Industry

Old technology, new market

Players are enhancing and adding newer features to differentiate their product offerings in the fiercely competitive MS market. These not only improve the performance of routine tasks but also make it simpler to carry out challenging tasks as analysis of biomarkers and biologic drugs.

Analytical chemistry’s workhorse is mass spectrometry. Mass spectrometers are a crucial component of the market for analytical instrumentation because they analyze the sample. However, a recent change in the laboratory environment is requiring a change in the shape and capabilities of mass spectrometry equipment. Shorter testing times, faster throughput, and smaller footprint requirements for laboratories are driving the market to create more compact, higher-performing systems.

Indian market dynamics

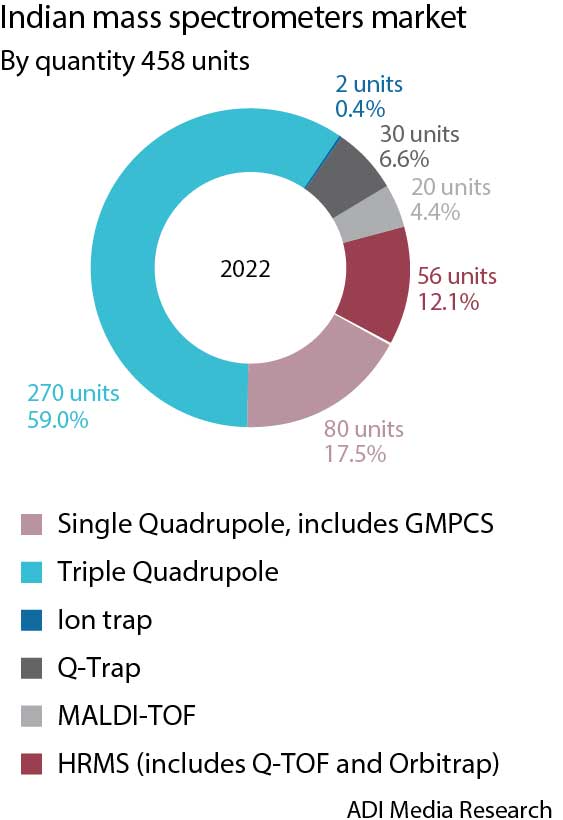

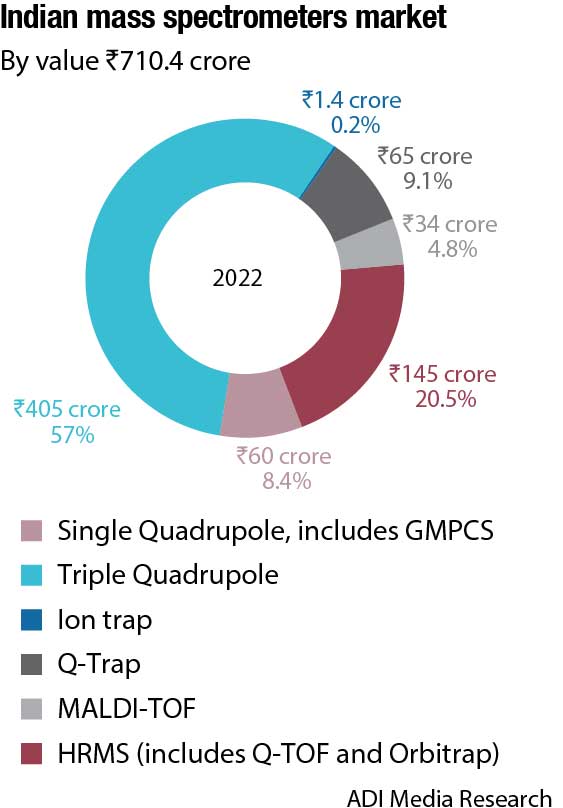

The Indian mass spectrometers market gained huge traction in 2022. Estimated at ₹710.4 crore, it saw an 84.5 percent increase over 2021 by value. By quantity the market increased from 268 units in 2021 to 458 units in 2022, a 71 percent increase.

Major players. SCIEX, Waters and Agilent dominate the market. New products are being launched by them regularly, and they are upbeat on their grip on the market.

| Leading players* | |

| 2022 | |

| Segment | Major Players |

| Single Quadrupole | Waters, Shimadzu, Agilent, and Thermo Fisher Scientific |

| Triple Quadrupole | SCIEX, Waters, Shimadzu, Agilent, and Thermo Fisher Scientific |

| ion trap | Thermo Fisher Scientific |

| Q trap | SCIEX |

| MALDI-TOF & MALDI TOF-TOF | Biomerieux, Shimadzu, and Bruker |

| HRMS (includes Q TOF and Orbitrap) | SCIEX, Waters, Agilent, Thermo Fisher Scientific, and Bruker |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian mass spectrometers market. | |

| ADI Media Research | |

Other players in this segment include Thermo Fisher Scientific, Shimadzu and Bruker. The world’s smallest MALDI-TOF imaging solution from Shimadzu features a dual-polarity ion source. Suitable for users starting out in the world of biomolecular imaging, the compact format of the Shimadzu benchtop MALDI-TOF system provides a welcoming platform by combining the ease of MALDI analysis with extremely intuitive software in an all-inclusive imaging kit. The system can serve as an ideal teaching tool to introduce users to MALDI imaging. In addition, it offers a low-cost entry point to users who would like to see what MALDI imaging can offer for their workflow.

bioMérieux is leading the MALDI TOF segment, with VITEK MS being its fast-moving model. An automated mass spectrometry microbial identification system it contains a comprehensive FDA 510(k) cleared database for bacteria and fungi, including mycobacteria, Nocardia, and molds—now including Brucella, Candida auris, and Elizabethkingia anophelis.

The HRMS segment estimated at ₹145 crore, with 56 units in 2022, saw a major increase over 2021. Thermo Fisher Scientific leads the pack. The vendor has had success with its newest Orbitrap Ascend Tribrid, a high-end instrument aimed at proteomic and biopharma applications. The addition of a second collision cell is the most significant advance in the new system, as this feature improves the speed of the instrument and allows researchers to analyze more of the ions introduced into the machine. The instrument can accumulate ions (in a collision cell) while doing an analysis in the Orbitrap or the ion trap, as it gives an enhancement in sensitivity, key for low-level proteins.

Complex technology, high entry cost and shortage of trained manpower are potent combinations to restrict entry of new players. August 2022 saw the exit of PerkinElmer through a sale to private equity firm New Mountain Capital, divest its food safety, environmental testing and industrial quality assurance divisions, including its chromatography and mass spectrometry hardware made for use in forensics, semiconductor manufacturing, chemical production and more.

The government is active in this segment. The state government agencies and Public Sector Undertakings have invited bids for 7 single quadrupole mass spectrometers so far in 2023. These include 3 units by Telengana, 2 units by Kerala, 1 unit each from Maharashtra and Gujarat state government. Other bids have been invited by CSIR, NDDB, DST and MoFAHD.

Increasing government spending, cost benefits in terms of affordable manpower, real estate expenses compared to other global markets and growing startups are providing impetus to the industry.

Drugs of abuse analysis at the fingertips

Bhaumik Trivedi

Assistant Manager, Clinical & Diagnostic Business Development,

Shimadzu Analytical (India) Pvt Ltd

Drugs of abuse is use of illegal drugs or the use of prescription or over-the-counter drugs for purposes other than those for which they are meant to be used, or in excessive amounts. Drug abuse may lead to social, physical, emotional, and job-related problems. “Drug abuse is an exclusively urban phenomenon is a myth,” said Gary Lewis, the South Asia regional representative of the UN Office on Drugs and Crime. Abuse of such drugs can lead to physical and mental damage as well as leads to dependence and addiction.

To understand the prevalence of drug abuse in India, a study was conducted by the Ministry of Social Justice and Empowerment (MoSJE). As per the 2019 report, 14.6 percent of the population uses alcohol. It is higher among men than women. It was found that 2.8 percent of the population uses Cannabis. For overcoming the burden Ministry of Social Justice & Empowerment which is the Nodal Ministry for Drug Demand Reduction has formulated and launched Nasha Mukt Bharat Abhiyaan (NMBA) on August 15, 2020.

Liquid Chromatography Mass Spectrometry [LC-MS/MS] is the go-to technology. Testing for drugs of abuse can be used to

- Discover drug abuse;

- Monitor someone who has a substance abuse problem;

- Detect drug intoxication; and

- Determine the overdosed drug.

Moreover, these tests will have the potential to improve the quality of clinical management in emergencies and can be used as evidence in court of law.

Conventional immunoassays can be sometime regarded as speculative owing to following limitations:

- The results are frequently class-specific and cannot be linked to a single medication or drug metabolite, and

- Cross-react with structurally related and unrelated substances, resulting in false-positive results.

This is where LC-MS/MS will have an EDGE.

With numerous advantages like ultra-high sensitivity, capability to handle heavy workload due to automation, artificial intelligence, ease of operation and software capabilities, LC-MS/MS will always have an upper hand as a reliable analytical tool in drugs of abuse testing.

Gaining popularity of California Certified Organic Farmers (CCOF) has also given a push to this segment. CCOF certification under the Global Market Access (GMA) program allows for export to Europe without requiring import licenses. This eliminates the need for additional certifications, paperwork, and expenses and exporting companies to EU collectively concentrate on core organic certification issues and shift away from minor differences in international standards.

There is rising demand for mass spectrometry from the food and beverage testing industry. The scheme of setting up and upgradation of food testing laboratories by Ministry of Food Processing Industries (MOFPI) introduced on June 8, 2022 is another driver. The food facilities so created under the Scheme are made available to the food processing units for testing their products.

The Indian market is expected to witness the highest growth in the contract development and manufacturing organization (CDMO) space due to the low cost of the R&D and manufacturing side, not to mention the highly skilled workforce. The biggest advantage in outsourcing to India is the cost benefit compared to the United States and Europe; it is estimated that the cost of outsourcing to India is 37.5 percent lower than this competition.

Another major advantage in outsourcing to India is the world class manufacturing facilities available. Additionally, Indian CDMO’s have an outstanding track record. In the pharmaceutical industry, India is the largest exporter of OTC’s to the United States with over 40% of the market share, meaning that we will not be missing out on the quality of the drug due to years of experience. There have been many companies that have enjoyed recent success; Biocon, Sai Life Sciences, GVK Bio, and Piramal (to name a few) have a fantastic track record in terms of commercial delivery.

Finally, in profitability, the Indian CDMO’s outperformed their counterparts having far higher EBITDA margins from 25-35 percent compared to 10-20 percent margins of their European and US competition.

The growing applications of the technology and the stringent regulatory guidelines for drug development and safety in biopharma is pushing sales. MS is used for analysis throughout the process of biopharmaceutical development, from initial target identification and proteomics to toxicology and industrial quality control.

Drug discovery involves three key elements: determining the mechanism of disease, identifying molecular targets for treatment and developing bioactive compounds to act on these targets.1 As proteins are the most common drug targets and are also increasingly used as biotherapeutics, MS-based techniques in proteomics and chemoproteomics are essential for drug discovery and development. Proteome profiling, combined with affinity probes and other chemoproteomics techniques, is used in target deconvolution to identify both drug targets and the molecules that affect their activity. Thermal profiling combined with high-resolution MS is used to determine drug mechanisms of action (MoA) and the stability of their protein targets. MS can be used in the identification of active compounds from traditional herbal remedies, to develop regulated biotherapies. It is particularly useful when detecting compounds in solution with other nearly identical molecules. High-resolution MS techniques can distinguish masses down to several decimal points, which allows better identification of the components of the solution. This trend is expected to continue.

The increasing investments by market players in research and development activities and the expansion of their distribution networks in the region are also creating continued demand. Add to this, global investor interest in India.

However, the industry faces a major challenge from the dearth of skilled professionals. The players are offering training sessions and workshops to enable users to understand the intricacies of the instruments and their applications. MS is a complex and precise analytical technique and requires highly trained and experienced personnel.

Global market dynamics

The global mass spectrometry market in terms of revenue is estimated to be worth USD 4.5 billion in 2022, poised to reach USD 7 billion by 2028, growing at a CAGR of 7.5 percent from 2023 to 2028. Increased spending on pharmaceutical R&D, government regulations on drug safety, a growing focus on the quality of food products, an increase in crude and shale gas production, and enhanced government initiatives for pollution control and environmental testing are high-growth prospects for the mass spectrometry market.

Product insights. The instruments segment held the largest revenue share of 77.39 percent in 2022. Spectrometers offer a wide range of applications in the biotechnology sector and are witnessing rising awareness about the benefits of mass spectrometry workflows. These instruments can be used in clinical and preclinical testing for drug discovery as well as for biomedical research in the pharmaceutical industries. Consequently, the demand for mass spectrometry devices for high-throughput screening is also growing.

The consumables and services segment are projected to record a rapid CAGR of 8.93 percent over the next 5 years, with increasing demand from various academic institutions and research centers. The institutions offer researchers access to mass spectrometry systems in their labs at a nominal cost and, in turn, drive the demand for consumables. In addition, revenue from services, such as maintenance and analytical testing, is expected to grow with the increasing adoption of the technique for various academic and pharmaceutical research and development activities.

Technology insights. Quadrupole liquid chromatography-mass spectrometry led with the largest share of 37.09 percent in 2022. Demand for this technology has grown significantly in the past few years due to the advantages offered by the technique. For instance, the triple-quadrupole technology is one of the essential analytical techniques for clinical research analysis, and can measure trace levels of biomarkers in complex matrices of biological fluids. Several key players have established offerings in this domain.

The Fourier transform-mass spectrometry (FT-MS) is the fastest-growing segment, and is expected to grow at a CAGR of 8.78 percent. This can be attributed to the high resolving power, minimal error rate, high accuracy, and ease of operations offered by the technique. The technology also has applications in forensic laboratories for the identification of drugs and contraband substances, such as cocaine. Such a broad range of applications opens up new avenues for the growth of the segment.

Buyer insights. Over the past few decades, mass spectrometry has been a leading technology in pharmaceutical analysis, which incorporates both qualitative and quantitative components. Also, the area of usage of MS is increasing at an unprecedented rate, as new applications are getting developed almost on daily basis. Coupled with it, instrumentation development is advancing to keep up with the continuously rising demand for sensitivity and throughput, sometimes influenced by the tightening of regulatory requirements.

A wide variety of biological and chemical entities are characterized and analyzed by using MS, which is one of the key analytical techniques utilized in drug discovery and development. Absorption, distribution, metabolism, and elimination (ADME) assays with high throughput have been incorporated into drug discovery programs in large numbers due to the improved sensitivity, selectivity, and ease of automation that are available with liquid chromatography combined with MS (LC-MS and LC-MS/MS).

Tandem mass spectroscopy has made room for newer, more expansive applications. The higher mass resolution and sensitivity in quantitative assays, a variety of ionization techniques, the ability to monitor single ions or multiple reactions, and the availability of several sample-processing/clean-up techniques have all increased the implications of MS in the pharmaceuticals industry.

The drug discovery and development category held the largest mass spectroscopy market share of over 42 percent in 2022. MS serves as a major application in drug discovery and development. It helps in determining the structure of drugs and metabolites. In addition, it is involved in a quantitative and comprehensive analysis of a wide array of metabolites in biological samples.

The usage of various ionization techniques, such as electrospray and matrix-assisted laser desorption techniques, allows the analysis of a wide range of biomolecules including peptides, lipids, and sugars. Furthermore, it helps in the confirmation of combinatorial chemistry synthesis, ADME assays, and traditional small-molecule quality assurance/quality control (QA/QC).

Opportunities. The growth of the MS market is driven by the increasing use of technology in developing countries. The increasing focus of manufacturers for the development of new products and technologies is expected to provide immense opportunities. India and China are expected to provide abundant growth opportunities. Increasing investments in research and development activities and the expansion of distribution networks are the key drivers.

Challenges. Premium product pricing is one of the major factors constraining growth. High-end MS systems are typically priced at a premium, and these prices can be prohibitive. The cost of consumables, such as sample preparation kits, is also quite high. Cost of hiring and maintaining skilled personnel is also a major challenge.

Geographical insights. North America accounted for the largest market share of 41.94 percent in 2022 due to the high extent of research and development activities, and the presence of an established research and healthcare infrastructure. The mass spectrometry market in North America is driven primarily by factors, such as the growing funding for research and government initiatives in the US, widespread usage of mass spectrometry in the metabolomics and petroleum sector, and CFI funding toward mass spectrometry projects in Canada. In addition, the FDA is encouraging the use of analytical techniques to ensure that the pharmaceutical products released in the market adhere to quality requirements.

The Asia-Pacific region is expected to grow at the fastest CAGR of 8.97 percent. The rising attention drawn by proteomics and genomics research, as well as the increase in initiatives, undertaken by academic institutions for the development of protein-based therapeutics, have presented significant growth opportunities.

In the Chinese clinical industry, diagnostics and research using MS are developing rapidly. Doctors and patients are gradually becoming more familiar with biomarkers that were previously only detectable, using mass spectroscopy platforms. Additionally, LCMS systems are now used for biomarker assessments that were previously incompatible with clinical requirements and were made using different technologies.

Major players. The major players in the global mass spectrometry market are Thermo Fisher Scientific, SCIEX, Agilent Technologies, Waters Corporation, PerkinElmer, Shimadzu Corporation, Bruker, Analytik Jena, JEOL, Rigaku, DANI Instruments, LECO, and Hiden Analytical. These companies are considered emerging key players in recent years due to various strategic investments, agreements, and product launches in the mass spectrometry market space.

Industry updates

In October 2022, Shimadzu Corporation acquired Tescan, a manufacturer of mass spectrometers. The acquisition will help Shimadzu to expand its product portfolio in the field of mass spectrometry.

In August 2022, Agilent Technologies acquired Mosse Automation, a company that specializes in automation and data acquisition solutions for mass spectrometry. The acquisition will help Agilent expand its product and services portfolio in the mass spectrometry market.

In July 2022, Waters Corporation acquired TA Instruments, a manufacturer of mass spectrometers and chromatography systems. The acquisition will help Waters to expand its product portfolio in the mass spectrometry market.

In May 2022, Thermo Fisher Scientific acquired Advanced Scientifics, Inc., a manufacturer of sample-introduction systems for mass spectrometers. The acquisition will help the company to expand its product and services portfolio in the field of mass spectrometry.

In January 2022, Bruker Corporation acquired Hiden Analytical Limited, a leading manufacturer of mass spectrometers. The acquisition will expand Bruker’s range of products and services portfolio in the mass spectrometry market.

Recent advances make headway

As technology has been advancing exponentially over the years, more efficient diagnostic tools have been developed for cancer detection, and MS tops the list. It has not only advanced in methods but also in the way that samples are being prepped, thus creating new avenues in cancer diagnosis.

New development in ionization methods has unlocked new ways to process data without having the sample degraded too much during ionization. ESI (electron-spray ionization) and MALDI (matrix-assisted laser desorption/ionization) are recent advanced ionization methods that are considered soft ionization methods and have led to new ways of processing samples. Additionally, imaging MALDI has been able to detect masses on the sample that is on the matrix. Seeing this data in a spatial-based result can help researchers determine where the novel biomarkers are with respect to those already investigated. Some of the advances in mass spectrometry scanning modes include data-dependent acquisition, BoxCar data acquisition method, and data-independent acquisition. The downside of using these modes is lower inter-sample reproducibility, which hampers the capability of finding novel biomarkers across various samples.

Recent technological developments in MS and automation have revolutionized its application for use in high-throughput screens. High-throughput screening drug discovery, during which thousands or millions of compounds are screened, remains the key methodology for identifying active chemical matter in early drug discovery pipelines. These methods allow the targeting of unlabeled biomolecules in high-throughput assays, thereby expanding the breadth of targets, for which high-throughput assays can be developed compared to traditional approaches. Moreover, these label-free MS assays are often cheaper, faster, and more physiologically relevant than competing assay technologies.

Transferring MS from laboratories to clinics

For the first time, complex mixtures, such as whole blood, urine, and tissue samples, can be analyzed on-site directly without the need of sample preparation and chromatographic separation. Ambient ionization MS is, therefore, widely employed for analysis of therapeutic drugs, metabolites, and other bioactive species in biofluids. This technology presents a huge implication on transferring MS technology to non-expert users, such as nurses and physicians for clinical and POC disease diagnosis.

Ambient MS produces minimal damages to the sample, which also shows exceptional potential for tissue analysis. For instance, DESI is one of the ambient ionization methods mostly employed for this purpose. Recently, a direct sampling probe, named MassSpec Pen, was developed to further enable on-site tissue profiling. A rapid evaporative ionization MS (REIMS) method, also known as the intelligent knife (iKnife), was also developed for the chemical analysis of electrosurgery-generated aerosols. A hand-held mass spectrometry desorption probe, using picosecond infrared laser (PIRL), was developed to couple with an optical surgical tracking system. This direct sampling MS system, enabled in situ tissue pathology and the histopathological analysis of neuronal tissues in a mouse model, showed comparable results between PIRL and the surgical scalpel method. Rapid classification of medulloblastoma subgroups, based on small molecule signatures, has been achieved subjected to 10- to 15-s principal component analysis of PIRL-MS data.

Outlook

Mass spectrometry is a powerful tool in analytical chemistry, and is experiencing a translation from analytical chemistry to clinical applications. Ambient ionizations allow biological samples to be sampled directly in their native environment without pretreatment. Meanwhile, the soft nature of ambient ionization guarantees minimal destruction to the biological samples and invasions to the patients. This is a prerequisite that mass spectrometry technique could be transferred to non-expert users and used in clinical settings, such as nurses and physicians in clinical office and operation room. Another difficulty for the technical translation is the size and mobility of the mass spectrometry systems, which prevent the application of mass spectrometry in on-site scenarios, such as ambulances and outdoors for point-of-care diagnosis. Miniature mass spectrometry systems with an adequate performance can well fill the gap. Instead of pursuing ultimate high performance as large-scale instruments, the system design for miniature MS systems is intended to achieve a balance among the size reduction, ease of use, and required performance of specific applications. With highly specific molecular information in hand, miniature mass spectrometry systems incorporated with direct sampling methods are expected to provide point-of-care service and personalized treatment for patients in future.