DNA Sequencers

Offering Great Promise

With the rapid pace of change brought on by sequencing technologies in 2018, the momentum is expected to continue in 2019 in research, testing, and clinical practices for a myriad of applications and benefits.

Demand for accurate, inexpensive, and fast DNA-sequencing data has led to the evolution and dominance of a new generation of sequencing technologies. DNA sequencing is expected to revolutionize the conceptual foundation of these fields. However, issues related to public health and safety could pose a challenge to the DNA-sequencing market growth. The first method described for DNA sequencing was called plus-and-minus (Sanger) method. However due to inefficiency of this method, the manufacturers described a breakthrough method for sequencing oligonucleotides via enzymic polymerization. The enzymic method for DNA sequencing has been used for genomics research as the main tool to generate the fragments necessary for sequencing, regardless of the sequencing strategies. Since completion of the first human genome sequence, demand for a faster and cheaper sequencing method has increased greatly. This demand has driven the development of second-generation sequencing method or next-generation sequencing (NGS). This method is expected to revolutionize the field of genomics in coming years. Despite opening new edge of genomics research, the fundamental shift away from the conventional sequencing to the NGS technologies has left many undiscovered applications and capabilities of these new technologies, especially those in clinical segment. In addition, the evolution of new sequencing technologies has raised the demand for commercially available platforms, whose diverse applications are restricting the potential of NGS for clinical research and physician scientists.

Researchers and instrument developers have produced an array of DNA-sequencing technologies, which offer faster sequencing with higher accuracy at lower costs. For instance, one of the primary market players in the field has launched a system that consists of 10 ultra-high-throughput sequencers and can sequence about 18,000 human genomes per year.

Researchers are now using innovative technologies for genome mapping that take lesser time for completion. Other than this, the reduction in sequencing costs has led many companies to invest in R&D activities, and offer cost-effective solutions such as whole genome sequencing, de novo sequencing, and specific disease diagnosis.

The demand for DNA sequencers has increased significantly with surge in sequencing applications and rise in technological advancements in DNA sequencing. In addition, surge in the number of genome-mapping programs globally and increase in R&D investment is expected to drive the market growth in the years to come.

Indian market

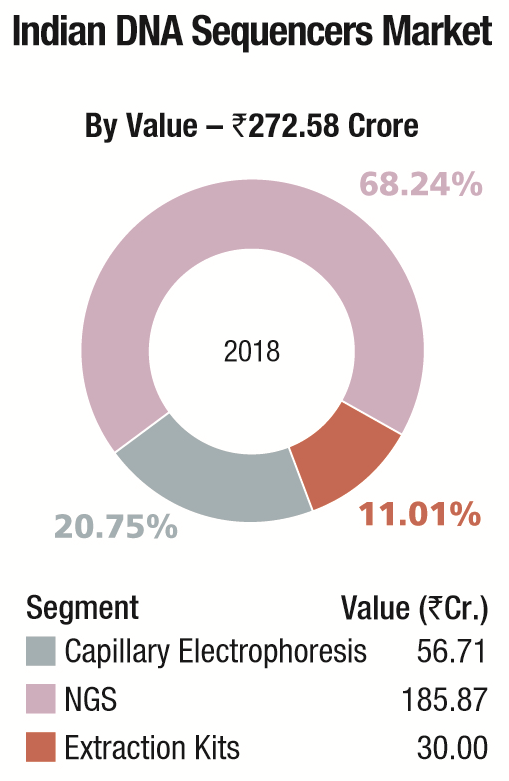

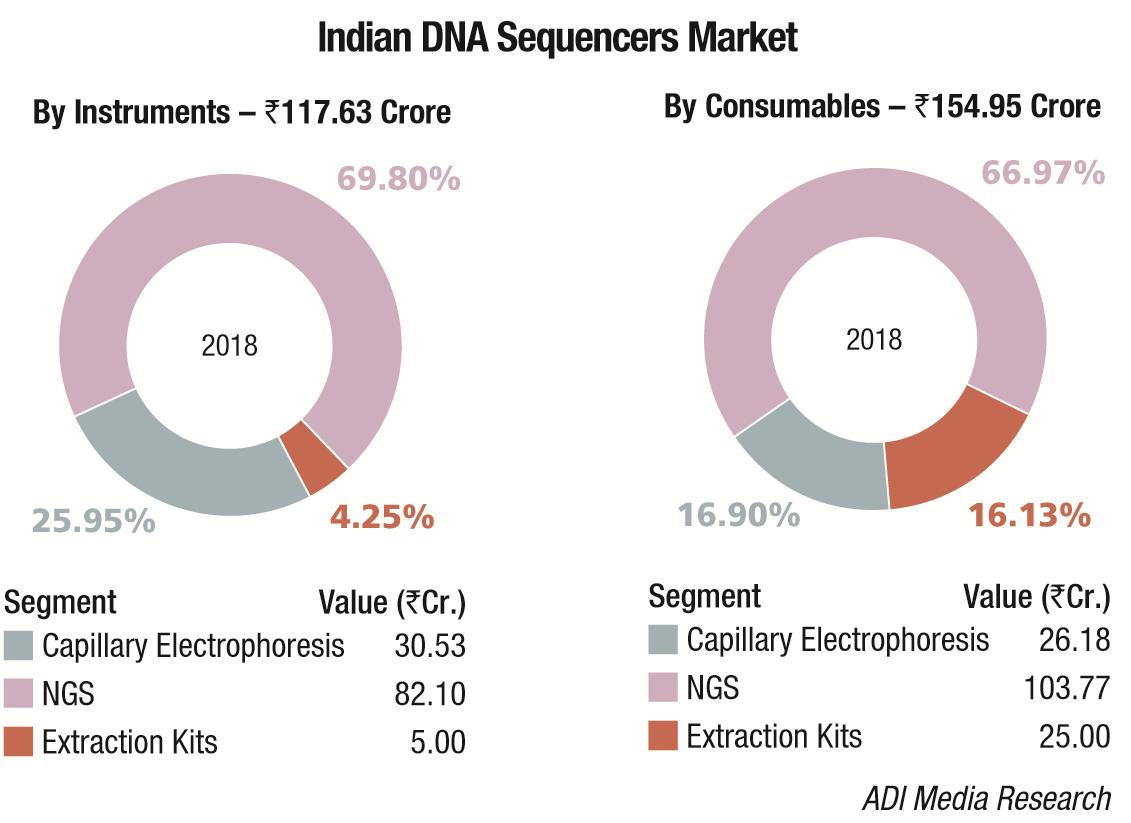

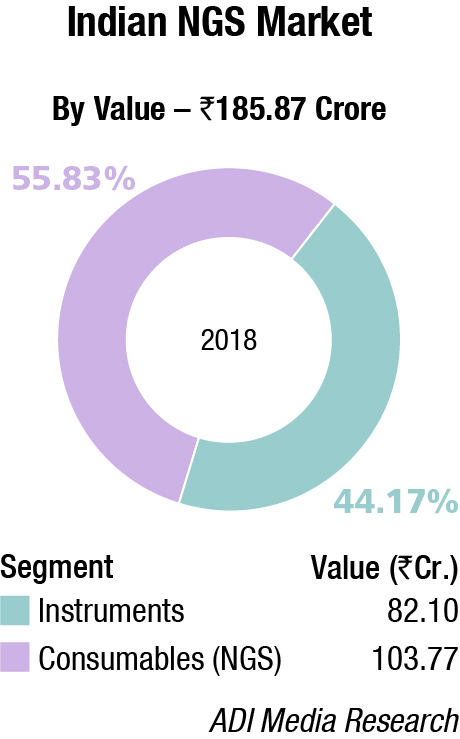

The Indian market in 2018 for DNA sequencers is estimated at Rs 272.58 crore. It may be segmented as capillary sequencers, NGS, and DNA-extraction kits for hospitals. NGS continues to dominate the segment with Illumina, marketed by Premas Life Sciences at a 68.24 percent share, leading the pack.

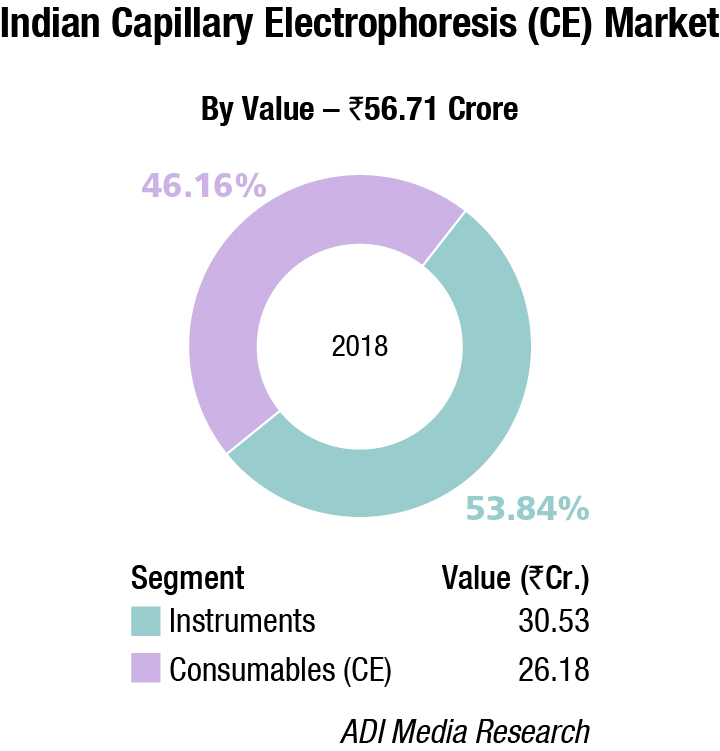

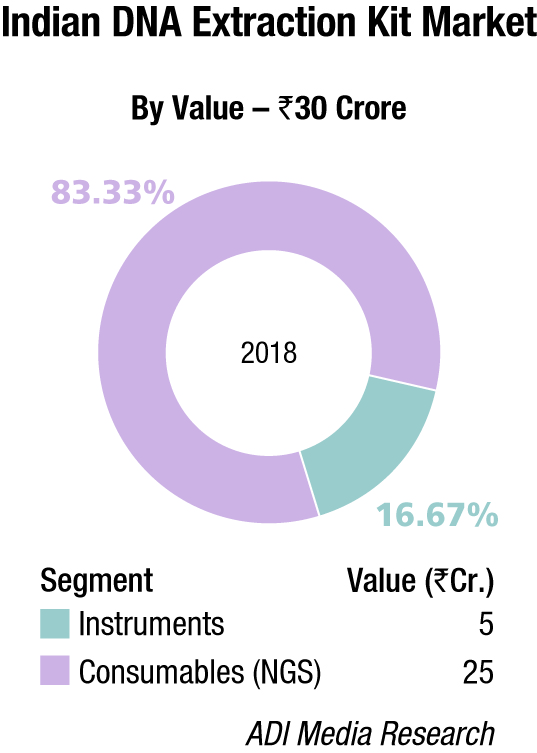

Thermo Fisher almost monopolizes the capillary electrophoresis segment, with instruments contributing a 53.84 percent share. The DNA-extraction-kit market for hospitals is estimated at Rs 30 crore and consumables are the main buy, constituting 83.3 percent share. Qiagen, Thermo Fisher, and Promega are the major players in this segment.

Global market

The global DNA-sequencing market is anticipated to grow at a CAGR of 17.46 percent between 2019 and 2027, predicts Inkwood Research. Some of the factors primarily driving the DNA-sequencing market include breeders requirement for animals and plant reproduction, developing technology and applied markets, increasing research and development in DNA-sequencing market, increasing prevalence of cancer cases, entry of new market players, increasing conferences and workshops related to DNA-sequencing market, continuing decline in sequencing costs, growth in liquid-biopsy applications, increasing personalized therapies, and surge in genome-mapping programs.

Standardization, accuracy, and ethical concerns in diagnostic testing, and harm to the skilled professionals while chemical handling, can severely hinder the growth of the DNA-sequencing market. For medical molecular-diagnostic testing, the accuracy of DNA-sequence analysis depends on at least three mechanisms. The main reason for the shortage of skilled professionals is the lack of awareness among people regarding DNA-sequencing techniques, and the lack of trained professionals as this technology is still in its initial phase of development.

The DNA-sequencing market in North America is expected to hold the largest share by 2027, possibly with growing geriatric population and the prevalence of various chronic disorders. In North America, the prevalence of various cancers, such as prostate cancer, breast cancer, bronchus cancer, bladder cancer, rectum and colon cancer, melanoma of the skin, non-Hodgkin lymphoma, renal pelvis cancer, thyroid cancer, endometrial cancer, pancreatic cancer, and other forms of cancer are growing rapidly due to which the demand for DNA sequencing is continuously snowballing.

On the other hand, the Asia-Pacific market is anticipated to be the fastest-growing region for the smart DNA-sequencing market. India, China, and Japan are the emerging nations that are contributing to the growth of Asia-Pacific DNA-sequencing market.

NGS

The global NGS market was valued at USD 8.49 billion in 2018 and is expected to register a CAGR of 12.78 percent between 2019 and 2025, estimates Grand View Research. Introduction of advanced and rapid sequencing technologies for clinical processes is expected to drive the market. Advancements in the bioinformatics field also drive the adoption of NGS platforms in diagnosis and analysis of rare diseases, identifying therapeutic targets, and for prenatal testing. NGS methodologies are expected to witness high demand in clinical diagnosis, genomics research, and in the precision treatment of varied diseases. Moreover, the rapid development of companion diagnostics in delivering advanced genomic and personalized medicine is poised to fuel the market growth in the near future. The advent of targeted therapies in oncology and other fields has significantly transformed the companion diagnostics. The NGS techniques are likely to help expand the companion diagnostics vertical as NGS panels are capable of measuring several biomarkers in one test. Consequently, this makes the NGS method an ideal targeted therapy in delivering precision medicine.

| Segment | Tier I | Tier II |

|---|---|---|

| Instruments | Thermo Fisher (brand Applied Biosys) | – |

| Consumables | Thermo Fisher | Promega |

| Segment | Tier I | Tier II |

|---|---|---|

| Instruments | Illumina (Premas Life Sciences) | Thermo Fisher and Pacific Biosciences (Imperial Life Sciences) |

| Consumables | Thermo Fisher, Agilent, and Illumina (Premas Life Sciences) | NER, Nimble Gene, and Pacific Biosciences |

| Segment | Tier I | Tier II |

|---|---|---|

| Instruments and Consumables | Qiagen, Thermo Fisher, and Promega | HiMedia, BioMérieux, and Perkin Elmer |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian DNA Sequencers market. | ||

| ADI Media Research | ||

Significant reduction in the cost of genetic sequencing from USD 95.26 million per genome in 2001 to USD 108.1 thousand in 2009 and USD 1000–1200 in 2017 will boost the market. The prices for installation of sequencing platforms are also decreasing significantly. This is also expected to have a positive impact on the demand for NGS techniques. Development of novel products and services by prominent companies is also expected to propel market growth. For instance, in August 2018, Illumina received approval for MiSeq Dx sequencing system from the China National Drug Administration.

Companies are also focusing on the introduction of economical sequencing devices for routine medical checkups as well as increasing their installation base by providing the NGS services in different countries. For instance, in June 2018, Oxford Gene Technology expanded its NGS custom cancer panel, SureSeq myPanel, which enabled the researchers to focus on cancer-related genes. And in April 2018, Agilent Technologies signed an agreement to acquire Lasergen, Inc. to boost NGS workflow for clinical applications.

NGS platforms and related products accounted for the majority of the market share in 2018. It comprises sequencing platforms, instruments, and software that are used during the preparation of samples, libraries, and sequencing of those samples.

On the other hand, the NGS services segment is expected to be a promising segment during 2019 to 2025. These services assist the researchers to better understand genomic sequences, develop personalized medicines, and in the diagnosis of rare and chronic diseases, such as cancer.

Oncology was the key application segment in 2018. With the rapid expansion of NGS capabilities, it is possible to sequence multiple genomes simultaneously and targeted sequencing of several cancer genes, consequently allowing the oncologists to access genetic information present in gene clusters related to tumor cells and cancer. Rapid proliferation in genealogy, paternity testing, and rising health awareness is anticipated to boost growth of consumer genomics in coming years. Companies, such as 23andMe, are involved in the provision of the personal genome service.

Academic research was the largest end-use segment in 2018 and is likely to expand further on account of wide usage of NGS methodologies in research and Ph.D. projects, on-site bioinformatics courses, and workshops. Several universities and research centers provide molecular biology courses and NGS applications. For instance, the Wageningen University & Research in the Netherlands offers state-of-the-art NGS facilities and technology for several clinical applications, thus inducing substantial growth in this segment.

The clinical research segment will register the fastest CAGR as NGS is used in cancer research for the discovery of new cancer-related genes, reviewing tumor heterogeneity, and detection of alterations. Availability of clinical-research solutions through market entities for screening and detection purposes also accelerates the vertical progression.

Strong presence of prominent firms, such as Roche Holding AG, contributes to the introduction of rapid and high-throughput sequencing capabilities, thereby boosting the market growth. Asia-Pacific is also projected to have a lucrative growth due to significant developments initiated by key companies for technological integration of NGS methodologies. For instance, in January 2018, Illumina, Inc. collaborated with KingMed Diagnostics to utilize Illumina’s NGS technology for oncology and hereditary disease testing.

Key companies in the global market include Illumina, Qiagen, F Hoffman-La Roche Ltd., Thermo Fisher Scientific, PierianDx, Genomatix GmbH, Eurofins GATC Biotech GmbH, Oxford Nanopore Technologies, BGI, PerkinElmer, and Bio-Rad Laboratories.

Market participants focus on collaborative models and are undergoing geographic expansion strategies, majorly in untapped regions. For example, in April 2018, Illumina collaborated with Bristol-Myers Squibb for the employment of Illumina’s NGS capabilities to develop and commercialize in-vitro diagnostic assays to support Bristol’s oncology portfolio.

Technology trends

The innovation driven by NGS in 2018 will continue in 2019, offering great promise in a variety of areas. In 2018, researchers began to develop programs to make diagnostic testing more easily available for patients enrolled in the public health plans of the Centers for Medicare and Medicaid Services (CMS), opening up its benefits to potentially hundreds of patients. New genetic data analysis, such as that from the Cancer Genome Atlas, is revolutionizing the deep analysis of various cancer types and driving the development of precision medicine. Funding from a wide variety of sources will continue to support programs to improve whole genome sequencing, to release the first FDA-designated public genetic variants repository and to introduce new processes that drive down the cost of sequencing, to name just a few remarkable advances in the field. Discover how these initiatives promise to shape the future of NGS development in 2019:

CMS extends health plan coverage for NGS testing. The reach of NGS diagnostic testing is set to dramatically expand in 2019 as the CMS said it will cover NGS testing for patients with advanced cancer in its health insurance plans. The CMS said these tests, when used as a companion diagnostic to identify patients with certain genetic mutations that may benefit from US Food and Drug Administration (USFDA)-approved treatments, can assist patients and their oncologists in making more informed treatment decisions. Also, when a known cancer mutation cannot be matched to an approved treatment, the results from the diagnostic lab test using NGS can help determine a patient’s candidacy for cancer clinical trials.

The first data based on the Pan-Cancer Atlas is published. The Cancer Genome Atlas (TCGA) is a collaborative project between the National Cancer Institute and the National Human Genome Research Institute, which after multiple years of research released the Pan-Cancer Atlas in 2017. In 2018, 25 papers were published together in the journal Cancer Cell, representing the first research published that utilizes the 2.5-petabyte, publicly available database. The Pan-Cancer Atlas is a comprehensive, multi-dimensional map of aberrations to the genome and epigenome of 33 different types of cancer. In total, data was derived from tumor tissues and normal tissues of over 11,000 patients. Research highlights include a study that compared 971 adenocarcinomas from different tissues in an effort to understand the factors differentiating gastrointestinal tract adenocarcinomas from other cancer types. Another study showed strong correlative links between whole chromosome or chromosome arm imbalance and somatic mutation rates, and the expression of proliferation genes across the 33 cancer types in the Pan-Cancer Atlas. Importantly, the Pan-Cancer Atlas remains publicly available for further mining, and promises to continue to revolutionize the deep analysis of various cancer types.

UK project sequences 100,000 whole genomes. In December 2018, the British government had reached its six-year goal of sequencing 100,000 whole genomes from National Health Service patients. With the project’s completion, this year the UK intends to apply whole genome sequencing at scale in direct healthcare, as well as provide access to high-quality, anonymized, or de-identified clinical and genomic data for research, aimed at improving patient outcomes. The project is intended to support a NHS Genomic Medicine Service, which will provide equitable access to genomic testing to NHS patients starting in 2019.

NIH funding for genome centers pushes precision medicine discoveries. The National Institute of Health (NIH) All of Us research program awarded USD 28.6 million in September 2018 to establish three genome centers, which will begin to generate genomic data from biosamples contributed by the program’s participants. This information will become a critical part of the program’s precision-medicine research platform, a national resource to support studies on a variety of important health questions. The centers, led by Baylor College of Medicine, the Broad Institute, and the University of Washington, will generate and analyze genomic data from biosamples contributed by participants in the program. All of Us is aiming to sign up at least 1 million participants for its precision-medicine research platform, including from groups that have been historically underrepresented in research. So far, it has registered more than 110,000 people, 60,000 of whom have completed all elements of the core protocol. Their data will be available to researchers for health-related studies. The centers will produce genomic data for the research effort and will analyze data that will be returned to participants. Participants interested in receiving results will initially obtain information from a list of 59 actionable disease-risk genes, as defined by the American College of Medical Genetics and Genomics, as well as pharmacogenomic results. In the future, they will also obtain information about their ancestry and traits.

FDA releases guidelines for development of NGS-based tests. With the rapidly decreasing costs of NGS technologies, genetic screening is becoming an increasingly commonplace aspect of patient treatment. This trend promises to accelerate in 2019 as the USFDA released a set of guidelines in April for the design, development, and validation of tests that utilize NGS and publicly available databases of genetic variants to support the soundness of data derived from the tests. The two key guidelines outline the USFDA’s expectations when assessing whether pre-market applications are safe, accurate, and reliable for the detection of specific genetic variants in a clinical setting.

African pan-genome analysis reveals that reference genome sequences may not be adequate. The human reference genome is a digital database representative of the complete set of genetic information belonging to humans. Data from the deep sequencing of a small number of individuals’ DNA compromises the database. However, the best utilization of sequencing data for population genetics, healthcare, and medical screening relies on a reference genome that is representative of all populations. A team at John Hopkins University analyzed sequencing data at between 30x and 40x depth from 910 individuals of African descent, representing 1.2 trillion paired-end reads. Analyses revealed almost 300 million bases in 125,715 contigs did not align to the most recent reference genome release (GRCh38). This bears a significant result for the future of human genomics, as a single reference genome may not be adequate for all demographics. As only a small number of individuals are used to create GRCh38, some pan-genome contigs have been lost. The African pan-genome containing the new contigs identified by the team at John Hopkins University represents a reference genome that contains 10 percent more genetic information than the current-generation human reference genome.

France’s personalized medicine project to begin sequencing genomes. France’s national personalized medicine initiative has started sequencing patient samples with two pilot genomic platforms. The project is called the Plan France Médecine Génomique 2025, and each platform is expected to generate roughly 18,000 genomes from patient samples by 2021.

USFDA recognizes ClinGen database as public genetic variants repository. The USFDA announced in December that it is recognizing the clinical genome resource consortium’s ClinGen database as the first FDA-designated public genetic variants repository. The recognition of the database, which contains information about genes, genetic variants, and their relationship to disease, aims to encourage the development of novel diagnostic technologies that scan a person’s DNA to diagnose genetic diseases and guide medical treatments. The approval is the first of its kind issued through the agency’s Human Variant Database Program, which is intended to help reduce regulatory burdens on companies developing NGS-based genetic tests and foster the advancement of precision medicine.

Outlook

With the rapid pace of change brought on by sequencing technologies in 2018, one can expect to see the momentum continue in 2019 in research, testing, and clinical practices for a myriad of applications and benefits.

Praveen Gupta

Managing Director

Premas LifeSciences

“The NGS market has been flat in 2018-19 in terms of growth. There was a major slowdown in research funding, partially due to it being an election year. 2019-20 looks very promising and I expect a 30-percent YoY growth. The main key driver is a major spurt in human whole-genome sequencing projects, involving Indian population (IndiGen and Genome India); major cattle genomics projects are underway and there has been a huge increase in clinical markets adoption of NGS for whole-genome sequencing, oncology, HLA, and NIPT.”