MedTech

Patient monitoring, as critical as ever

Patient care is rapidly being transformed and new types of products, services, and applications are emerging. In this environment, patient monitoring continues to play a central role in helping to enable the actual transformation.

Patient monitoring systems have always occupied a very significant position in the arena of medical devices. Advanced technologies in patient monitoring are emerging in response to the increased healthcare needs of an aging population, new wireless technologies, better video and monitoring technologies, decreasing healthcare resources, an emphasis on reducing hospital days, and proven cost-effectiveness. New wireless and Bluetooth technologies, improved infrastructure, and patient familiarity with wireless devices are all combining to advance sales and use of new technologies in patient monitoring systems.

Patient monitoring systems have always occupied a very significant position in the arena of medical devices. Advanced technologies in patient monitoring are emerging in response to the increased healthcare needs of an aging population, new wireless technologies, better video and monitoring technologies, decreasing healthcare resources, an emphasis on reducing hospital days, and proven cost-effectiveness. New wireless and Bluetooth technologies, improved infrastructure, and patient familiarity with wireless devices are all combining to advance sales and use of new technologies in patient monitoring systems.

There are a large number of companies offering wireless and remote technologies, patient data processing applications and equipment, or EMR data transfer equipment. Players supplying patient monitoring systems to hospitals are large, established healthcare companies, often working in conjunction with information technology (IT) companies on an entire system. Moreover, technological giants such as Google, Apple, and Amazon are tapping into the remote patient monitoring (RPM) market; leading to drastic changes in healthcare.

Further, IoT applications in healthcare facilitate important tasks as improving patient outcomes and taking some burden off health practitioners. IoT-enabled devices have made remote monitoring in the healthcare sector possible, unleashing the potential to keep patients safe and healthy, and empowering physicians to deliver superlative care. Growth in IoT healthcare applications is indeed projected to accelerate as the Internet of Things is a key component in the digital transformation of the healthcare industry and various stakeholders are stepping up their effort in this field.

Though most of the markets are dropping down, COVID-19 outbreak has positively affected various healthcare related markets, one of them being patient monitoring systems. At present, the patient monitoring systems market is witnessing a tremendous growth as these devices are playing a crucial role to combat the pandemic and monitor patients. Patient monitors including cardiac monitors, respiratory devices, and temperature monitoring devices are facing a huge demand, owing to their immense usage in patient treatment along with IoT combined with other transformative technologies like Cloud and Artificial Intelligence (AI).

Dr Chetan C Mehta

Dr Chetan C Mehta

Consultant Critical Care, BAPS Pramukhswamy Hospital

“Real time smart and remote patient monitoring equipment are the need of time now, with changing dynamics of healthcare delivery in India. We need more and more portable, remote, wireless, and ambulatory monitoring systems so that we can expand our healthcare delivery outside the wall of traditional hospitals.”

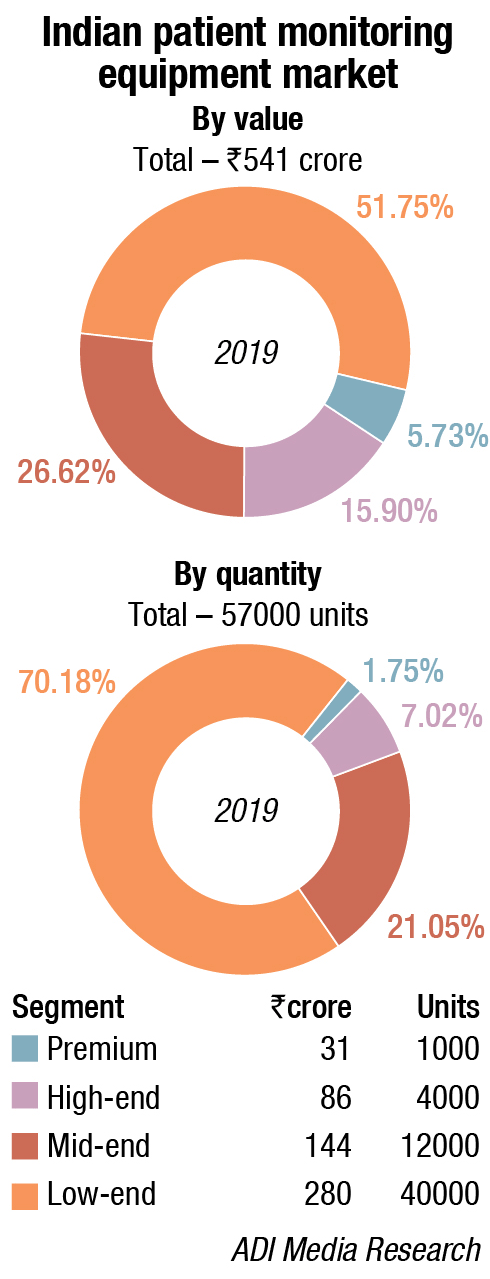

Indian market dynamics

COVID-19 provided a major impetus to the patient monitoring market, albeit in March and April the ventilators had taken precedence. As the mad rush for ventilators cooled down, tenders were invited end-May onwards for patient monitors. The private sector was absolutely quiet, since they were mostly in a lockdown mode. August onwards the private hospitals, especially ones setting up COVID wards or dedicated areas became active, and as COVID moved to smaller towns, there was demand from those areas too. While the orders from HLL and AIIMS-Delhi, Rishikesh, Bhopal amongst others had been for high-end monitors, the private sector went in for entry level models. This trend is expected to continue, at least till March 2021.Leading players as Philips trebled their production in both their plants, Germany and China. Some premium brands as GE do not have an entry level model, hence could not take advantage of this windfall. Others as Skanray, BPL, Schiller, and some Chinese brands had a field day. As expected, it was all about meeting demand, price was no longer the only criteria, even for bids invited by the government bodies.

Global market dynamics

The global patient monitoring devices market is estimated at USD 25.76 billion in 2019, and projected to reach USD 44.86 billion by 2027, at a CAGR of 4.4 percent from 2020 to 2027 by Allied Market Research. From past few years, the digital technologies powering patient monitoring devices have widely influenced the operational costs. The cardiac monitoring segment dominated the patient monitoring devices market, governing around 26.08 percent of the global market value in 2019 and its dominance in the market is expected to continue over the 7 years. It is estimated to garner USD 10.25 billion by 2027, registering a CAGR of 4.8 percent from 2020 to 2027. The wireless segment accounted for more than 36 percent patient monitoring devices market share in 2019. The global patient monitoring devices market is highly competitive, and prominent players have adopted various strategies for garnering maximum market share. These include collaboration, product launch, partnership, and acquisition.

The road ahead

Patient care will be transformed in the next 10 to 15 years and new types of products, services, and applications will emerge. In this environment, patient monitoring will play a central role in helping to enable the actual transformation. For patient monitoring companies to remain competitive in this changing landscape, they will need to adapt business models and product roadmaps.

Companies will need to adopt technologies that can deliver systems and devices that redefine usability. Care of the future will be more agile and patient monitoring systems more easily deployable, particularly if this means converting the home to a care environment. Similarly, this agility needs to be supported by access to data management platforms, which share a high level of integration. Models of workflow management and remote support that optimize the use of healthcare staff without compromising the quality of care need to be developed. Only then will they overcome the challenge of building continuity across multiple hospital sites and with out-of-hospital care.

The companies best placed to make the most of this changing environment are those with a robust digital health strategy that can navigate the transformational changes inherent in moving from offering monitoring as a product, to monitoring as part of a broader service offering. Building out the digital ecosystem to take advantage of a wider set of data streams and products requires partnerships with a range of non-traditional vendors and companies that give access to a broader set of capabilities, spanning technical, organizational, and clinical domains.

Moreover, technology will allow more efficient knowledge transfer between therapeutic team members and even access to other experts who may not be on site. It is also worth noting that the collection of large amounts of data, often longitudinal in nature, will provide an opportunity to identify trends, patterns, and correlations at both the population level and at the systems level within a patient, benefitting treatment regimens and clinical decision support.