Trends

Medical devices industry venture financing deals in Europe – Jan 2022

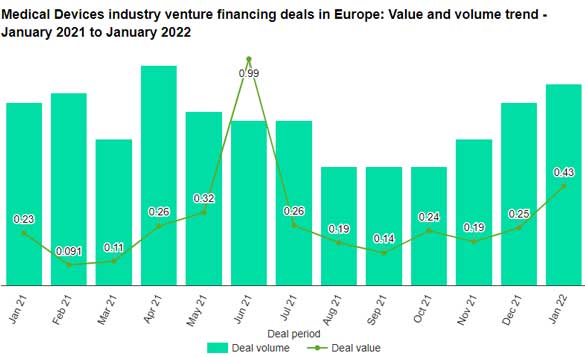

Total medical devices industry venture financing deals worth $433.9m were announced in Europe in January 2022, led by $90m venture financing of DistalMotion, according to GlobalData’s deals database.

The value marked an increase of 72.01% over the previous month of $252.22m and a rise of 59.1% when compared with the last 12-month average of $272.62m.

Europe held an 18.62% share of the global medical devices industry venture financing deal value that totalled $2.33bn in January 2022. With a 4.99% share and deals worth $116.31m, France was the top country in Europe’s venture financing deal value across medical devices industry.

In terms of venture financing deal activity, Europe recorded 22 deals during January 2022, marking an increase of 10.00% over the previous month and a rise of 22.22% over the 12-month average. France recorded six deals during the month.

The top five medical devices industry venture financing deals accounted for 69.05% of the overall value during January 2022.

The combined value of the top five medical devices venture financing deals stood at $299.59m, against the overall value of $433.9m recorded for the month.

The top five medical devices industry venture financing deals of January 2022 tracked by GlobalData were:

- 415 Capital Management and Revival Healthcare $90m venture financing deal with DistalMotion

- The $75m venture financing of ONI by ARCH Venture Partners,ARTIS Ventures,Axon Ventures,Casdin Capital,Oxford Science Enterprises,Section 32 and Vertical Venture Partners

- Genextra,Grand Pharmaceutical Group,Indaco Venture Partners SGR and Panakes Partners $55m venture financing deal with InnovHeart

- The $44.59m venture financing of Safeheal by Genesis MedTech International and Sofinnova Partners

- Baillie Gifford,eureKARE,HealthCor Management,Irving Investors and T Rowe Price Associates $35m venture financing deal with DNA Script

Medical Device Network