MedTech

OR equipment gains prominence

Before COVID struck, hospitals in tier I and II cities were investing heavily to upgrade their devices as well as to increase the number of beds, and OR equipment were no exception. In recent years, growing efforts to ensure better treatment and comfort for patients has been complementing the growth of the OR equipment market.

Hospitals are increasing investments to improve services and quality of medical equipment. Corporate hospital chains are investing and OR equipment is no exception.

Operating rooms (ORs) are continuously evolving with the arrival of new product launches. And are getting smarter, more effective, and less risky for patients.

This includes OT tables and OT lights, that are no longer low on priority.

Operating tables

The operating tables industry is a bit fragmented; manufacturers are mostly in Europe, North America, Japan, and China. Among them, Europe and North America account for more than 78 percent of the total output value of the segment.

A typical lifetime of a surgical table is 10 to 15 years. This leads to a need for replacing the operating table that has surpassed its lifecycle, and these are being replaced by the advanced new modalities. This coupled with development of new healthcare facilities, is anticipated to drive demand.

Indian market dynamics

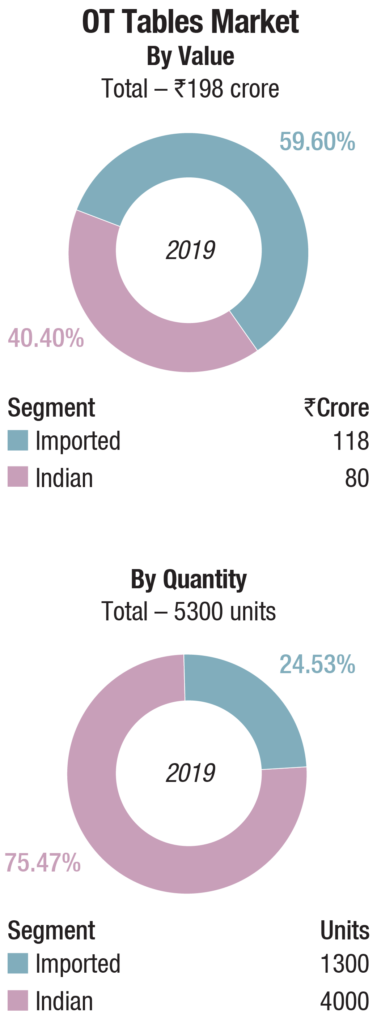

In 2019, the Indian OT tables market is estimated at Rs. 198 crore with sales at 5330 units. The market size has remained same as 2018. With the international players dropping the prices, the share of the imported segment is increasing gradually every year. The Indian segment continues to be dominated by Cognate, Staan, and Galaxy; closely followed by Magnatek Enterprises and Palakkad Surgical. Other aggressive players include Surgdent, Midmark, and many other regional players.

The imported segment continues to be segmented into three categories, based on unit price. The leading players for high-end tables include Getinge, Mindray, Stryker, and Steris, and mid-end is dominated by Magnatek. Many other small players continue to import in small quantities and supply the product.

COVID-19 has not been kind to this segment at all. The four months, March-June were particularly distressing with orders cancelled, credit periods increased, and no new orders forthcoming. Some companies as Trident shifted to supplying oxygen generators and Magnatek added other product lines as furniture for their customers in the medical institutions, and to modular OTs. Some normalcy has returned since July.

Global market

With the COVID-19 crisis refusing to relent, the global market for operating tables is estimated at USD 880.6 million in the year 2020 and projected to reach a revised size of USD 1.1 billion by 2027, growing at a CAGR of 2.8 percent over the next 7 years, predicts Reportlinker.

Major Players in Indigenous OT Tables Market* – 2019 |

||

|---|---|---|

| Tier 1 | Tier 2 | Others |

| Cognate, Staan, and Galaxy | Palakkad and Magnatek | Surgdent & Midmark, and many local brands |

Major Players in Imported OT Tables Market* – 2019 |

||

|---|---|---|

| ASP | Tier 1 | Tier 2 |

| 8 Lakhs | Magnatek | Bet Medical, Trident, and Many local companies importing small quantities |

| `14-45 Lakhs | Getinge, Mindray, Steris, and Stryker | Mediland, Mizuho, Schärer, Takeuchi, Schmitz, and Medifa |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the indigenous and imported OT tables market. | ||

| ADi Media Research | ||

General surgery including cardiovascular surgeries, gynecology surgeries, ENT surgeries are among the most common surgical procedures performed globally. This has been pivotal in the dominance of general surgery tables in the global operating tables market. The demand for advanced surgical tables is primarily being driven by the upsurge in specialty surgical procedures, including orthopedic surgeries, spine surgeries, and neurology surgeries. These surgical procedures require different surgical approaches, which require specific patient position, to enable the surgeon to perform the procedure. Introduction of advanced surgical tables, with improved ergonomics, better patient positioning, and procedure-specific design, has fuelled the demand for these tables in the global market. The growing prevalence of neurological disorders, along with the increasing incidence of trauma, sports injuries, and other orthopedic disorders, is presenting a large number of patients undergoing surgical procedures. This has led to increasing demand for procedure specific operating tables by healthcare facilities globally. The integration of operating rooms, with imaging modalities including MRI, CT scanners, and C-arms, has also led to growing demand for imaging tables with radiolucent table-top in the global surgical tables market. General segment is projected to grow at a 2.7 percent CAGR to reach USD 797.1 million by 2027. Specialty segment is expected to grow at a CAGR 2.9 percent for the next 7-year period. This segment currently accounts for a 24.9 percent share of the global operating tables market.

Non-powered surgical tables enable the healthcare providers to maneuver and position the patient according to the requirements of the procedure. However, the extent of maneuverability and flexibility offered by these non-powered surgical tables is limited, owing to limitations in design and other aspects. The constant demand for advanced operating tables by healthcare facilities globally led to the introduction of powered surgical tables including electric and battery-powered tables.

The powered tables have been instrumental in offering improved ergonomics to surgeons globally and has led to ever-increasing demand. Offering different modes including tilt, traverse, slide and other functional options for movement and positioning of the patients, is a major reason for the dominance of the segment in the global operating tables market in 2020.

The operating tables market in the US is estimated at USD 238 million in the year 2020. The country currently accounts for a 27.03 percent share in the global market. China, is anticipated to reach an estimated market size of USD 214.7 million in the year 2027 trailing a CAGR of 5.1 percent through 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 0.7 percent and 2 percent respectively over the 2020-2027 period. Within Europe, Germany is expected to grow at approximately 1.3 percent CAGR while Rest of European market will reach USD 214.7 million by the year 2027.

The global healthcare industry is booming exponentially, with increasing number of hospitals, clinics, ambulatory surgical centers and other establishments, thereby potentially raising the demand for operating tables. Medical tourism has also been increasing, especially in Brazil where health ministries, external affair, tourism and culture are working together to increase the number of medical tourists. This factor will eventually work as a facilitator for the growth of the operating tables market as these types of equipment are essential parts of healthcare infrastructure and ensure safe and efficient healthcare service.

New technology and process development have ensured advancements in the operating tables’ market landscape. With development and innovation in the medical industry, operating tables are being designed according to patients’ need and usage. As the surgical methodology is turning out to be more specialized, it has become the centerpiece of the operating room. This factor has paved the way for the exponential growth of the operating tables market. The potential offered by operating tables has now set opportunities for market players to develop and commercialize specific products. Robotic surgeries are on the rise, and the result is likely to lead to increased demand for specialty operating tables. Apart from developing specialty operating tables, the use of anti-microbial coating over mattresses is also a trend observed to carve a niche. Many manufacturers are focusing on the quality of operating tables, using an anti-bacterial and anti-rusted surface with ions of silver to ensure maximum hygiene and prevent cross-contamination over the surface. The antibacterial activity continues to work even when surfaces made of these materials are scratched. Such technological advancements are likely to remain instrumental in the growth of operating tables market.

Disease profile of the world is changing at an astonishingly fast rate. Chronic disease prevalence is increasing, owing to the changing lifestyles. Cases where people require regular diagnosis or hospitalization have also been on the rise. Obesity is one such disease that is often dealt with using surgery, which is expected to contribute to the growth of the operating tables market. Increasing obese population has intensified the need for healthcare services. According to the World Health Organization, more than 60 percent of the world’s population reside in nations where obesity and overweight cause more deaths than those who are underweight. Such conditions are likely to create lucrative opportunities for the manufacturers of operating tables. The rise in population with obesity has led to the adoption of minimally invasive techniques to carry out weight loss surgery. Surgical procedures especially laparoscopic procedures such as gastric banding and liposuction for weight loss, require advanced operating tables well suited for surgery, thereby compelling manufacturers to redefine innovation and product development strategies.

Rachit Luthra

National Franchise Manager (Comms & Medical Franchise),

Stryker India

“The demand for OT tables and lights of international standard and quality have gone up significantly in the last 5 years. We are seeing the demand from tier II and tier III cities as well. Surgeons look for a sturdy workhorse, which allows them to perform the surgery with high precision in right color temperature setting. As we learn to live in the new normal, the market is reviving and increasingly hospitals are looking at lights that can last for a long time while maintaining the same quality throughout its lifetime and without breakdowns because even a one-day downtime of OT tables and light disturbs the whole economic analysis and cost of ownership”.

Constant focus on innovation, and introduction of advanced surgical tables in the market, is a pivotal reason attributable to the dominance of these players in the global surgical tables market in 2020. HillRom Service’s acquisition of Trumpf Medical, and Getinge AB acquiring Maquet, has strengthened their positions in the operating room equipment market, along with the operating tables market. Entry of domestic players, with improved designs and advanced surgical tables at comparatively lower costs, is projected to further fragment the semi-consolidated structure of the surgical tables market. Some of the global companies include Merivaara Corp., Steris plc, Staan Bio-Med Engineering, AGA Sanitätsartikel, Mizuho OSI, Alvo, and Schaerer Medical.

Operating room lights

Surgical lights are an essential component of any operating theatre and surgical suites. They are designed to illuminate the site of surgery to provide optimal visualization of small, low-contrast objects at variable depths in incisions as well as body cavities. With an increase in the number of surgical procedures, the demand for surgical lights is increasing. Additionally, there is an increase in the number of manufacturers and distributors of surgical lights across the globe, creating enormous growth opportunities.

Major Players in Indian OT Lights Market* – 2019 |

||

|---|---|---|

| Tier 1 | Tier 2 | Others |

| Imported | ||

| Getinge, Dr. Mach, and Magnatek | Mindray, Steris, KLS Martin, Dräger, Stryker, Galaxy, Bet (Vivid), and Siemon | Chinese brands |

| Indigenous | ||

| Bharat Surgicals and United Surgicals | Matrix, Cognate, Staan, Confident Dental, Technomed, and Galaxy | Many small Indian unorganised manufacturers mainly in Delhi, Bhiwani, and Southern Indian states |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the indigenous and imported OT tables market. | ||

| ADi Media Research | ||

The light-emitting diode (LED) technology has changed the complete scenario of the lighting used in medical facilities and almost completely replaced the halogen technology in the operation theatres. Approximately 95 percent are now LED-based. This attributes to the long lifespan of 5-10 years of the LED surgical lights that can also be operated through a computerized panel that allows the integration of multiple lighting features in single lighting systems. Different color rendition can be used to view different types of cells, tissues and organs for a better understanding of the condition. Also, the technology reduces the power consumption in the medical facilities by nearly 80 percent, thus leading to an increase in market size.

Indian market dynamics

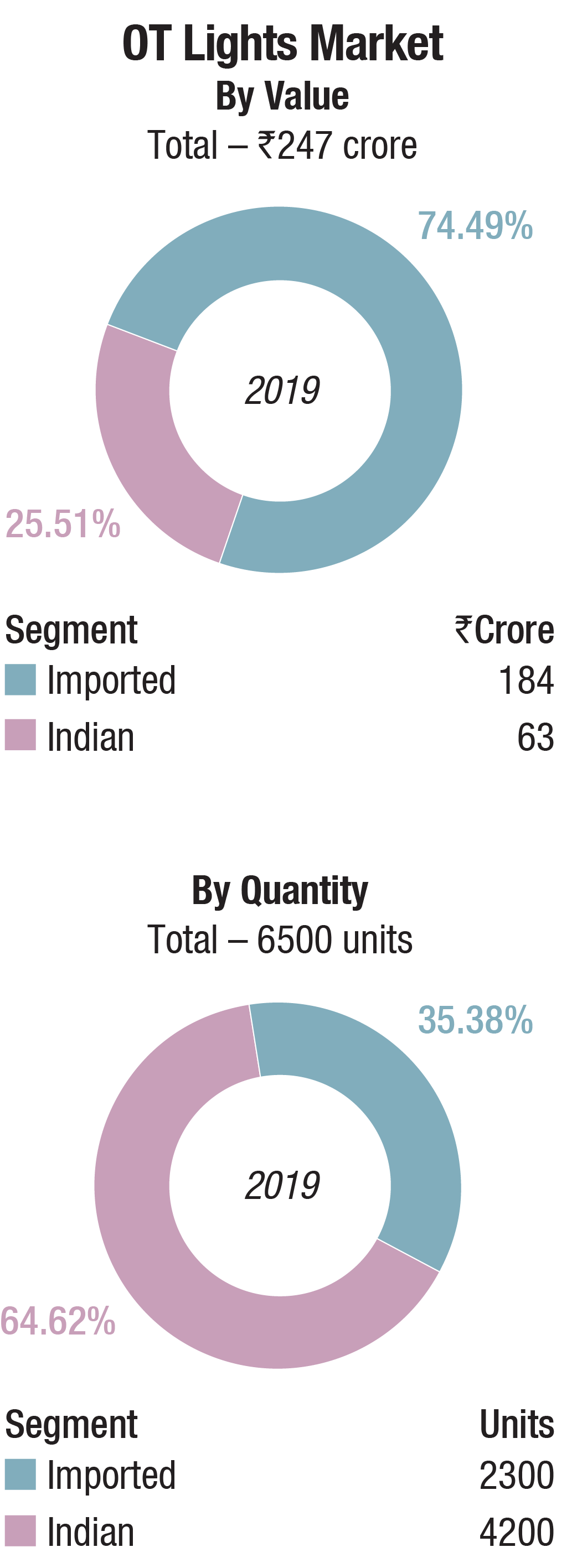

In 2019, the Indian OT lights market is estimated at Rs. 247 crore, with 6500 units, an 8 percent increase in 2019 over 2018.The imported lights are estimated at 2300 units and indigenous brands at 4200 units, The increase in the market is attributed to the imported lights, primarily as the vendors reduced their prices by as much as 20 percent and some brands shifted sourcing from the western countries to import from China. The economy was tight in 2019, and although the pandemic hit only in March 2020, payments had not been forthcoming from many customers for the supplies made in 2019.

The imported segment is estimated at `180 crore and the Indian at Rs. 63 crore. This segment continues to be dominated by Dr. Mach, Maquet, and Magnatek. Other players also aggressive in this segment are Mindray, Steris, KLS Martin, Dräger, Stryker, Galaxy, Bet, and Siemon. The indigenous OT lights segment is dominated by Bharat Surgicals and United Surgicals. Aggressive presence is seen of Cognate, Matrix, Staan, Confident Dental, Technomed, and Galaxy. The unorganized segment and regional manufacturers located primarily in Delhi, Bhiwani, and southern states of India continue to cater to this market.

COVID-19 impacted the market for OT lights too, as it did their counterpart, OT tables. The government buying and that by the corporate chain hospitals was at an abysmal low. The private hospitals and smaller nursing homes did some buying, albeit the low-end priced range. The situation is not expected to ease until the pandemic is under control and elective surgeries resumed.

Global market

The global surgical lights market is expected to reach USD 3838 million by 2026, registering a CAGR of 4.5 percent from 2020 to 2026, states Allied Market Research. Surge in number of hospitals, increased investment in operating room equipment, and increase in global geriatric population are the major factors that drive the surgical lights market growth. In addition, growth in regulatory approvals for different surgical lights propels the market growth. Further, rise in product availability, significant surge in demand for well-equipped surgical lights for better and enhanced visibility and accessibility of healthcare facilities, and improvement of healthcare infrastructure in the developed economies boost the growth of the surgical lights market. However, high cost of LED and CFL lights and implications caused from their vigorous usage are the factors anticipated to hamper the market growth. On the contrary, technological advancements in these lights and surge in awareness toward patient care are expected to create lucrative growth opportunities for the market expansion.

Halogen lights continue to have a larger market share, being 59.7 percent in 2019. LED lights are expected to have a faster CAGR of 6.8 percent over the next 6 years and overtake the halogens over time. This is largely with increasing awareness, incentive programs to encourage the large healthcare facilities to install LED lighting, and rising efforts to improve the patient experience. Moreover, increasing medical tourism in developing nations is anticipated to provide the requisite impactus.

The US holds the largest share in the global surgical lights market. The growth of this regional market is attributed to the increasing number of surgical procedures and extensive use of LED surgical lights in hospitals and surgical centers.

Europe is the second-largest market for surgical lights with Western Europe, holding the largest market share. The factors driving the market growth are the availability of funds for research and development activities and an increasing number of surgical lights manufacturers and distributors.

Asia-Pacific exhibits growth opportunities for a key player in the market, focusing on geographical expansion, new product launch and partnerships. For instance, in April 2019, Shenzhen Mindray Bio-Medical Electronics Co., Ltd launched the HyLED X series, a high-end surgical light series. Such strategies result in Asia-Pacific becoming the fastest-growing region in the surgical lights market.

In the Middle East & Africa, the surgical light market is driven by the development of the healthcare sector in nations such as Saudi Arabia and the United Arab Emirates and rising demand for diagnostic and treatment services for various chronic diseases. The Middle East is the largest market whose growth is attributed to an increase in the demand for innovative surgical solutions.

Key players operating in the room lights market include Getinge Group, Trumpf GmbH +Co. KG, Steris Corporation, Berchtold Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd, Koninklijke Philips N.V, and Skytron, LLC. Skytron LLC dominates the market in the US with the largest share followed by Steris Corporation, Getinge Group, and Berchtold Corporation.

OR lighting the key factors

ORs require specific pieces of equipment. Many of these are high-tech and used for advanced surgeries and would be inadequate without integrated lighting. Good and high-quality lighting is critical to the safety and efficiency of the OR procedure, specifically in lateral, minimally invasive, and deep-cavity cases.

Mounting configuration of surgical lights. The mounting and configuration choices are ones made with the intended purpose of the surgical suite in mind. In addition to lights, mounting configurations can include auxiliary arms for other equipment such as in-field monitors, radiation shields, and equipment booms. Lightweight suspension can assist in maneuverability of the arms. Systems that are upgradable, expandable, and modular offer the best flexibility for today’s needs as well as unknown needs in the future.

Shadow control. Shadows cause a certain percentage of reduction in light during a procedure due to an obstruction, such as hands or heads of surgical staff members, or surgical instruments. Superior shadow control depends on strategically placed LED light bulbs within the surgical lighthead, multiple overlapping LEDs, and a design that allows for maximum central light. Most surgical lights have the handle positioned in the center of the light which precludes the ability to place LED lights in that area. An offset handle allows for more LEDs to be placed in the center of the lighthead, allowing better illumination of the deep cavities. It is general practice for most perioperative teams to position the surgical light directly over the operative site. To maximize lighting effectiveness, clinicians may find is beneficial to position one light at the head of the table and one light at the foot and point both lights laterally. In this position, it is possible to further reduce the effects of obstruction to the lighthead.

Heat management. LED surgical lights emit significantly less heat than other types of lights. Surgical light heat can be measured in two places: the surgical site and the lighthead. An open design on a surgical lighthead allows heat to escape and surgical plume smoke to dissipate.

Illumination. Illuminance has often been referred to as brightness, but this can lead to confusion with other uses of the word. Brightness refers to non-quantitative perceptions of light. Illuminance is a quantitative measure of the amount of lux that is hitting the surface. For surgical lighting, this refers to the central illumination that is at the center of the lighting focal point measured one meter from the lighthead. Proper illumination is a compromise to ensure a good visibility with minimal glare and prevent eye strain for surgeons. The spot size can vary depending on the type of surgery to limit peripheral glare.

Surgical lights are critical for optimal patient safety and staff comfort. The quality of surgical light can have an impact on the quality and precision of work during a procedure. As the new standard in operating room lighting, LED lights emitting pure white light allow for accurate and consistent assessment.

Way forward

The integration of OR systems with various devices will continue to play an increasing role and present a challenge for manufacturers and users. At the moment, all manufacturers have their own operating philosophy the OR staff needs to understand. This is rapidly changing, where the different technologies communicate with each other and equipment can be used effectively. Even though these ideas have already been initiated, they will continue to evolve over the next few years and perhaps even over the next decade.