Hematology Instruments and Reagents

Making progress against persistent challenges

The analyzer market continues to be as impacted as the rest of the lab industry with the uncertainty and unpredictability that ensues with the current state of affairs. While the extent of the impact brings ambiguity, the need for clinical laboratory solutions to support medical professionals remains constant.

The strides in the hematology market have been catalyzed by multiple distinct factors. Advances in diagnostic technologies for hematologic malignancies and automation in devices have helped address current and emerging needs of patients in the hematology market.

Over the past 20 years, there has been a tremendous advancement in the technology of hematology analyzers and their availability to the general practitioner. New paradigms in medicine and healthcare have increasingly broadened the market potential. Hematology care encompassed by oncology, immunology, and molecular biology is opening new avenues in the hematology market. A case in point is through understanding of hematopoietic stem cells.

The strides in the global hematology market have been catalysed by multiple distinct factors. Advances in diagnostic technologies for hematologic malignancies and automation in devices have helped address current and emerging needs of patients in the hematology market. Over the past few years, new paradigms in medicine and healthcare have increasingly broadened the market potential. Hematology care encompassed by oncology, immunology, and molecular biology is opening new avenues in the hematology market. A case in point is through understanding of hematopoietic stem cells.

An understanding of success of specific treatments for haematological disorders has further enhanced the quality of care in the hematology market. Advances in cancer immunotherapy protocols play crucial role in shaping the contours of the market. Advances in cancer immunotherapy protocols play crucial role in shaping the contours of the market.

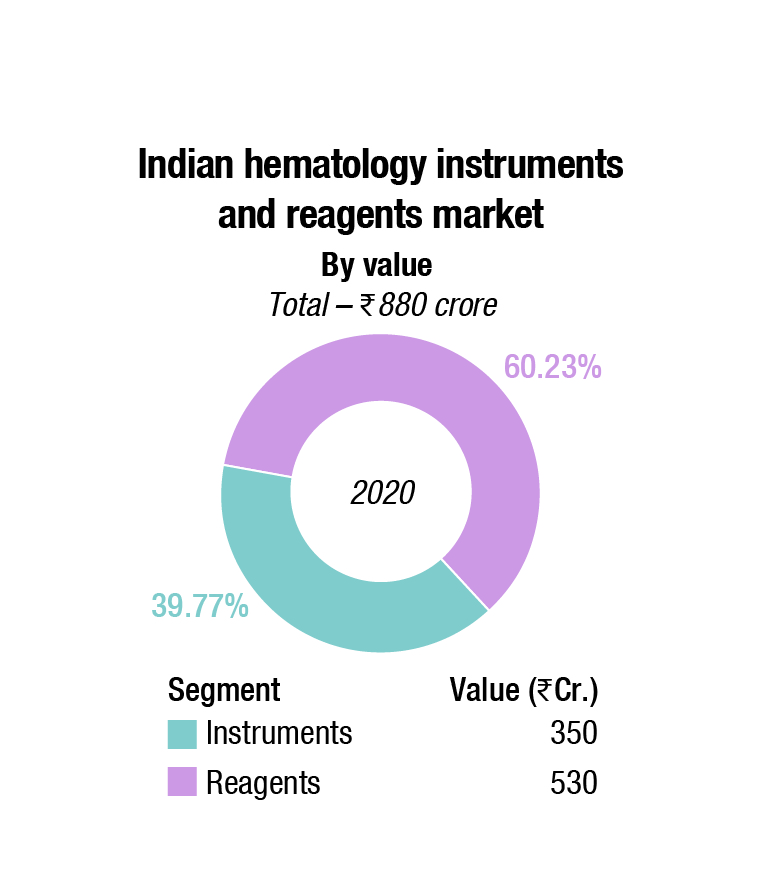

The Indian hematology instruments and reagents market in 2020 is estimated as Rs. 850 crore. Reagents constitute 62 percent of the market at Rs. 530 crore, and instruments, all fully automated.

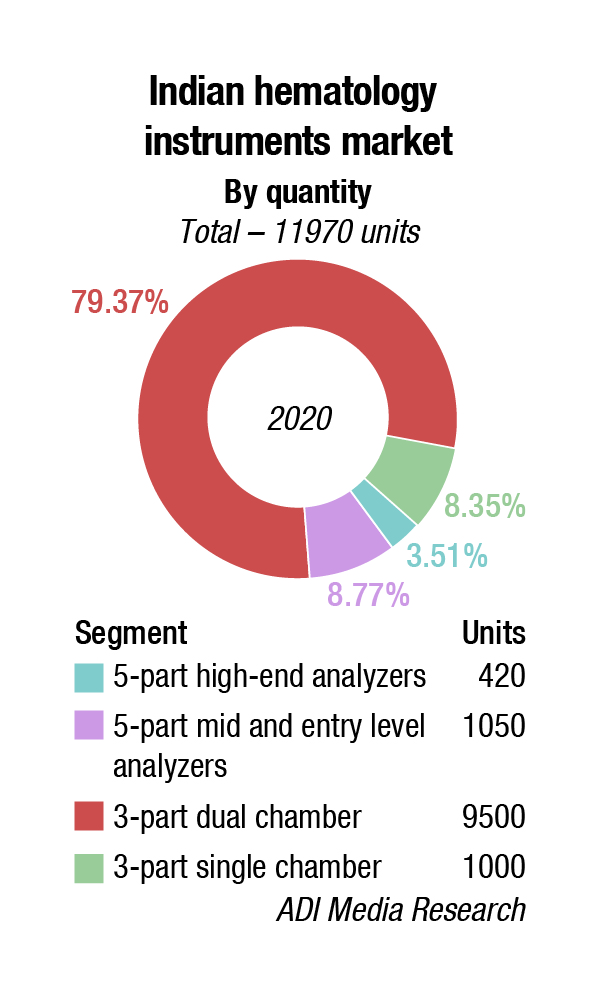

The hematology instruments market may be segmented as 3-part and 5-part analyzers. Within the 5-part analyzers, the entry-level or standalone analyzers have been the preferred ones. However, as COVID-19 pandemic raged through the country, buyers preferred the 5-part high-end analyzers, and the 3-part dual chamber analyzers to the single chamber models. It has all become a function of affordability. Stringent manufacturing protocols are finally finding their place in the industry. Customers want to keep intervention of service technicians as minimum as possible.

| Tier I | Tier II | Tier III | Others |

|---|---|---|---|

| Transasia, Horiba, Mindray, Beckman Coulter, and Sysmex | Abbott and Nihon Kohden | Trivitron, Boule, Dymind, and Siemens |

Agappe, CPC, Roche, Dirui, Meril, Beacon, Diatron, Shenzhen Prokan, Urit, LabIndia, and many small importers |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian hematology instruments and reagents market. |

|||

| ADI Media Research | |||

There are five dominant players in this market. Transasia, Horiba, Mindray, Sysmex, and Beckman Coulter, with the latter having restricted their offerings to the high-end range. Boule is gradually cementing its presence in the 3-part dual chamber segment. Abbott, Trivitron, Nihon Kohden, and Siemens give serious competition to these players. Many other players including Agappe, Beacon, CPC, Urit, and Meril are active in this segment.

COVID-19 hurt the hematology market considerably. The routine CBC tests have been on the backburner since March 2020. It is the in-patients that kept this industry going, as they had to be often tested twice a day, which gave impetus to the capillary testing procedure. It is estimated that the number of CBC tests done in 2020 were down to 110 million from 330 million tests in 2019. A back-of-the envelope calculation indicates that about 27 percent tests done are on 5-part analyzers; 65 percent are on 3-part dual chamber and 8 percent on 3-part single chamber.

While March-August 2020 saw an estimated 50 percent drop in vendor sales, the focus on COVID-19 situation was so much that the inquiries that had been received from various diagnostic centers did not convert to firm orders. 5-part high-end analyzers continue to be almost totally on rentals, while the other product segments have a mix between outright sales and placements.

As the Indian economy finds itself on the edge amid second wave, the lockdown declared by the government so far have been regional. The vendors are hopeful that if this remains the norm, the industry will revive itself. Elective surgeries will need to be done, OPDs will be held with some specified restrictions and routine tests will once again be recommended.

There are other challenges faced by the hematology community. Voluntary blood donation has dropped due to fears of contracting the SARS-COv-2. The ongoing pandemic will have consequences on the training of residents in hematology, who are now managing COVID-19 patients. Over the next year or more, this will affect a generation of clinical and laboratory physicians and scientists. Many clinical trials evaluating therapeutic discoveries for hematological disorders will suffer, as accrual to clinical trials has reduced while basic and translational research is hampered as resources are re-prioritized.

The SARS-Cov-2 virus is not going to disappear soon. It may mutate and change in virulence, and eventually it will be contained through public health measures, vaccinations and therapeutic interventions. The hematology community will need to ensure optimal care for their patients by adapting to the challenges posed by this virus.

The global hematology analyzers and reagents market is expected to grow from USD 3.93 billion in 2020 to USD 4.31 billion in 2021 at a compound annual growth rate (CAGR) of 9.7 percent, estimates The Business Research Company. The growth is mainly due to companies resuming their operations and adapting to the new normal while dealing with from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The hematology analyzers and reagents market is expected to reach USD 5.69 billion in 2025 at a CAGR of 7.2 percent.

Automation of hematology diagnostics process has led to reduced turnaround time, thereby accelerating the overall treatment regimen. Furthermore, automation has also led to reduced administrative errors and overall costs of diagnostic tests. Thus, it is expected to boost growth of the hematology testing market in the forthcoming years.

Dominance of hematology analyzers can be attributed to the presence of fully-automated analyzers which are objective, have high-throughput, and are cost-effective. Furthermore, these hematology analyzers can also detect atypical results and can improve measurable parameters such as red cell distribution width, platelet distribution, reticulocyte (RET) counts, and nucleated red cells counts.

Advancements in hematology analyzer

Advancements in hematology analyzer

Archana Ravindranath

Group Product Manager – Hematology,

Transasia Bio-Medicals Ltd.

Rising incidences of blood related disorders and rapid technological advancements are projected to lead to growth of the global hematology market. In fact, Asia-Pacific is the fastest growing market for hematology products due to the lack of healthcare infrastructure, poor lifestyle habits, rising income levels, ageing population, growing health awareness and changing attitude towards preventive healthcare.

Revolutionary advancements in fluidics, electronics, mechanics, computing along with AI enabled algorithmic tools have led to advancement in hematological analysis and have also contributed to reduction in the size of analyzers.

Workflow Optimization: Instruments with sophisticated hardware and intuitive software showcase greater accuracy.

Optimization streamlines processes, enhances productivity, increases lab profitability, improves operational efficiency, and eliminates unnecessary processes. This is turn minimizes errors and improves turn-around time thereby resulting in a cost advantage.

Informatics solutions and predictive analytics also improve the bottom line by compliance management, minimizing process variations, statistical reporting capabilities and eliminating oversights.

Automated labs have enabled laboratory professionals to focus on driving better clinical outcomes and spending less time managing operations by reducing human errors and eliminating time-consuming, repetitive tasks.

New affordable, modular, mid-scale hematology solutions use a unique combination of ultra-high definition imaging, artificial intelligence (AI) and traditional methods to analyze thousands of blood cells per minute to improve turnaround time.

Better clinical insights: Technological advances are allowing pathologists access to additional parameters and more cellular information and minimizing unnecessary manual reviews. Additional parameters have a great potential to identify changes in cell morphology that typically occur in several acute medical conditions. As a result, hematology analyzers are gaining trust as a powerful tool for the management of any medical condition and assisting pathologists in clinical decision-making.

Transasia Bio-Medicals Ltd. offers fully automated three and five part range of differential hematology analyzers that integrate an array of features for enhanced clinical insights to save time and labor, while enhancing patient care.

The advent of point-of-care (PoC) hematology testing devices has led to improved diagnostic and patient outcomes. These devices are user-friendly and are available for use outside the hospital settings. This is anticipated to increase the acceptability and accessibility of hematology testing which, in turn, is anticipated to propel market growth.

The rising number of blood donations globally is driving the hematology analyzers and reagents market as hematology analyzers are used to test and screen blood in blood banks. Blood banks are witnessing a huge outflow of blood to hospitals and other end-users and inflow of blood from blood donations on a daily basis. According to the WHO, there was an increase of 7.8 million blood donations from voluntary unpaid donors from 2013 to 2018. As the number of people donating blood increases, the demand for hematology analyzers and reagents increases, thereby driving market growth.

Recalls of defective hematology analyzers is acting as a restraint on the hematology analyzers and reagents market. A product recall is done by the manufacturer or developer of the product as a precautionary measure when safety issues or defects are discovered that can endanger the consumer. A faulty hematology analyzer may provide wrong results and may lead to misdiagnosis, affecting consumer confidence in the analyzers. Regulatory authorities caution healthcare professionals to be aware of the potential for inaccurate diagnostic results with these analyzers and to take appropriate actions including the use of alternative diagnostic testing or confirming analyzer results with manual scanning or estimate of cell counts.

Dr Aarti Khanna Nagpal

Dr Aarti Khanna Nagpal

Lab Head & DGM, SRL Limited,

C K Birla Hospital

“Hematology analyzers were being used only for cell counts and differential leukocyte analysis till we saw a tremendous advancement in the technology of these analyzers. Over the past decade, there has been a paradigm shift in reporting CBC parameters and these analyzers are capable of reporting parameters including immature granulocyte fraction, immature platelet fraction, reticulocyte hemoglobin content, red cell fragments, as well as new parameters for detection of functional iron deficiency. In addition to this, they also provide information about bacterial and viral infections and in screening of hematological malignancies using leucocyte positional parameters and morphologic properties of peripheral leukocytes, known as cell population data. New tools and parameters will continue to emerge as the market competition increases and technology evolves. Indeed, this is an exciting time to be in the field, and the next 5 years should promise to bring better patient care and more options for laboratory professionals.”

Leading companies are working on making devices easier to use. Technological advancements include hemoglobinometers, a pocket-sized compact device that has patient data stored in it and has printable features. Many of the companies are developing a combined hematology and CPR system to improve functionality and features. The development of small and compact systems with high accuracy is increasing such as Cell-Dyn series from Abbott.

Over the years, interested stakeholders in the hematology market have benefitted from advances in understanding the biology of hematopoietic stem cells. An expanding cancer immunotherapy protocols have also expanded the potential of the market. Emerging area of induced pluripotent stem (iPS) cells will likely open new doors of opportunities in the not-so-distant future.

The advent of instruments that help clinicians’ measure patient-reported outcomes has taken the quality of care in the hematology market to a new trajectory. These outcomes are of vital prognostic value as they enable clinicians to incorporate patients’ perspective in the treatment process. Patient-reported outcomes assessments are gathering steam in clinical trials as well as clinical practice.

Manufacturers are increasingly investing in the research and development of analyzers with microfluidics technology that uses low volumes of sample and reagents. Microfluidics deals with the flow of liquids inside channels as small as a few micrometers. Low reagent consumption by hematology analyzers with microfluidics technology helps reduce operating costs significantly. For instance, the HA5 hematology system from BioSystems is based on microfluidics technology and uses approximately 75 percent less reagents compared to normal hematology analyzers. Also, the respons3H and respons5H hematology systems by DiaSys use microfluidics technology and consume 70 percent less reagents.

In January 2021, Beckman Coulter launched DxH 560 AL, a tabletop hematology analyzer designed to reduce the time and resource constraints faced by small- to mid-sized laboratories. In the same month, Roche signed a global business partnership agreement with Sysmex, renewing a long-standing arrangement allowing Roche to distribute Sysmex hematology testing products, including instruments and reagents, according to a press release from Roche. In 2019, Luminex Corporation had acquired flow cytometry portfolio of EMD MilliporeSigma..

Technology has changed almost everything in science, which is need of the hour

Technology has changed almost everything in science, which is need of the hour

Kshama Nandode

Product Manager Hematology,

Mindray India

Over recent years, there has been increasing demand for hematological tests with clearly defined turnaround times (TAT) along with a need for cost containment. Also skilled and knowledgeable technical staff are the key. Fortunately, there have been advances in blood cell counting instrumentation resulting in a reduction of manual blood film review. The examination of blood films by microscopy remains one of the major labor-intensive procedures in the laboratory and the challenge is to reduce the number of films examined without missing important diagnostic information.

With recent advances in hematology analyzers there are now possibilities to do more with less. Today the capability to count blood cells has gone beyond the classical 5-part differential. The next need of the hour is TAT. For the most accurate and reproducible hematological results, whole blood specimens should be analyzed as soon as possible after collection. In modern day scenario ample of chain labs and chain hospitals are in trend. Samples are drawn off-site and then transported at ambient temperatures to main or central laboratory. Transportation times may vary depending on distance and location of the laboratories.

Automated hematological analysis of specimens, particularly analysis of the differential count if delayed beyond 4 hours, may yield doubtful and often invalid, results.

Newer technologies for WBC differentials have reduced many of the problems associated with automated differential counts dependent on scatter properties only. These technologies not only depend upon the size and structure of the cell but also give information of the maturity level of the blood cells. This staining technology does not imply to only WBC but also immature RBC counting wherein reticulocytes are stained and differentiated depending on their level of maturity.

Modern day hematology analyzers not only provide reliable and accurate WBC differentials’ counting but also have improvised technologies for RBC and platelet analysis. Thus, providing utility as hematopoiesis markers and functioning of bone marrow.

NRBC has become an integral part of the CBC analysis. NRBC with every CBC is the modern mantra. Hematology analyzers have been a boon during the COVID pandemic situation by evaluating prognostic parameters like NLR. Unnecessary hospitalization of patients has been reduced due to this very helpful parameter.

All this immediate and reliable testing has led to saving patient lives and decreasing mortality. Thus, hematology analyzers are essential instruments in a routine clinical laboratory for disease diagnosis, prognosis, and treatment monitoring.

Some of the leading players in the international market are Abbott Laboratories, Sysmex Corporation, Danaher Corporation, Siemens Healthcare, Sigma Aldrich Corporation, Drucker Diagnostics, Bio-Rad Laboratories, Roche Diagnostics, Mindray Medical International Limited, and Horiba Ltd. Sysmex Corporation, Beckman Coulter, and Horiba account for more than 90 percent of the market. The majority of the company’s manufacturing units are based in the Asia-Pacific region. The companies are increasingly focusing on the launch of advanced products to expand their market share.

Current trends in hematology

Current trends in hematology

Nitin Srivastava

Associate Vice President,

Vector Biotek Pvt. Ltd.

The growth of the hematology market is attributed to the increasing incidences of blood disorders and other diseases which keep challenging the diagnostic laboratories round the clock. The role of the laboratory in disease diagnosis and management has expanded in recent years, causing an overwhelming rise in testing demands. To cope with these demands, today’s products must deliver more clinical data and must be easier to operate, relieving overburdened laboratory staff members of cumbersome tasks.

The modern-day analyzers are providing five to seven parts differential white-cell analysis, based on the different technologies, such as electrical impedance, radiofrequency conductivity, light scatter, fluorescent scatter, and cytochemistry. They also provide additional information in the form of cell population data and Lymph Index using the volume, conductivity, and scatter technology, granularity index, large unstained cell population, and hemoparasites which can be utilized in the screening of benign and malignant hematological conditions.

In the recent past, several new products and technologies have emerged in the market, all of which promise to change the traditional understanding of laboratory hematology workflow and standards. New automated systems broaden capabilities beyond traditional methodologies. Globally, due to fast-moving product development, many products are launched on the scene to provide unique solutions to uprising customer needs.

Revolutionary advancements in computing, electronics, along with continuous innovation in the areas of biotechnology, fluidics, and mechanics, led to a reduction in the size of these analyzers. Many of the technologies like innovative flow cytometry analysis, genomics testing, advanced automated imaging processing and microfluidics are at the early stages of development and exist outside the routine core workflow, but it will not be long before they become standard hematology workflow.

In addition to all above developments the current pandemic situations due to COVID-19 has also become instrumental in growing demands for hematological testing. It is an established fact by now that hematological abnormalities like lymphopenia, thrombocytopenia are associated with disease progression, severity and mortality.

Thus with growing demands of hematology testing vis-a-vis solutions being developed by the manufacturers, it is the beginning of the golden era for hematology markets.

Among the various regions, North America has been showing vast revenue generating potential. Rising concern of blood-related disorders, notably in the US, and constant research for developing cutting-edge instruments have reinforced the prospects of the region. Meanwhile, Europe and Asia-Pacific are potentially promising regional markets, with the latter showing considerable appetite for growth. Growing awareness of hematologic disorders and improving oncology care are aspects augmenting prospects. Advances made in transplant biology and immunology in Europe will help open numerous lucrative avenues in the region in the coming few years.

Dr Vandana Khare

Dr Vandana Khare

Sr Consultnt Pathology,

Pushpawati Singhania Research Institute, Delhi

“Newer advancements include cellular morphometric parameters (CMP) based on automated intelligent morphology (AIM) technology. It provides new insights into red and white blood cell morphology. Another is monocyte distribution width as sepsis biomarker. It is incorporated in modern advanced hematology analyzer, as part of a routine CBC with differential to support prompt clinical decision. Slidemaker stainer cellular analysis system provide better results with better slides prepared automatically based on orders received from LIS. CytoDiff multiparametric flowcytometric systems provide 16-part differential systems with additional immunologic subpopulations of B and T/NK lymphocytes, and are more sensitive to detect blasts and immature granulocytes. It is bliss for physician’s OPD as well as patient as testing can be completed while the doctor is examining the patient and alleviates the burden on the patients of making a separate visit for the test results.”

Laboratory automation has been for long limited to clinical chemistry and immunochemistry platforms. The major hurdle encountered in developing models of automation for laboratory hematology is represented by the peculiar sample type, which is whole blood anticoagulated with dipotassium ethylenediaminetetraacetic acid (EDTA). The presence of EDTA in the sample, which irreversibly sequestrates ionized calcium and many other metal ions, makes EDTA plasma an unsuitable sample matrix for clinical chemistry and even for coagulation testing, thus generating considerable obstacles for consolidation of laboratory hematology with other branches of laboratory medicine.

Nevertheless, a number of technological solutions have been developed for laboratory hematology in recent times. These basically include commercialization of modular, high-throughput, and versatile analyzers, which can be easily interconnected by means of sample conveyers, and can fit the organization of small, medium, and large facilities; integration of pre-analytical workstations, which can be identical to those included in models of total laboratory automation, or can be specifically designed to suit hematological testing; connection with automated slide strainers, which help improving the entire slide making process; as well as integration of automated image analysis systems.

Throughout the relatively long history of laboratory hematology, the only reliable means for identifying, enumerating, and sizing blood cells has been for long represented by optical microscopy of peripheral blood smear. This practice carries many drawbacks, since it is inevitably time-consuming, vulnerable to high inter- and intra-observer inaccuracy and imprecision, needs specific education and training of microscopists, and poorly suited for rapid diagnostics as otherwise needed in patients with many acute hematological disorders.

Recent technological advances have led to development and commercialization of innovative automated image analysis systems, which are suited for automation and can hence be directly connected (in series) with hematologic analyzers. These innovative platforms scan the slides (usually at a picture of ×100 objective), and store digitalized images of blood smears at high magnification. The images are analyzed by artificial neural networks based on a preexisting database of blood elements (thus including RBC), which can be locally customized or updated by the users. The images can be transmitted to, and displayed on, computer screens, which can be even placed at long distances from the scanner, for analysis and potential reclassification of blood elements. The operator can also increase the size of the images, or expand single sections of the scan, so obtaining a more accurate view. The operator can then accept and conserve the automatic classification, or move elements from one cell category to another, thus improving the final reclassification. Albeit these automated image analysis systems have been originally developed for analysis of white blood cells (WBC), specific information can also be garnered on erythrocyte morphology, thus including the presence of anysocytosis, hypochromia, microcytosis or macrocytosis, spherocytosis, elliptocytosis, ovalocytosis, stomatocytosis, acanthocytosis, echinocytosis, polychromasia, poikilocytosis, and abnormal erythrocytes. Recent data showed that the diagnostic sensitivity of these systems for identifying some critical categories of abnormal erythrocytes is excellent, typically higher than 80 percent, thus making the use of digital image analysis a highly valuable, and probably more accurate and reproducible alternative to optical microscopy.

Emerging trends in hematology analysis

Emerging trends in hematology analysis

Pravin Gundewar

Sr Product Manager,

Sysmex India Pvt. Ltd.

The persistent growth of the hematology market is attributed to the increasing incidences of blood disorders and increased prevalence of other diseases and infections. Rapid technological advances in hematology analysis and the emergence of high throughput hematology analyzers with novel parameters have also contributed to rapid growth.

The role of the laboratory in disease diagnosis and management has expanded in recent years and this has resulted in an overwhelming rise in testing demands. The availability of skilled technologists and specialists has also been a challenge across the country, more severe in tier II and tier III cities. To meet the needs of an overworked and mostly multitasking workforce, today’s hematology analyzers not only must deliver more clinical data than ever before, but also should be easier to operate, relieving overburdened laboratory staff members of cumbersome tasks.

Hematology analyzer manufacturers have responded to these needs with technological evolution in the areas of new product developments, workflow improvisation, analytical advancements, and clinical information management. Further revolutionary advancements in computing, electronics and manufacturing, along with continuous innovation in the areas of biotechnology, fluidics and mechanics, have led to a reduction in the size of analyzers and increase in the speed of analysis.

All these developments have resulted in accelerated overall treatment regimen with improved accuracy and elimination of human error. This evolution is providing the clinicians a plethora of information that was not available earlier.

We all are advancing to such a future where the hematology cell counters have ability to identify and monitor clinically significant cellular transformations. Technologies like fluorescence flow cytometry not only increases accuracy and precision of testing but also adds many new parameters like immature granulocytes (IG#, IG%) and NRBC in routine CBC+Diff analysis. This also gives option for reticulocyte count and enumeration of reticulocyte fractions. Fluorescence flow cytometry offers option for various body fluid analysis without additional hardware or reagents on cell counters.

The advanced hematology analyzer from Sysmex, a global leader in hematology automation uses fluorescence flow cytometry in all 5-part differential hematology analyzers. Sysmex provides options from standalone hematology analyzers to scalable systemization with integration of various modules like automated cell counters, slide maker, and AI enabled automated cell image analyzers.

Notably, the use of these systems may also enable an efficient recognition of parasitoid infections such as malaria, as well as the reliable identification of intravascular and spurious hemolysis, which would be otherwise undetectable on whole blood specimens. Interestingly, most of these automated image analysis systems are also capable of optimizing the identification of rare RBC abnormalities, since morphological erythrocyte alterations can be more efficiently visualized on the computer screen. Finally, the creation of a large personalized database of images of suggestive RBC abnormalities, represents a valuable resource for education and training of students and laboratory professionals.

Hematology analyzer, a matter of pride in Atmanirbhar Bharat

Hematology analyzer, a matter of pride in Atmanirbhar Bharat

Dr Vijay Parekh

Scientific Advisor – R&D Equipment,

Agappe Diagnostics

Importance of basic hematology parameters in healthcare is well established and needs no re-emphasis. Millions of samples are tested daily on fully automated hematology analyzers and an Indian lab without automated hematology analyzer is practically unimaginable.

In that context, it is appropriate to look back at the path we walked to reach here. In rapid times of 4G tele spectrum soon to be 5G, bear in mind that hematology analysis saw 6 generations of technological changes spread over 2 generation of diagnosticians.

I fondly recall my first semi-automated cell counter of early 1979-80. It was imported, provided only Hgb, RBC & WBC, cost about ₹35,000 and ₹5 in reagent cost per sample. There was 150 percent tax on import. The uncertainty of imports pushed me to prepare reagents in-house! With economic liberalization of 1990s, fully automated hematology analyzers appeared. They produced 18 hemat parameters including 3-part WBC differential and were called 3-PDA analyzers. They too were imported at a capital cost of ₹5 to 10 lakhs with running cost of ₹10-15 per sample. Such stiff costs denied majority of Indian patients the benefits of automated analysis. Once convinced of the benefits, users demanded cost reductions, which encouraged IVD industry to respond favorably. Today Indian user has a wide choice of analyzers, understands the pros-cons of analyzer features and undisputable benefits of automated analysis. As scale of economies tilt in the users’ favor, larger segment of patients is benefitting.

Indigenization began in 1990s with local manufacturing of reagents and consumables and resulted in lower operative costs permitting deeper penetration into tier II, III cities, and towns. However, in spite of the massive increase in installations, international IVD manufacturers continued with distribution route rather than local manufacture of hematology analyzers in India.

Taking a strong cue from these subtle but definite shifts in users’ requirement, it was imperative to bring forth a product that is developed for India. The recent developments in the IVD sector have sent out an alarming message on the need for developing products locally. The Indian hematology market with 12,000 units of 3-PDA annually is purely import dependent with just one player offering an Indian solution since September 2020. More than 500 instruments of Indian origin are installed across India with a lot more demand generated for Indigenous products. A move that can set in motion in the Atmanirbhar Abhiyan initiative by Government of India.

Albeit the laboratory diagnostics of anemia remains a rather simple enterprise, accurate disease characterization has emerged as a mainstay in the era of precision (laboratory) medicine, even for RBC disorders. The many technological advances occurred in laboratory medicine over recent times have enabled the introduction of a vast array of innovations, which have led the way to more efficient patient care and more convenient organization of resources and workflows within the laboratory. In the foreseeable future, the better understanding of phenotypic heterogeneity of RBC disorders, also supported by IT tools such as expert diagnostic systems or artificial neural networks, will predictably enable to improve the global management of these disorders at multiple levels. Yet, some additional issues will need to be addressed, on top of it all the current lack of harmonization in laboratory hematology.

Dr Sonal Jain

Dr Sonal Jain

Head Hematology,

Dr Dang’s Lab Pvt. Ltd

“The healthcare faces the most unprecedented challenges with the pandemic having entered its second year. There is a surge in all health disorders other than the viral illness itself. Owing to the much needed diversion of healthcare resources toward handling the pandemic, healthcare infrastructure is increasingly less equipped to handle a lot of other problems. The most optimal utilization of resources is the key to sustenance through these difficult times and should be an important part of strategic planning for the post pandemic world. Healthcare industry including companies involved in instrument manufacturing, reagents need to innovate and bring out the best and the most cost effective solutions. Learning, unlearning, and relearning is the key to survival through the unprecedented times.”

Considerations when buying a hematology analyzer. When purchasing a hematology analyzer or cell counter, the following may be key considerations:

Parameters. Cell counters may report on ranging from the classic 8 parameters to 36 parameters and 2–6 histograms and scatter diagrams. The decision on number of parameters required generally depends on the type of test needed, which in turn depends on case mix and load. Look at the size, type of facility, and testing capability needs. Is your facility a large multi-specialty hospital with an active inpatient population, mix of all types of cases, and high throughput requirement? If yes, one probably needs a fully automatic 5-part differential (Or even 6-part) hematology analyzer. If there is frequent need for stat testing due to high number of critical cases, then a back-up semi-automatic 3-part differential cell counter may also be required. Small and medium secondary care hospitals can opt for 3-part differential cell counters. They are mostly less automated, have less throughputs and limited test menus, but would suffice for their requirements. Less frequent, specialized test requirements can be outsourced.

Current and future throughput. Analyzers come with throughput ranging from 40 to 200 samples per hour. One may decide based on hospital throughput requirements.

Sample volume and mode. Generally hematology analyzers support 3 modes-Pre-diluted mode, whole blood mode, and capillary whole blood mode for various test requirements. Capability to work with smaller volumes is useful, especially for pediatric tests. There are some cell counters supporting as low as 9µl samples also.

Data storage. Cell counters offer storage capacity starting from 35000 to 100,000 results, including histograms, scatter diagrams etc.

Dimension and weight. If buyers are concerned about the space they have for the laboratory, then the compactness of the system may be important to them.

Efficiency and cost. Check the number and quantity of reagents that need to be used as well as their shelf-life. Ask for per test cost that one may incur based on the present and future volumes of samples.

Touchscreen and LCD display. Modern analyzers come with extensive touchscreen and large, convenient LCD displays for all operations, including inventory management system, thereby eliminating the need for a separate computer system. On the flip side, if staff is not properly trained and careful in using touchpads, one may require touchscreen replacement or unnecessary frustrations with faulty touchpad/keys, even though the analyzer functions are all intact.

Decentralized hematology testing can help improve efficiency in health assessments

Decentralized hematology testing can help improve efficiency in health assessments

Jeanette Nikus

PhD, Global Product Manager,

Boule Diagnostics

Over the years, the trend in clinical diagnostics has fluctuated between centralized and decentralized testing. A more recent patient-centric healthcare approach has shifted the scale to the latter, and the current pandemic has further accelerated this development.

Decentralized hematology testing can help shorten time to diagnosis and initiation of treatment. A complete blood count (CBC) is typically the first test requested to monitor patients’ health status, and the results form the basis for decisions on further testing, diagnosis, and treatment. In infectious disease investigations, for example, a CBC is less expensive than many pathogen-specific tests, and a WBC differential count, as part of the CBC, can give an early indication of a virus infection or a bacterial infection that can be treated with antibiotics.

Instruments suitable for decentralized testing are typically requested to be small and easy to use. As decentralized laboratories can be far away from service functions and lack back-up instrumentation, these analyzers also need to be robust with low maintenance requirements. Of great benefit is also if reagent packages can be stored at room temperature.

The COVID-19 pandemic has accelerated the field of telemedicine, allowing meeting with patients from remote. Although the convenience of virtual healthcare, it provides no substitute for diagnostic testing. To omit the need of on-site personnel trained to draw venous blood, analyzers that can handle small sample volumes to allow analysis of capillary blood from a fingerstick sample will be of great importance to support this evolution.

Capillary blood sampling can also be an option for patients that are hard to puncture such as elderly. As a fingerstick is often easier on the patient than a vein puncture, capillary sampling is typically also used with children and for monitoring of critically ill patients undergoing invasive therapy.

Technology advancements have enabled manufacturers of hematology system to provide test devices for use in decentralized clinical settings, but which can still produce high-quality analysis results comparable to central laboratory reports. Connection capabilities will help bridge possible gaps between site of testing and location of specialists for interpreting results, to further support a patient-centric approach to healthcare.

Closed tube sampling or open tube sampling? A critical factor for any type of hematology analyzer instrument that analyzes potentially infectious body fluids is automation that eliminates or minimizes contact between the user and the specimen so as to ensure user safety. In this regard closed tube sampling is considered safer than open tube sampling devices. Also check how the device deals with waste management.

Maintenance support. In case of fault or failure, quick and efficient service by the seller is critical because the blood samples deteriorate quickly. This is the reason most labs opt for reagents based rental systems, rather than outright purchase. In case of rentals, it is up to the seller to repair or replace the system within the promised SLA. However, a rental model works only for regular and higher volumes. If volumes are smaller than planned it may turn out to be costlier per test.

Trained staff. Carefully assess the staff’s capacity or training to use the new system. Some specific blood analysis testing may be high in complexity and may require extensive training for procedures requiring a high degree of operator preparation, calibration, intervention, and analysis.

Digital connectivity. Another important factor to consider when purchasing a hematology analyzer is the system’s digital/computer interface capabilities. Number of ports available, printer systems, LAN/wireless connectivity, HL7 compliance, and barcode scanner interface are all important. Seamless integration with hospital information system, lab information management systems, and/or electronic medical records may be required based on the systems the hospital already has.

Budget. Last but not the least — techno-commercial evaluation needs to be done based on the budget of the hospital.

Technological advancements and emerging trends

Technological advancements and emerging trends

Rajesh Patel

CEO – IVD, India,

Trivitron Healthcare

Hematology deals with disease aspects affecting the blood-forming organs and blood, which includes bleeding disorders, clotting problems, and anemia. It also deals with transfusion medicine, which involves performing blood typing, cross matching for compatibility and managing large amounts of blood products.

To meet the needs of an overworked and increasingly generalized workforce, today’s products not only must deliver more clinical data than ever before, but also must be easier to operate, relieving overburdened laboratory staff members of cumbersome tasks. Innovators have answered these needs with technological evolutions in the areas of new product commercialization, clinic workflow, analytical advancements, and clinical information management.

Hematology instrumentation developers are now equipped to meet the challenges of high technology coupled with customers’ demands for cost efficiency.

The global market

The hematology products and services segment accounted for the largest market share in 2019. The hematology analyzers and reagents market is classified into hematology, hemostasis, and immunohematology products and services. This can be attributed to the increasing adoption of PoC testing hematology analyzers in emerging economies, the launch of technologically advanced hematology products, the increasing preference for automation, and the availability of a wide range of services from major hematology providers.

Commercialization

In the past 2 years, several new products and technologies have emerged on the market, all of which promise to change the traditional understanding of laboratory hematology workflow and standards. New automated systems broaden capabilities beyond traditional methodologies that include cellular analysis combined with manual review. Globally, due to fast-moving product development, small entrepreneurial niche manufacturers and large multinational companies have launched products on the scene to provide unique solutions to evolving customer needs.

New tools and parameters will continue to emerge as the market competition increases and technology evolves. Thus, the traditional concept of laboratory hematology will also evolve – to one leveraging a variety of orthogonal techniques to produce deeper clinical insights faster and at a lower cost than ever before. Indeed, this is an exciting time in the field, and the next 5 years should see seismic changes that promise to bring better patient care and more options for laboratory professionals.

The analyzer market continues to be as impacted as the rest of the lab industry, with the uncertainty and unpredictability that ensues with the current state of affairs. While the extent of the impact brings ambiguity, the need for clinical laboratory solutions to support medical professionals remains constant.

Regardless of what the future holds for the clinical lab analyzers market, the one thing that remains constant is change. And as changes in disease detection and management keep coming, the lab industry and its analyzers will keep meeting the challenges that the new trends present.