OR Equipment

Tables and Lights-The Pillars of an OR

Advances will continue as lighting choices, illumination, and surgical tables become smarter in the ORs and medical field. Each step forward will make for a safer environment for both the patient and the surgical team.

With several advancements in medical technology, medical equipment makers are also looking forward to make better operating tables and lights that will enhance medical services. Operating tables and lights are one of the necessary components of any OR or surgical suites that are available in variety of different configurations, features, and wattage amounts.

As an OR is one of the most critical areas of a hospital; it needs the latest technology for making it a safer place for any patient. Earlier in OR, medical practitioners were using simple surgical lights, surgical devices, and operating tables. But, now there has been a significant transition with the adoption of latest technology in modern hospitals. As the need for operational efficiency increases, the adoption of automated and latest technologies within the ORs has also increased. Now ORs are equipped with surgical robotics, advanced operating tables, high-resolution displays, and well-integrated infrastructure with modern hybrid.

As an OR is one of the most critical areas of a hospital; it needs the latest technology for making it a safer place for any patient. Earlier in OR, medical practitioners were using simple surgical lights, surgical devices, and operating tables. But, now there has been a significant transition with the adoption of latest technology in modern hospitals. As the need for operational efficiency increases, the adoption of automated and latest technologies within the ORs has also increased. Now ORs are equipped with surgical robotics, advanced operating tables, high-resolution displays, and well-integrated infrastructure with modern hybrid.

Today’s OR demands an enhanced focus on the needs of safety for patients and staff. With this increase in demands, most efficient, customized, and seamlessly integrated ORs are designed to tackle the need of the room that allow the medical practitioner to optimize patient care and outcomes. Presently, there are several types of surgery lights in the market, such as operating tables, portable exam lights, and ceiling-mounted OR lights.

One of the most basic changes in the OR is the redesigning. Some medical facilities are creating hybrid ORs that combine both conventional ORs with imaging equipment for making better medical treatment output. In the past decade, there has been much technological advancement for the improvement of operating tables. These technological advancements will help future surgical procedures to be faster, less stressful, and safer for both patients and medical practitioners. While operating tables with latest features are being developed, basic requirements for the present generation of surgical tables continue to increase.

The development of more advanced, powered-in operating tables, and hybrid operating equipment that can auto-adjust, helps in creating new opportunities for manufacturers of operating tables in the global market. Newer and more advanced operating tables serve to increase the efficiency of the surgical process and are being increasingly preferred by surgeons across the world.

Integration of hybrid ORs in hospitals and developing healthcare infrastructure are some of the factors likely to fuel the global surgical tables and lights market growth. Highly advanced operating tables, powered by the latest technologies, improve the working ergonomics of the surgical team and demand for this equipment is expected to increase considerably in the coming years.

Integration of hybrid ORs in hospitals and developing healthcare infrastructure are some of the factors likely to fuel the global surgical tables and lights market growth. Highly advanced operating tables, powered by the latest technologies, improve the working ergonomics of the surgical team and demand for this equipment is expected to increase considerably in the coming years.

Key players are adopting organic and inorganic growth strategies to expand their product portfolios, strengthen their geographical reach, expand customer base, and gain market share. For instance, in May 2018, Hill-Rom Services Inc., in association with IMRIS, announced the launch of its new magnetic-resonance neurosurgical imaging tabletop in the new TruSystem 7500 OR table platform. This step would enable Hill-Rom Services Inc. to meet the demand for ergonomic and MRI-suitable tables from hospitals and neurosurgeons across the globe.

Operating tables

There has been a gradual shift from manual operating tables to more sophisticated operating tables incorporating the latest technologies such as hydraulic and electro-hydraulic-powered tables with battery systems and locking drawers to allow skilled operating room staff to access the operating table drawers. The development of more advanced powered as well as hybrid operating equipment that can auto-adjust is likely to create new opportunities for manufacturers of operating tables in the global market. Newer and more advanced operating tables serve to increase the efficiency of the surgical process and are being increasingly preferred by surgeons across the world. The development of pressure-distribution mattresses will prevent unintentional injuries to patients during operations and these are also witnessing a growing demand among the global surgeon community. Highly advanced operating tables powered by the latest technologies improve the working ergonomics of the surgical team and demand for this equipment is expected to increase considerably in the coming years.

Of the three types of technologies implemented in operating tables, the non-powered/manual operating tables segment is anticipated to be in higher demand, resulting in an increased revenue share throughout 2019 to 2025. This segment is estimated to reach a market valuation in excess of USD 550 million by the end of the year 2025. The non-powered/manual operating tables segment is projected to be the most attractive in the global market, with an attractiveness index of 1.4 during 2019 to 2025.

Powered operating tables is the second-largest segment by technology in the global operating tables market, with a market valuation of over USD 470 million by the end of 2025. However, the hybrid operating tables segment is projected to be the fastest-growing segment in the global operating tables market, and is expected to exhibit the highest segmental CAGR of 4.6 percent over the next 6 years.

Powered operating tables is the second-largest segment by technology in the global operating tables market, with a market valuation of over USD 470 million by the end of 2025. However, the hybrid operating tables segment is projected to be the fastest-growing segment in the global operating tables market, and is expected to exhibit the highest segmental CAGR of 4.6 percent over the next 6 years.

The current mergers and acquisitions by key players in the market is one of the best reasons for the development of operating tables global market. The latest trends, demographics, product portfolio, geographical segmentation, and regulatory framework of the operating tables market are showing positive results in the market.

There have been continued changes from manual operating tables to more technology-equipped operating tables incorporating the latest technologies such as electro-hydraulic and hydraulic-powered tables with locking drawers and battery systems to allow skilled OR staff to access the operating table drawers. The development of more advanced technological and hybrid operating equipment can create new opportunities for manufacturers of operating tables in the global market.

The US captured the largest share of the global market, due to increasing geriatric population with rising unhealthy lifestyle among the population. Furthermore, well-developed healthcare infrastructure will increase the growth of US market in near future. The Asia-Pacific operating tables market is driven by innovations in surgical robotics (which is currently developing with CAGR 10.4 percent, from USD 3.9 billion in 2018 to USD 6.5 billion by 2023) to ensure better efficiency in medical care. There is a growing demand for high-load-bearing operating tables and specialized tables for cardiac and neurological surgery across this region. Multi-functional operating tables are capturing most of the Europe regional market. Over a decade, leading hospitals across Europe have been moving away from using different types of surgical stretchers, chairs, and tables for any surgical procedures toward using a single-table system that can be used for different surgical procedures. The MEA market has been increasing due to the increase in the adoption of technologically advanced operating tables. There is the huge development on deploying automatic, remote-controlled operating tables to provide superior surgical services to patients across healthcare institutions in the region. The addition of robotic arms, C-arm imager, and radio translucent operating tables is the latest innovation in the MEA operating tables market.

Key players are focusing on cost reduction, flexibility, and scalability for capitalizing on the increasing demand for operating tables. Several technological innovations are supposed to do the growth pattern of the application release automation market in the near future. The development of more advanced technology is due to hybrid operating equipment that can auto-adjust, likely to create new opportunities for operating tables’ manufacturers in the global market.

Key players are focusing on cost reduction, flexibility, and scalability for capitalizing on the increasing demand for operating tables. Several technological innovations are supposed to do the growth pattern of the application release automation market in the near future. The development of more advanced technology is due to hybrid operating equipment that can auto-adjust, likely to create new opportunities for operating tables’ manufacturers in the global market.

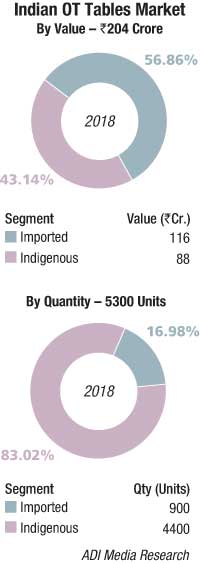

Indian market dynamics

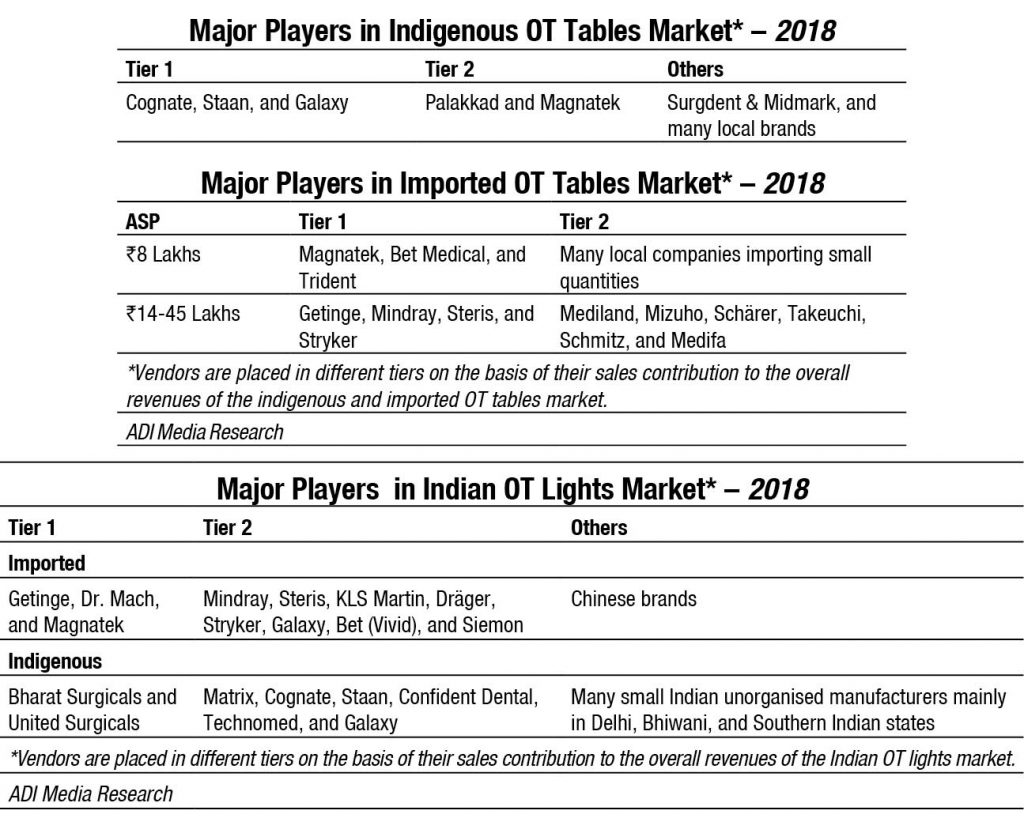

In 2018, the Indian OT tables market is estimated at Rs 204 crore with sales at 5330 units. The indigenous segment with 4400 units continues to dominate with 83 percent of the total market, and in value terms is estimated at Rs 88 crore, share being 43 percent of the market. The Indian segment is dominated by Cognate, Staan, and Galaxy; closely followed by Magnatek Enterprises and Palakkad Surgical. Other aggressive players include Surgdent, Midmark, and many local players. The indigenous manufacturers have improved the quality and features of the surgery tables. Features as patient-centered transfer system, extreme-positioning possibilities, lifting range from 535 to 1235 mm, patient weight capability up to 250kg and carbon fiber tabletops are not uncommon.

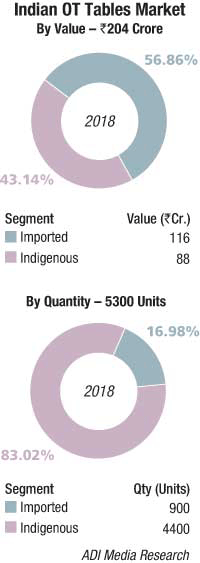

The market for imported OT tables in 2018 is estimated at 900 tables, valued at Rs 116 crore. This market for further analysis may be segmented by its average unit selling price. The high-end tables, in the unit price range between Rs 14 lakhs to Rs 45 lakhs is catered to by Getinge, Mindray, Stryker, and Steris. Other brands with some presence include Mediland, Mizuho, Schärer, Takeuchi, Schmitz, and Medifa. The OT tables, at a unit price in the vicinity of Rs 8 lakh are catered to by Magnatek and Bet Medical. These are Chinese models at competitive prices. Many small players continue to import in small quantities and supply the product.

2019 seems to be a more promising year than 2018. HLL had invited bids but not awarded orders in 2018, these are expected to be closed in H2 2019, approximating to 182 OT tables and 216 OT lights. There was specific requirement expressed by the states of Rajasthan, Chattisgarh, MP, Orissa, and Telengana too. Now that the election process is over, other states are also expected to award orders.

In the integrated ORs, intelligent sensor technology is gaining popularity and tables and lights are controlled by a single panel, enabling the team to concentrate on the patient rather than the surgical equipment. While the Indian market is moving toward the value segment, discerning customers including AIIMS, Delhi; PGI Chandigarh; Apollo Group; and Aster demand to cater for features required for IoT and robotics surgery. Increasingly some vendors are catering for modular OTs.

To encourage the Make in India initiative, a tender condition has been introduced recently. The bids being invited by HLL and state governments, in case where the lowest bidder (L1) is an overseas vendor, are awarding 25 percent of the order to an Indian supplier, the second lowest bidder (L2), provided his quoted price is not more than 10 percent of L1, at L2 price. This seems to be setting a precedent for other non life saving equipment.

Technology trends

Development of operating techniques has made procedures more specific and extensive, with far greater requirements for adjusting the operating table and the patient’s positioning. The tables have evolved to become more flexible and can now be outfitted for a greater variety of procedures.

Advanced orthopedic operating tables. The evolution of orthopedic procedures from invasive to non-invasive needs patients to be positioned differently, and these specialized surgical tables allow handling a variety of procedures/positions. The new tables help to reduce the need for additional patient transfers to imaging rooms, and thus enhance patient safety and minimize the time taken to perform surgeries.

Multi-functional and multi-disciplinary operating tables. The new surgical tables are specifically engineered for the MRI environment and are segmented for optimal patient positioning. Furthermore, the multi-functional design offers the flexibility of interchangeable tops and, therefore, multi-disciplinary use. The new multi-disciplinary tables make it possible to perform 90 percent or more of the OR’s surgical procedures on a single accessory-enriched mobile platform, which reduces the need to invest in capital-intensive and underutilized specialty tables.

Mobile hybrid operating tables. The mobile hybrid table combines the benefits of interventional and surgical tables. Not only does it provide radiolucency, mobility, and integration of imaging devices as found in conventional interventional tables, but also makes the proper accessories easily available, in that it includes rails for mounting surgical equipment clamps or retractors as found in a conventional surgical table. The hybrid table consists of two modules: a floating table top that offers 360-degree radiolucency over long distances, and a mobile module comprising the base part and a mobile bracket.

OR lights

Today’s surgical light must be flexible when it comes to movement and positioning, as well as intensity control, so that one surgical light is adaptable to different procedures. OR lights are important in a hospital as they must meet the demands of different medical personnel who may have varying medical lighting requirements. The use of an LED surgical light for medical lighting is not just about energy saving and reductions; it contributes to a lower, stable room temperature that helps maintain nomothermia in patients, which ultimately limits surgical-site infection risks, aids in and improves wound healing, and promotes patient satisfaction and timely discharges with the added benefit of improving staff comfort.

Medical lighting systems generally include single and/or dual light heads that are attached to a boom arm or track suspension that is equipped with sufficient light reflection, spectral characteristics, focus, pattern and intensity adjustments to help greatly reduce the creation of shadows by OR lights. Medical lighting helps to illuminate the subject’s true color more accurately than that of bulb lights and has the added benefit of multiple arrangements of small light sources, fixed at different angles to aid in shadow reduction for a more consistent surgical light, even when surgical personnel lean into the area of illumination created by the OR lights.

Advances in medical lighting technology such as LEDs offer many advantages for use as OR lights over traditional tungsten halogen and gas discharge fixtures, which include reduced electricity use, longer life, reduced heat generation, and lower ultra-violet radiation, which helps to reduce the potential of creating dry, exposed tissue.

To cater to the growing demand for energy-efficient lighting, several companies are offering products that are designed especially for low heat and high-efficiency operation. The increasing demand for energy-efficient lights will be a major factor driving the global surgical lights market growth in coming years.

The global OR lights market is expected to reach the valuation of USD 595.00 million by the year 2023, predicts Market Watch. LED lights held for the highest market share in 2018. By type of light, vein light is anticipated to grow at the fastest CAGR.

The market of surgical lights in America includes a special focus on LED in ORs and ambulatory surgical centers. The regional market is primarily getting driven by North America, where market giants like the US and Canada are increasing due to their superior infrastructure as that has easy incorporation of new technology. South America could also create substantial demand for the market owing to the betterment in healthcare structure.

Europe’s market growth mostly depends on the number of suppliers in the region. The market is implementing advanced technology inside the OR. Germany, France, and UK are contributing the most due to their superior technological backup.

The Asia-Pacific market is benefiting from the synergistic efforts shown by private and government organizations. The growing use of LED lights for a better infrastructural setup will provide the much-needed support to the OR lights market. India, Japan, and China are the largest contributors of the market. This regional growth is getting more thrust due to the increasing demand for cost-effective surgical lighting solutions.

In the Middle East & Africa, the market would get substantial traction from countries, such as Saudi Arabia, Oman, Qatar, and Dubai. These regions are investing more to take the market forward.

Indian market dynamics

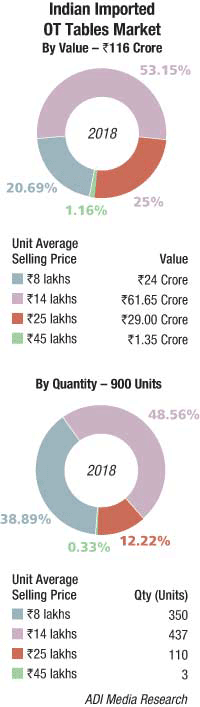

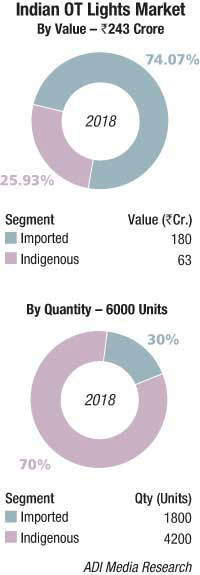

In 2018, the Indian OT lights market is estimated at Rs 243 crore, with 6000 units; with imported lights at 1800 units and indigenous brands at 4200 units. Value-wise the imported segment is estimated at Rs 180 crore and Indian at Rs 63 crore. The imported lights have a 30 percent share when compared to the imported OT table segment at 16 percent, in volume terms. This may be explained by the smaller price differential between imported and indigenous lights as compared to that of the OT tables.

The imported segment of OT lights is dominated by players as Dr. Mach, Maquet, and Magnatek. Other players also aggressive in this segment are Mindray, Mindray, Steris, KLS Martin, Dräger, Stryker, Galaxy, Bet (Vivid), and Siemon. Companies are looking at importing the lights in an CKD condition, which attract duty of 2.5 percent as against 15 percent, and assembling the parts in India. The Chinese companies continue to have presence in this segment although increasingly the Indian players are seen to have an edge as their quality is perceived to be better than their Chinese counterparts. This may be attributed to the increasingly stringent conditions imposed by BIS in the last couple of years and insistence that manufacturers adhere to them in the bids invited by the tendering authorities.

The indigenous OT lights segment is dominated by Bharat Surgicals and United Surgicals. Aggressive presence is seen of Cognate, Matrix, Staan, Confident Dental, Technomed, and Galaxy. The unorganized segment and regional manufacturers located primarily in Delhi, Bhiwani, and southern states of India continue to cater to this market.

It is expected that with LED lights, with a longer life span, having replaced the halogens almost completely, the Indian market for OT tables and lights will become equal in numbers.

Technology trends

ORs require specific pieces of equipment. Many of these are high-tech and used for advanced surgeries and would be inadequate without integrated lighting. Good and high-quality lighting is critical to the safety and efficiency of the OR procedure, specifically in lateral, minimally invasive, and deep-cavity cases.

The luminance management device system. The luminance management device (LMD) maintains optimum visual acuity and avoids difficulties adapting to excessive variations in luminosity, thus regulating the illumination reaching the surgeons’ eyes. LMD offers total freedom of movement without any drop in illumination. The homogeneous light volume provides a column of light even in the deepest surgical cavities without needing adjustment.

Cordless surgical lighting. It offers untethered illumination via a cordless battery pack. This freedom from traditional corded lighting enables illumination in places where traditional light sources are not capable of going. Paired with a suction, retractor, and innovative zip strap-mounting options, the light offers versatile targeted illumination.

Surgical light with flexible shaft. The system overcomes the limitations of traditional overhead surgical lighting by allowing the LED light source to be precisely directed via a long, flexible shaft. The result is the safe illumination of a precise surgical area from virtually any angle without the need for the surgeon to wear a head light.

User-controlled lighting. Flexible lighting ensures a surgical suite can meet all its needs. As with most state-of-the-art surgical suites, data collection includes voice recordings, radiology scans, patient data, and images from endoscopic and overhead cameras, and from cameras mounted on booms. The lighting for data collection as well as display (and viewing) is critical, yet complicated. In minimally invasive surgery, the lighting requirement is different because the surgeon is directing a probe inside the patient’s body while looking at a screen, which is difficult to read in bright light. Recently, this problem is eliminated with advances in user-controlled lighting systems.

Infection control. In today’s ORs, clean air enters the room through inlets in the ceiling, while dirty air is removed through outlets closer to floor level. The new surgical light has been developed for hospital ORs, which are known for their strict standards on hygiene. The system is designed in such a way that it allows air to flow through it, so that air will not circulate above the patient. It also has reduced surface area, thus collecting less dirt than many conventional solutions.

Outlook

OR is a demanding environment that requires precision, efficiency, communication, skilled surgeons and healthcare professionals, and quality lighting. Advances will continue as lighting choices, illumination, and surgical tables become smarter in the ORs and medical field. Each step forward will make for a safe environment for both the patient and the surgical team.

Digitization in healthcare

Phani Vadlamani

Phani VadlamaniNational Sales Manager for Surgical Units & Government Business (PMLS),

Mindray Medical India Pvt. Ltd.

The digitization of healthcare is a rapidly evolving movement. Given the sensitive information involved in the healthcare industry, there are a number of factors to consider when digitizing elements of medical monitoring, recording, assessment making, and sharing. Digital transformation in healthcare is the positive impact of technology. Telemedicine, AI-enabled medical devices, and EHRs are just a few concrete examples of digital transformation in healthcare.

Over the last couple of years, demand for integration of medical equipment data, video, and images has been increasing continuously. Doctors, administrators, and patients or their relatives demand reports in digital media, which can be easily accessed and also serve as a quick solution to be shared in any corner of the world in this era of internet. High-level digital integration will make patient records accessible not only in the hospital but they can also be shared even outside the hospital. It has also greatly reduced paper or filing work, and the life of storing data has also increased.

Hospitals of more than 200 beds should go for complete digitization of patient data, which will increase efficiency as well enable transfer of patient data via different online means. We need to bring multiple functionalities onto a single platform, including all data from multiple sources like patient monitors, ECG machines, defibrillator, endoscopy, pumps, biochemistry and hematology analyzers, ultrasound, imaging modalities, clinical information systems (HIS & PACS), and the like.

With the increasing number of robotic surgeries, digitization has helped to boost it with the use of live surgery concept. Surgery procedures are more transparent by sharing all recorded data as well as surgery videos to patient relatives. Day care surgeries like MIS surgeries are more than other specialized surgeries, which can be recorded and used for training, creating digital medical for patient record purpose. Merger of big hospitals with remote hospitals or day centers will increase with the help of digitization. Complex surgeries can be performed in any part of India, thereby boosting medical tourism in the country.

A number of such digital systems have begun to be put in place to revolutionize healthcare and deliver patients the best care possible. Between an aging population and generation that was born into mobility, access to medical care from anywhere in the world is essential and already available. Integrating systems that permit web access, communication, data transfer, and a report share from a mobile device keep patients happy as they can enjoy their mobile lives. It also grants physicians more flexibility than ever before, as they can check in on their smartphone, communicate with a patient, or go over a result within minutes from their mobile phone. The digital elements mentioned above are guiding healthcare’s technological revolution, and even more digital implementations are in place and unfolding.