Reports

Global healthcare PE and M&A report 2021

In terms of the types and mix of deals that closed, COVID-19 had sharply different effects on each sector and even segments within a sector.

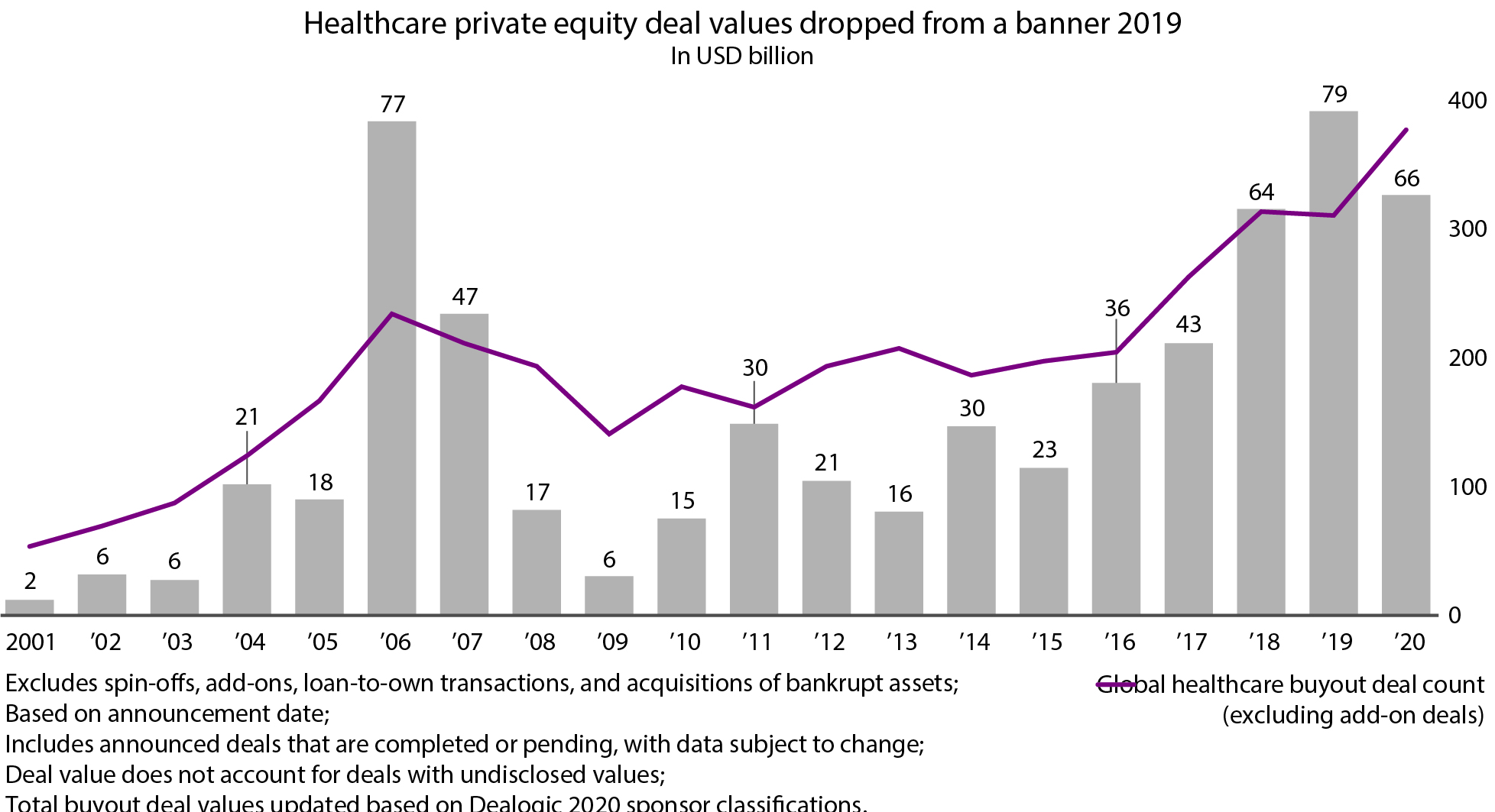

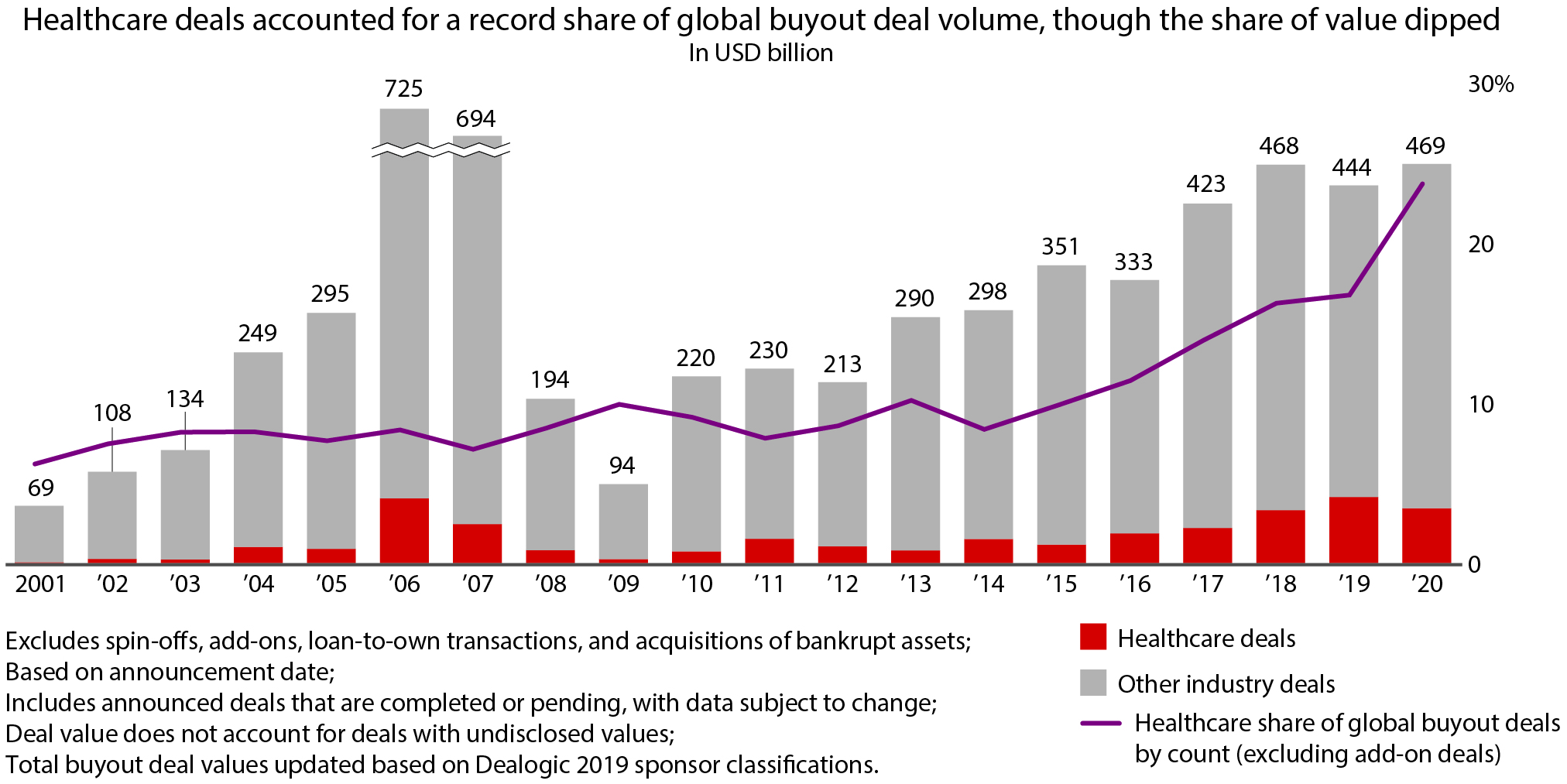

The industry’s historical outperformance during recessions may have roused greater investor interest relative to other parts of the economy. Ample dry powder in search of opportunities, along with capital markets’ strong appetite for exits created fertile conditions for investment. As a result, even with the pandemic upsetting all manner of business activities and deal processes, healthcare deal volumes jumped higher than record 2018 and 2019 levels despite a 14 percent decline in volume across private equity globally.

Meanwhile, the total disclosed value of healthcare deals declined for the first time since 2015, due to a convergence of several factors:

- The coronavirus and subsequent lockdowns suppressed or disrupted deal activity in several sectors, particularly among potentially high-value deals. Business owners sidelined some assets rather than attempting a sale amid weaker market conditions.

- No blockbuster transactions on the order of the 2019 USD 10.1 billion Nestlé Skin Health deal occurred during 2020.

- Some of the largest assets wound up transacting to special purpose acquisition companies, or SPACs.

Looking ahead, one obvious and unanswered question concerns what timing and shape the rebound will take after the coronavirus abates. Many scenarios could play out, but investors will need to disentangle the impacts of COVID-19 from the rest of an asset’s business fundamentals.

Other factors inject uncertainties into future investments as well. Regulatory and policy decisions such as surprise billing legislation, drug pricing actions, medical device regulation, and changes to public insurance availability may have major consequences for entire healthcare subsectors. Savvy investors will develop a clear understanding of the implications of any change in order to inform their decisions, as policy shifts will create both risks and opportunities. Investors should keep an eye out for models that can have direct or derivative value in the future, such as enabling healthcare IT or innovative models that can transplant proven concepts from one care setting to another—for example, Medicare Advantage strategies applied to traditional Medicaid or commercial populations.

Despite these shifts, healthcare should remain an attractive industry for investment because of its strong demographic and demand foundation, the supply-constrained nature of many businesses, and a strong pipeline of innovation.

Indeed, although COVID-19 has caused widespread challenges, the changes wrought by the pandemic also create new business opportunities. With private equity funds looking to put dry powder to work, and the ongoing rise in demand for healthcare, competition for attractive opportunities will intensify among both financial sponsors and corporate buyers. As competition and multiples grow, this will raise the bar for generating attractive returns, which will increase the complexity and importance of robust diligence and value creation planning.

Healthcare private equity market 2020: The year in review

Private equity, like the broader economy, faced acute challenges in 2020 brought on by the global pandemic. Yet buyers and sellers still managed to complete deals at a brisk pace, and healthcare showed remarkable resilience given the extent of the disruption caused by COVID-19 and the lockdowns imposed in most countries. In fact, healthcare buyouts posted record-setting volumes in 2020, albeit at reduced total and average deal values.

For global private equity as a whole, the number of deals fell to 3,096 in 2020, compared with 3,600 in 2019. However, disclosed deal values increased by 7.5 percent to USD 592 billion. In contrast to the overall private equity market, healthcare private equity deal volume actually rose. However, disclosed healthcare deal values were more negatively affected. Over the past five years, total healthcare deal value outgrew the value of private equity deals overall, going from 7 percent of total disclosed value in 2015 to 18 percent in 2019. That trend reversed in 2020 as the industry’s share of disclosed value fell to 14 percent, in line with 2018 levels. This may seem surprising, given healthcare’s record of providing superior returns through economic downturns.

However, this is a logical outcome considering some of the structural features of the COVID-driven downturn.

Unlike prior economic shocks, such as the financially driven Great Recession and the 2015 industrial mini-recession, COVID-19 had a more direct and significant impact on the healthcare industry. Previous recessions saw healthcare private equity offering a flight to quality, as volumes and profit margins tended to come under less pressure than other, more discretionary industries. By contrast, this pandemic’s systemic effects concentrated intensely on healthcare.

While demand related specifically to COVID-19 medical treatment, prevention, or management clearly rose, other forms of healthcare experienced substantial volume losses, treatment deferrals, capacity and supply constraints, and countless other disruptions. This trend varied within sectors and subsectors, where specific secular and cyclical factors prompted different responses. Such an upheaval inserted substantial uncertainty for buyers and sellers of assets, thereby reducing deal appetite, especially for the largest deals that have been a hallmark of prior years. For example, between 2015 and 2018 the top 10 healthcare buyouts represented roughly USD 20 billion to USD 40 billion of disclosed value, or about 60 percent to 75 percent of disclosed value for all healthcare deals. 2019 was also a blowout year for large deals, with 54 total deals of disclosed value above USD 1 billion, and the largest single deal, Nestlé Skin Health, accounting for 13 percent of total disclosed value on the year. In 2020, however, the top 10 deals represented only 43 percent of total value, the largest being DXC Technology at USD 5 billion. Among deals with disclosed values, the average size of a check fell to USD 296 million in 2020 from USD 686 million the year earlier as large volumes of lower-value deals jumped in 2020, especially in the Asia-Pacific region.

Despite ample reserves of available capital, private equity sponsors and corporates alike hesitated to make mega-acquisitions in a time of straitened balance sheets and depressed equity valuations. Further, sellers with particularly strong assets held off on exiting on the thesis that a better valuation could be achieved after the pandemic.

Given investors’ gravitation to healthcare in 2020, it is expected that it will remain difficult for investors to pick and choose large deals. Competition will intensify for attractive assets that come to market in high-interest segments, as many investors are looking to enter growth areas. Investors will need to diversify their search and forge strong relationships across the industry, in order to position themselves to access high-value, accretive opportunities.

COVID-19 was not the only relevant factor dampening disclosed value. For instance, a number of large assets traded without disclosing value. Also, capital markets showed a greater appetite for initial public offerings (IPOs), with a number of the largest healthcare assets going public after passing through one or more private equity owners. In previous years, these assets might have passed to another sponsor and counted toward total activity. At the same time, even amid a turbulent macro environment, many investors were able to secure rapid financing, allowing them to move quickly on available assets and shore up tightened balance sheets. In the US and Europe, debt-to-EBITDA multiples remained high, a sign of good access to credit for investors.

MedTech: Four themes fueled deals despite the pandemic

Investment in the MedTech sector generally fluctuates year-to-year, so the steady performance in 2020 is encouraging. Many private equity sponsors have historically faced challenges in acquiring attractive MedTech assets. On one end of the asset spectrum, private equity funds face stiff competition from corporates looking for tested, high-performing MedTech targets to integrate with their broader businesses. On the other end, not all healthcare private equity investors have an appetite for more speculative, early-stage targets. Layered on that underlying dynamic, MedTech experienced major disruptions in 2020 from COVID-19. Specifically, the pandemic and subsequent lockdowns caused patient volumes to plummet, especially for elective procedures, and it squeezed standard supply chains for many of the sector’s products and device components.

The number of deals during the year increased to 62 from 59 in 2019. Disclosed value dipped 3 percent to USD 4.2 billion in 2020. This slight decline partly stems from a lack of deals valued at USD 1 billion or more, whereas there were two in 2019.

Four investment themes emerged from our analysis of 2020 deal flow:

- Life sciences opening avenues into high-growth segments such as diagnostics;

- New attention to consumer-facing technologies that could disrupt traditional models;

- Strong growth in MedTech deals in China; and

- Opportunities for value in carve-outs.

Life sciences diagnostic equipment and consumables are on a roll. Firms producing technology that supports R&D with clinical laboratory tools and diagnostics can benefit from tailwinds in both diagnostics and advanced drug development. Unlike many MedTechs, these firms do not make the typical surgical implants and consumables, but instead focus on high-tech devices and equipment, such as genomic sequencers for biopharma applications, used to test or develop other products or assess diseases.

Consumerism gains a foothold. Consumers in many major markets have shown an interest in discretionary spending on healthcare products, presenting new growth avenues for MedTech firms. Direct-to-consumer (DTC) channels are intriguing because MedTech firms can market a product directly, and hospitals and healthcare payers have less sway over pricing and sales tactics. DTC firms with business models suited to ride the wave of healthcare consumerism have thus garnered interest from private equity investors.

Domestic deals in China heat up. Population growth and other macro trends have long spurred growth in China’s healthcare markets. Now the government has begun to promote domestic development of the industry in order to reduce reliance on Western firms. These macro and political factors spurred acquisitions of Chinese MedTech companies, which jumped to 25 in 2020 from a low base of 6 in 2019. Many such deals appear to focus on earlier-stage technology or targets with lower price tags, and often consist of consortium investments.

Carve-outs to unlock value. Carve-outs have allowed acquiring firms to gain entry to attractive indications, or to unlock a category leadership position in a smaller sub-segment. Private equity firms actively sought out these opportunities, as evidenced by one of 2020’s largest MedTech buyouts, Montagu Private Equity’s acquisition of RTI Surgical Holdings’ OEM business. The deal involves compelling technology and expected robust market growth due to macro tailwinds. One challenge for private equity funds continues to be the competition from corporate investors looking to bolster portfolios while realizing synergies. For instance, Smith & Nephew acquired the extremity orthopedics unit of Integra Life Sciences for USD 240 million to broaden its product portfolio in the higher-growth extremities segment, and to take advantage of potential scale with their other orthopedics positions.

Back to a bright future. Despite the pandemic, many of the structural strengths of medical devices and life sciences tools have persisted, suggesting a return to growth in 2021. Moreover, deals deferred during the pandemic, as both buyer and seller expectations changed, should again generate interest over the coming year. Further out, heightened interest has been anticipated among private equity funds and corporates in a few highly attractive sub-segments, intensifying the competition for deals. Firms with consumer-focused solutions and devices, or with technology that facilitates at-home care, such as remote diagnostics, will likely remain attractive given their ability to ride the tailwinds of shifts to home care. We also expect sustained momentum of past carve-outs and life science deals as acquiring firms look to establish strong category leadership footholds across MedTech. The ability to build sector depth and operational capabilities in some of these more competitive segments will remain critical to winning marquee assets.

The 10 largest announced buyouts in 2020 accounted for 40% of disclosed value

| Target | Target Region | Acquirer(s) | Acquirer region | Sector (includes related services) | Approximate deal value (USD billions) |

|---|---|---|---|---|---|

| DXC Technology Company (state and local HHS business) |

North America | Veritas Capital Fund Management | North America | Provider | 5.0 |

| ELSAN Groupe | Europe | KKR, Ardian | Europe | Provider | 4.1 |

| 1-800 Contacts | North America | KKR | North America | Provider | 3.0 |

| Pathway Vet Alliance | North America | TSG Consumer Partners | North America | Provider | 2.7 |

| Colisée Patrimoine Group | Europe | EQT Infrastructure Investment Fund, existing management, Caisse de Dépôt et Placement du Québec |

Europe | Provider | 2.6 |

| Precision Medicine Group | North America | Blackstone Group, Berkshire Partners, TPG Capital |

North America | Biopharma | 2.3 |

| Takeda Consumer Healthcare Company | Asia-Pacific | The Blackstone Group Japan | North America | Biopharma | 2.3 |

| Nichii Gakkan | Asia-Pacific | Bain Capital | Asia-Pacific | Provider | 1.6 |

| WellSky Corp | North America | Leonard Green & Partners, TPG Capital | North America | Provider | 1.5 |

| Priory Group | Europe | Waterland | Europe | Provider | 1.4 |

| Total top 10 deal value | 26.6 | ||||

| Total healthcare PE buyout deal value | 65.8 |

2021 and beyond: What are the implications of healthcare as national defense?

Most of the policy and health responses to COVID-19 have focused on attempts to contain the pandemic and return to some semblance of a normal economy—albeit a different normal than a year ago. But the pandemic also exposed cracks in the healthcare system, such as shortages of critical medical supplies and personal protective equipment, limited coordination of early diagnostics, mixed readiness for modern healthcare delivery models such as telehealth, and historically offshored healthcare supply chains. At the same time, the pandemic underscored that healthcare is a critical piece of national infrastructure, not just another business sector.

Over the course of 2020, government investment has been observed in the healthcare industry unlike any other year in modern times. The degree of public funding for healthcare, the embrace and reimbursement of innovative emerging care models, moves to encourage R&D collaboration, which accelerated vaccine development to an unprecedented pace, and the push to shore up domestic supply chains for critical medical equipment all demonstrate ways that healthcare can radically improve.

The notion of healthcare as national defense began to take hold in 2020, but what are the implications of this mindset? During Operation Warp Speed, the US government appropriated and deployed nearly USD 18 billion of investments to fight COVID-19 through public-to-private partnerships across the healthcare value chain. What other major healthcare problems will governments target in the coming year?

The structural, macro, and market factors discussed will no doubt continue to lift healthcare private equity. Opportunities to extend development of platforms will continue to open up, especially as subscale assets struggle with prolonged effects of the pandemic. The healthcare private equity market may get even more active in 2021 as the backlog of disrupted deals from 2020 returns to baseline level. This mass of stalled deals will take some time to work its way through the system, but the strongest assets could quickly reach markets early in the year.

Plenty of investment themes are starting to emerge or to achieve their full potential

Healthcare providers

- Provider buy-and-builds in new therapeutic areas and contexts, such as next generation senior care based models.

- Next generation home-based healthcare models.

- Risk-bearing provider models and assets with exposure to Medicare Advantage (MA) patients and plans.

- Direct contracting plays and expansion of these models to commercial and Medicaid populations.

- A sharper focus on key episodes and conditions that require shifts to new models of care, such as behavioral health and post-acute care.

- Expanding across borders within European and Asia-Pacific provider platforms.

Healthcare payers

- Expanded supplemental benefits for MA patients.

- Next-generation employer navigation and third-party administrator solutions.

Biopharma

- Services for the cell and gene therapy value chain.

- Pharma services focused on commercialization.

- Cold chain and specialty pharma logistics.

- Next-generation clinical trials.

MedTech

- Technology that facilitates home-care models such as remote diagnostics

- Life science tools and diagnostics

Healthcare IT

- IT for alternative sites of care and nonclinical providers.

- Fintech strategies across areas such as revenue cycle management and payments.

- Consumer health technology, especially in the Asia-Pacific region.

What do investors need to do to succeed in current conditions?

Given rising valuations and heated competition, investors will need to evolve their deal theses in order to thrive. The winners in healthcare private equity will be those that can identify the future implications of COVID-19, riding the momentum of healthcare as a national defense. They will spot analogies from other industries and regions that can be incorporated into their own assets—by, for instance, comparing healthcare IT to technologies in other industries. They will push the thinking on how to implement next-generation solutions to traditional healthcare models, asking, say, how lessons from MA plans and innovative primary and post-acute care models could be applied elsewhere. They will also craft creative partnerships to overcome historical hurdles, because collaboration may be an essential lever to create value in the future. In short, investors that can create value by employing unique solutions stand to become the champions in the years ahead. Bain & Company