IVD

Technologies revolutionizing coagulation

High-throughput results, increasing adoption of automation, and development of high sensitivity and specificity of coagulation instruments will drive the market growth in the years to come.

The IVD industry in India has been witnessing immense progress. Major technological advancements and higher-efficiency systems have taken the sector to new heights. Advanced cutting-edge technologies are being used to understand disease prognosis, thereby strengthening the sophistication level of the participants in the sector. The growing demand for personalized medicines, innovations in diagnostic techniques, increasing preference for point-of-care testing among the general population, a growing geriatric population base, and an increase in disposable incomes are driving the growth of the IVD sector in India.

The Indian coagulation market is a significantly growing market in the IVD segment. Majority of the coagulation testing is performed in hospitals or attached laboratories as compared to standalone labs. In the coming years, numerous diagnostic centers will be established in rural areas, propelled by improved diagnostic tools, enhanced treatment monitoring, increased availability of over-the-counter tests, easy availability of coagulation solutions at affordable prices, and high investments from the private sector. For instance, Metropolis Healthcare has announced plans to add 800 collection centers, and 10 labs by the end of fiscal year 2019. High-throughput results, increasing adoption of automation, and development of high sensitivity and specificity of coagulation instruments will drive the market growth in the years to come.

Moreover, global companies are expanding their operational footprint in India, which presents a growing market for their products like ready-to-use test kits equipped with features like high specificity and acute diagnostic analysis. Thus, the market in India is growing at an extraordinary pace and the country has the potential to emerge as a global manufacturing hub in the medical devices space.

Moreover, global companies are expanding their operational footprint in India, which presents a growing market for their products like ready-to-use test kits equipped with features like high specificity and acute diagnostic analysis. Thus, the market in India is growing at an extraordinary pace and the country has the potential to emerge as a global manufacturing hub in the medical devices space.

Indian market dynamics

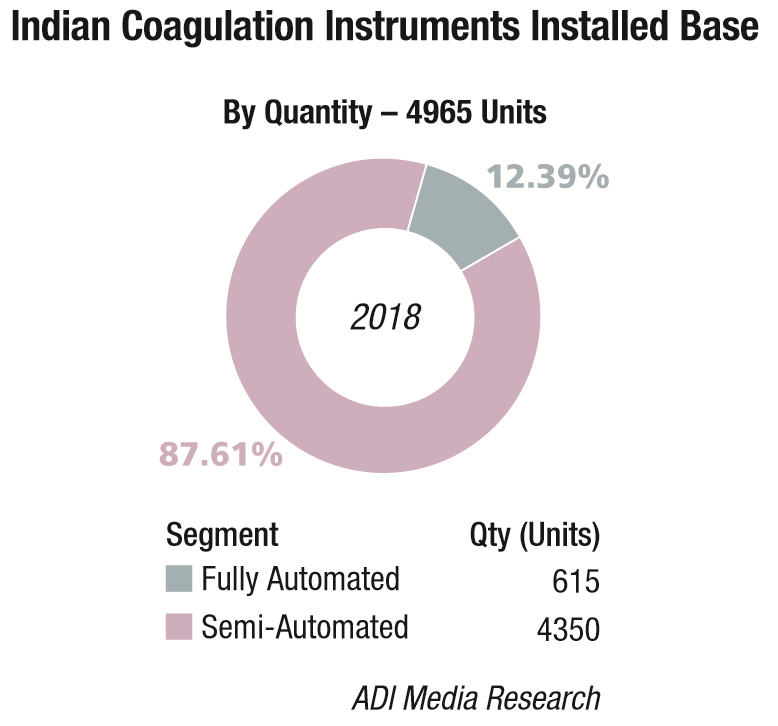

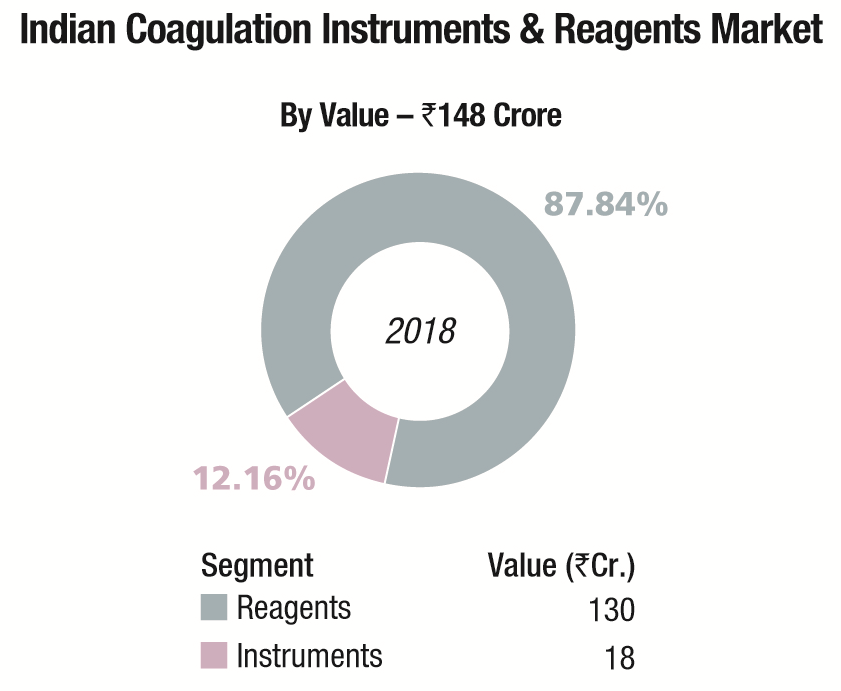

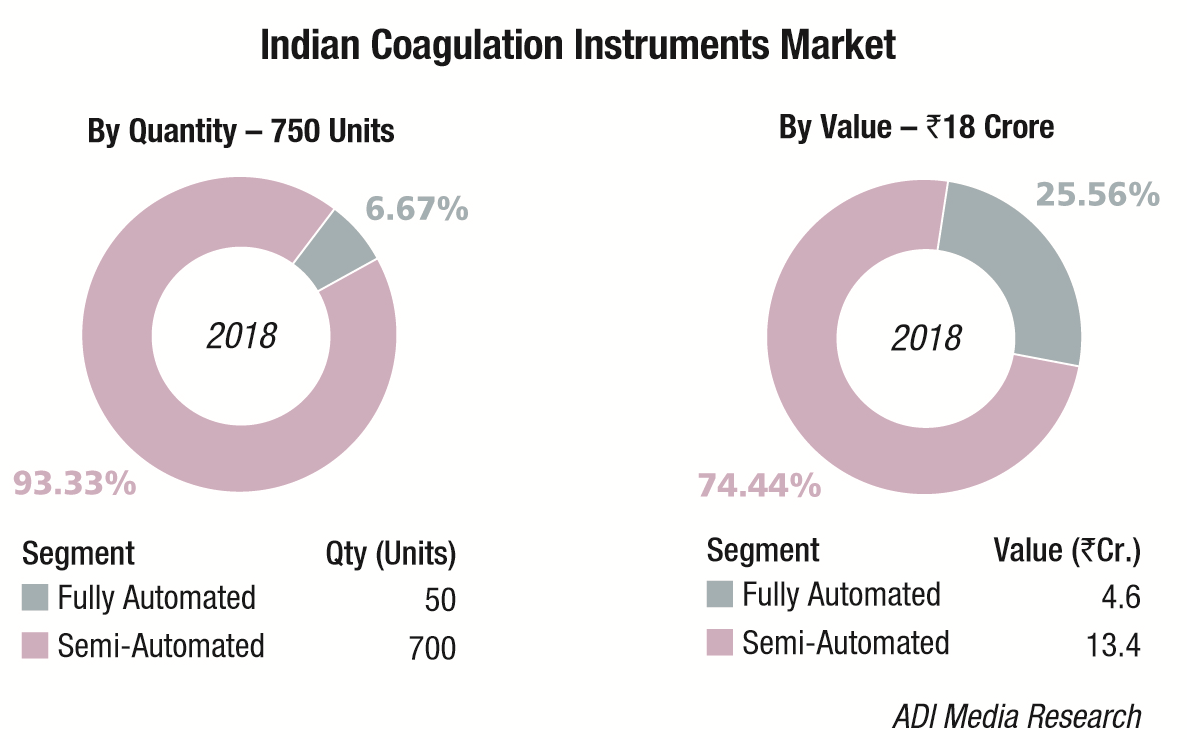

The Indian coagulation instruments and reagents market in 2018 is estimated at ₹148 crore. The year showed a 9 percent growth over 2017. The installed base in 2018 is estimated at 4965 instruments, with semi-automated instruments at 4350 units, and fully automated ones at 615 units.

In the ₹130 crore reagents market, although 80 percent of tests conducted are for routine parameters (PT and APTT) and remaining 20 percent are for specialized coagulation parameters, the revenue accruing from routine tests is 60 percent and 40 percent is from specialized parameter tests. In the recent past with increase in screening tests and therapeutic monitoring of hemostasis, many new innovative techniques have been introduced for coagulation analyzers. Automation has revolutionized workflow with modern complex coagulometers having high-throughput, reliability, flexibility, easy-to-use advanced software with inbuilt LJ graphs and calibration curves, improved accuracy and precision with minimum human error in measurement.

In the recent past with increase in screening tests and therapeutic monitoring of hemostasis, many new innovative techniques have been introduced for coagulation analyzers. Automation has revolutionized workflow with modern complex coagulometers having high-throughput, reliability, flexibility, easy-to-use advanced software with inbuilt LJ graphs and calibration curves, improved accuracy and precision with minimum human error in measurement.

Automation in coagulation starts from single channel coagulation analyzer to fully automated multi-channel coagulation systems and as compared to the other segments in the IVD, only few multinational companies are present in the fully automated coagulation segment, which is purely on import. In fully automated segment there is a shift from bigger system to compact system to address the space constrain in the laboratories especially in the metro cities and there is an increase in the reagent rental business model. Like fully automated segment, there are only few players in the semi-automated coagulation segment and most of these instruments are purely on import. In the semi-automated coagulation analyzer segment there is a new trend where the laboratories are moving from open systems toward closed systems. Since the forex rates are going higher than the expected, there is a huge impact on the price of hardware and consumables which is eluding the rural laboratories from coagulation testing. Local manufacturing is the key success factor in this segment and there are few manufacturers in India who envisioned this.

Since the forex rates are going higher than the expected, there is a huge impact on the price of hardware and consumables which is eluding the rural laboratories from coagulation testing. Local manufacturing is the key success factor in this segment and there are few manufacturers in India who envisioned this.

| Tier I | Tier II | Tier III** | Others |

|---|---|---|---|

| Stago (including Trinity) | Werfen India and Sysmex | Agappe, Abbott Diagnostics, Compact Diagnostics, Tulip, and Transasia | bioMérieux, CPC Diagnostics, Meril Diagnostics, and Roche |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian coagulation instruments market. | |||

| **Instruments are primarily SA | |||

| ADI Media Research | |||

Global market

The global coagulation analyzers market is expected to reach a value of USD 6.2 billion by 2024 from USD 3.6 billion in 2018, with a CAGR of 9.2 percent during 2019 to 2024, predicts Research and Markets. The rising demand for coagulation analyzers is anticipated due to increasing population base suffering from lifestyle associated disease, and chronic blood disorders. Furthermore, increasing awareness about these conditions is expected to improve the diagnostic rate and preventive care management, which is predicted to substantially increase the testing volume.

Analyzers retained dominant share of the total revenue in 2018 and are expected to grow at a lucrative CAGR over the next 5 years. Factors promoting this growth are anticipated to be developing healthcare infrastructure and rising healthcare spending, coupled with increasing incidences of lifestyle-related conditions, such as obesity, diabetes, and cardiovascular disorders. Special emphasis on providing quality and timely care to patients is expected to propel growth of diagnostic market, which in turn is anticipated to cause a hike in demand for hemostasis analyzers.

Clinical laboratory segment held the largest share in 2018. Clinical laboratory analyzers are predominantly used in hospitals for hematological analysis of patients on a daily basis.

Consumables held over 65 percent of the share, and are further segmented into reagents and stains. All tests require the presence of reagents; hence large inventory or repeated orders of these products are placed by hospitals, leading to higher demand. Increasing volume of testing and development of new assays is expected to boost sales of these consumables.

In terms of test type, prothrombin segment was estimated to account for the largest share in the region, followed by APTT test based in 2018.

Rapid expansion in hospitals and primary healthcare centers is expected to be a high-impact rendering driver. In addition, favorable government initiatives to improve healthcare delivery are expected to help the future growth. Furthermore, availability of advanced equipment, which has higher accuracy and features to perform multiple tests, is another vital driver for the growth.

Industry Speak

Technological advancements and emerging trends on coagulation testing

Rajesh Patel

Business Head

Agappe Diagnostics Ltd.

The highly specific pre-treatment of samples, which is particularly distinct to other test systems, the citrated plasma sample, is unique to the clotting assays. In the recent past, the amount of pre-analytics involved in hemostasis testing is seen as a major drawback. Regardless of innovations, hemostasis testing still requires specific technical and clinical expertise, not only in terms of measurement procedures but also for interpreting and then appropriately utilizing the derived information.

The coagulation testing market is expected to register a moderate CAGR of 6.5 percent during 2017 to 2023. The growing prevalence of liver disease, hemophilia, and thrombophilia are expected to drive the market growth. The high cost associated with a fully automated coagulation analyzer is the major constraint for a laboratory in India to adopt the latest technological advancements in the segment. The coagulation market in India is at a two-way junction, one is the shift towards automation and on the other hand, a paradigm shift can also be expected toward a next-generation miniaturized point-of-care (POC) coagulation testing device. The automation segment is controlled mainly by the multinational companies with their fully automated systems, which are placed on reagent rental in high-workload laboratories. Though rapid coagulation is gaining traction, the reliability of test results is still debatable.

In semi-automated systems, the market is controlled by European and Japanese brands. Low-cost Chinese instruments are finding it difficult to gain the market share. More safety is preferred when it comes to coagulation reagents as the need is that the reagents should be more hygienic. Lyophilized coagulation reagents prove to be hygienic for testing as their use reduces chances of contamination. Some coagulation testing devices comprise test-specific packs, containing the necessary reagents to perform the test. These kinds of closed systems are easy to use and inexpensive. Such products are used to minimize the possibility of cross contamination and also to reduce the cost of consumables.

In PT estimation, proper ISI values need to be entered into the system before testing. In majority of the cases, improperly entered ISI value is one of the culprits for error in the PT estimation. To address this, instrument manufacturers have come up with a new semi-automated coagulation system with smart card technology, where all the details like ISI values or calibration curves of the specific reagents are encoded in the smart chip to eliminate analytical errors. These systems are highly compact using densitometric principle, dual wavelength measurement giving accurate results, and are affordable for the rural population in India. We are expecting for better innovations to come into the coagulation analysis in the near future in such affordable forms for the hemostasis lab of a common man.

Diagnostic centers dominated the end-use segment in 2018, with the prevailing trend of outsourcing the hemostasis tests to diagnostic centers. However, hospitals are expected to witness lucrative growth during 2019 to 2024 because of the rapid expansion of hospitals, coupled with availability of analyzers and consumables based on hospital needs.

Some of the major players operating in the global coagulation testing market include Alere Inc., Thermo Fisher Scientific Inc., Sysmex Corporation, Siemens AG, F. Hoffmann-La Roche AG, Abbott, Axis-Shield Diagnostics Ltd., Danaher Corporation, Becton, Dickinson and Company, Bio/Data Corporation, and Chrono-Log Corporation. The players are mostly present in the international space, and due to easy global accessibility are competing directly to gain a bigger share.

Vendors update

In May 2019, Haemonetics Corporation received clearance from the USFDA to expand the medical indication of its TEG 6s hemostasis analyzer system for use in adult trauma settings. This clearance builds on the current indication for the TEG 6s system in cardiovascular surgery and cardiology procedures. The site-of-care TEG 6s system provides actionable test results in as little as 10 minutes.

In April 2019, Ortho Clinical Diagnostics, in collaboration with Diazyme Laboratories, Inc., launched its D-Dimer assay. The D-Dimer assay detects the presence of intravascular coagulation and fibrinolysis through the measurement of fibrin-degradation product D-Dimer

In April 2019, Stago launched STA Satellite, which is a fully automated benchtop analyzer capable of simultaneously performing clotting, chromogenic, and immunologic assays. The STA Satellite offers complete automation to the low-volume coagulation laboratory and satellite labs, delivering a powerful, reliable analyzer within a small footprint. The system enables integrated health networks to standardize patient testing results including D-dimer and Anti-Xa. With an integrated barcode, continuous sample loading with positive sample identification, removable sample carousel for 20 primary tubes, and a removable reagent carousel with 16 positions, the Satellite provides the only true walkaway hemostasis solution for low-volume and satellite laboratories.

In March 2019, Arkray, Inc. launched Spotchem HS HS-7710 blood coagulation analyzer. With this analyzer, it is possible to perform measurements quickly and easily in the operating room, allowing doctors to comprehensively determine blood coagulability, using whole-blood samples.

In February 2019, Diapharma launched T2F thrombodynamics analyzers to provide qualitative and quantitative evaluation of the coagulation state of a blood plasma sample. The T2 system analyzes spatiotemporal dynamics of fibrin clot formation and thrombin generation, and calculates numerical parameters describing the coagulation process.

In January 2019, Neomedica launched NRDD 66, a benchtop coagulation analyzer based on the optical-measurement principle. In addition to five sampling positions, this analyzer also supports the ability to execute an emergency sample. With six low dead-volume reagent positions and four testing channels and continuous loading, this analyzer can perform up to 120 tests per hour and is used for fast detection of blood coagulation. Accurate and convenient, this fully automated, open-system coagulation analyzer is an ideal choice for laboratories of all throughputs, big hospitals and scientific research institutes.

In December 2018, Sysmex Corporation launched its next-generation analyzers in the hemostasis field, the automated blood coagulation analyzers CN-6000 and CN-3000. Through the launch of the CN-6000 and CN-3000, Sysmex aims to further enhance levels of productivity, reliability, and operability, in turn responding to diverse customer needs and contributing to even better efficiency and higher quality in the field of hemostasis.

In November 2018, Horiba Medical launched the Yumizen G1500 (open tube) and Yumizen G1550 (closed tube), fully automated analyzers that can manage the diagnostic and monitoring requirements of clinical laboratories with a mid to high workload.

Industry Speak

Relevance of IQC and EQA programs

Dr Omkar Kadhane

Dy. Product Manager – Coagulation

Transasia Bio-Medicals Ltd.

The Indian coagulation market is expected to touch ₹140 crore by 2021. The market is majorly driven by the reagent business with a great emphasis on quality and timely reporting. The PT, aPTT, and TT are the most frequently ordered coagulation tests by clinicians. On the other hand, fibrinogen (Fbg) and factor VIII test are frequently performed by blood banks to assess the viability of fresh frozen plasma. Considering increasing demand for these tests and the entry of new players, a lot of emphasis is being laid on IQC (internal quality control) and EQA (external quality assurance) programs to validate the quality of coagulation testing.

Establishing biological reference ranges

Coagulation-testing quality-control programs are required to assess not only analytical procedure, but also each and every step involved in the assay. The establishment of reference ranges and related critical values are important factors while interpreting the coagulation test reports. A streamlined and well-participated EQA scheme aids in establishing biological reference ranges and critical alert values. Having said that, providers are facing challenges to develop EQA programs for new technologies, such as molecular biological screening tests for thrombophilia. Complications in procedure, lack of awareness, and inadequate infrastructure are the main challenges in maintaining quality control of molecular biological coagulation screening testing.

Advantage of L-J chart analysis

Along with EQA, routine IQC usage and analysis with the help of L-J charts helps in maintaining quality control in coagulation-testing procedures, without compromising traceability of the reference material. However, most semi-automated analyzers in India lack IQC analysis modules. Many single-channel coagulation analyzers not only lack storage capacity of quality-control data, but also access to data because of the absence of wider displays or inbuilt printers.

On the other hand, though fully automated systems have quality-control modules, they are rudimentary. It is important for laboratories to take into account these important aspects before selecting a coagulation analyzer. Transasia Bio-Medicals Ltd. is one of the companies in the country to provide semi- and fully automated analyzers with advanced L-J chart-analysis module, a wide display, and critical parameters like D-Dimer.

Technology trends

Currently available conventional coagulation tests include the activated partial thromboplastin time (aPTT), prothrombin time (PT), and international normalized ratio (INR). These in-hospital tests are performed on blood plasma, and require a central laboratory with trained personnel. However, access to specialized coagulation testing in a central laboratory is often limited in community hospitals as well as at point-of-injury in remote battlefield or civilian conditions, and the long delay associated with such tests means that results are obtained at time points much later than the onset of hemostatic imbalance.

On the other hand, several handheld PoC coagulation devices are currently commercially available. 2018 witnessed the increasing trend of diagnostic testing steadily moving out of the central laboratory and into testing sites closer to patients, thus making technological innovations in hemolysis management patient-centric. With the advent of novel strategies, there are high expectations arising amongst manufacturers. They are increasingly focusing on the devices’ distinct features, including rapid results, reduced patient discomfort, simplicity, cost-effectiveness, enablement of early diagnosis and accessibility in remote areas, and making these technologies affordable and available to medical professionals.

Second Opinion

Evolving trends in advanced diagnostics

Dr Shelly Mahajan

Clinical Lead – GenomicsCARINGdx

Mahajan Imaging

With the advent of new and more robust technologies in healthcare, the delivery of the services is changing dramatically around the globe. The healthcare ecosystem is becoming more patient centric. The evolution of lab-testing has patient safety and better care at heart. The clinicians and patients are more open to accepting new and up-to-date technologies. There is much more awareness about latest updates in healthcare delivery in the patients. This is where we come in as providers of highest-end diagnostic services. Running parallel with the latest industry updates becomes extremely critical. Diagnostics nowadays is much more dependent on in-vitro diagnostics, molecular diagnostics, and point-of-care (PoC) tests than it ever was. Hence, healthcare providers are required to meet up with the need of the hour.

Speaking of the needs, in this day and age turn-around time tops the list. Results are needed much faster without compromising on quality so that medical decisions can be taken as early as possible. Clinical PoC testing is moving on to quantitative assessment of biomarkers. Automation in laboratories for sample transport, sample processing, and report generation is getting much more advanced and error free. With NGS, the cost of DNA sequencing has reduced multi-fold. This allows multi-gene testing to be done on much less sample and cost. NGS provides a cheaper, easy-to-use, and high-throughput option for gene sequencing. This is a huge leap toward more advances in data generation for genomics, transcriptomics, and epigenetics, which can translate into a development in therapy decisions and better patient care.

As glamorous as it may sound, these growing trends come with their share of challenges. Upgrades in healthcare technology are more difficult than the rest to implement since the consequences of anything going wrong are much more grave. Hence, getting the approval of regulatory bodies is a critical step. Another issue in this regard is cost. Even though India can stand on the same pedestal as the rest of the world in terms of scientific expertise, cost becomes a major hurdle since we are dealing with self-paying customers. That forces us to accept the newer trends slower than we want to.

India presents a unique opportunity for the world’s best doctors to gather together along with the best technologists to create new technologies focused on solving difficult clinical problems at the least-possible cost.

Second Opinion

Market and technological dynamics

Dr Vanajakshi S

HOD & Sr. Consultant

Department of Hematology & Clinical Pathology

Apollo Health City

The global coagulation analyzer market was worth USD 3.6 billion in 2018 and is expected to reach a value of USD 6.2 billion by 2024, registering a CAGR of 9.2 percent during 2019 to 2024.

On product

Over the past decade, rapid advancements in technology and the introduction of new coagulation analyzer tests have led to an increase in the quality and efficiency of hemostasis laboratories. Some of the modern complex coagulators also possess high throughput, flexibility, and reliability. Other than this, they provide improved accuracy and precision, and easy-to-use advanced software provided with in-built graphs and calibration curves. There has been a significant rise in the prevalence of cardiac diseases, obesity, DM (diabetes mellitus), growing geriatric population, auto-immune diseases, stroke, PE (pulmonary embolism) and DVT (deep vein thrombosis) cases, spontaneous abortions, pregnancy problems, and surgical bleeds due to use of Plavix and other anti-platelet medicines, which has created the need for improved coagulation analyzers across the globe. Besides this, the sales of coagulation analyzers are positively being influenced by the increasing number of hospitals, diagnostic centers, and research institutes established worldwide. Special emphasis on providing quality and timely care to patients is expected to propel growth of diagnostic market, which in turn is anticipated to cause a hike in demand for hemostasis analyzers.

On technology

Optical/Electro-mechanical technology is predicted to gain the highest share over the forecast period. This growth is anticipated due to rising combination of immunological, chromogenic with photo optical technique, which has led to development of high-performance, multipurpose optical hemostasis analyzers.

On test-type

Prothrombin time segment was estimated to account for the largest share in the region followed by APTT test, in terms of test type. The APTT test is estimated to account for the second-largest share in the hemostasis analyzers market by test type. The APTT test is majorly used for detecting coagulation inhibitors, disseminated intravascular coagulation (DIC), liver diseases, acquired and inherited abnormalities of the intrinsic coagulation pathway, and monitoring of heparin therapy. The test may be carried out using different principles, such as photo-optical and electro-mechanical.

On end-use

Rapid expansion in hospitals and primary healthcare centers is expected to be a high-impact rendering driver. In addition, favorable government initiatives to improve healthcare delivery are expected to help the future growth. Furthermore, availability of advanced equipment, which has higher accuracy and features to perform multiple tests, is another vital driver for the growth. The end users of hemostatic analyzers include hospitals, diagnostic centers, research institutes, and others.

Some of the ongoing technologies expected to impact the market in coming years include:

Dielectric spectroscopy (DS) is a fully electrical, label-free, and nondestructive measurement technique that can enable a simple and easy-to-use PoC device for extracting information on the physiologic properties of blood in real time. It is a well-established method to study the molecular and cellular composition of a variety of biomaterials. However, this technique has been restricted to studies using laboratory-based benchtop measurement equipment and >100 µL blood-volume samples.

T2 magnetic resonance (T2MR) is a new technology that is able to detect clot formation based on partitioning of red blood cells and proteins, which occurs during fibrin formation and platelet-mediated clot contraction. This device can be used to measure clotting times, individual coagulation factors, and platelet function. T2MR has also revealed a novel hypercoagulable signature that needs further study to determine if it can be used to predict patients at higher risk of thrombosis. This helps medical professionals determine the diagnosis without compromising with the accuracy of the diagnosis.

Infrared spectroscopy is being utilized to detect clot formation in the Perosphere Technologies’ hand-held PoC coagulometers. This device uses fresh or citrated whole blood with clotting activation initiated by glass contact. The turnaround time is fast, providing a clotting time within 3 to 10 minutes. Although the use of handheld devices is not new, preliminary data shows that this device may be useful in assessing coagulation response to any of the direct oral anticoagulants (doacs) as well as the antithrombin-dependent activated factor X (fxa)-inhibiting anticoagulants. This allows medical practitioners to make the diagnosis with precision, and that too in a short time.

Microfabricated sensors have been successfully developed for PoC blood-coagulation monitoring, which utilize blood viscosity by monitoring a frequency shift when the blood sample is in direct contact with a micro-fabricated resonant structure. Nonetheless, the force applied when blood is in direct contact with a mechanical transducer can potentially interfere with the natural coagulation process. Non-contact methods have also been developed; however, they require the use of discrete ultrasonic transducers or laser illumination and optical microscopy and require a regular blood sample.

Manufacturers are actively pursuing novel analyzers, which more specifically assess the role of platelets in human pathologies, including bleeding and thrombotic disorders, cancer, sickle-cell disease, stroke, ischemic heart disease, and others. There are several analyzers like acoustic waves that are already commercially available, with ability to assess platelet contractile forces. These analyzers are utilized in a miniaturized PoC device capable of using only a small amount of citrated whole blood, measuring the time required for fluorescent microspheres to cease motion due to clot formation. The result provided is a clotting time in seconds. Also, this system may be useful for assessing anticoagulant effects. All things considered, the ongoing novel strategies based on microfluidics and nanotechnology may enable potential for self-testing and self-monitoring, but a great reduction in sample volume is needed. There are important mechanical parameters that relate to coagulation but are not measured, and finally they do not evaluate, monitor, or mitigate acute bleeding or thrombosis risk. These drawbacks demand for the development/standardization of novel strategies that can improve the clinical diagnosis process. A continuous quest is ongoing to discover new methods of clot detection, or other novel types of coagulation analyzers are in development or will soon be ready for prime time for use in routine diagnostics of hemostasis disorders. However, these require more standardization and more clinical studies to assess and exploit their potential before they are made available in the market.

Outlook

Manufacturers are looking forward to cost-effective, multi-parameter, portable, novel, and pocket-sized analyzers with a specially trained workforce in clinics and hospitals, backed by less training cost, to handle them. High-throughput results, increasing adoption of automation, and development of high sensitivity and specificity of coagulation instruments will drive the market growth in the years to come.