Headlines of The Day

Standardisation key to ensure better, affordable healthcare access

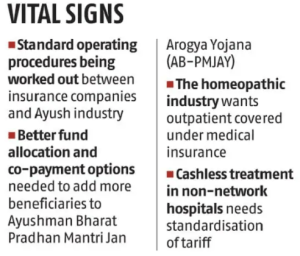

More than 3 million Accredited Social Health Activist (ASHA), anganwadi workers, and helpers will now be covered under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY). Work is underway to develop the required modalities for providing Ayush (Ayurveda, Yoga, Naturopathy, Unani, Siddha, and Homeopathy) coverage by insurance companies and the extension of cashless coverage to non-empanelled hospitals by medical insurers.

Three major moves announced in a span of the last 10 days or so can potentially shake up the hospital sector in India and alter access to health care for millions. However, industry stakeholders say that standardisation is key to ensuring these moves help the actual beneficiaries.

For starters, data from the AB-PMJAY dashboard reveals that almost one in five hospitals empanelled under the scheme is not active. Of the 28,523 hospitals under the scheme, around 6,030 are not active.

AB-PMJAY, the world’s largest publicly funded health assurance scheme, which provides health care coverage of Rs 5 lakh per family per year, has so far covered 62.2 million hospitalisations worth Rs 79,174 crore.

Hospitals, however, say that the rise in Ayushman Bharat beneficiaries can strain hospital resources.

Dr Shuchin Bajaj, founder and director of Ujala Cygnus Hospitals, said, “The rise in Ayushman Bharat beneficiaries can strain hospital resources, potentially leading to increased patient load, financial challenges due to reimbursement rates, and concerns about maintaining the quality of care.”

He added that “small hospitals may face infrastructure strain, necessitating careful monitoring, evaluation, and system strengthening to ensure effective health care delivery”.

Hospital industry sources claim that the increase in beneficiaries should be balanced by appropriate funding. As such, the rates under the scheme are low, say hospitals, who recommend a co-payment option by patients.

Meanwhile, sensing the growing demand and popularity of Ayush treatments, the insurance regulator has asked general insurers to engage with the core group of experts for the insurance sector constituted by the Ministry of Ayush and develop the required modalities for providing Ayush coverage.

The Insurance Regulatory and Development Authority of India has also asked companies to modify products that contain limitations for Ayush treatments and ensure compliance.

Rajiv Vasudevan, chief executive officer (CEO) of Apollo AyurVAID Hospitals in Bengaluru, told Business Standard that of their total patient pool (they run 200-odd beds), 85-90 per cent have some sort of coverage under central government health scheme or medical insurance.

“What happens is there are tariff differences in reimbursement with allopathic counterparts, or certain procedures are not covered. Now the regulator wants these disparities to be ironed out,” he said.

Vasudevan said that people in the age bracket of 25-45 years are warming up to the idea of ayurveda and integrated care.

“Accreditation and standardisation would help the industry. Now there are 200 national accreditation boards for hospitals-accredited ayurvedic hospices in the country,” he added.

In all, there are 700-odd ayurvedic hospitals. These could significantly reduce the burden on allopathic care if medical insurance coverage is improved and standardised.

Vasudevan feels that almost two-thirds of medical care includes pre-procedure and post-procedure care — be it cardiac, neurological, trauma, rheumatism, etc. This is where Ayush’s stream of medicines plays a role.

The managing director (MD) and CEO of one of India’s largest hospital chains said that the move can help reduce the burden on conventional (allopathic) hospitals, especially, to ensure better coverage in the hinterland.

Southern states are likely to benefit the most.

Ajith Kumar, general secretary of the Ayurvedic Medical Association of India, said that in Kerala alone there were 4,000-5,000 ayurvedic practitioners and there are around 100 government hospitals in the state.

The homeopathic industry, however, feels that unless outpatient treatment is covered by medical insurers, the move may not benefit them.

Dr A K Gupta, national secretary-general of the Homeopathic Medical Association of India, said that most homeopathic treatment is covered under daycare.

“Outpatient needs to be covered by insurers to encourage people. There are 277 homeopathy hospitals where we even do surgeries (with a combined approach with allopathic medicines like anaesthesia), and around 10 million people use homeopathy treatment in clinics and hospitals. But the majority of treatment is in outpatient,” he explained.

Taking things a step ahead, the General Insurance Council (GIC), which represents general insurance companies, recently launched an initiative providing cashless treatment available to policyholders even in non-empanelled hospitals that are registered under The Clinical Establishments (Registration and Regulation) Act, 2010.

This move, however, has been met with some scepticism.

The MD quoted above said that there are standard tariffs that are agreed upon between an insurance provider and a network hospital.

“Now, what will be the rate at which a non-network hospital will charge a patient is a matter which is not clear. If they charge at rack rates, then there will be disputes between hospitals and insurance companies and the patient would ultimately suffer,” he said, adding that clarity and standardisation are required here.

K Singh, DGM, operations, PSRI Hospital in Delhi, said: “Hospital patient volumes and revenue streams are expected to be significantly impacted by the project. It is anticipated that the number of patients choosing cashless services will rise significantly from the present 63 per cent of patients to possibly reaching 90 per cent with the implementation of ‘Cashless Everywhere’.” Business Standard