Reports

MedTech’s biggest deals in 2021 and what to expect next

The year in MedTech ended as it began, with a burst of dealmaking, driving companies’ growth ambitions.

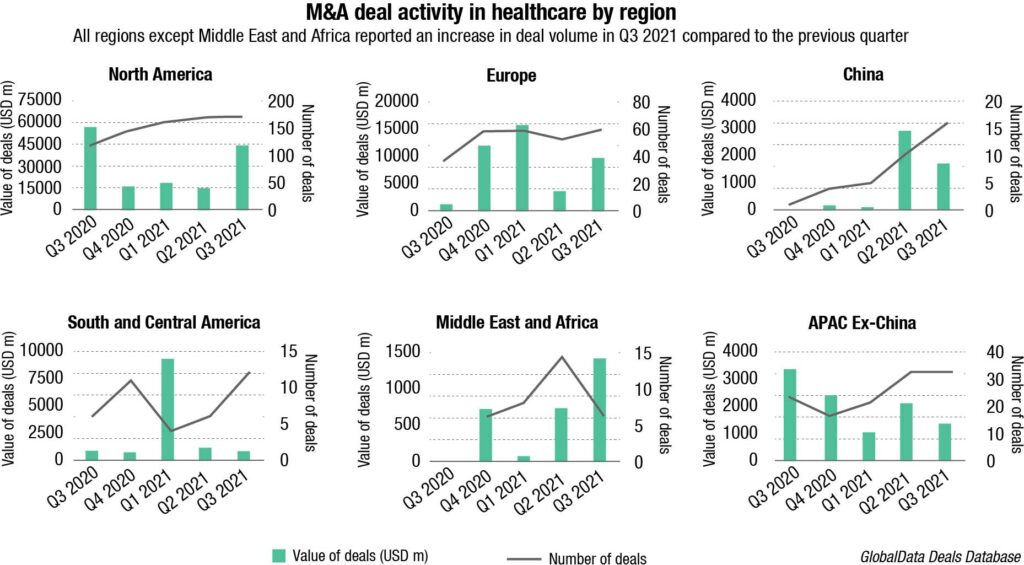

After pausing in early 2020 amid Covid-19’s uncertainties, acquisition-minded MedTechs were soon making up for lost time. The global healthcare M&A market saw 10 billion-dollar-plus M&A deals in Q3 2021, compared to just four in this financial year’s second quarter.

The healthcare sector recorded 216 domestic deals in Q3 2021, compared to 52 cross-border M&A deals. Domestic M&A deals’ value grew by 41 percent in Q3 2021, compared to Q2 2021.

The largest sub-sector, IT vendors, suppliers and service providers, recorded growth of 23 percent in M&A deal value in Q1–Q3 2021, compared to the same period in 2020.

There were 258 private company acquisitions in Q3 2021, while only 16 public company acquisitions were recorded by GlobalData during the same quarter. Private company acquisitions recorded an increase of 4 percent in deal volume, although there was a drop of 21 percent in deal value in Q3 2021, compared to the previous quarter.

Diagnostics deals played a large role in the MedTech sector’s M&A wave in 2021, fueled by buyers flush with revenue from the expansion of Covid-19 testing.

Across all of healthcare, companies are taking advantage of abundant capital, both in the private markets and via the rise of special purpose acquisition companies (SPACs). MedTech players in particular are motivated to gain scale as a defense against reimbursement pressures and to accelerate revenue generation by investing in high-growth areas.

Divestitures, such as Johnson & Johnson’s consumer health spinoff, GE’s healthcare transaction, and Zimmer Biomet’s creation of the ZimVie spine and dental company – all announced last year – are expected to remain a vehicle for freeing up capital.

The following is a look back at a collection of MedTech deals valued at USD 1 billion or more in 2021.

Thermo Fisher and PPD

In early December, Thermo Fisher completed the USD 17.4-billion acquisition of PPD, a provider of clinical research and laboratory services to pharma and biotech companies. The deal, first announced in April, followed Thermo Fisher’s failed bid to buy molecular diagnostics company Qiagen. Thermo Fisher also assumed and retired about USD 3 billion of PPD’s debt. PPD will become part of Thermo Fisher’s laboratory products and services unit.

Recently, the company has also completed the acquisition of PeproTech for a total cash consideration of approximately USD 1.85 billion. Based in the US, PeproTech develops bioscience reagents known as recombinant proteins, which include growth factors and cytokines. These reagents are used in the development and manufacturing of cell and gene therapies as well as in wide cell-culture applications, which are mainly models related to cellular research.

Baxter and Hillrom

Baxter’s USD 10.5-billion deal to buy Hillrom, announced in September, is an example of an acquisition driven by the need to build scale. Baxter CEO Joe Almeida has described the combination as a move to expand the company’s connected-care portfolio. The Hillrom acquisition, valued at about USD 12.4 billion including debt, was completed last month. The acquisition is expected to add to Baxter’s product portfolio and innovation pipeline in a way that allows it to offer a wider range of medical products and services to patients and clinicians across the care continuum. A major part of the deal involves accelerating the companies’ expansion into digital and connected-care solutions to enable patients to access hospital-level care at home or in other care settings.

Danaher and Aldevron

Danaher agreed to acquire Aldevron, a manufacturer of high-quality plasmid DNA, mRNA, and proteins, for approximately USD 9.6 billion. Fargo, North Dakota-based Aldevron, which employs approximately 600 people, develops the DNA, mRNA, and proteins to serve biotechnology and pharmaceutical customers across research, clinical, and commercial applications. It will continue to operate as a standalone company and brand within Danaher’s life sciences business segment.

Illumina and Grail

In August, Illumina announced that it completed its long-awaited and much-scrutinized acquisition of cancer-detection company Grail, but, due to that scrutiny, it will hold Grail as a separate company as the European Commission conducts an ongoing regulatory review. More than one year ago, the San Diego-based company agreed to acquire Grail, a startup that spun out from Illumina nearly five years ago, for cash and stock consideration of USD 8 billion. In the spring, the companies had agreed to postpone the merger while the US Federal Trade Commission (FTC) challenged the deal. A US judge ruled in favor of an FTC petition to drop its case against the merger without prejudice, a move that allowed the EU to continue investigating the merger.

Quidel and Ortho Clinical Diagnostics

One of 2021’s biggest acquisitions was announced just before Christmas. Quidel would pay USD 6 billion to buy Ortho Clinical Diagnostics, a 2014 Johnson & Johnson spinout that went public last year, joining forces to address a USD 50-billion market opportunity in in-vitro diagnostics. The acquisition is expected to close in the first half of 2022.

Steris and Cantel Medical

The announcement of Steris’ USD 4.6 billion cash and stock deal for Cantel Medical in January helped kick off the sector’s busy year of M&A. Steris gained a collection of endoscopy products and a foothold in the dental products market through the transaction, which was completed in June.

Roche and GenMark Diagnostics

Roche is to buy GenMark Diagnostics for USD 1.8 billion, picking up the company’s novel technology for testing a range of pathogens with one patient sample. GenMark’s respiratory pathogen panels identify the most common viral and bacterial organisms in upper respiratory infection, including SARS-CoV-2, complementing its own portfolio of Covid-19 diagnostics products.

DiaSorin and Luminex

A month after Roche announced its GenMark takeover, Italy’s DiaSorin revealed plans to acquire Luminex for USD 1.8 billion in a bid to expand its molecular testing business, and broaden its presence in the US. GenMark and Luminex compete with BioFire and Quidel in the multiplex testing space.

Boston Scientific and Baylis Medical

Boston Scientific was an active acquirer in 2021, including two targets valued at over USD 1 billion. The company’s USD 1.75-billion acquisition of Baylis Medical, announced in October, exemplifies the company’s need to invest in high-growth areas.

Baylis specializes in devices that facilitate access to the left side of the heart, for procedures such as atrial fibrillation ablation, left atrial appendage closure, and mitral valve interventions. The deal is expected to close in the first quarter of 2022.

GE Healthcare and BK Medical

GE Healthcare in December completed the USD 1.45-billion acquisition of BK Medical from private equity firm Altaris Capital Partners. GE Healthcare said the agreement, reached in September, will help advance its USD 3 billion ultrasound business beyond diagnostics and into surgical and therapeutic interventions, adding capabilities in the fast-growing surgical visualization segment.

Medtronic and Intersect ENT

Medtronic announced its intent to buy Intersect ENT in a deal valued at USD 1.1 billion, to broaden its product portfolio for ear, nose, and throat procedures. Intersect’s steroid-releasing implants are designed to open nasal passages in the treatment of chronic rhinosinusitis.

Boston Scientific and Lumenis

Boston Scientific closed its acquisition of Lumenis’ global surgical business. The USD 1.07-billion purchase, from an affiliate of Baring Private Equity Asia, was first announced in March. Lumenis’ laser systems, fibers, and accessories are used in urology and otolaryngology procedures.

Cardinal Health and private equity

Medical supplies and drugs distributor Cardinal Health agreed to sell its Cordis business for about USD 1 billion to private equity firm Hellman & Friedman. Cardinal bought the cardiovascular device manufacturer from J&J in 2015. The divestiture will decrease Cardinal’s medical segment profit by about USD 60 million to USD 70 million on an annual basis.

Outlook

As expected, 2021 represented a bounce back to M&A in the medical device industry with about USD 85 billion of deals, while 2020 levels were exceptionally low due to Covid-19 challenges. Nevertheless, more activity is expected ahead in 2022 for the subsector, as the need for both scale-given reimbursement pressures as well as the need to invest in high growth areas. Given the fragmented nature of this subsector, the need for continued consolidation exists. Finally, expect continuing aggressive portfolio management and the use of divestitures to free up money for reinvestment in high-growth areas, with private equity as potential bidders.