Coagulation Instruments and Reagents

Increasing diagnostic centers to propel coagulation

The market for coagulation analyzers is receiving an impetus from the increasing number of hospitals, diagnostic centers, and research institutes being established worldwide.

Automated technologies have revolutionized the monitoring of coagulation disorders in the central hospital laboratory setting, allowing for high-throughput testing, improved accuracy and precision, accompanied by a marked reduction in human errors. However, they still require trained operators and sample transportation. Novel analyzers have also been developed, which more specifically assess the role of platelets in human pathologies, including bleeding and thrombotic disorders, cancer, sickle cell disease, stroke, ischemic heart disease, and others. Over the past decade, rapid advancements in technology and the introduction of new coagulation analyzer tests have led to an increase in the quality and efficiency of hemostasis laboratories. Some of the modern complex coagulators also possess high throughput, flexibility, and reliability. Other than this, they provide improved accuracy and precision, and easy-to-use advanced software provided with in-built graphs and calibration curves. There has been a significant rise in the prevalence of cardiac diseases, obesity, diabetes mellitus, growing geriatric population, auto-immune diseases, stroke, pulmonary embolism and deep vein thrombosis cases, spontaneous abortions, pregnancy problems, and surgical bleeds owing to the use of Plavix and other anti-platelet medicines, which has created the need for improved coagulation analyzers across the globe. Besides this, the sales of coagulation analyzers are positively being influenced by the increasing number of hospitals, diagnostic centers, and research institutes established worldwide. Special emphasis on providing quality and timely care to patients is expected to propel growth of diagnostic market, which in turn is anticipated to cause a hike in demand for hemostasis analyzers.

Over the past decade, rapid advancements in technology and the introduction of new coagulation analyzer tests have led to an increase in the quality and efficiency of hemostasis laboratories. Some of the modern complex coagulators also possess high throughput, flexibility, and reliability. Other than this, they provide improved accuracy and precision, and easy-to-use advanced software provided with in-built graphs and calibration curves. There has been a significant rise in the prevalence of cardiac diseases, obesity, diabetes mellitus, growing geriatric population, auto-immune diseases, stroke, pulmonary embolism and deep vein thrombosis cases, spontaneous abortions, pregnancy problems, and surgical bleeds owing to the use of Plavix and other anti-platelet medicines, which has created the need for improved coagulation analyzers across the globe. Besides this, the sales of coagulation analyzers are positively being influenced by the increasing number of hospitals, diagnostic centers, and research institutes established worldwide. Special emphasis on providing quality and timely care to patients is expected to propel growth of diagnostic market, which in turn is anticipated to cause a hike in demand for hemostasis analyzers.

Indian market dynamics

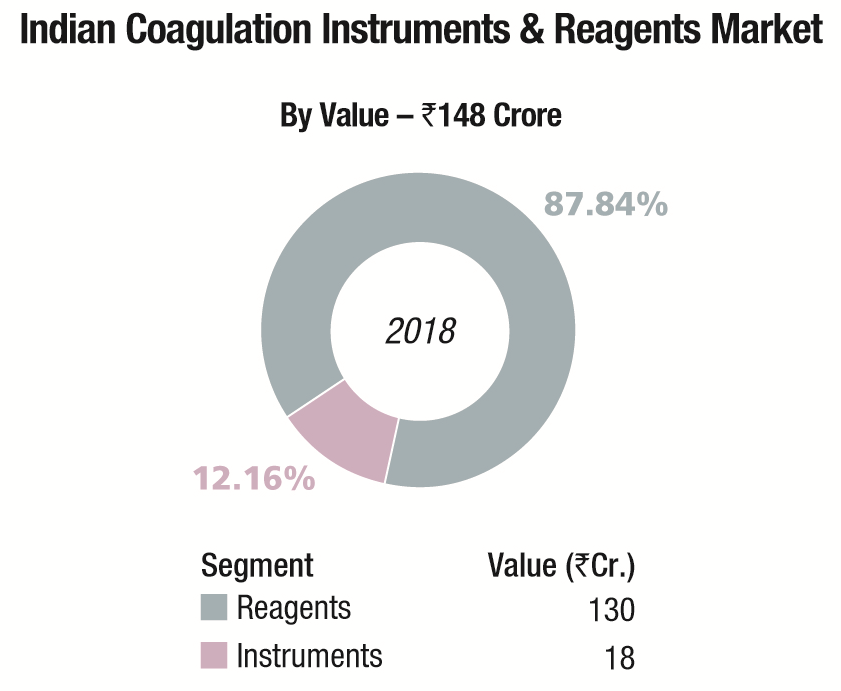

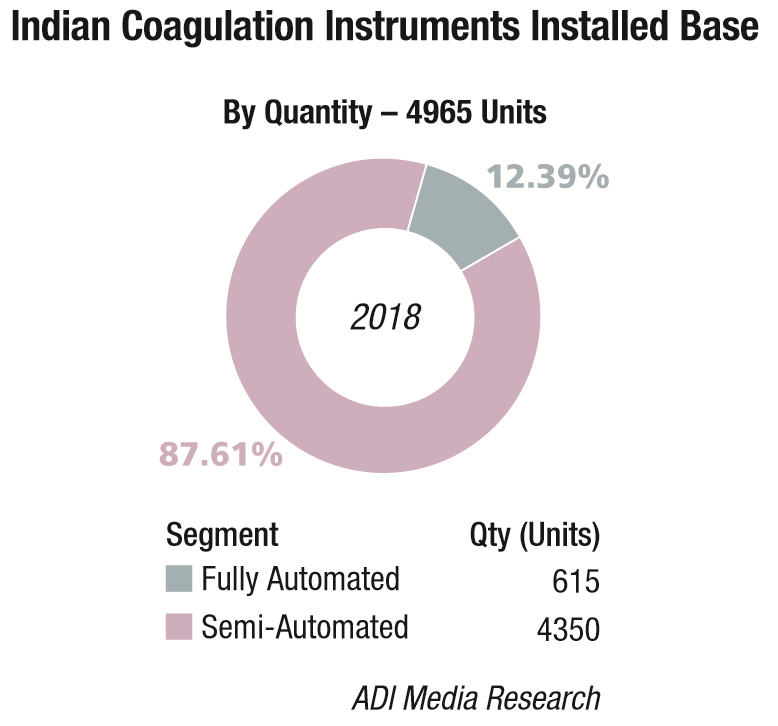

The Indian coagulation instruments and reagents market in 2018 is estimated at Rs 148 crore. The year showed a 9 percent growth over 2017. The installed base in 2018 is estimated at 4965 instruments, with semi-automated instruments at 4350 units, and fully automated ones at 615 units.

In the Rs 130 crore reagents market, although 80 percent of tests conducted are for routine parameters (PT and APTT) and remaining 20 percent are for specialized coagulation parameters, the revenue accruing from routine tests is 60 percent and 40 percent is from specialized parameter tests.

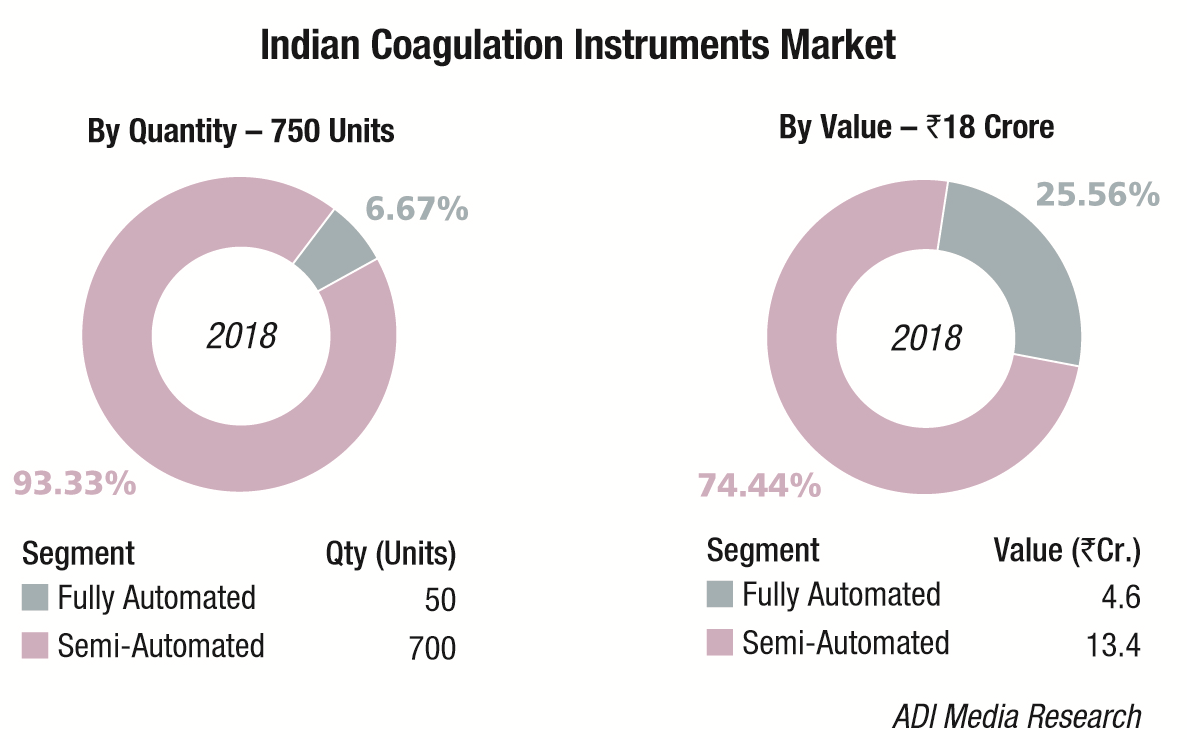

In the recent past with increase in screening tests and therapeutic monitoring of hemostasis, many new innovative techniques have been introduced for coagulation analyzers. Automation has revolutionized workflow with modern complex coagulometers having high-throughput, reliability, flexibility, easy-to-use advanced software with inbuilt LJ graphs and calibration curves, improved accuracy and precision with minimum human error in measurement. Automation in coagulation starts from single channel coagulation analyzer to fully automated multi-channel coagulation systems and as compared to the other segments in the IVD, only few multinational companies are present in the fully automated coagulation segment, which is purely on import. In fully automated segment there is a shift from bigger system to compact system to address the space constrain in the laboratories especially in the metro cities and there is an increase in the reagent rental business model. Like fully automated segment, there are only few players in the semi-automated coagulation segment and most of these instruments are purely on import. In the semi-automated coagulation analyzer segment there is a new trend where the laboratories are moving from open systems toward closed systems.

Automation in coagulation starts from single channel coagulation analyzer to fully automated multi-channel coagulation systems and as compared to the other segments in the IVD, only few multinational companies are present in the fully automated coagulation segment, which is purely on import. In fully automated segment there is a shift from bigger system to compact system to address the space constrain in the laboratories especially in the metro cities and there is an increase in the reagent rental business model. Like fully automated segment, there are only few players in the semi-automated coagulation segment and most of these instruments are purely on import. In the semi-automated coagulation analyzer segment there is a new trend where the laboratories are moving from open systems toward closed systems.

| Tier I | Tier II | Tier III** | Others |

|---|---|---|---|

| Stago (including Trinity) | Werfen India and Sysmex | Agappe, Abbott Diagnostics, Compact Diagnostics, Tulip, and Transasia | bioMérieux, CPC Diagnostics, Meril Diagnostics, and Roche |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian coagulation instruments market. | |||

| **Instruments are primarily SA | |||

| ADI Media Research | |||

Since the forex rates are going higher than the expected, there is a huge impact on the price of hardware and consumables which is eluding the rural laboratories from coagulation testing. Local manufacturing is the key success factor in this segment and there are few manufacturers in India who envisioned this.

Global market dynamics

The global coagulation analyzers market was worth USD 3.6 billion in 2018 and is expected to reach a value of USD 6.2 billion by 2024, registering a CAGR of 9.2 percent during 2019–2024, estimates ResearchAndMarkets. Analyzers retained dominant share of the total revenue in 2018 and are expected to grow at a lucrative CAGR over the next 5 years. Factors promoting this growth are anticipated to be developing healthcare infrastructure and rising healthcare spending, coupled with increasing incidences of lifestyle-related conditions, such as obesity, diabetes, and cardiovascular disorders. Special emphasis on providing quality and timely care to patients is expected to propel the growth of diagnostic market, which in turn is anticipated to cause a hike in demand for hemostasis analyzers.

Clinical laboratory segment held the largest share in 2018. Clinical laboratory analyzers are predominantly used in hospitals for hematological analysis of patients on a daily basis.

Consumables held over 65 percent of the share and are further segmented into reagents and stains. All tests require the presence of reagents; hence, large inventory or repeated orders of these products are placed by hospitals, leading to higher demand. Increasing volume of testing and development of new assays is expected to boost sales of these consumables.

In terms of test type, prothrombin segment was estimated to account for the largest share in the region, followed by APTT test based in 2018.

North America accounted for the largest share of the global blood coagulation analyzer market in 2015 and will continue to lead the market during 2019–2024. The North American market is being driven by increased awareness of blood-related diseases among its people, rising prevalence of CVD and growing usage of coagulation analyzers. The key players contributing to the robust growth of the blood coagulation analyzers market are entering into partnerships, mergers and acquisitions, and joint ventures in order to boost the inorganic growth of the industry.

Players are mostly present in the international space, and due to easy global accessibility, they are competing directly to gain bigger share. The new vendor entrants in the market are finding it hard to compete with the international vendors based on quality, reliability, and innovations in technology. Key players in the coagulation analyzers market include Siemens AG, Thermo Fisher Scientific Inc., Roche Diagnostics, Alere Inc., Sysmex Corporation, Diagnostica Stago, Helena Laboratories, Instrumentation Laboratory, International Technidyne Corporation, Beckman Coulter Inc., and Nihon Kohden Corporation.

Technological advances

There are several technological advances in the field of coagulation analyzers to make results in less time.

T2 magnetic resonance (T2MR) is one new and emerging technology that is able to detect clot formation. T2MR is able to detect clot formation, based on partitioning of red blood cells and proteins, which occurs during fibrin formation and platelet-mediated clot contraction. This device can be used to measure clotting times, individual coagulation factors, and platelet functions. T2MR has also revealed a novel hypercoagulable signature that needs further study to determine if it can be used to predict patients at higher risk of thrombosis.

Acoustic waves are alternatively used in another novel, miniaturized point-of-care device capable of using only a small amount of citrated whole blood, measuring the time required for fluorescent microspheres to cease motion due to clot formation. Overall, 1 mL of whole blood is initially needed to be collected, but only < 10 µL is loaded onto the device. The result provided is a clotting time in seconds. This system may be useful for assessing anticoagulant effects, and the device has been studied in patients receiving different types of anticoagulants, such as heparin, argatroban, rivaroxaban, dabigatran, and warfarin.

Infrared spectroscopy is instead used to detect clot formation in the Perosphere Technologies’ hand-held point-of-care coagulometers. This device uses fresh or citrated whole blood (~10 µL) with clotting activation initiated by glass contact. The turnaround time is fast, providing a clotting time within 3 to 10 minutes. Preliminary data showed that this device may be useful in assessing coagulation response to any of the direct oral anticoagulants as well as the antithrombin-dependent activated factor X inhibiting anticoagulants such as heparin, low molecular weight heparin, and fondaparinux.

Laser speckle rheology (LSR) is employed to detect clot formation, using another novel optical hand-held point-of-care device that performs several coagulation tests, including prothrombin time, activated clotting time, clot polymerization rate (α-angle), clot stiffness, fibrinolysis, and platelet function. LSR quantifies tissue viscoelasticity from light-scattering patterns called laser speckle, using small amounts (40 µL) of whole blood and providing test results within 10 minutes.

Outlook

Manufacturers are looking forward to cost-effective, multi-parameter, portable, novel, and pocket-sized analyzers, with a specially trained workforce in clinics and hospitals, backed by less training cost, to handle them. High-throughput results, increasing adoption of automation, and development of high sensitivity and specificity of coagulation instruments will drive the market growth in the years to come.