts and resulting displaced populations have driven up medical costs due to an increased need for care and reduced availability of providers.

The growth in medical costs is projected to decline further or remain unchanged in most regions in 2024. The sharpest decrease is expected to occur in Europe, where medical trend is projected to drop from 10.9 percent in 2023 to 9.3 percent in 2024, the lowest rate of increase projected in any region. While this decline is encouraging, Europe has traditionally seen much lower levels of trend. The stubbornly high medical trend in Europe can be attributed primarily to higher healthcare cost increases in countries in Eastern Europe and in Turkey.

The growth in medical trend in Latin America is expected to decrease from 12.4 percent to 11.6 percent, while in Asia Pacific, the trend rate is projected to remain unchanged at 9.9 percent. In North America, it is anticipated that medical trend will drop from 9.8 percent to 9.4 percent, due in large part to abating inflation. In the Middle East and Africa, trend is expected to increase slightly from 11.3 percent to 12.1 percent.

While the growth in medical trend is projected to slow globally in 2024, costs are expected to resume their ascent over the longer term.

Key factors influencing medical trend rates and opportunities to control costs

Musculoskeletal disorders are cited as a top condition by incidence followed by cardiovascular disease and cancer. Mental health ranks among the fastest-growing conditions by incidence and cost. Poor ergonomics in employees’ home work environments and a sedentary lifestyle are key factors contributing to musculoskeletal disorders.

Employees also continue to struggle with mental health issues, including anxiety and depression, which can affect overall employee well-being and productivity. Mental and behavioral health disorders are expected to remain among the top five fastest-growing conditions by both cost and claims over the next 18 months. In the Americas, mental health is the top condition by incidence of claims.

Cancer remains the top condition affecting costs globally and across all regions. Moreover, cancer is projected to be the fastest-growing condition globally by cost and the second-fastest-growing condition by incidence in the next 18 months. This is likely due in part to delayed access to or avoidance of care during the pandemic. Missed screenings can lead to cancer being diagnosed at later stages, resulting in higher costs.

New medical technologies and overuse of care drive healthcare spend. The use of new medical technologies ranging from artificial intelligence-powered diagnostic tools to gene therapy remains the leading external factor contributing to increased medical costs. This is particularly the case in Asia Pacific, where rapid development of medical technologies has occurred in an effort to catch up with other regions.

Additionally, overuse of care due to providers recommending too many services is the leading factor driving up medical costs per person. This commonly occurs where systems are overburdened and providers have limited time to spend with patients.

Overuse of care as a significant cost driver has declined from three-quarters (74%) in 2022 to 59 percent in 2023. This decline may be due to the easing of the surge in care following the Covid-19 shutdown, which likely contributed to overuse of care.

Exclusions and other variations in healthcare programs thwart the impact of well-being and DEI initiatives. In regions such as Asia Pacific and the Middle East and Africa, many organizations’ medical insurance programs continue to exclude coverage for treatment of certain conditions for which treatments exist and despite a recognized need for care among the insured population. These exclusions — which include drug and alcohol abuse treatments, HIV/AIDS medications, fertility treatments and gender-affirming care — can significantly affect employee wellbeing and diversity, equity and inclusion (DEI) efforts. Insurers are increasingly interested in expanding eligibility in these programs to be more inclusive, but legal or major sociocultural considerations in some countries pose barriers to change.

Public healthcare systems in other regions have embedded inclusion and widespread program eligibility in their scope of coverage; however, in countries with public systems where quality of and access to care have deteriorated, coverage gaps exist, and private insurers have not yet caught up to these needs.

The decline in the quality and funding of public healthcare systems has increased as a top driver of private medical costs, from 27 percent in 2022 to 34 percent in 2023. Public healthcare systems are facing major challenges due to geopolitical conflicts, inflation and risks of a global recession. Moreover, many of these systems face a backlog of scheduled procedures that resulted from the Covid-19 pandemic. At the same time, the number of medical practitioners and staff in social healthcare systems has reportedly declined in many local markets, contributing to lengthy wait times. Consequently, the demand for private healthcare to bridge the gaps within public systems is higher than ever.

Telehealth provides opportunities to manage healthcare costs more effectively. Telehealth and virtual care help reduce the need for costly emergency room visits and provide cost-efficient access to specialists, especially in the area of mental health.

While the use of telehealth globally continues to rise, there is considerable variation across regions in the medical services delivered through telehealth. In some countries, patients are utilizing healthcare more than ever due to the accessibility that virtual care affords. In others, there is a noted patient preference for in-person care. But overall, that employees globally view virtual consultations favorably in comparison to in-person consultations.

Indian market scenario

Medical trend has outpaced the general inflation rate, and healthcare costs are projected to increase in 2024 and beyond. Various macro and micro economic factors contributed to this level of medical inflation, including greater demand and utilization, advancements in technology, increasing medical tourism and rising costs of raw materials. Additionally, the average length of hospital stay has increased, which has raised total average per- patient costs. Factors such as increasing costs of hospital supplies, hospital staff compensation, consulting fees and other expenses (including rent, utilities and technology) influence the rising cost of hospitalization.

While insurers are expected to impose premium increases for 2024, potential future legislation could help control medical inflation. A bill has been introduced to India’s parliament to establish a national commission to control medical inflation. If approved, this will influence the future of the healthcare sector in India.

What’s driving medical trend

The 2024 survey tracks medical costs from a global network of 266 insurers in 66 countries.

Basic medical/outpatient costs and hospital/inpatient costs are expected to rise across all regions. The key behavioral factors that drive medical costs per person include the overuse of care due to medical practitioners recommending too many services (59%) and the lack of integration between primary, specialty and facility care (48%). Additionally, poor health habits continue to be a key factor negatively impacting medical costs (49%).

The higher costs of new medical technologies (57%) along with the decline in the quality or funding of public health systems (34%) and the profit motive of providers (34%) are the key external factors driving medical costs.

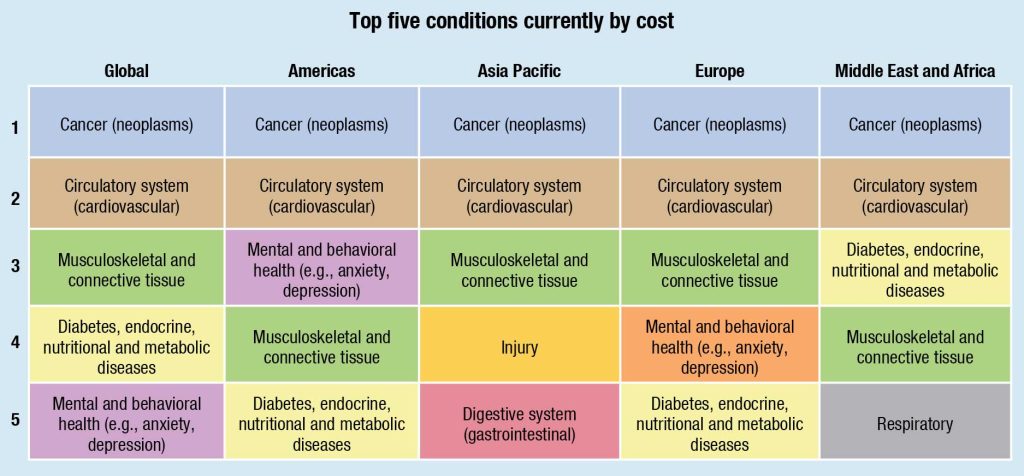

Top conditions by cost

Cancer, cardiovascular and musculoskeletal remain the top three condition by cost. The percentage of insurers citing cancer as a top condition remains basically the same as in last year’s study: 78 percent in 2023 and 77 percent in 2022. Over two-thirds (67%) cite cardiovascular as a top condition in this category, up from 51 percent last year. As a result, cardiovascular moves up to second place this year from third place in 2022. Many behavioral risk factors contribute to the growing incidence of cardiovascular disease, including an unhealthy diet, sedentary behavior, tobacco use and excessive use of alcohol.

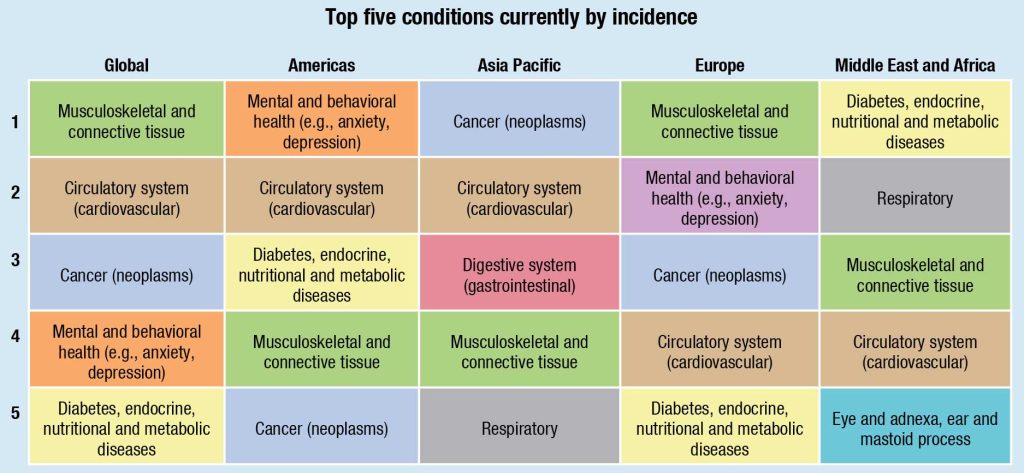

Top conditions by incidence

Musculoskeletal, cardiovascular and cancer are the top three conditions by incidence. A growing number (57% in 2023 versus 46% in 2022) cite musculoskeletal as a top condition in this category. There is less variation in the percentage of people ranking cardiovascular and cancer as top conditions by incidence. Cardiovascular moves up to the second spot, highlighting the growing burden of cardiovascular diseases.

Over the next 18 months, mental and behavioral health are expected to be tied with cancer for the top spot as the fastest-growing condition by incidence globally. Cardiovascular moves up to third place, with 46 percent expecting this condition to be among the fastest growing in the next 18 months, up from 34 percent in 2022.

Regional perspectives

Cancer and cardiovascular rank as top two in highest cost conditions across all regions, including the Americas, Europe, Asia Pacific, and the Middle East and Africa. In the Americas, mental and behavioral health is the third leading condition by cost, whereas in Europe and Asia Pacific, musculoskeletal takes the third spot. In the Middle East and Africa diabetes, endocrine, nutritional and metabolic diseases are cited as the third most expensive condition category.

Greater variation by region is seen in the top conditions by incidence of claims. Mental and behavioral health is the leading condition in this category in

the Americas, while cancer is the top condition in Asia Pacific. Europe rates musculoskeletal as the leading condition by incidence, whereas in the Middle East and Africa diabetes, endocrine, nutritional and metabolic diseases are in the top spot.

All said, global medical trend is expected to decrease in 2024 but remains elevated in the double digits. Moreover, the majority of insurers anticipate higher or significantly higher healthcare cost increases over the next three years.

| Global medical trend globally and by region | ||||||

| Gross | Net** | |||||

| 2022 | 2023 | 2024 (projected) | 2022 | 2023 | 2024 (projected) | |

| Global† | 7.4 | 10.7 | 9.9 | –0.3 | 5.2 | 6.5 |

| Latin America† | 10.5 | 12.4 | 11.6 | 2.7 | 6.3 | 7.9 |

| North America | 8.0 | 9.8 | 9.4 | 0.5 | 5.6 | 7.1 |

| Asia Pacific | 7.2 | 9.9 | 9.9 | 2.2 | 5.6 | 7.0 |

| Europe | 6.7 | 10.9 | 9.3 | –2.4 | 5.0 | 5.9 |

| Middle East and Africa | 9.8 | 11.3 | 12.1 | 2.6 | 4.2 | 6.8 |

| † Global and Latin America numbers exclude Argentina and Venezuela ** Net of general inflation |

||||||

Managing medical trend

Cost-sharing

Globally, respondents identify deductibles as the most common cost-sharing approach. In the Americas, 76 percent of insurers indicate that deductibles are common or very common, while a similar percentage of insurers in Europe (78%) hold this view. Member coinsurance is the second most common approach to cost sharing globally. Regionally, this approach is most prevalent in Asia Pacific and the Middle East and Africa where 57 percent and 43 percent of insurers, respectively, indicate that this approach is common or very common. Other less prevalent approaches to cost sharing include member copays and an annual limit on out-of-pocket expenses.

Cost management

Seventy-five percent of insurers globally indicate that contracted networks of providers help them effectively manage medical costs, making this the top cost management method. This method is especially popular in the Middle East and Africa (90%), Europe (77%) and the Americas (73%).

Telehealth remains the second most popular cost management method. Slightly over six in 10 insurers (61%) globally cite telehealth as an effective approach to managing costs. This is a popular approach in the Americas where 82 percent of insurers say they use telehealth to help clients effectively manage medical costs. Over half of insurers in Europe (58%) and the Middle East and Africa (67%) also share this view.

Moreover, 60 percent of insurers globally report that placing limits on certain services is an effective way to manage costs. This cost management method is most popular with insurers in the Americas (74%) and those in the Middle East and Africa (65%).

Availability of claim data

For policies covering more than 500 lives, insurers are most likely to provide claim data by top 10 medical causes (73%), followed by high-level claim data (63%) and data on medical facilities used by the insured population (52%).

The use of International Classification of Diseases (ICD) coding continues to grow, with 58 percent of insurers globally reporting they use ICD-10, up from 37 percent in 2022. Over half of insurers in the Middle East and Africa (77%), Europe (62%) and Asia Pacific (51%) use this coding system.

Medical insurance exclusions

Many medical insurance policies continue to include coverage exclusions to limit their exposure. However, many of the conditions excluded are being increasingly recognized as needed and important to members. Globally, over half of group policies covering more than 500 lives exclude fertility treatments (67%), alcoholism and drug use (62%), doulas and midwives (59%), and gender re-affirming care (57%). The most common exclusions in each region are those that support DEI strategies: doulas and midwives in the Americas (84%), fertility treatments in Asia Pacific (75%), and Europe (75%) and gender reaffirming care in the Middle East and Africa (60%).

Working with their consultants and brokers, organizations can take action to bridge these coverage gaps and help deliver more equitable healthcare while also managing costs.

Based on a report, Global Medical Trends Survey-2024, WTW.