Trends

Interventional cardiology devices market declines in 2020

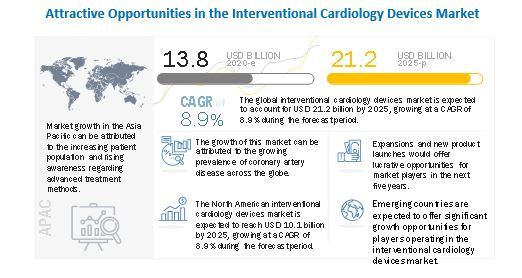

The global interventional cardiology devices market size is projected to reach USD 21.2 billion by 2025 from USD 13.8 billion in 2020, at a CAGR of 8.9% during the forecast period. Growth in this market is majorly driven by the rapid growth in the geriatric population and the associated increase in the prevalence of coronary artery diseases, the approval of new and advanced products, and the rising incidence of diabetes. However, the availability of alternative treatments and product failures and recalls are the major factors that are expected to restrain the growth of this market during the forecast period.

Covid -19 impact

Globally, the outbreak of COVID-19 has impacted every aspect of the medical device industry, including the market for interventional cardiology devices. In the past six months, the number of patient visits to hospitals has reduced significantly, despite the fact that emergency and OPD services are available in cardiology departments. Nationwide lockdowns and social distancing measures have reduced patient visits significantly. This has further reduced the sales of interventional cardiology products. Many of the leading players in the interventional cardiology devices market, such as Boston Scientific, Medtronic, and Abbott, have registered a decline in sales for Q2 and Q3 of 2020

Driver: growing prevalence of coronary artery diseases

According to the Centers for Disease Control and Prevention (CDC), coronary artery disease (CAD) is the most common type of heart disease in the US, killing 365,914 people in 2017. The CDC also estimates that nearly 18.2 million people above the age of 20 are currently suffering from CAD in the US. According to the British Heart Foundation, as of June 2020, there were 2.3 million people in the UK living with CAD. Each year, 170,000 people die from heart and circulatory diseases in the UK. Such a massive patient population and the high mortality rate is expected to increase the demand for interventional cardiology devices in the coming years.

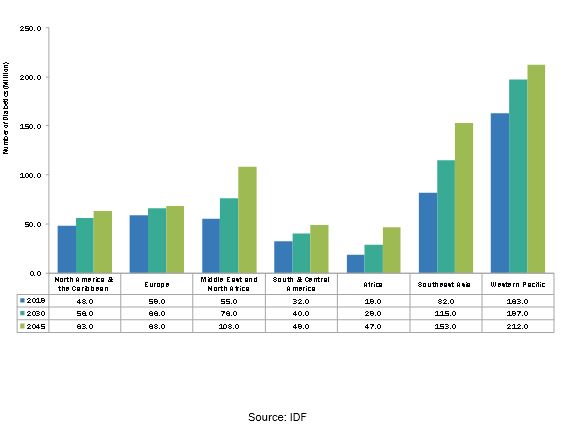

Risk factors, such as diabetes and hypertension, also fuel the demand for interventional cardiology devices. People with diabetes are more likely to have other conditions that raise the risk of coronary heart disease. Over time, high blood sugar can damage the blood vessels that control the heart. According to the International Diabetes Federation (IDF), globally, the number of people suffering from diabetes is expected to reach 700 million by 2045 from 463 million in 2019. In the US alone, 1.5 million Americans are diagnosed with diabetes each year [Source: American Diabetes Association (ADA)]. Growth in diabetes prevalence can largely be attributed to the growth in the geriatric population; it is estimated that 25% of all geriatric individuals (aged 60 years and above) suffer from diabetes in the US (Source: ADA)

Global incidence of diabetes, by region, 2019 Vs. 2030 Vs. 2045

According to an article published in the Lancet Journal in October 2016, the global prevalence of interventional cardiology diseases was 115.1 million in 2005, which rose to 154.6 million in 2015. With the growing geriatric population in all major regions across the globe, the prevalence of interventional cardiology diseases is expected to increase further in the coming years. This, in turn, will increase the demand and uptake of interventional cardiology devices in major markets during the forecast period.

Opportunity: Emerging markets

India, China, and Brazil are relatively untapped markets for interventional cardiology. The high incidence of diabetes and the large geriatric population in these and other emerging countries offer significant growth opportunities for the interventional cardiology devices market.

According to the IDF, ~77.0 million people suffered from diabetes in India alone in 2019; this is projected to reach 101.0 million by 2030. Similarly, in China, the population suffering from diabetes is projected to reach 140.5 million by 2030, from 116.4 million in 2019.

Furthermore, in India, the disposable income reached 2,937.0 billion in 2019 from 2,818.0 billion in 2018 (Source: TRADING ECONOMICS). In addition, increasing health awareness in the aforementioned countries is expected to increase the demand for advanced treatment methods, including interventional cardiology.

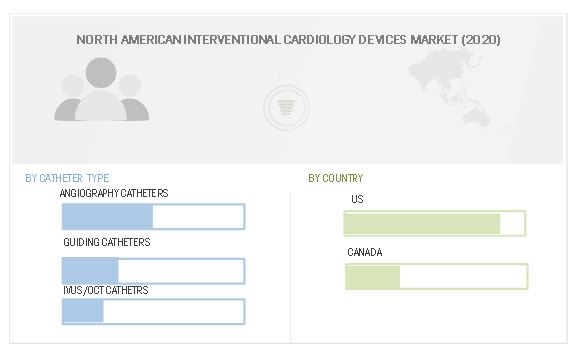

Angiography catheters segment accounted for the largest share of the catheters market in 2019

Based on type, the catheters market is categorized into angiography catheters, guiding catheters, and IVUS/OCT catheters. Among all the angiography catheters segment accounted for the largest share of the catheters market in 2019. This is due to the high and increasing prevalence of coronary artery diseases (CAD), coupled with the growing awareness about the benefits of the early diagnosis of CADs.

Embolic protection devices accounted for the largest share of the interventional cardiology devices market in 2019

Based on type, the hemodynamic flow alteration devices market has been categorized into embolic protection devices and chronic total occlusion devices. Among both, the embolic protection devices segment accounted for the larger share of the hemodynamic flow alteration devices market in 2019. This can be attributed to the advantages of embolic protection devices over chronic total occlusion devices, such as the ability to capture embolic debris without interrupting continuous blood flow. Moreover, an increasing number of interventional procedures for treating coronary artery diseases.

North America accounted for the largest share of the interventional cardiology devices market in 2019

Based on the region, the interventional cardiology devices market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2019, North America accounted for the largest share of the interventional cardiology devices market. The large share of North America can be attributed to factors such as the increasing prevalence of diabetes, rising aging population, availability of reimbursement, and the presence of all key players.

Prominent players in the interventional cardiology devices market are Medtronic (US), Boston Scientific Corporation (US), Abbott (US), Edward Lifescinces Corporation (US), Cardinal Health (US), iVascular (Spain), Becton, Dickinson, and Company (US), B. Braun Melsungen (Germany), Terumo Corporation (Japan), Biosensors International Group (Singapore), and Biotronik SE & Co. KG (Germany). – MarketsandMarkets