Patient Monitoring Equipment

Growth momentum poised to continue

Remote patient monitoring has abundant potential, but patients must be familiar with the intended use-cases before embracing the technology.

Patient-monitoring equipment is a central component of every hospital’s workflow. Before the market experienced disruptions, caused by the COVID-19 pandemic, the global market for patient-monitoring equipment was valued at approximately USD 3.7 billion in 2020. Due to a sharp increase in demand for monitoring equipment in the diagnosis and treatment of COVID-19, this number has only risen during the pandemic, and is expected to grow at a mid-single-digit rate through 2027. Among the fastest-growing markets in this space are cardiac monitoring, remote patient-monitoring (RPM), temperature management, and electroencephalogram (EEG) monitoring.

Beyond the temporary spike in demand, caused by the COVID-19 pandemic, the patient-monitoring equipment market is also expected to grow at a moderate rate for the foreseeable future, driven by an aging demographic, which contributes to further complications, requiring monitoring solutions. Improved connectivity in monitors will also be a significant growth driver for this market as hospitals move toward integrated monitoring solutions to improve accessibility and analysis of patient data. Finally, technological advancements in various patient-monitoring equipment markets will also drive growth as in-demand new features command higher selling prices.

A trend that is currently prevailing in the patient-monitoring market relates to the adoption of less-invasive, more accessible, patient-centric monitoring devices configurations. This is exemplified by the movement toward minimally invasive and non-invasive modalities in the cardiac output market, and the uptake of wireless telemetry solutions and remote patient-monitoring platforms in both hospital and alternate care sites. Furthermore, the emphasis is now being placed on patient comfort and mobility across lower-acuity care settings, wherein gaps in monitoring are further being filled with portable solutions.

With respect to consumables, there is a shift in demand toward disposable units in many regions as a proactive means of reducing cross-contamination risk and reducing liability concerns. Each of the aforementioned trends is in line with the general drive to improve patient outcomes through reduced complication and mortality rates, thereby promoting long-term cost savings. This will, in turn, help to improve the quality of care, while also alleviating pressure associated with budgetary constraints across the care continuum.

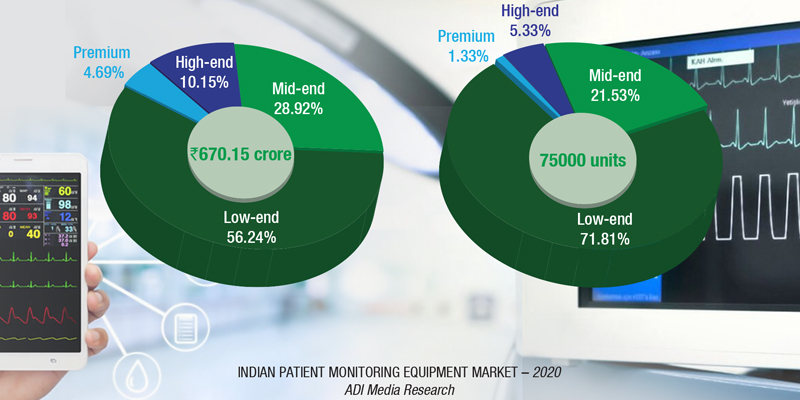

The Indian market for patient-monitoring equipment in 2020 is estimated at ₹670.15 crore, and 75,000 units. High-end systems constituted 4.6 percent share in value terms (it was 15.9 percent share in 2019, and 100 units of super premium, had sold in 2019, that seemed to be missing this year) and 1.3 percent in volume terms (it was 7 percent in 2019). The belly of the segment continues to be competitively priced systems, the mid-end, and low-end segment, and the buying in 2020 shifted even more; it has progressively been increasing since 2018. The two segments dominated with a combined share of 85 percent by value and 93 percent by volume. The six brands, Philips, Mindray, Nihon Kohden, GE, BPL, and Schiller continue to lead this segment. This year, the Chinese brands as Contec, Edan, Yonker, and Comen among many others did really well.

2020 was not a typical year for the Indian patient-monitoring market, as for many other medical equipment and devices. There was an approximate 35-percent increase in demand, with some emphasis on the wireless monitors. This enabled monitoring of patients outside of conventional clinical settings, e.g., in the home. It simplified the accessibility toward healthcare resources, and improved communication between patients and their healthcare providers by simplifying data transmission. Also, the issue of staff shortage was addressed by this.

The market increase was seen in the mid-end, and more so in the low-end monitors, perhaps because the government had minimal procurement this year. This gave an impetus to the Chinese brands. Leading players as Philips had trebled their production in both their plants, Germany and China in 2019.

|

Indian patient monitoring equipment market |

|

|

Leading players* – 2020 |

|

| Segment | Vendors |

| Tier I | Philips |

| Tier II | Mindray, Skanray, BPL & GE |

| Tier III | Nihon Kohden, Schiller, Contec, Drager & Bionet |

| Others | Edan, Comen, Yonker, and many Chinese brands; Nidek, GMI, Baxter, and EMCO |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian patient monitoring equipment market | |

| ADI Media Research | |

Technology has helped healthcare progress by leaps and bounds. It has reshaped patient care, clinic, and hospital management while inventing and innovating improved drugs, and predicting the course of treatment based majorly on data analytics. New market entrants, new business models, and the IoT revolution are providing more insight into the patient condition through novel data feeds and analytics. The drivers for change are numerous, such as the containment of cost, improvement of patient care, and better clinical outcomes. The shift from treating illness to managing health is also demonstrated by an increase in the use of monitoring outside of the clinical setting, in addition to a change in the breadth of what is monitored. This includes both physiological measurements and behavioral measurements. These changes require to re-think traditional approach to the development of patient-monitoring technology, and to ensure harness the technical enablers safely and effectively to develop products that improve on current monitoring methods, both within and outside of the hospital setting.

Physicians have been challenged to reinvent their practices in order to accommodate their patients during the COVID-19 pandemic. The growing market of remote patient monitoring has become a sought-after solution as indicated by recent increased demand and supply shortages.

As such, global remote patient-monitoring market is expected to double over the next 5 years. Its applications during the intense periods of the COVID-19 pandemic encouraged people to utilize such technologies more frequently than they had previously.

The pandemic has significantly increased the groundwork for effective remote patient-monitoring usage by physicians and patients. The increased awareness of remote patient-monitoring products due to companies attempting to restart normal business operations is expected to extend to at-home usage by individuals.

The next trend in remote patient-monitoring technology is miniaturization, a process whereby devices makers are making their solutions smaller and less invasive, while partnering with new companies expand their market share and grow the technology. As remote patient monitoring continues to advance, it stands to have a positive effect on both patients and the healthcare providers treating them.

Non-traditional players are entering the market. Remote patient monitoring has seen exponential growth in recent years, boosted further by the widespread adoption of consumer wellbeing monitoring and, more recently, its subsequent convergence with long-term healthcare monitoring in the home and other non-clinical environments. With changes in the reimbursement environment and mounting evidence pointing to the as-yet-untapped potential of telehealth in many countries, non-traditional medical devices manufacturers are increasingly eager to enter and disrupt the healthcare market.

However, making the most of RPM as a user or buyer of the technology means taking the time to understand how it works and whether patients should take special precautions to increase the chances of getting the most accurate results. For example, does data transfer occur automatically, or must a patient act to send it to a provider? Should a person wear a monitoring gadget while sleeping or just when awake?

Clarifying those specifics before moving ahead with increased use should boost adoption rates for providers and patients alike. RPM has abundant potential, but patients must be familiar with the intended use-cases before embracing the technology.