Industry

Will Indian MedTech industry defy the international polycrisis?

Many of the well-established MedTech industry trends have been accelerated and intensified in the recent years, and the 2020–2023 period will in hindsight be viewed as a transformational time, from which the winners of the next decade will emerge.

2023 has been about post-pandemic stability. The entire ecosystem, including the industry, hospitals, diagnostic centers – the entire fraternity – have been working toward stabilizing their operations and revenues. While the global economy was still reeling from the pandemic, challenges as inflation, climate change, the war in Europe, and supply chain disruptions coalesced into what experts called a polycrisis.

While healthcare has historically been resilient during recessions, MedTech is not insulated. MedTech companies increasingly find themselves operating in a more turbulent market, with the confluence of the release of monthly inflation data, and wage pressures, both of which negatively affect health system margins. As demonstrated during the 2008–09 recession, large equipment manufacturers are likely to be impacted as hospitals prioritize capital equipment repairs over replacement to reduce spending. In the event of a recession, history suggests we could see a bifurcated deal market, with some megadeal carve-outs, accompanied by a softness in some subsectors.

In 2022, several major MedTech companies reconsidered their portfolios and made plans to spin off businesses. These announcements included:

- 3M to spin off its USD 8.6 billion healthcare division that manufactures bandages, surgical supplies, and biopharmaceuticals.

- GE completed its spin-off of its healthcare business, which offers a range of products focused mostly on medical diagnostic imaging, and was valued at nearly USD 30 billion on its IPO date.

- Johnson & Johnson to spin off its consumer health unit, which generated USD 14.6 billion in revenue in 2021, into a new company called Kenvue.

- Medtronic to spin off at least two units – patient monitoring and respiratory interventions – that contributed USD 2.2 billion in revenue in its 2022 fiscal year.

Notably, the USD 2.1-billion institutional buy-out (ibo) oneoncology by AmerisourceBergen and TPG Capital was the industry’s largest disclosed deal. Among the top-five others were Meridian Bioscience acquired by SD Biosensor and SJL for USD 1540 million in July 2022, Hanger acquired by Patient Square Capital for USD 1250 million in July 2022, Natus Medical acquired by ArchiMed for USD 1200 million in April 2022, and Certara acquired by Arsenal Capital Partners for USD 449 million in November 2022. Leading financial advisors were Piper Sandler Companies, Centerview Partners, Harris Williams, and JPMorgan Chase & Co. The top-ranked legal advisors supporting these private equity deals were Morgan, Lewis & Bockius; Wilson Sonsini Goodrich & Rosati Professional; and Covington & Burling.

The near term could represent a pivot point for the MedTech industry’s portfolio moves. The uncertainty around Covid-19 and its impact on operations has waned, even if the virus itself has not, allowing businesses to shift their focus to external matters. Cash flows are returning to normal, and the top-30 large diversified MedTechs now hold more than USD 300 billion in dry powder (cash or cash equivalents).

In US alone, there were 17 private equity deals announced in Q2 2023. In value terms, private equity deal activity increased by 959 percent in Q2 2023, worth a total value of USD 2.3 billion, compared with the previous quarter’s total of USD 217.1 million, and rose by 67 percent as compared to Q2 2022, according to GlobalData’s Deals Database. Related deal volume increased by 31 percent in Q2 2023 versus the previous quarter and was 6 percent higher than in Q2 2022.

High-growth small- and midcap stocks have become more affordable over the past 12 months, following years of swelling valuation multiples. Their valuations, for the most part, have been compressed not as a result of poor performance but of macro forces, including speculation that rising interest rates will increase risk levels for unprofitable smaller companies.

Diversified MedTech acquirers have the benefit of not only an improving financial environment but also an advantageous value creation opportunity. Large manufacturers, with reliable supply chains and well-funded omnichannel commercial models, are now in a stronger position to accelerate a target’s performance, both operationally and commercially.

As a result of these shifts, the industry can again see portfolio activity as a critical value creation lever. Some large global MedTechs are leveraging significant levels of cash on hand to facilitate acquisitions (e.g., Johnson & Johnson/Abiomed for about USD 16.6 billion cash, Thermo Fisher/The Binding Site Group for approximately USD 2.6 billion cash, BD/Parata Systems for roughly USD 1.5 billion cash). Meanwhile, acquisitions are becoming broader, including capability expansions, site-of-care extensions or both (e.g., Stryker/Vocera for around USD 3.1 billion, Medtronic/Cathworks promotion with right to acquire for up to USD 585 million).

Dr Mansukh Mandaviya

Dr Mansukh Mandaviya

Union Minister for Chemicals & Fertilizers and Health & Family Welfare

Indian medical devices industry has the power to emerge as the global leader in manufacturing and innovation in the next 25 years, with a potential to grow from its current size of USD 11 billion to reach USD 50 billion at 28 percent per annum by 2030. To invite investors from across the world, India is allowing 100-percent FDI (under the automatic route for both greenfield and brownfield setups.

We have identified six strategies to tap the potential of the sector, and to strengthen the industry into a competitive, self-reliant, resilient, and innovative industry that caters to the healthcare needs of India and the world.

In addition to the Medical Devices Policy, we are also proposing a National Policy on Research and Development and Innovation in the Pharma-MedTech sector in India to enable strong collaborations and translational research.

With rapid strides in innovation, India is now on a momentous journey to take on the global arena in the sphere of medical devices and technologies, and has invited Japanese medical devices companies to take advantage of these opportunities to Make in India, Innovate in India, and Discover in India.

It has been a winding road for some. While some large MedTechs are leveraging significant levels of cash on hand to selectively acquire targets, others are taking the opportunity to diligently prune and reposition their portfolios. Executives are looking closely at portfolios to maximize fit and focus on higher-growth businesses, shedding lower-growth and less strategic businesses where there is an active market of buyers for carve-outs, including private equity, as well as strategic buyers.

With high barriers to entry, sophisticated technology innovations, and substantial clinical and nonclinical unmet needs to address, the industry looks set for a future of profitable growth. Over the past three decades, the industry has outpaced the S&P index by almost 15 percentage points, with stellar periods in the early 1990s, mid-2000s, and late 2010s. Yet creating value has become more difficult in the past five years, especially for large diversified companies. In fact, the top-30 cross-category companies have underperformed the S&P over one-, three-, and five-year periods. McKinsey has studied this in detail.

Value creation in MedTech has stalled. This stalled value creation largely stems from investors’ apprehensions about the growth prospects of large companies. In MedTech, growth can create a valuation flywheel – a fast-growing top line compels investors to prioritize revenue over profit and cash flow, and that in turn allows companies to invest more in R&D, M&A, and market creation, fueling yet more growth in sales. Growth and growth expectations are driving MedTech valuations.

Total capital raised by the industry dropped year over year, falling 30 percent, which was particularly noticeable in the first six months of 2022. Staffing recruitment and retention have proven difficult, and a looming shortage of clinical care providers in the next five years will stress the health sector overall. The IPO market also took a dip from the record highs seen in 2021, the USD 4.4 billion raised in the period from 2021 to 2022, was comfortably above the USD 3.3 billion average during the previous decade. However, almost all of this capital was raised in the first half of the year, with the first six months of 2022 adding only USD 76 million to the total. Ditto for venture capital raised during the 2021 and 2022 period. Around 36 percent of the USD 8.5 billion raised came from early-stage funding rounds, in line with the average of 35 percent from the previous decade and up from 29 percent the previous year. The vast majority of the largest venture rounds of the 12-month period went to late-stage companies. M&A dealmaking – while generating USD 77 billion in the 12-month period ending June 2022 – is below the average of the previous decade.

Although the industry’s revenue growth has accelerated, on average, during the past ten to 15 years, much of the improvement has come from small- and midcap companies. McKinsey studied MedTech companies with USD 0.1 billion and USD 10 billion and with growth expectations in excess of 10 percent CAGR as of April 2022. In 2016, analysts’ consensus growth estimate for these companies was 11 percent CAGR; by 2022, it had topped 17 percent. For large diversified MedTechs, growth expectations barely budged – from 4.6 percent in 2016 to 4.7 percent in 2022.

A number of factors have contributed to the lower growth expectations for large-cap MedTech companies. These include the drag of the legacy business. Most larger companies remain overexposed to low-growth markets that depress overall growth rates and muffle the impact of innovative new products. High-growth markets do exist – in fact, 25 percent of the total MedTech market is projected to grow at 6 percent or more a year from 2022 to 2025. But the legacy businesses in the portfolios of large MedTech tend to distract them from these markets. The burden of scale is another factor. A company with USD 10 billion in sales must generate USD 500 million to USD 600 million of new revenue every year to keep pace with market growth. The slowing pace of therapy adoption is also an important factor. And perhaps, the most inhibiting is the lure of near-term earnings. Innovation portfolios at large companies are weighed down by incremental programs that will fix the next quarter, not ideas to unlock transformative new treatments for underserved patients or plans to seize opportunities presented by technological advances.

Questions remain about the pace and magnitude of portfolio moves in the next few years. They include whether elective-procedure volumes will continue to fluctuate, whether shareholders of growth stocks will be willing to sell, and what role geopolitics will play in M&A strategies. However, the fundamentals remain. Growth drives valuations, portfolio moves can accelerate growth, and today’s financial and strategic environment is attractive for M&A.

Some of the impacts of PE on the MedTech CDMO/CMO landscape were noted in a recent MassMedic report. The analysis concluded that there were twice as many M&A transactions for CDMO/CMOs by PE firms than by industry strategics in the last two years. Major PE firms are now listed as owners of many major OEM supplier players, according to the report.

Some noteworthy PE-owned CDMOs include Viant Technology, Orchid Medical Group, Steripak, Veranex Inc., Resonetics LLC, Cadence Design Systems Inc., Cirtec Medical Corporation, Life Science Outsourcing, and Westfall Technik.

Some of the major PE firms involved include Vance Street Capital LLC, Water Street, Kohlberg & Company, Carlyle Group Inc., Endeavor Capital, AEA Investors, Sverica Capital Management, Rockwood Equity, and Argosy Capital Group Inc.

Pavan Choudary

Pavan Choudary

Chairman,

MTaI

India is a natural ally for the Western countries, including Japan, and is emerging as one of the most attractive destinations for foreign players looking to invest in the healthcare space. The opportunities for global MedTech players to collaborate lie in R&D, healthcare worker skilling, harnessing India as the China+1 destination in Asia in manufacturing, conducting clinical trials, and striking academic partnerships.

Mergers and acquisitions

M&A has been and likely always will be a major driver of change within the medical technology industry. Consolidation through M&A has radically altered the MedTech OEM landscape since 2003. A case in point is that six of the top-30 companies in June 2003 are now no longer independent entities.

- Tyco Healthcare. Listed at No. 4 in 2003, Tyco Healthcare later became Covidien and is now part of Medtronic. Parts of Covidien are now at Cardinal Health, courtesy of Medtronic. The world’s largest medical devices company sold its medical supplies business (within its Minimally Invasive Group) to Cardinal Health in April 2017 for USD 6.1 billion.

- Guidant Corp. With USD 3.2 billion in sales, Guidant ranked ninth on the list in 2003. Boston Scientific Corp. bought the company in early 2006 for USD 27.2 billion, outbidding rival Johnson & Johnson by nearly USD 9 per share. There were many reverberations of that acquisition, not the least of which was a breach of contract lawsuit from J&J, recalls, product liability suits, and a USD 600-million legal settlement with J&J.

- Kodak Health Imaging. Kodak is one of the best-recognized names/brands in its field, at least for the (well) over-30 crowd. Kodak Health Imaging came in at number 14 on the list in 2003, with USD 2.1 billion in revenue. Toronto-based Onex Healthcare Holdings Inc. purchased Kodak’s Healthcare Group in early 2007 for USD 2.55 billion and renamed it Carestream Health. However, Carestream Health no longer makes it to the top-30 list, probably because portions of it was sold to Philips in 2019.

- Applera. Posting USD 1.6 billion in sales in 2003, Applera was listed at number 18. The company was comprised of the Applied Biosystems Group (Foster City, Calif.) and Celera Genomics Group (Rockville, Md.). By December 2006, Applera’s Celera Genomics Group dropped the Genomics from its name after acquiring full ownership of Celera Diagnostics, which was a joint venture with Applied Biosystems. Shortly after, Applera spun off its Celera Group as a separate company, completely detaching itself from the Applied Biosystems research instrument tool business. Celera, of course, is no longer on the top 30 list.

- St. Jude Medical. Tied with Applera at number 18 with USD 1.6 billion in sales in 2003, St. Jude Medical Inc. was sold to Abbott Laboratories in 2016 for approximately USD 25 billion. US anti-trust regulators okayed the deal once Abbott agreed to sell its Vado steerable sheath and St. Jude consented to selling its Angio-Seal and Femoseal vascular closure products to Japanese medical devices company Terumo for a combined USD 1.12 billion in cash.

- Dade Behring. Among the top 10 in-vitro diagnostic manufacturers (listed separately from the devices manufacturers) was Dade Behring, which ranked sixth with USD 1.3 billion in revenue in 2003, not too shabby, considering the company filed for Chapter 11 bankruptcy in 2002. By 2005, the company employed more than 6000 workers and had operations in 43 countries to serve more than 25,000 medical customers. In 2006, Dade Behring was the world’s largest clinical diagnostics firm.

The changing OEM landscape creates opportunities for private equity

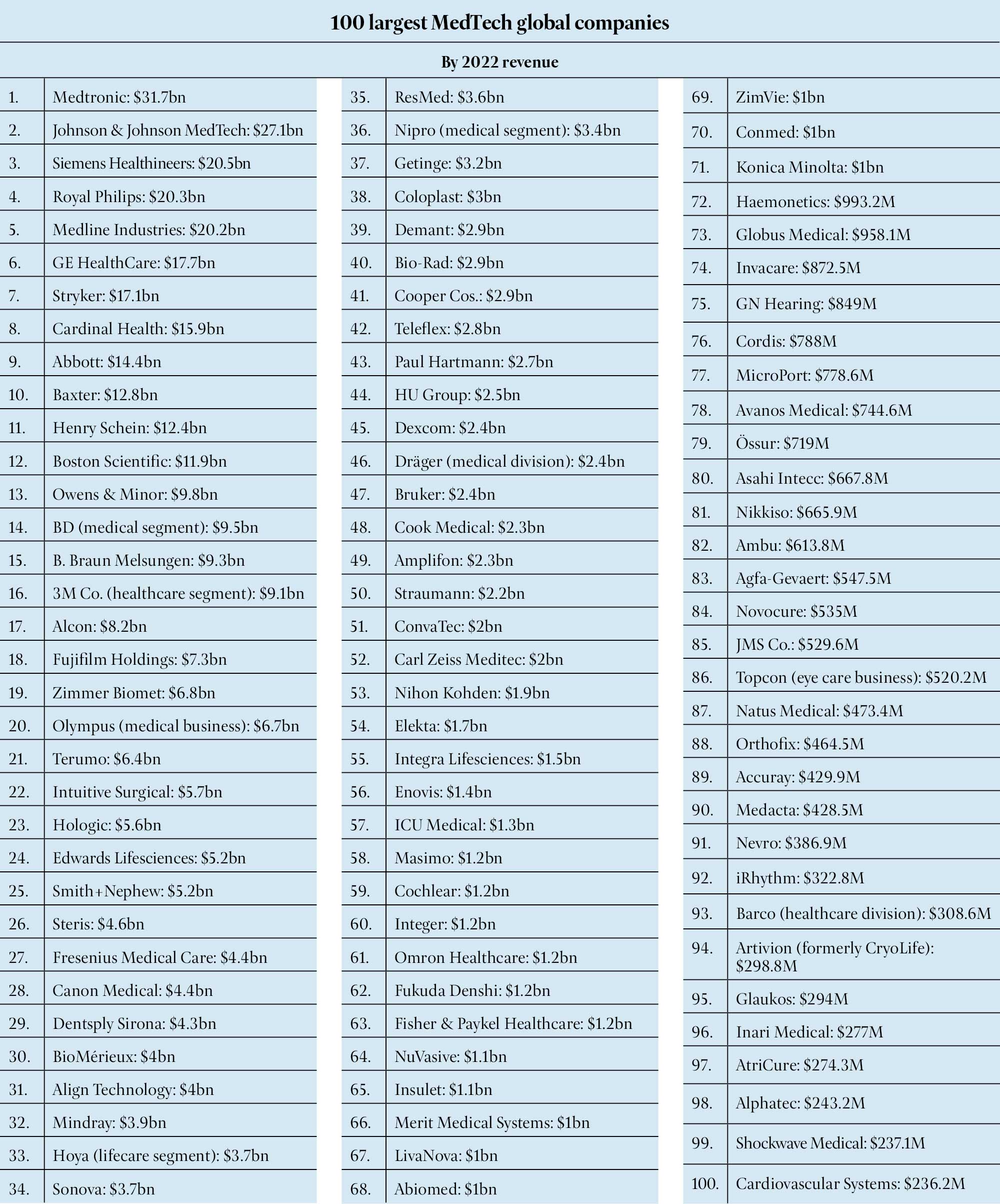

For years, MedTech original equipment manufacturers have been stratified between the large diversified players and their much smaller peers. In a list of the 100 largest publicly traded MedTech companies, Medtronic, No. 1 on the list with over USD 31 billion in revenue, is more than 130 times larger than Cardiovascular Systems, the No. 100 company. Historically, these larger OEMs have leveraged their scale to enable longstanding, sticky relationships with large health systems, and created broad product portfolios to meet those customers’ needs.

That said, the healthcare landscape is changing, and OEMs are adapting in several ways. Public MedTech companies cite several trends that are driving changes to their operations. These trends suggest ways for private equity to participate in MedTech in 2023 and beyond.

Much of the MedTech buyout activity from 2022 focused on OEMs that served niche applications, ranging from cardiology to med-aesthetics to dental imaging. Given the momentum behind this theme that carried into Q4, we expect to see continued opportunities for private equity sponsors to invest behind smaller OEMs serving end markets with favorable tailwinds.

OEMs are increasingly outsourcing parts of their value chains, from research to manufacturing. Contract manufacturing organizations and contract development and manufacturing organizations are poised to be bright spots as OEMs look to reduce the time and cost required to bring products to market, in addition to seeking out specialty manufacturing capabilities that OEMs typically lack.

As supply chains remain tangled, we anticipate continued appetite for assets that enable supply chain resilience. OEMs are interested in diversifying their supply chains to more regions, so suppliers outside of China may be particularly appealing.

The OEM-supplier consolidation over the past 20 years has been significant, and it is interesting that the majority of that behavior has been driven by the growth of private equity investments into MedTech. By some estimates, approximately 80 percent of privately owned (non-public) contract manufacturing organizations (CMOs) or contract design manufacturing organizations (CDMOs) belonged to private founder owners in 2010 and 20 percent were held by PE. Ten years later, that ownership ratio reversed itself. It has become more difficult for a PE to find a founder-owned MedTech OEM supplier business to purchase.

Arvind Sharma

Arvind Sharma

Partner,

Shardul Amarchand Mangaldas & Co.

The approval of the National Medical Devices Policy, 2023, by the Union Cabinet is a welcome step toward making India self-sufficient in the medical devices market. This provides an opportunity to boost domestic production of medical devices, and reduce the need for imports. The increased domestic production will also result in better local access, affordable prices, and a chance to innovate within the medical devices sector of the country. While providing a lucrative picture for the future of the medical devices sector, the policy embodies a framework that promises simultaneous efforts toward six core focus areas in the medical devices sector. This presents us with an extremely positive outlook for the medical devices sector in India, and one can hope to see exponential growth in the coming years.

Challenges abound

Pricing pressures. During the pandemic, OEMs and large suppliers of technology components required to launch new medical devices, and to sustain the lifecycles of the existing products raised their prices to historic levels, largely in response to supply chain challenges. Although the Covid-19 crisis has abated, the economic consequences of the pandemic continue to have a significant economic impact on medical devices companies.

Inflation in the US and many other countries has resulted in higher interest rates; increased costs related to capital, manufacturing, shipping, and labor; scarcity of some raw materials; and weakened exchanges rates against the US dollar. Pricing pressure on MedTech companies has also been driven by consolidation of healthcare providers, growth of governments as the primary payers of healthcare, and reductions in reimbursements and medical procedure volume levels.

This all means that it continues to be a seller’s market for suppliers and distributors of electronic components, including monitors, on-board PCs, servers, and scores of other peripherals.

Digital health startup funding is way down, consistent with headlines about Google shuttering many ventures. Amazon too has made some big plays in the space.

Rising interest rates and a flight to quality have hampered technology companies and their long-term view.

Also, we are coming to terms that healthcare is not really a scalable business. Fragmented integrated delivery networks with abysmal data-sharing protocols, payers who follow patients only for a few years, hospitals whose episode of care is over when the calendar is changed, and doctors whose patient load seems devilishly designed to minimize personalization makes healthcare local.

When it comes to innovation, the procedure is getting more focus than the product, robotics being a perfect example. Million-dollar capital equipment and enormous development programs – all dedicated to making a procedure more repeatable, faster, easier to train, or less exhausting to perform. But at the end of the day, the implantable really is not that different. Visualization and video capture are another example of how the fundamentals are not different, but the promise comes in the improvement of the procedure.

China has been an uninterrupted success story. 2023 is the year when the unfettered ambitions and unmitigated growth story of China has been clobbered by volume-based procurement. Companies are breaking out China from the rest of Asia because the financial impact is large enough to hide positive signals from the rest of the region. Even looking at some of the more important recent growth drivers in the global market (such as soft tissue robots and structural heart), China already has a robust market of incumbents before western multinationals even enter. So in 2023 we must come to grips with the moderation of the China dream.

There is one other thing worth mentioning. While the impact of China on the home markets of many Western multinationals does not appear to be enormous, there is a mounting competition for the rest of Southeast Asia. While firms are starting to internalize the impact of losing the China market, the impact on the rest of the Southeast Asia market is underappreciated.

But despite these challenges, rebounds are likely on the horizon. The innovation revolution of virtual care presents significant opportunity to MedTechs. The accelerated acceptance of home-based care was largely due to Covid-19, but flexible care delivery offers many benefits. MedTech companies can serve vulnerable populations, increase detection of underdiagnosed diseases, and deliver better outcomes. Additionally, rethinking commercial models and redesigning supply chains provide the chance to market devices in a new way and ensure that there will be less disruption in the future. Supply chain transformation will be another priority for the sector. The disruption to supply chains during the pandemic continues to affect the industry, with the shortage of semiconductor chips, and the rising costs of raw materials and labor representing ongoing challenges that MedTechs will need to address as they plan their growth strategies for the future.