MB Stories

IVD industry stands at the precipice of a significant transformation

Opportunities need to be leveraged mindfully, with a focus on addressing India’s unique healthcare challenges to ensure that the potential of the IVD industry is fully realized.

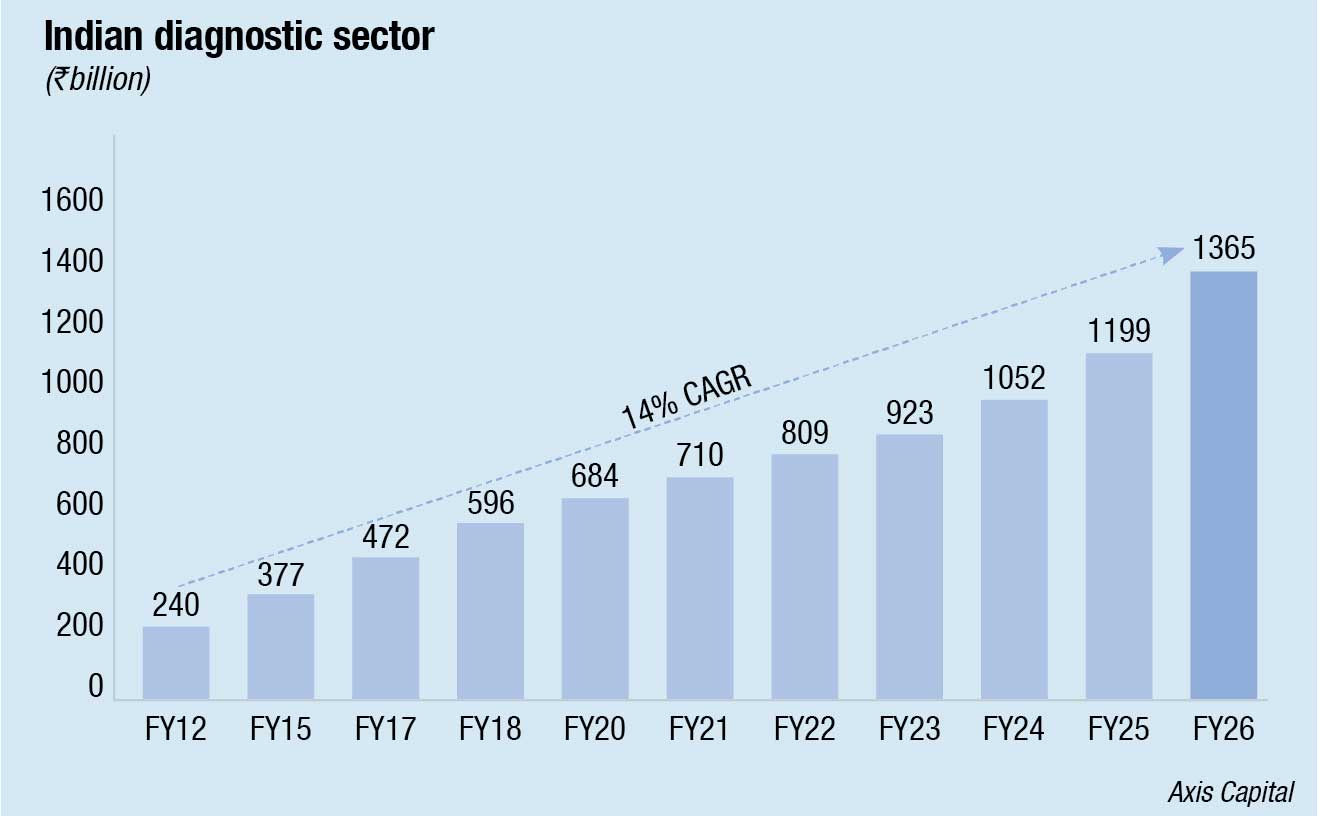

The ₹925-crore Indian diagnostic industry is generating a lot of interest. Poised at an 11–15 percent CAGR for the next five years, the sector benefits from major tailwinds, such as rising per capita incomes, rising life expectancy, and the rising prevalence of non-communicable diseases (NCDs), both acute and chronic. Favorable macros as growing healthcare spends and increasing disease burden present opportunity.

The needs of patients are changing due to the nature of diseases that require precise prescriptions instead of a broad range of antibiotics, which makes accuracy of diagnostic services paramount. Doctors now require a diagnostic test in 75 percent of patients prior to prescribing medication.

Amid the pandemic, the demand and the requirements from the diagnostic industry had transformed largely. We are currently operating in a radically changing environment, which is marked by rapidly evolving services due to changing consumer expectations, location-agnostic care needs, and a rise in new ecosystem partnerships that are accelerating the industry several years forward.

There is an increased emphasis on preventive healthcare in India. Furthermore, rising rates of chronic diseases, such as diabetes, cardiovascular conditions, and cancer necessitate timely and accurate diagnosis, effectively positioning IVD tests as a critical tool.

The rise of point-of-care testing (POCT) performed at or near the site of the patient, such as the doctor’s office or patient’s own home is gathering pace. POCT provides significantly faster turnaround times than central or satellite laboratory testing, and is associated with much lower costs. Recent years have emphasised the need for faster, accurate, more affordable, and less invasive diagnostic tests. During the height of the Covid-19 pandemic, rapid at-home testing kits were indispensable tools. As the prevalence of diseases continues to rise, POCT will only become more important, particularly in remote and low-income settings.

At-home services like home sample collection for diagnostic tests are getting more mainstream. During Covid, when the entire nation was forced to rely on the humble phlebotomist to visit their homes, they realized how much easier this was than navigating the traffic to visit a lab, just to give a blood/urine sample. This change is gradual yet irreversible!

Over the last 2–3 years, India’s diagnostic industry has seen new entrants like corporate chains, both from within and outside the healthcare domain. These companies have been attracted by the dynamics of the industry, such as strong cash generation, low entry barriers, low capital investments, and superior RoCE.

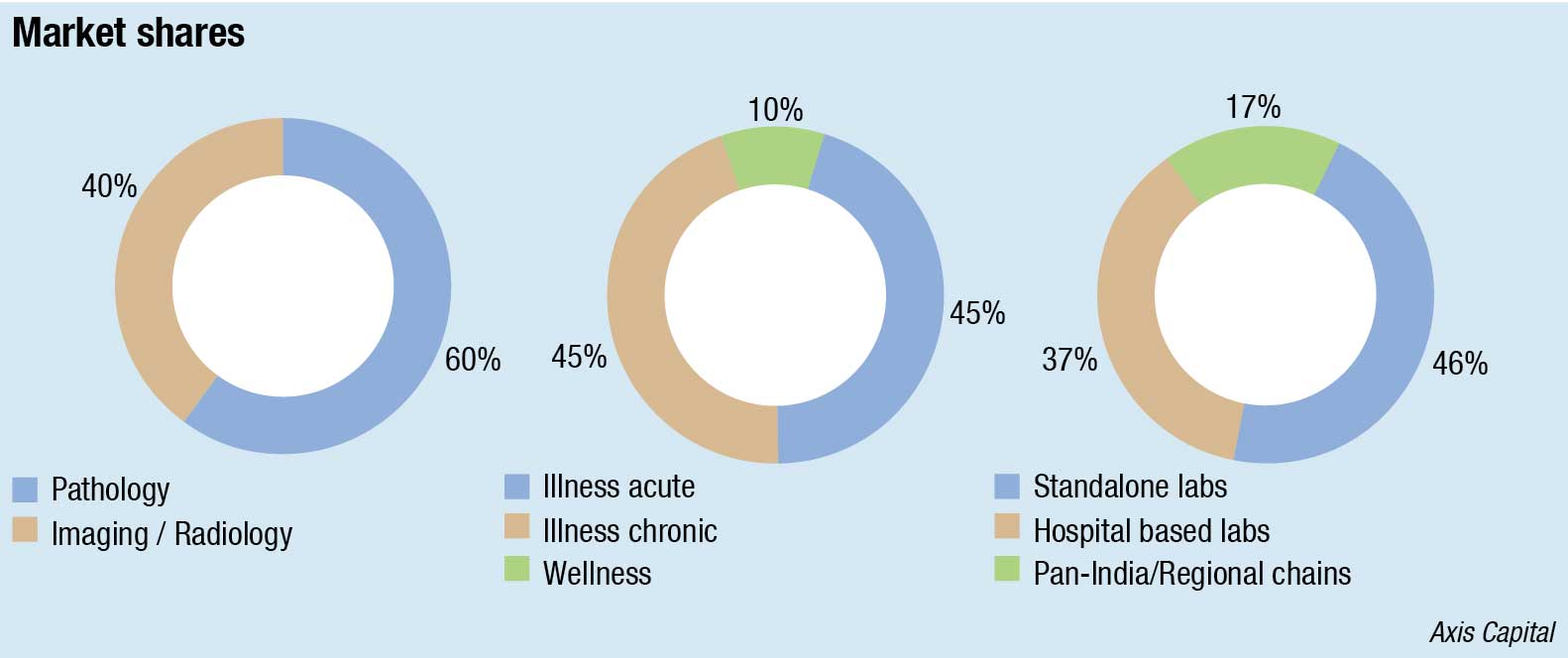

The players range from large national and regional organized chains to small unorganized standalone service providers. The large diagnostic chains operate through the hub-and-spoke model, which consists of large labs, the reference labs in key locations along with a network of smaller labs, and collection centers. Certain diagnostic service providers outsource the services to existing organized diagnostic service providers instead of setting up a reference lab themselves. Such companies benefit by offering complete healthcare services to customers, and by getting new business without having to invest in reference labs. Then there are labs operating in public or private hospitals. These are either overseen by the hospital itself or there is a tie-up in the form of a revenue-sharing agreement between the hospital and the diagnostic service providers. Also, there are institutional players that are B2G, and follow the PPP model with participation only in government tenders.

Corporates, well placed in the pharma industry, are now venturing into diagnostics by leveraging existing doctor and distribution network. Lupin Diagnostics was launched in October 2021 and is currently present in East India and West India. Pathkind Diagnostics (promoted by Mankind Pharma) has 2000 collection centers and a network of 80-plus labs, which offer specialized tests too, thus becoming a full-scale diagnostics player. Torrent Pharma and Adani Health are expected to launch their diagnostic arms soon.

The surge in competition from and amongst companies is scaling up with aggressive online aggregators like Practo, Meditest, Spice Health, MFine (only collection of samples), and e-diagnostic companies (e-pharmacy players diversified into diagnostics). Tata 1mg started in 2013 as a medicine content platform and by 2014 further diversified into a marketplace platform with a focus on e-pharmacy. The company added e-diagnostic services in 2015, initially as an online aggregation and fulfilment platform for leading companies like DLPL, Metropolis, SRL, etc. Tata 1mg has since expanded to offer its own test portfolio of 320 tests, 40 city coverage, and 12 labs (Delhi, Gurgaon, Mumbai, Pune, Nagpur, Hyderabad, Chennai, Bangalore, etc.) of which 10 are NABL accredited and two are newly commissioned in December 2022. The company has plans to further expand in the near term, to add 10 new labs over the next two years.

Till last year, the four largest players (Lal PathLabs, Metropolis Healthcare, SRL Diagnostics, and Thyrocare Technologies) had about 6 percent in market share. Local labs had a 46-percent market share while hospital-based labs a 37-percent.

The Indian government’s focus on strengthening the healthcare infrastructure and boosting domestic manufacturing presents a significant opportunity for the IVD industry. The Atmanirbhar Bharat initiative also extends support to the IVD industry. By incentivizing R&D and manufacturing of diagnostic kits within the country, the initiative helps make critical diagnostic tools.

Another noteworthy initiative is the government’s emphasis on public-private partnerships (PPPs). This model allows the government to collaborate with private entities to increase innovation, efficiency, and service delivery in the IVD sector. This synergy allows for the integration of advanced technologies, access to global best practices, and improvement in the overall quality of diagnostic services.

Some existing noteworthy public-private alignments include:

In March 2023, the Ministry of Health and Family Welfare issued an update on medical colleges under PPP model. The regulations of National Medical Commission (NMC) allow establishment of a medical college under PPP model. The appropriate government may allow the utilization of the facilities of a hospital owned and managed by it for establishing a medical college by a person/agency/trust/society/company by entering into a memorandum of understanding for this purpose. Such hospitals should have minimum 300 beds with necessary infrastructural facilities, capable of developing into teaching institution for the proposed medical college.

Krsnaa Diagnostic Limited has established its market position in the PPP diagnostic services segment. It has been awarded seven new PPP contracts post Q3 FY2022. In FY23, Krsnaa was awarded two major pathology tenders, one in Maharashtra for setting up one lab and 600 collection centers, at BMC, it is looking for annualized revenue of ₹30 crore–40 crore. And one in Odisha for setting up 5 labs and 386 collection centers, a ₹50–55 crore annualized revenue potential. It was also declared as the lowest bidder (L1) bidder by National Health Mission, Rajasthan, for providing laboratory services under the free diagnostics initiative on hub-and-spoke model in the entire state, in consortium with Telecommunications Consultants India Ltd. In May 2023, the company was declared L1 for setting up diagnostic centers in Assam by NHM. The same month, it was selected for installation, operation, maintenance, and running of an MRI and CT scan center under PPP in the municipal peripheral hospitals located in Mumbai.

In 2022, Maharashtra and Apollo Hospitals signed an agreement to set up diagnostic centers across the state, offering various services, from basic blood tests to complex genetic testing, at affordable prices.

In 2021, Rajasthan and SRL Diagnostics partnered to launch telemedicine and teleradiology services in the state’s district hospitals, and Karnataka collaborated with Manipal Hospitals to launch a mobile health bus service with advanced diagnostic facilities at an initial investment of ₹2 crore.

The PPP-driven transformation of India’s diagnostic sector is here to stay. Three areas of focus are policy framework development, capacity building, and fostering sustainable partnerships.

The diagnostic industry has always been an early adopter of technology. With increasing competition and tests becoming more commoditized, there is a need for super-efficient operations using digitization tools, such as artificial intelligence (AI) for process efficiencies, thus keeping the bottom line healthy. AI is the tool that allows for advanced predictions; its application in healthcare will radically transform how healthcare is practiced and lead to a healthier, more productive, and more equitable world. AI helps the industry process to a new age of enhanced diagnosis, while being minimally invasive.

AI for Health is a USD 60-million, five-year philanthropic program from Microsoft, created to empower nonprofits, researchers, and organizations tackling some of the toughest challenges in global health. In India, SRL Diagnostics signed an agreement on AI consortium with Microsoft in 2020. The work done by the SRL Microsoft consortium in developing deep learning-based algorithms for assistive technology in a relatively short span of time, speaks volumes about the capabilities of both the partners. This will be useful in screening liquid-based cytology slide images for the detection of cervical cancer in the early stages. Post-validation, the API product will be previewed outside the SRL ecosystem in various cervical cancer diagnostic workflows. This API has the potential to impact the laboratory diagnostic process by reducing subjectivity and time required for rapidly identifying cells of concern, thereby increasing overall accuracy.

While routine blood tests will remain the mainstay of the overall industry, further advancements in IVDs and genomics have taken the power of diagnostics to a new level. Sophisticated assays are now in use, enabling doctors to screen for complex diseases like cancer at an earlier stage, where cure rates are higher and symptoms may not yet be present. Scientists are working hard to flip the traditional model of healthcare through the development of next-generation diagnostic tests.

Predictive and prognostic biomarkers are driving this revolution. Biomarkers are also used to inform treatment decisions, helping physicians predict a patient’s response to a drug, avoid adverse side effects, and optimize treatment plans. With other biomarkers being identified all the time, scientists are well on their way to a new model of medical care known as precision medicine, where the right treatment can be selected for the right patient the first time around.

Further trends in the IVD market include the high demand for low-volume sample analysis and high-throughput screening methodologies. One emerging technology with the potential to answer these challenges is microfluidics – miniaturized devices that manipulate the behaviour of a fluid through a series of reagents. Microfluidics devices are sometimes referred to as lab-on-a-chip due to the technology’s ability to integrate several laboratory functions on a single integrated circuit.

The potential for microfluidics is only just emerging, with advantages including low-volume sample analysis, high-throughput analysis, automation, and rapid analysis times, plus a small footprint, low cost, portability, and disposability. As the industry continues moving to POCT, lab-on-a-chip devices are the ideal way to get there, and a large number of medical devices companies are currently innovating in this space.

It remains an industry with minimum entry barriers. There is no minimum standard of care or regulations to operate. Due to the regulatory vacuum, lab accreditation has stemmed as a legitimate self-regulating mechanism, upon which many now place reliance. While lab accreditation is not a legally mandated requirement, the National Accreditation Board for Testing and Calibration Laboratories (NABL) prescribes the criteria for accreditation of various labs. This voluntary accreditation aids in providing comfort about quality and standardized services to consumers, as well as the government. However, the compliance norms prescribed by NABL predominantly focus on quality of equipment more than other aspects of diagnostics. And while bonafide efforts, such as voluntary accreditation and self-regulation are being made, there is absence of an over-arching, all-comprehensive framework, which regulates diagnostic labs in India.

The Clinical Establishments Act (2010) provides for registration and regulation of clinical establishments in the country and prescribes the minimum standards of facilities and services to be provided by them. However, the Act is mandatory in only 11 states and all Union Territories except Delhi.

In contrast, jurisdictions like the US and the UK have detailed advisories and regulatory standards, which apply to clinical laboratory testing. In the US, the Clinical Laboratory Improvement Amendments (CLIA) regulate laboratory examinations and other procedures, basis the complexity of the lab tests (i.e., methodology of the procedure, number, and type of tests and examinations), and ensure laboratories produce accurate and timely patient test results, regardless of where the test is performed. Likewise, in the UK, the public health department has issued guidance notes, inscribing the standards for microbiology investigations.

The Indian diagnostic industry operates at one of the lowest price points in the world, primarily driven by volume-based efficiencies, which also drives affordability and accessibility. Over the last five years, while the consumer price index (CPI) price inflation has grown by around 30 percent, test prices have remained the same or gone up only marginally. In addition, today in India, a customer in a Tier-II town or a Tier-I city can access tests at the same price. That said, marginal increase in the prices have been announced by chains like Dr Lal PathLabs and Metropolis Healthcare recently.

As the diagnostics sector continues to grow, consolidation in the space is being seen. Consolidation is one of the ways to boost performance, opening doors to synergies and scale economies. Merger and acquisition (M&A) activity is helping fill the geographical gap, involving companies acquiring smaller players in regions where they do not have a significant presence, to expand their reach and gain access to new markets. While this is an effective way to grow a business quickly, importance of organic growth cannot be undermined. Companies that can successfully balance M&A with organic growth will be well-positioned to succeed in this dynamic and evolving industry.

Despite these opportunities, the Indian IVD industry must navigate challenges. Fragmented market dynamics, lack of standardized regulations, and the need for skilled personnel are on the top of the list.

Availability of skilled human resources remains a challenge and adds to the cost, especially in new geographies. Emphasis needs to be placed on developing skilling institutions to meet the increased demand for healthcare professionals. Laboratory automations, large volumes, and building process efficiencies help mitigate the effects of these cost elements.

Reagents and consumables are the key cost elements that impact profitability in the diagnostic sector. Since 85 percent of the reagents and consumables are imported, there has been an impact on this element due to rupee devaluation. In addition, sample transport requirements and logistics costs have gone up over the last few years.

These factors, coupled with the need for affordable and high-quality diagnostic solutions, call for comprehensive strategic planning and adaptive business models.

In conclusion, the Indian IVD industry stands at the precipice of a significant transformation.