Industry

2019 – Shaping the future of MedTech

The adage, what goes up, must come down, is not likely to apply to the global healthcare sector in 2019. Aging and growing populations, greater prevalence of chronic diseases, exponential advances in innovative, but costly, digital technologies—these and other developments continue to increase healthcare demand and expenditures.

The adage, what goes up, must come down, is not likely to apply to the global healthcare sector in 2019. Aging and growing populations, greater prevalence of chronic diseases, exponential advances in innovative, but costly, digital technologies—these and other developments continue to increase healthcare demand and expenditures. Healthcare stakeholders—providers, governments, payers, consumers, and other companies/organizations—struggling to manage clinical, operational, and financial challenges envision a future in which new business and care delivery models, aided by digital technologies, may help to solve today’s problems and to build a sustainable foundation for affordable, accessible, high-quality healthcare. This vision may have a greater probability of becoming a reality if all stakeholders actively participate in shaping the future— by way of shifting focus away from a system of sick care in which we treat patients after they fall ill, to one of healthcare which supports well-being, prevention, and early intervention.

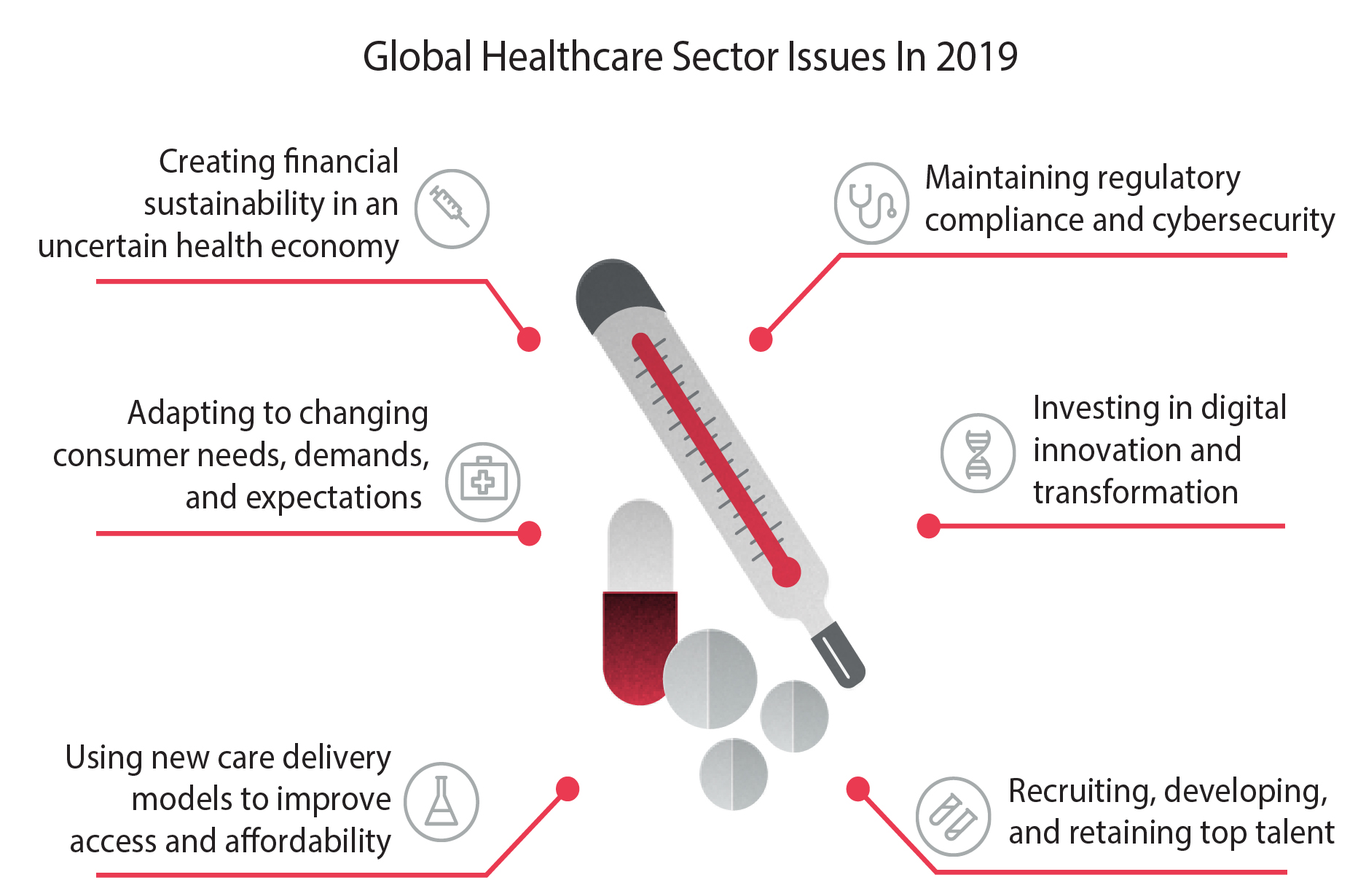

Healthcare sector issues in 2019

Creating financial sustainability in an uncertain health economy

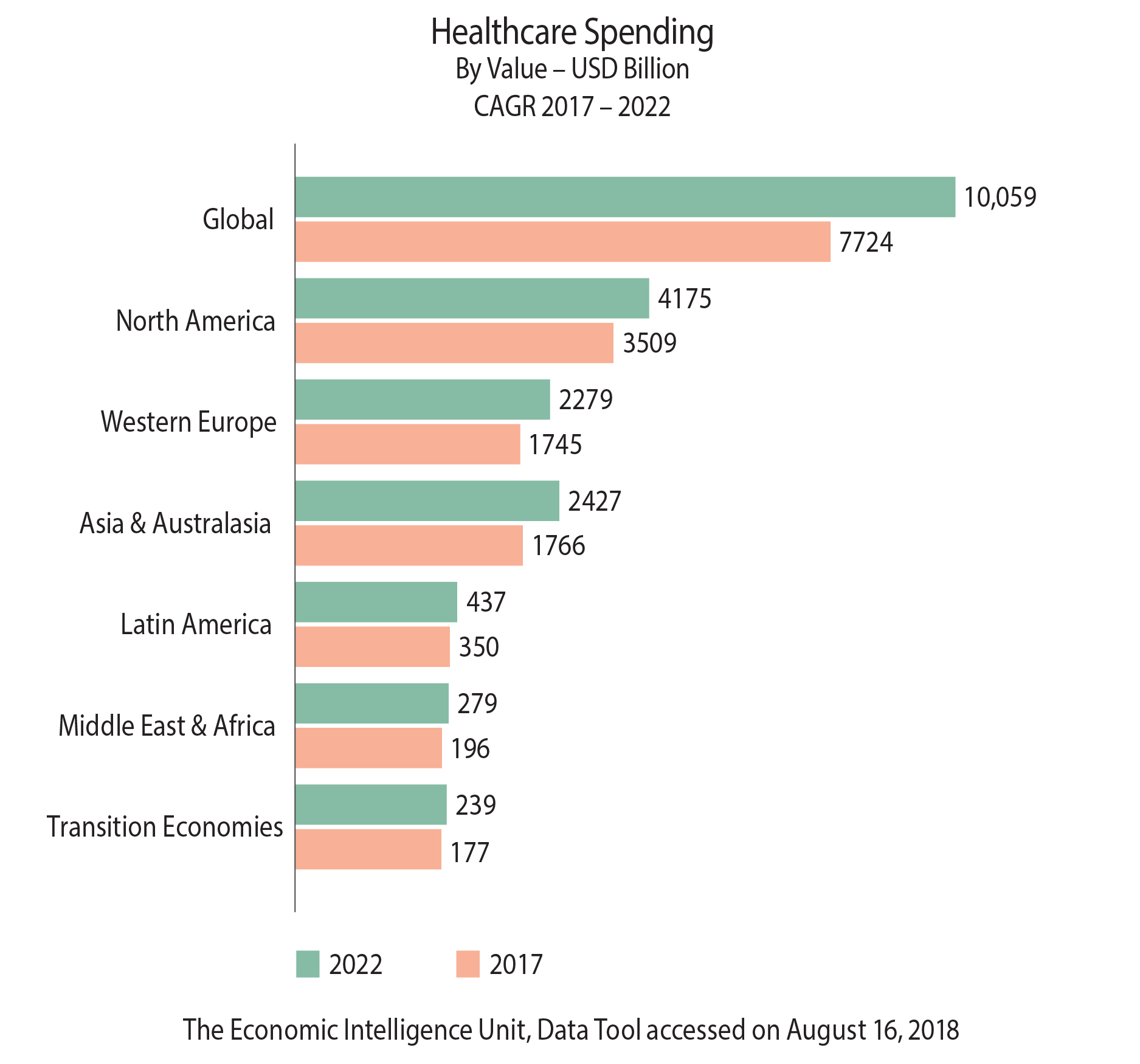

Global healthcare expenditures are expected to continue to rise as spending is projected to increase at an annual rate of 5.4 percent between 2017-2022, from USD 7.724 trillion to USD 10.059 trillion. The emergence of personalized medicine, increased use of exponential technologies, entry of disruptive and non-traditional competitors, the demand for expanded care delivery sites, and revamped payment and public funding models are all impacting the financial performance of the healthcare ecosystem. The healthcare market is looking to health technology for help, along with mergers, acquisitions, and partnerships. Stakeholders are also exploring alternative revenue sources such as vertical integration. Will approaches to well-being hold financial answers for the future?

Stakeholder considerations

Shrinking margins and rising costs are driving public and private health systems to use technology innovations, M&A, and other partnering arrangements to improve operational efficiencies and reduce expenses; however, doing so can be complicated by price controls, misaligned incentives, and disruptive market entrants. Yet there are ways to shape a more positive fiscal future. Governments that leverage private sector strengths in cost-efficient operations, through public-private partnerships and other collaborations, could help bolster underfunded and/or underperforming public health systems. Also, positioning requested investments in prevention and well-being as providing benefits in terms of economically active citizens and improved GDP may register more favorably with government treasury departments. Healthcare providers that stress rigorous financial management, efficient operational performance, outcomes-based care, and innovative solutions development (e.g., moving certain procedures to outpatient settings) could improve care provision, reduce costs, counter declining margins, and align their cost structure and care models with reimbursement trends and payment models, respectively. Health plans that focus on affordability and create differentiation through innovation (i.e., member-focused digital service offerings) could reduce the cost of care provided to members and maintain strong margins. Providers and payers that embrace new business care delivery and risk models could offset the disruptive potential of powerful market entrants and emerge as leaders in the new ecosystem of affordable healthcare solutions. One suggestion is to learn from industries outside of healthcare, where we see technological and business process innovations that are applicable in a healthcare setting. For example, the use of robotic process automation to improve claims time without overtime or increased staffing is growing. Also, some offshore vendors handling healthcare providers’ revenue cycle processes are replacing full-time equivalent (FTEs) employees with bots. While some leaders may be reluctant to change the status quo, assessing and taking risks will be an important part of shaping a more sustainable global healthcare system.

Using new care delivery models to improve access and affordability

Moving from volume to value will require building an outcomes-based financial model and data infrastructure to maximize value-based

care (VBC) reimbursement pathways, which will likely be fundamental to many health systems’ sustainable growth. This shift is the most apparent in the United States, where the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) provisions will see payment adjustments and incentive payments take effect in 2019. Clinical innovations, patient preferences, and government program payment policies are prompting hospitals to shift certain services to alternative points of care and even to virtual environments that benefit from a cost and access perspective. It is also being seen that social determinants of health often have agreater impact on health outcomes than does healthcare.

Stakeholder considerations

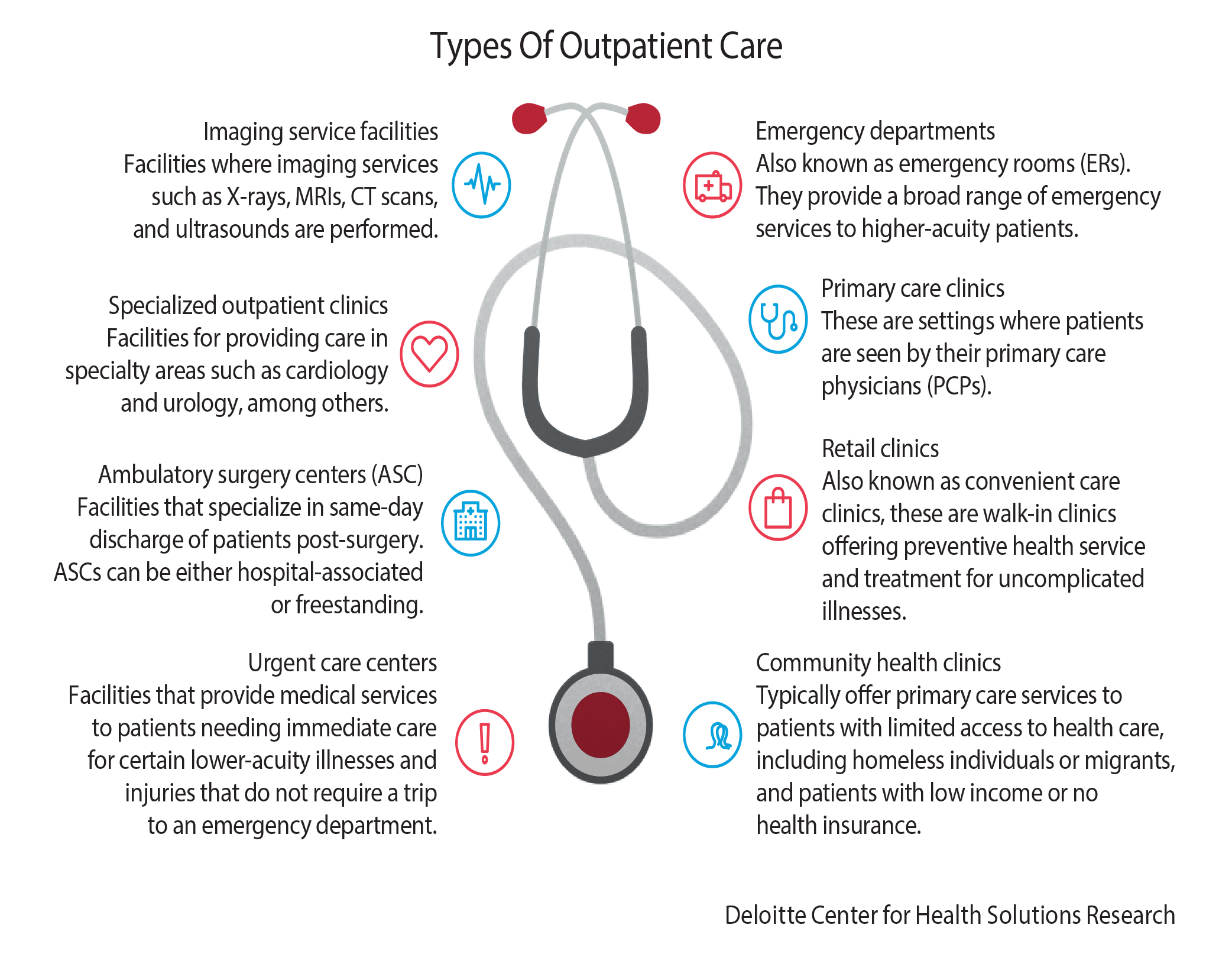

It appears that it is time to hit refresh on healthcare financing and operational models if we intend for the system to be sustainable for future generations. Clinging to fee-for-service as the basis for provider reimbursement could burn a deep hole in any country’s budget, as the cumulative costs of managing elderly and chronic disease patients are simply too high for individuals, governments, and payers to bear. Similarly, continuing to use hospital facilities to conduct low-risk, routine surgeries drives up costs for payers and patients. As they look beyond hospital walls to shape a more cost-efficient future, public and private health systems—especially those that receive a large portion of their revenue from value-based contracts—will likely need to expand outpatient services. Doing so may require investments in facilities, staff, and technology to grow capacity and infrastructure for outpatient services. A good place to start is partnering with or acquiring healthcare organizations and physician networks that already have the capacity (e.g., ambulatory surgery centers, outpatient clinics, and retail centers) and people to support care in outpatient settings and grow the volume of services performed there. Upgrading health information technology (HIT) also may enhance outpatient capabilities: Health systems can use case management, supported by analytics, to help decide which care setting is the most effective, safe, and efficient for a patient’s procedure. Adopting a whole-system, whole-life approach to funding and delivering healthcare likely increases the potential to reduce costs, boost quality, and improve access and affordability—if all members of the health care ecosystem unite behind the common goal of long-term sustainability.

Adapting to changing consumer needs, demands, and expectations

Patients and caregivers, dissatisfied with poor service and lack of transparency around price, quality, and safety, are expecting healthcare solutions that are coordinated,  convenient, customized, and accessible. With healthcare becoming “shoppable” and increased costs for patients in a cost-sharing model, enhancing the patient experience is a potential area for dramatic change. Non-traditional companies from consumer, retail, and technology sectors are also making forays into the healthcare value chain with solutions that are disrupting the norm. As preventative health takes a greater role, “nudging’ is increasingly seen as an option to help with patient adherence.

convenient, customized, and accessible. With healthcare becoming “shoppable” and increased costs for patients in a cost-sharing model, enhancing the patient experience is a potential area for dramatic change. Non-traditional companies from consumer, retail, and technology sectors are also making forays into the healthcare value chain with solutions that are disrupting the norm. As preventative health takes a greater role, “nudging’ is increasingly seen as an option to help with patient adherence.

Stakeholder considerations

As healthcare becomes more shoppable and consumers increasingly pay a larger percentage of their care with their own money, enhancing the patient experience is regarded as a potential driver of hospital performance. Hospitals’ reimbursements are increasingly tied to quality performance metrics that capture the patient experience as well as clinical outcomes, and many public and private payers have begun to recognize patient experience as a core element of quality. Being patient-centered and taking steps to engage patients in their own healthcare is not simple, but it is seen as an industry imperative. Organizations should understand how consumer behaviors and expectations are transforming care delivery and adopt a more consumer-driven, retail mindset and approach—with a focus on greater convenience, service, and support. Again, women use their family and social networks to recommend services and physicians, yet health systems do not routinely take this into consideration when planning their engagement strategies. Both providers and payers may need to re-orient themselves around greater transparency—of costs, quality, processes, and services. Organizations also should more effectively communicate the value of products and services in a way that helps consumers compare cost and quality information and enables them to make confident decisions about healthcare in a manner that more closely mimics alternative purchasing and customer service models like retail. Given the new emphasis on patient experience as a core element of care quality and value, health systems should consider investing in the tools and technologies to better engage patients and enhance the patient experience. Also important is delivering educational insights to inform patient decision-making and behaviors. Possible solutions include medical information and pharmacovigilance, nursing educational support, and between-visit care.

Investing in digital innovation and transformation

There is an exponential increase in the pace and scale with which digital healthcare innovations are emerging. Digital technologies are supporting health systems’ efforts to transition to new models of patient-centered care and helping them develop “smart health” approaches to increase access and affordability, improve quality, and lower costs. From Blockchain, RPA, cloud, artificial intelligence (AI), and robotics, to the internet of medical things (IoMT), digital and virtual reality are just some of the ways technology is disrupting healthcare. These technologies are helping with diagnosis and treatment, helping with speed, quality and accuracy, and improving the patient experience.

Spotlight on digital health innovations

AI and robotics. Artificial Intelligence, the theory and development of computer systems able to perform tasks that normally require human intelligence, is anticipated to transform healthcare by performing clinical and business tasks currently performed by humans with greater speed and accuracy, and by using fewer resources. AI can provide decision support  and practitioner assistance for tasks such as diagnosing patients and spotting disease outbreaks earlier; accelerating the development of new drugs and devices; and streamlining middle- and back-office functions such as making physician referrals, coding patient pathways, and approving claims. It is important for healthcare stakeholders to realize that AI techniques are designed to support and augment workers and not replace them, allowing highly trained resources to focus on more valuable, patient-facing activities. For instance, robotics could improve drug compounding preparation, decontaminate and sterilize medical equipment, and reallocate personnel resources to more high-value areas (e.g., allow nurses to spend more time directly with patients). Driverless cars could take patients to their appointments, improving continuity of care. Drones could pick up medication that an elderly patient may have dropped on the floor. Robotic applications in pharmacies and surgery are being used today, though the full potential of the technology has not yet been reached. AI and robotics applications are still at the early-adoption stage among healthcare stakeholders and patients. Increased uptake may depend on innovators’ ability to reduce cost and improve the accuracy of technologies such as natural language processing, big data, and cognitive technologies; and healthcare professionals’ and patients’ acceptance and trust of the new tools.

and practitioner assistance for tasks such as diagnosing patients and spotting disease outbreaks earlier; accelerating the development of new drugs and devices; and streamlining middle- and back-office functions such as making physician referrals, coding patient pathways, and approving claims. It is important for healthcare stakeholders to realize that AI techniques are designed to support and augment workers and not replace them, allowing highly trained resources to focus on more valuable, patient-facing activities. For instance, robotics could improve drug compounding preparation, decontaminate and sterilize medical equipment, and reallocate personnel resources to more high-value areas (e.g., allow nurses to spend more time directly with patients). Driverless cars could take patients to their appointments, improving continuity of care. Drones could pick up medication that an elderly patient may have dropped on the floor. Robotic applications in pharmacies and surgery are being used today, though the full potential of the technology has not yet been reached. AI and robotics applications are still at the early-adoption stage among healthcare stakeholders and patients. Increased uptake may depend on innovators’ ability to reduce cost and improve the accuracy of technologies such as natural language processing, big data, and cognitive technologies; and healthcare professionals’ and patients’ acceptance and trust of the new tools.

Digital reality. DR is the umbrella term for augmented reality (AR), virtual reality (VR), mixed reality (MR), 360-degree, and immersive technologies. Immersive describes the deeply engaging, multisensory, digital experiences that can be delivered using DR. As with many new digital capabilities, these technologies made their first inroads in the consumer world as forms of gaming and entertainment. Now they are reaching a tipping point at which enterprise and organizational adoption are beginning to outpace entertainment uses. Initial barriers in technology, cost, and content are beginning to fall, and early adopters are already hard at work creating solutions to help transform healthcare. Among providers, the use of AR and VR is currently focused in several discrete areas. For patients, these technologies can speed education about conditions or treatment plans. They can even be therapies themselves when used in visualization and relaxation exercises. Applications in opioid addiction therapy, phantom limb treatment, phobia therapies, cancer therapy planning, peri-operative planning, post-traumatic stress disorder, and general pain management are some established examples. DR tools can be used to help maintain mental acuity through participation in situations that limitations such as physical mobility may otherwise make difficult, and some VR-based therapies are beginning to appear as ways to help Alzheimer’s disease patients improve their memory. In the clinical setting, AR and VR can help physicians and care teams at the point of care. For example, surgeons can use a heads-up display to provide a data overlay on the patient’s body during surgery or to visualize the entire procedure during pre-surgical planning. Combined with medical imaging, AR is beginning to provide clinicians with the ability to project medical images, such as CT scans, directly onto the patient and in alignment with the patient’s body—even as the person moves—to provide clinicians with clearer lines of sight into internal anatomy. In the educational setting, curricula across undergraduate, graduate, and continuing medical education programs and institutions are increasingly incorporating AR and VR enablement.

Internet of medical things. The rise of the IoMT is being fueled by an increase in the number of connected medical devices that can generate, collect, analyze, or transmit health data or images and connect to provider networks, transmitting data to either a cloud repository or internal servers. Importantly, the IoMT generates intelligent and measurable information to help improve the speed and accuracy of diagnostics and target treatments more efficiently and effectively. It enables remote clinical monitoring, chronic disease and medication management and preventive care, and it supports people who require assistance with daily living, like the elderly and disabled, to live independent lives for as long as possible. IoMT also has the potential to lower costs, improve efficiency, and deliver better patient outcomes.

Stakeholder considerations

Digital technologies are supporting health systems’ efforts to transition to new models of patient-centered care and smart health approaches to drive innovation, increase access and affordability, improve quality, and lower costs. Digital solutions also have the potential to enable better use of health data in research and innovation to support personalized healthcare, better health interventions, and health and wellness services. Increasing health system digitization does have some challenges to overcome— among them, solving interoperability issues and risks around connected devices; standardizing disparate systems and processes; and taking pilot models to scale to facilitate system-wide adoption. Health systems and payers also need to be careful not to hard-wire in (possibly erroneous) analytics-generated assumptions about data patterns that supposedly indicate how different populations should be treated in an integrated healthcare model. Adopting many of these innovations requires capabilities that fall beyond the traditional purview of healthcare organizations. Healthcare leaders should consider building ecosystems that embrace non-traditional players and sources of knowledge outside their own four walls. Cross-sector and cross-industry partnerships and joint ventures can help minimize capabilities gaps (e.g., technology development, data capture, or patient engagement), achieve connectivity at scale, and ensure the effective transmission, aggregation, analysis, and management of data from connected devices. Such collaborations could allow all stakeholders to improve their understanding of patient needs and deliver more proactive, cost-effective care.

Maintaining regulatory compliance and cybersecurity

As data is becoming the new healthcare currency, protecting it will be key. Clinical innovations, connected medical devices, and market complexity have amplified the continued need for evolving government policies, regulatory oversight, and risk management. The rapid growth of “consumptive” health services such as prescription drug pricing in the United States have recently received a lot of regulatory attention. Cybersecurity is another top concern to the industry. It is the huge volume of high-value data and growing demand for interconnected IT environments that make healthcare an attractive target for cybercrime.

Stakeholder considerations

Managing the impact of new and changing healthcare regulations requires that organizations public and private, large and small, take a proactive, well-planned and collaborative approach to compliance. What is also critical—especially in the increasingly digitized and connected healthcare environment—is adopting a systematic approach to protect systems and data from cyber threats. While government policies and regulations seek to strengthen healthcare security and safety on a macro level, individual organizations should focus executive attention on compliance, ethics, and risk—and drive awareness throughout the enterprise. Many cyber incidents can be avoided if healthcare organizations invest in crisis management capabilities that make their cyber-diligence stronger, fitter, and better, such as establishing real-time monitoring, cyber-threat modeling and analysis, and threat mitigation and remediation. And since many hospitals, health plan, and government employees may lack awareness of and training to manage financial, operational, compliance, and cyber risks, staff education should be an important part of every risk management program.

Recruiting, developing, and retaining top talent

An aging workforce, rising demand for healthcare services, moral and well-being concerns are driving shortages of appropriately skilled healthcare staff in both developed and developing economies. But, there are different dimensions shaping the future of work. While automation is impacting a number of administrative processes, telehealth and digital medicine tools are enabling a “care anywhere” model. Organizations are building and deploying new staffing models, such as allowing nurses to work remotely, while still building strong patient relationships.

Stakeholder considerations

In technological terms, the future of healthcare is already here. But for many providers, payers, and governments, the plan for working in that future is still on the drawing board. How do organizations procure and sustain the new skills and capabilities they need? How do they recruit the right people, manage, and develop them? How do they support and guide the current workforce into the new reality of a digital world? All stakeholders should come together in an iterative process that integrates the views of service users, the current workforce, and their employers about the resources and skills required in the rapidly evolving healthcare environment.

New ways of working augmented by digital technologies can enable task-shifting and role enrichment to create a sustainable and flexible workforce that is able to respond efficiently and effectively to users’ needs. As each organization seeks to map out its own workforce strategy, it should adopt an exponential mindset: Each part of the workforce will evolve not along a single linear path, but in response to a collection of forces. Rather than fearing this wave of change as an overwhelming challenge, provider organizations should proactively seek out the opportunities for augmentation and automation in clinical workflows—and pinpoint where both clinicians and patients will benefit from an aligned financial reimbursement system, new technologies, innovative talent models, and expanded locations where care is delivered.

Way forward

This outlook envisions a future in which the global healthcare system is organized to keep people well—not just cure when they are ill; where technology-enabled care is available when and where people need it; where drugs and devices are personalized and based on an individual’s needs and situation; and where people understand the cost and impact of their options for care.

The opportunities to shape this future have never been more promising and abundant. But it will take participation, collaboration, and investment by all healthcare stakeholders—providers, governments, payers, and consumers—in 2019 and years to come to turn opportunities into realities.

This article is based on a report 2019 Global Health Care Outlook by Deloitte.