MB Stories

The year ends with a whimper for OR equipment market

The OR equipment manufacturers expect some normalcy to return in 2022, when the stalled projects make progress and expansion is once again undertaken.

The pandemic has had ramifications for ways of working of various surgical procedures. There are strict guidelines specific to each specialty that have to be implemented and followed by surgeons to be able to continue to provide safe and effective care to their patients during the COVID-19 pandemic. The volume of surgeries has significantly declined during the pandemic, owing to the stringent guidelines by the regulatory authorities to avoid all non-emergent surgeries. This has impacted the procurement of operating room (OR) equipment for these surgical centers.

As COVID-19 restrictions have loosened in the country, elective and non-essential surgeries have been allowed to resume at many hospitals and ambulatory surgery centers. While this is obviously good news for patients and healthcare facilities, the reopening process is fraught with challenges.

When the recovery begins, it could be accompanied by a resurgence of demand for both elective and delayed essential procedures, straining business models and financial resilience.

In 2020, the global OR equipment market size was valued at USD 4.4 billion. The total market size is expected to increase at a compound annual growth rate (CAGR) of 4 percent to exceed USD 5.7 billion in 2027. The global operating tables market was valued at USD 840 million in 2020, and it is expected to reach USD 1025 million by 2026, registering a CAGR of 3.2 percent.

Globally, there are close to 35,000 surgical tables sold every year, with the US having the highest product demand. This number is expected to show single-digit growth over the next 7 years.

COVID-19 caused the OR equipment market to experience a substantial drop in sales in the first half of 2020. However, most of the sales in these markets are made years in advance and, therefore, unit sales have not been influenced significantly.

|

Major players in OT tables & lights market – 2020* |

||||

| OT tables | OT lights | |||

| Tier I | Tier II | Tier I | Tier II | |

| Indigenous | Magnatek, Palakkad, and Staan | Cognate and Technomed | Magnatek, United Surgicals, and Bharat Surgicals | Matrix, Cognate, Staan, Confident Dental, Technomed, and Galaxy |

| Imported | Getinge (Maquet) | Steris | Getinge and Dr Mach |

Mindray, Mediland, KLS Martin, Stryker, Steris, Brandon, Merivaara, and Eclipse |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the indigenous and imported OT tables & lights market. | ||||

| ADI Media Research | ||||

Due to the situation in most hospitals, replacing capital equipment was not a high priority throughout the pandemic, as long as the original equipment was functioning. Furthermore, sales representatives from many manufacturers had limited travel and access to hospitals and other care sites.

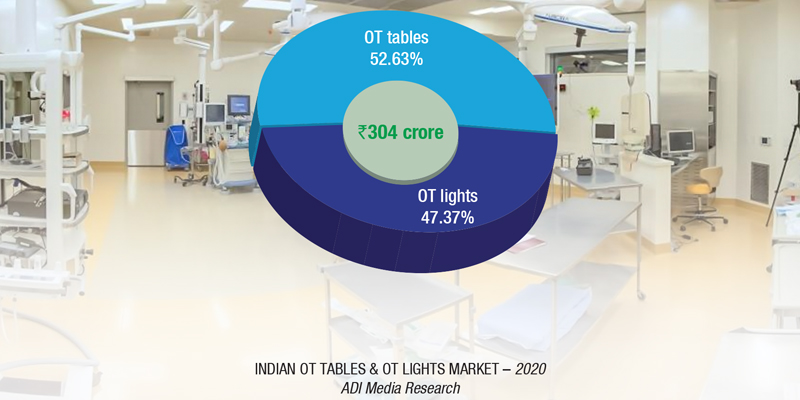

COVID-19 has changed the very face of the Indian OT tables and lights market. Priorities shifted since April 2020 and, with elective surgeries on the backburner, these two products saw demand plummet. There were just not enough funds available when it came to buying this product. And the customers that did buy, found the Indian products at more competitive prices and enhanced quality adequate to meet their needs. The Make in India thrust also favored the indigenous vendors. As a result, the imported brands lost major market share, particularly for OT tables.

The OT lights are also being bought from Indian players, albeit these are assembled here with imported components. Within this segment, 70 percent of the market constitutes the high-end Indian lights and 30 percent the value models. A handful of discerning customers shifted to the Indian lights, opting for the high-end models. The imported ones in any case attracted higher freights too. With somewhat changed market conditions, and erratic supply chain, the post-Covid era found the imported brands offloading their stock. Government procurement was at an all-time low.

With the customers having switched almost completely to superior LED lights, the quantities of tables and lights now bought are almost the same in numbers procured. This has translated into a major hit for the OT lights segment that has dropped by quantity and by value in 2020.

Demand in 2021 continues to be slow, albeit higher than in 2020. The vendors expect some normalcy to return in 2022, when the stalled projects make progress and expansion is undertaken once again.

Surgeons who work in poor light settings, and with limited resources at the operation, complain of insufficient surgical lighting a threat to patient’s life and well-being. Often many of the surgeries have been called off due to poor lighting at the operation theater. Considering such light arrangements in many of the operation theaters, development, and allocation of high-quality, economical, and sound surgical headlights are the need of the hour. It could provide perfect solution for such important issues during surgery.

The global surgical lighting and surgical boom market sizes are estimated at USD 492.3 million in 2021 and it is expected to reach USD 533 million by 2027. With the growing demand for a balance between shadow management and luminance of light, the demand for surgical lights is likely to rise in years to come, which will subsequently propel the growth of the surgical lights market.

The majority of the global surgical lighting market share was controlled by Stryker, Skytron, and Getinge. On the other hand, the global surgical boom market share was controlled by Stryker, Dräger, and STERIS. This global market research spans over 70 countries and includes the equipment boom, anesthesia/nursing boom, and utility boom markets.

For surgical lighting, a strong, renovated ceiling is required to be able to withstand the weight and blueprint of the new lighting system when installed. For surgical booms, a ceiling support structure, which is costly to install and prolongs the time necessary to install a surgical boom system, must be added.

The integration of OR systems with various devices will continue to play an increasing role and present a challenge for manufacturers and users. At the moment, all manufacturers have their own operating philosophy the OR staff needs to understand. This is rapidly changing, where the different technologies communicate with each other and equipment can be used effectively. Even though these ideas have already been initiated, they will continue to evolve over the next few years, and perhaps even over the next decade.