Molecular Diagnostics

Molecular diagnostics continues to deliver

The contribution of molecular testing to modern medicine is not finished yet.

Two decades ago, the thinking was that diagnostics would be largely conducted at the molecular level. It was anticipated that technologies capable of identifying a pathogen or a gene with high sensitivity just might displace tests based on associated antibodies or certain proteins. That has not happened. Traditional chemistry and ELISA testing still account for a major part of the laboratory workload.

Yet, there has been progress. Molecular-based diagnostics now accounts for one-eighth of the total market. Moreover, the opportunity for growth and the greatest promise for improved outcomes in so many diseases is in the molecular area.

The global market for molecular diagnostics is estimated at USD 8.76 billion in 2018 and is expected to grow to USD 12.95 billion in 2024. Molecular tests are experiencing revenue growth that is nearly triple the average for traditional in vitro diagnostics (IVDs), according to Kalorama.

What’s fueling this growth? A desire for better outcomes and accuracy, as well as more detailed identification of antigens, tumors, and mutations, helps explain the success. But the market is also getting impetus from advances in molecular technologies, including migration from traditional methods and also improvements to features of those methods, which have the effect of boosting prices and thus the market.

The bulk of the revenue comes from the same technology that originated it – polymerase chain reaction (PCR) technology. PCR-based testing still represents a high-growth segment. It accounts for more than half of the molecular-based testing market. Other segments in this market correspond to different technologies, such as isothermal nucleic acid amplification technology (INAAT), in situ hybridization (ISH), microarrays, and next-generation sequencing (NGS).

An evolution is happening within the scope of molecular testing. Hybridization-based testing technologies, such as microarrays and ISH, are being superseded in clinical practice by quantitative PCR (qPCR) technology and NGS. The latter category is the most interesting.

NGS is making a rapid run. Vendors are reporting improved clinical sales, and more systems are being used in diagnostic decisions.

The first NGS system was approved for clinical use by the FDA in 2013, so the market segment is quite new. However, a significant industry already exists for laboratory-developed tests (LDTs), performed as testing services on NGS platforms by certified clinical labs. NGS is increasingly used for clinically heterogeneous inherited disorders, resulting in an increase in the number of reported disease-causing genes.

A need to establish clinical utility

The potential of molecular diagnostics technology, like that of any diagnostics technology, depends on clinical utility. Coverage by Medicare and other payers for a molecular diagnostics product or test can be obtained through the demonstration of its clinical utility, particularly in terms of how a test can improve patient outcome.

Proving the utility of a test involves clinical data generation. It is also necessary to evaluate analytical validity (or the accuracy, precision, and reproducibility of test results) and clinical validity (or how well a test can determine the presence, absence, or risk of disease). Definitive clinical utility is becoming a criterion for the market success of new molecular diagnostics, particularly in the case of high-priced, advanced tests without comparable products on the market.

Clinical utility may also be defined more broadly. This point was emphasized by a report issued by the Association for Molecular Pathology (AMP) in 2016. According to the AMP, therapy-aligned definitions of clinical utility are too narrow because they fail to capture the value that tests can provide through additional prognostic criteria and predictive capabilities, including those relevant to patients’ family members.

However, the expanded scope for clinical utility proposed by AMP is incompatible with US health insurance outside of family plans, where testing of one parent may inform medical care of children also potentially at risk. Payers otherwise have no incentive to pursue testing, unrelated to patient outcome, since improved outcomes for family outside of children on the same plan would deliver no value to payers.

Developed and emerging markets

As in most IVD markets, sales to emerging markets are a way to counter some of the resistance and payment schemes in developed markets. China is one of the fastest-growing molecular diagnostics markets. The country’s growing urban middle class is demanding more services, spurring the development of private laboratories. The number of new independent clinical laboratories (ICLs) has grown substantially, with more individual labs focusing on advanced methods, such as gene-sequencing technologies. Increased spending in China and the progress of NGS product launches, test approvals, and sales will be key in assessing the future growth for this important testing market.

Indian market dynamics

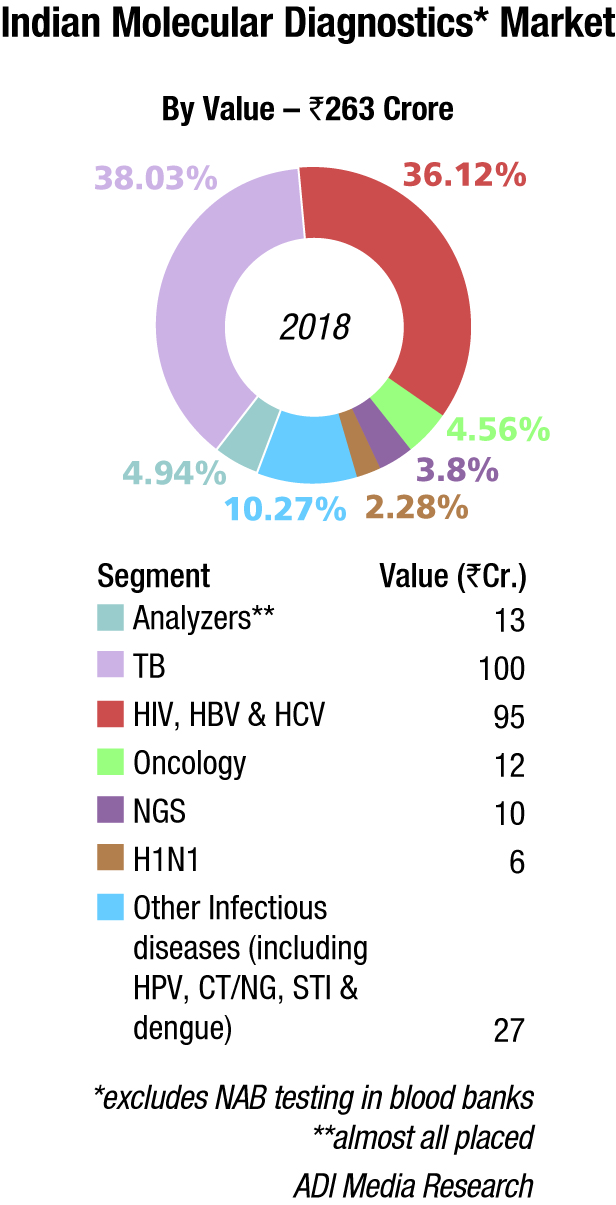

The Indian molecular diagnostics market is estimated at Rs 263 crore in 2018. Analyzers contributed Rs 13 crore, and most were placed. Roche, Abbott, and Qiagen continue to be the three dominant vendors.

In the reagents segment, TB at Rs 100 crore and HIV, HBV (hepatitis B virus), and HCV at Rs 95 crore have a combined contribution of 78 percent. India has set itself an ambitious target of eradicating tuberculosis by 2025. The large-scale implementation of the Indian government’s Revised National TB Control Program (RNTCP) is largely responsible for TB testing. There is not so much testing done by the private labs, and easy-to-use home kits are also available at very competitive prices.

Diagnosis of TB has entered an era of molecular detection that provides faster and more cost-effective methods to diagnose and confirm drug resistance in TB cases; meanwhile, diagnosis by conventional culture systems requires several weeks. New advances in the molecular detection of TB, including the faster and simpler nucleic acid amplification test (NAAT) and whole-genome sequencing (WGS), have resulted in a shorter time for diagnosis and, therefore, faster TB treatments.

Danaher (Cephid) has a very large share in the Indian TB-testing segment. The TrueNat test developed by MolBio Diagnostics can diagnose TB in one hour, as well as testing for resistance to the drug rifampicin. In 2016, six TB-related MolBio diagnostic products received CE-IVD marking. In January 2019, Qiagen announced plans to develop a proprietary new version of a QuantiFERON-based tuberculosis (TB) test, dedicated and tailored to the needs of low-resource regions, with a high disease burden of TB, like India. The new testing solution, QuantiFERON-TB Access (QFT Access), is designed to pair ultrasensitive digital detection of latent TB infection with a complete workflow created with a focus on cost efficiency and ease of use. Clinical trials are planned to start in 2019, and commercialization is expected to begin in 2020. In May 2019, Roche announced the CE-IVD launch of the cobas MTB-RIF/INH test to detect resistance to antibiotics within the tuberculosis DNA.

| High-end | Mid-end |

|---|---|

| Analyzers* | Roche, Abbott, Qiagen |

| TB | Danaher (Cephid), Molbio, Qiagen, Roche, and Bio-Rad |

| HIV,HBV, and HCV | Abbott, Qiagen, Roche; and Altona |

| Oncology | Qiagen, 3B BlackBio Biotech, Roche, and Siemens (Fast track) |

| NGS | Illumina, Thermo Fisher, and Agilent |

| H1N1 | Abbot, Qiagen, and Hi-Media |

| Other infectious diseases (including HPV, CT/NG, STI, and dengue) | Bio-Rad, Perkin Elmer, Beckman Coulter, bioMérieux, Tulip Diagnostics, CPC, Trivitron, and Medsource Ozone |

| *Clinical only | |

The National Viral Hepatitis Control Program was launched by the Ministry of Health and Family Welfare, Government of India, on the occasion of the World Hepatitis Day, July 28, 2018. It is an integrated initiative for the prevention and control of viral hepatitis in India to achieve Sustainable Development Goal (SDG) 3.3, which aims to ending viral hepatitis by 2030. This is a comprehensive plan covering the entire gamut from Hepatitis A, B, C, D, and E, and the whole range from prevention, detection, and treatment to mapping treatment outcomes.

In May 2019, Abbott announced that m-PIMA HIV-1/2 VL, the world’s first point-of-care viral-load diagnostic test, received the World Health Organization’s prequalification approval (WHO PQ). The test had received CE mark in December 2018. To provide the most effective HIV treatment and care, the WHO has recommended that everyone receiving antiretroviral therapy (ART) undergoes a viral-load test at 6 months and 12 months, and annually thereafter, if the individual is stable on ART.

It is estimated that in 2018, the Indian market for oncology, NGS, and H1N1 tests was Rs 28 crore. Other infectious diseases as HPV, CT/NG, STI, and dengue are also increasingly being diagnosed by molecular methods.

Outlook

The future of the molecular diagnostics market lies with nucleic acid amplification tests and sequencing-based tests. Time to results for real-time PCR and isothermal amplification are crucial for several infectious disease testing applications, including respiratory testing, hospital-acquired infections, bloodstream infections, and molecular point-of-care tests. Superior sensitivity and noninvasive sampling will make qPCR and NGS the future methods of choice for cancer testing and prenatal screening. The contribution of molecular testing to modern medicine is not finished yet.