Reports

Healthcare and life sciences outlook-2024

An analysis of how eight subsectors in the HCLS deal market fared during another year of industry challenges and global instability, and how deal activity and market drivers could shape the 2024 investment landscape by KPMG.

The healthcare and life sciences (HCLS) marketplace began last year facing widespread uncertainty. The US Federal Reserve was hiking interest rates at a historic pace even as inflation proved difficult to tame. Companies throughout the industry had to cope with a sharply higher cost of capital as they considered strategic changes to reposition themselves in an unpredictable post-Covid-19 environment. And although many economists insisted recession was imminent, employment reports and consumer spending numbers kept surprising on the upside. There were many more questions than answers as industry and PE leaders considered their next moves.

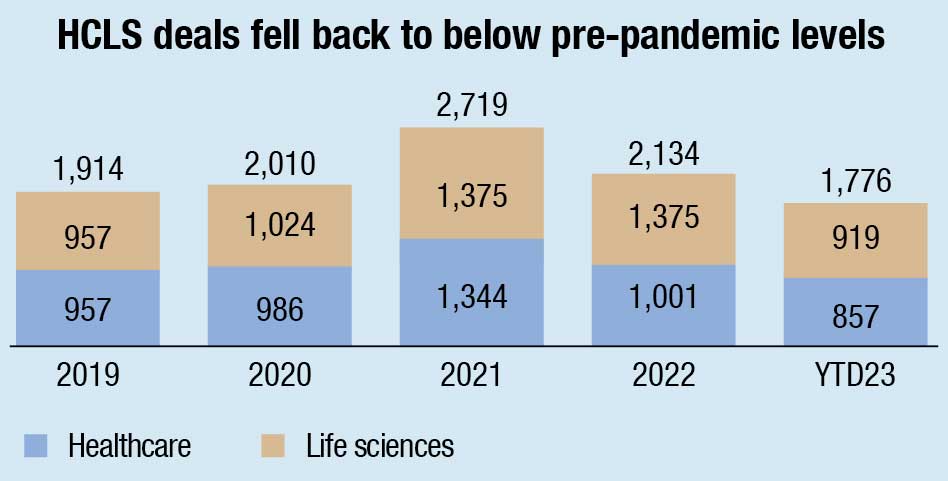

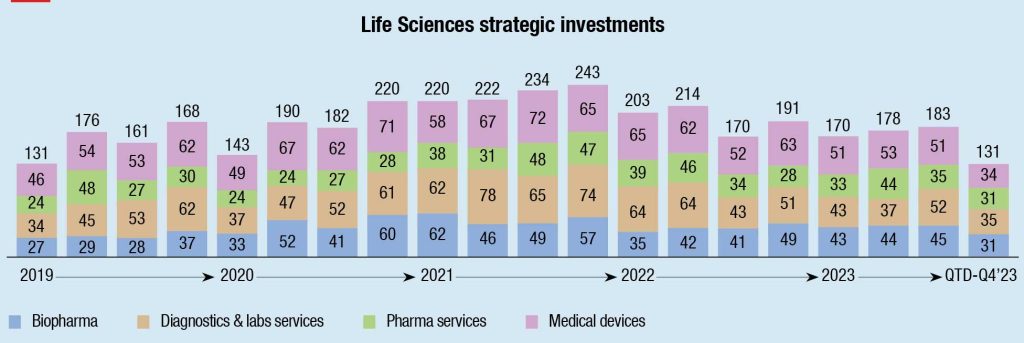

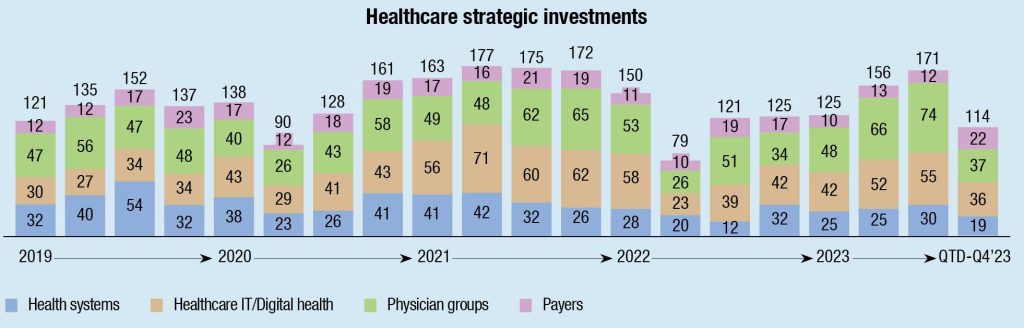

Against that backdrop, deal volumes for life sciences and healthcare dropped from 2022 levels, with life sciences transactions declining from 1,133 to 919, and healthcare deals falling from 1,001 to 857. Much of the retreat came in the fourth quarter. In terms of strategic investments, deals for life sciences companies dipped from 778 in 2022 to 662 a year later. But healthcare transactions by strategic investors went up, rising from 475 in 2022 to 566 in 2023.

Yet many deals were completed throughout the year. Large healthcare companies made moves to increase their scale, while smaller hospitals and health systems, in particular, looked for partners that could rescue them from an increasingly dire financial landscape. Biopharma deal activity has been more mixed. The number of acquisitions in 2023 remained stable compared to 2021 and 2022; however, other strategies for acquiring assets to build portfolios have declined sharply. This is an interesting development, as pharma leaders, forced by the specter of approaching price negotiation to reconsider their strategies for filling their pipelines and remaining competitive, made a few major acquisitions and many smaller ones, along with numerous partnerships and licensing agreements.

Companies in other life sciences subsectors considered their options for reshaping themselves as their industries continued to be transformed by a remarkable pace of innovation.

Even during the fourth quarter, when deal volume fell across the HCLS landscape, there were still motivations for dealmaking, including among largely sidelined financial investors looking to deploy a mountain of capital. But valuations for potential acquisition targets remained above long-term multiples, and interest rates were higher than they had been in many years, a combination that has discouraged some investors.

Still, as the end of the year approached, there was good news on the macroeconomic front, with inflation continuing to ease and further rate hikes by the Fed appearing less likely. With possible rate cuts next year and an economy that could achieve a soft landing, the environment for dealmaking could markedly improve.

To judge solely by the number of transactions, 2023 was a difficult year for deal makers across the HCLS landscape, which was challenged by persistent economic headwinds and a long list of subsector-specific issues. But look more closely, and you discover companies that adapted and evolved, responding with resilience and creativity to craft acquisitions, strategic partnerships, and creative financing arrangements that positioned them for success now and into the future.

Optimism about the coming year is widespread among the industry leaders who responded to KPMG’s annual survey. Some 70 percent said they invested more into M&A than expected during 2023, and 61 percent planned to ratchet up dealmaking further in 2024. They cited familiar challenges–competing for a limited number of prime target companies, forecasting the future performance of potential acquisitions, and dealing with the still-elevated cost of capital, among others–but remained sanguine about improving economic and industry conditions and their ability to find potent opportunities.

The year ahead

With the anticipation that some economic and industry headwinds may ease in 2024, respondents to our survey are feeling more positive about M&A activity in the coming year. Sixty-one percent expect more deals in 2024 than in 2023, and only 9 percent predict that deal volume will fall. But unlike a year ago, when 48 percent of respondents said they believed industry valuations would fall, 50 percent of this year’s respondents project an increase in valuations, compared with 30 percent who expect valuations to decline. We think this disparity in valuation points of view makes sense as there definitely appears to be a bimodal deal market where highly competitive targets are meriting higher valuations than targets where bidding wars have not materialized.

Based on Innovation: Pushing the deal market to adapt and evolve, a KPMG report.