Industry

Pre-Budget Recommendations

With the Union Budget 2019-20 scheduled for February 1, 2019, the industry bodies are busy presenting their wish list to the finance ministry.

The MedTech industry has major expectations, as this is the last budget by the current government ahead of 2019 general elections.

Federation Of Indian Chambers Of Commerce And Industry

FICCI in its pre-budget memorandum has made some recommendations for the healthcare sector. These include:

Long term financing option for healthcare sector. Healthcare was included in the harmonized master list of Infrastructure sub sectors by the Reserve Bank of India in 2012. This includes hospitals, diagnostics, and paramedical facilities. Also, IRDA has included healthcare facilities under social infrastructure in the expanded definition of infrastructure facility. In spite of this, long-term financing options are still not available for healthcare providers. The Ministry of Health and Family Welfare needs to work out a solution along with the Ministry of Finance to provide long term financing to the healthcare sector. This will channelize funds from the banking sector to create necessary healthcare infrastructure and enable development of innovative long-term financing structures for healthcare providers. It will also help in creating an attractive environment for domestic production of medical equipment, devices and consumables as well as catalyzing research and development. Also, the savings that hospitals accrue could be ploughed back to expand hospital bed capacity and facilities which would assist in improvising healthcare services and bed to patient ratio in the country. There is need for long term financing options for the healthcare sector, as provided to the other sectors accorded with the Infrastructure Status. Also, healthcare sector should be accorded National Priority status.

Interest subsidy on loans. Healthcare is a capital-intensive industry wherein very few players are able to generate decent returns. High upfront investment coupled with low price realization from the patients makes the gestation period of the projects extremely longer. It is accordingly recommended that an interest subsidy should be given to make investments attractive.

Provide capital subsidy on investments. Land prices are rising at a tremendous pace and it is exorbitant in the prime location of city. This escalates the project cost and makes it unviable. A subsidy on capital investment would reduce the upfront investment and help generate positive returns faster. Accordingly, capital subsidy for acquisition of land and construction of hospitals should be provided.

Provide specific funds within health sector. Access to funding by creating a specific fund for healthcare infrastructure and innovation would facilitate access to capital for the industry. These funds would encourage entrepreneurship and newer business models which are the need of the hour for improving access, availability and quality, especially in Tier II, Tier III and rural areas. The government should provide the seed capital for such a fund. The government should set up a Health Infrastructure Fund and a Medical Innovation Fund.

Provide for liberalized FDI regime for investments in medical education. There is a strong need for a liberalized FDI Regime for investments relating to medical education and training to bridge the huge demand-supply gap and meet global norms. Healthcare organizations should be allowed to leverage FDI for setting up colleges and training centers for healthcare professionals and for specialist training.

Set up health infrastructure fund and medical innovation fund. Access to funding by creating a specific fund for healthcare infrastructure and innovation would facilitate access to capital for the industry. These funds would encourage entrepreneurship and newer business models, which are the need of the hour for improving access, availability and quality, especially in Tier II, Tier III, and rural areas. The government should provide the seed capital for such a fund. It is recommended that the government should set up a Health Infrastructure Fund and a Medical Innovation Fund.

Provide import duty relief for lifesaving equipment. There are several anomalies involved in the current classification of lifesaving equipment leading to variations in import duties for similar set of products. Hence in such cases, there is a need to revisit the classification in order to make the import duty on lifesaving equipment consistently low or even exempt lifesaving equipment from duty completely to ensure lower cost of healthcare services delivery to the common man. Tax incentives could be provided to domestic manufacturers of medical devices. The Indian market would be more attractive to global manufacturers once tax rates are liberalized along with measures taken to improve ease of doing business.

Medical Technology Association of India

MTaI represents leading research-based medical technology companies with a large footprint in manufacturing and training in India. It expects the government to streamline tax and duty structure in Union Budget 2019-20 to ensure people get long-term access to quality medical devices.

Since 2017, the government has taken various measures to curb the price of medical devices. Price ceiling has been imposed on devices like stents and knee implants, while only a limited 10 percent annual price increase is allowed for other non-scheduled products. This is so, irrespective of cost challenges the manufacturers encounter during the year. In addition to this, the dual effect of the weakening of currency and inflationary trends have created an extraordinary situation and the medical device companies are finding it difficult to sustain the supply of medical devices in the present situation.

Meanwhile, the high custom duties levied on medical devices have created a cascading incremental effect on the landed cost of medical devices and is a major concern for the medical device industry. Approximately 70 percent of medical devices are imported into India to meet the rising demand for quality healthcare.

The issues that need to be addressed in the budget this year includes:

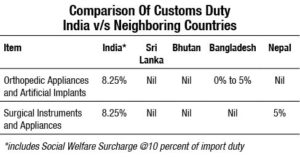

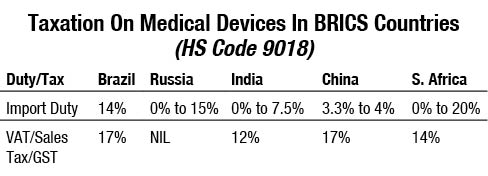

High custom duties. The high custom duties have adversely impacted the costs of products in India which contradicts the government’s efforts to provide low cost healthcare available to masses through the Ayushman Bharat program (PMJAY). We seek reduction of custom duties to 2.5 percent including all surcharges. Additionally, since the custom duty regime on most medical devices in neighboring countries of Nepal, Bangladesh, Sri-Lanka, and Bhutan is lower than in India, the duty differential could lead to smuggling of low-bulk-high-value devices. The result will not only be a loss of revenue for the government but also the patient will be beset with products which are not backed by adequate legal and service guarantees. Another point to note is that China, which has near self-sufficiency in segments like consumables, had reduced custom duties from 4 percent to 3.3 percent to avoid the problem of smuggling and to inject competition in the sector.

Customs duty and GST on spare parts. Customs duty on spare parts of the medical equipment is currently charged at a higher rate than the equipment itself. For example, heart-lung machine attracts basic custom duty of 7.5 percent and GST of 12 percent whereas its spare parts like roller pump attract basic customs duty of 10 percent and GST of 18 percent. Similarly, GST on contact lenses is 12 percent, whereas the contact lens solution which is the essential part of using contact lenses attract 18 percent GST. We recommend that the same customs duty and GST should be charged on spare parts and medical equipment.

Customs duty and GST on spare parts. Customs duty on spare parts of the medical equipment is currently charged at a higher rate than the equipment itself. For example, heart-lung machine attracts basic custom duty of 7.5 percent and GST of 12 percent whereas its spare parts like roller pump attract basic customs duty of 10 percent and GST of 18 percent. Similarly, GST on contact lenses is 12 percent, whereas the contact lens solution which is the essential part of using contact lenses attract 18 percent GST. We recommend that the same customs duty and GST should be charged on spare parts and medical equipment.

Tax holiday for R&D. Tax holiday should be provided to medical device R&D centers under the Transfer Pricing Act to boost investment in setting up in-house R&D capabilities. We also seek tax incentives for the industry for developing global patents from India and tax deduction on income made by individuals or a company for rewards earned on patent development or patent licensing.

Minimum alternate tax. We urge the government to reduce the Minimum Alternative Tax (MAT) rate to 15 percent from the present effective rate of 21.34 percent (including surcharge and education Cess). The high rate of MAT has cast a substantial burden on companies which are already affected by various external factors. Conceptually, MAT is a minimum and an alternate tax and hence it should not be at a rate, which is more than 50 percent of the basic corporate tax rate.

GST on trials and samples. GST should not be charged on trials and samples as doctors need samples/free trials/demos in order to satisfy themselves on the efficacy of the product in the best interest of patients. Cost of trials is already built into cost structures and is a business expense.

GST on healthcare services. Healthcare services are currently exempt from GST. As a result, hospitals are not able to claim GST input. This results in higher cost of treatment for the patient. Once zero-rated, hospitals will be able to avail GST credit on inputs, leading to lower healthcare services cost.

Expenditure on CSR. Expenditure on CSR is being disallowed in tax computation. CSR expenditure has been mandated under law and therefore should be claimable as tax-deductible expenditure.

Tax incentives on exports. Currently, there are no tax benefits on export income. Export being a growth engine for the economy it is important that efforts should be made to make it competitive in the international market. India’s export performance in the last 2-3 years has been on a decline, which impacts the balance of trade. Introduction of export incentives related to direct tax exemption for the export profits would attract more investments to sectors like medical devices.

Association of Indian Medical Device Industry

AiMeD expects the government to address the issue of India’s import dependence on medical devices.

Its recommendations include:

“Reasonable tariff protection for enabling make in India. To promote domestic medical device industry that will subsequently reduce India’s heavy reliance on import the current basic import tariff of 0-7.5 percent needs to be over 15 percent for medical device (the Bound Rate under WTO is 40 percent Duty) and concessional duty on raw material may be retained at 2.5 percent for now, for next 3 years. After GST, imported devices are cheaper by 11 percent and at times we are unable to compete with Chinese import in government tenders. In other countries like Iran as soon as a factory is put up, they support domestic product with import restrictions and duty protection.

The level playing field for domestic manufacturers. If the government can boost manufacturing of mobile phone and consumer electronics by levying 15 percent to 20 percent duty and for automotive, bicycles and motorcycles, we request for the medical device, which is even more important similar tariff protection clauses.

Unless the Indian manufacturers get level playing field and visible benefit to manufacture in India in comparison to the imports, nobody will venture out to this tedious job of putting together men, machine and capital for manufacturing of medical device in India to make quality healthcare affordable to common masses which is a dream and mission of Prime Minister Narendra Modi.

The heavily import-dependent medical device sector got a huge shock after implementation of Goods & Services Tax (GST). Earlier, the domestic manufacturers were getting CENVAT input credit (6.45 percent CVD+ education cess & 4.57 percent SAD+education cess) on the basis of manufacture and traders/importers were not getting CENVAT input credit. In GST regime, there was no difference between manufacturer and trader/importer.

Simply, anybody whether he is a manufacturer or trader/importer can get GST input credit on the basis of supply. Comparatively, trader/importer became beneficial to the extent of 11 percent and the manufacturer did not get this advantage and loss further competitiveness to imports. This is nothing but further disenchantment to the manufacturer for manufacturing the medical device in India.

If we compare other large developing countries, i.e., BRICS countries, we will find that India is possibly levying the lowest import duty on medical devices.

If we compare other large developing countries, i.e., BRICS countries, we will find that India is possibly levying the lowest import duty on medical devices.

Earlier Department of Pharmaceuticals (DoP) had consented to AiMed’s tariff rationalization proposal and forwarded the same to the department of revenue for consideration. In budget (Finance Bill) the custom duty was increased from 7.5 percent to 10 percent but the same day in the evening, the notification stated it at 7.5 percent. DoP and Department of Industrial Policy & Promotion informed that the department of revenue is awaiting clarification/response from Union Health Ministry to DoP’s proposal. With the health ministry assurance of actively considering tariff rationalization proposal, industry expects a positive response”.