Infusion Pumps

Adapting delivery to meet new realities

The market for infusion pumps has been ever-growing pertaining to its developmental dynamics. The shift in technology, automation, and uniform dosing, as well as the widespread adoption of modern healthcare technology for improved healthcare services, are all major elements propelling market competition.

The infusion pumps have been in use for four decades, with their applications increasing steadily. The infusion pump market is largely fueled by the growing incidence of chronic diseases, like cancer and others, together with the increasing adoption of these devices, due to widening applications of infusion pumps. At present, infusion pumps are extensively used in diabetes management, chemotherapy, and several other applications. The growing prevalence of these diseases across the world is creating lucrative opportunities for the players operating in the market.

Rapid technological innovations are projected to encourage companies to develop more user-friendly and technologically advanced infusion systems. Companies are working on incorporating detailed drug libraries into pumps, as well as enabling multi-directional interoperability, and assuring the instrument’s and the patients’ data safety (better electronic health record management). These are supposed to help with drug management in a variety of scenarios.

In addition, the key players in the market are focusing on product launches, individual disease treatment procedures, and collaborations as key strategy to increase their market.

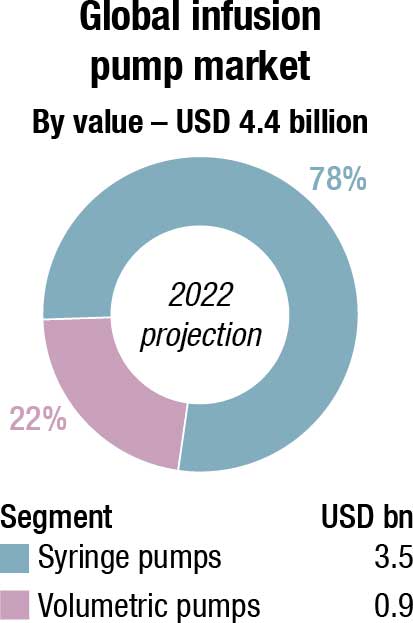

The global infusion pump market is projected at USD 4.4 billion in 2022, and is expected to reach USD 6.6 billion by 2030 at a CAGR of 5 percent, finds Future Market Insights (FMI). The growing incidence of chronic diseases, together with the rapid rise in the elderly population, increasing demand for ambulatory infusion pumps, and the rising volume of surgical procedures carried out around the world are the primary factors boosting the development of the infusion pump market. Moreover, increasing adoption of specialty infusion systems and growing demand for infusion pumps in the developing markets offer high growth opportunities for several players in this market.

Infusion pump market holds nearly 32.4 percent market value share of the USD 13 billion intravenous therapy market in 2021. In addition, the rapid advancement of technology in healthcare has resulted in increased health awareness.

As a result, the use of infusion pumps is expected to rise. Technology, safety features, and equipment shapes and sizes all contribute to the market’s growth.

Volumetric pumps are anticipated to hold a share of 22 percent in 2022, by product type, expanding at a rate of nearly 4.8 percent. Volumetric pumps have a broad range of applications in parenteral nutrition and disease management, due to which the market share of volumetric pumps is the maximum in comparison to other products. The simplicity, accuracy, and safety of these infusion pumps in the treatment of several therapeutic areas adds to the increasing demand for these pumps.

Presently, the volumetric pump segment is boosted by its advantages, broad applications, and growing use and increasing product launches in emerging and developed countries.

Furthermore, the demand for volumetric pumps is anticipated to grow globally, specifically in the South American and Asia-Pacific countries, due to their growing popularity and increasing focus of governments on the healthcare facilities.

Companies operating in the infusion pumps market are consolidating, with the presence of a few players. These players are involved in a number of strategic alliances.

The product launch and acquisition accelerate the manufacturer’s strategy to capitalize on the market share and capture a significant share of the market.

In March 2021, PromptCare acquired NBN Infusions, Inc., a New Jersey-based home infusion and respiratory therapy service provider. In this acquisition, PromptCare acquired all assets of NBN Infusions, Inc. This acquisition will help PromptCare to reinforce its market share in the Northeastern US.

In February 2021, Mindray Medical launched BeneFusion eseries – eSP, eVP, and eDS, new infusion systems – thereby expanding its product portfolio. In July 2020, Voluntis, a healthcare software company, and Biocon Biologics entered into partnership to develop and provide cutting-edge digital therapeutics, based on biologics therapy for aiding diabetes patients. In January 2020, Medtronic, Ireland, launched Efficio, networked with the SynchroMed II intrathecal drug delivery system.

Major players operating in the global infusion pump market include B. Braun Melsungen AG, CareFusion Corporation, Fresenius Kabi AG, Mindray Medical, Terumo Corporation, Medtronic Plc., Baxter International Inc., Smiths Medical, MOOG Inc., Johnson & Johnson Private Ltd., and Hospira, Inc.

A number of factors are restraining the demand for infusion pumps. Increasing number of product recalls and lack of skilled professionals and standard usage guidelines are the key factors restraining the market growth. Infusion pump is one of the most recalled medical devices owing to design deficiencies. Other errors linked with infusion pumps include alarm errors, software problems, insufficient user-interface design (human factor issues), battery failure, damaged components, fire, sparks, electric shocks, or charring. Faulty device design was accused for a large share of the recalls.

The impact of product recalls due to safety and efficacy issues on infusion pump sales is a major worry for device manufacturers. These recalls compel manufacturers to replace faulty infusion pumps with updated units and to compensate victims of significant injuries caused by mishaps. As a result, product recalls have an impact on the overall sustainability of the infusion pump market.

Lack of skilled professionals and standard usage guidelines is expected to hamper the market development. The lack of skilled professionals leads to errors while using the pumps, which in turn increases the risk of emergencies, thus, hampering the market growth.

In addition, infusion pumps are designed to deliver liquid medication and other solutions to a patient’s body, and are subject to rigorous standards and requirements to protect the health and safety of patients. The infusion pump market is regulated by various regulatory authorities, such as the US Food and Drug Administration (FDA), the Medicines and Healthcare Products Regulatory Agency (MHRA), and the European Medicines Agency (EMA) for the approval of new products.

In European countries, the CE mark certification is necessary to legally market and sell infusion pumps. Infusion pumps (non-implantable) are classified as Class-II b devices, and implantable infusion pumps are active implantable medical devices (AIMD). There are almost 300 UK-specific standards for medical devices.

The current process for developing new infusion pumps across several geographies is time-consuming and expensive. This is likely to hamper the growth of the infusion pump market in the coming years.

Impact of Covid-19 crisis on the market. The healthcare sector was one of the sectors, hit the hardest by the epidemic in 2020. Covid-19 patients’ case of emergencies and treatments pushed hospitals all over the world to their breaking point. The epidemic also brought to light regional disparities in access to medical care. The intense care of Covid-19 patients, in particular, posed a challenge to healthcare all around the world.

The pandemic had a significant impact on medical supply, medical devices, and pharmaceuticals manufacturers, with increasing demand for products intended to treat Covid-19 driving a ramp-up in production capacity. Many worldwide supply and value networks were disrupted by temporary export restrictions, making it difficult in obtaining the resources required for this operation.

Infusion pumps and ventilators, on the other hand, have been considered important devices because they are used in ICUs, CCUs, and emergency care.

In Covid wards, IV infusion seems to be a regular requirement. Infusion pumps have been used to control and dispense drug doses in hospitals and other emergency rooms, and because they can be regulated to do so without continual observation, they allow doctors and nurses to treat patients with minimal risk of infection. As a result, infusion pump demand increased dramatically in 2020 and infusion pump supply and distribution became a key concern.

Untapped, emerging markets and the growing adoption of specialty infusion pumps offer significant growth opportunities for players operating in the infusion pump market. However, increasing incidence of medication errors and lack of wireless connectivity in most hospitals are major challenges for the growth of this market in the coming years.

The US is estimated to account for around 88.5 percent of the North America infusion pump market in 2022. The dominant share of US can mainly be owing to the increased usage of specialty infusion pumps for the cure of chronic diseases, rising geriatric population, rising prevalence of chronic diseases, and the availability of several large hospitals in the country.

Germany is estimated to account for 15.4 percent of the European infusion pump market in 2022. Germany is expected to lead the market owing to the substantial rise in the prevalence of chronic diseases, such as gastrointestinal disorders and diabetes, growing popularity of infusion pumps in-home settings, and growing number of the up-coming players.

In addition, the development of the market is boosted by the factors, such as growing usage of insulin injection pens over conventional vials and syringes due to growing incidence of diabetes. Diabetes is a serious chronic disease with no particular cure. Occurrences and prevalence of diabetes is gradually growing in the country. As per the IDF (International Diabetes Federation), around 7.9 percent of the people in Germany suffer from diabetes – most of the patients have type 2 diabetes. The number of patients with diabetes is expected to grow considerably in the next two decades.

The infusion pump market in China is estimated to be worth USD 249.6 million in 2022 owing to rising disposable income, and increased patient awareness of infusion therapies. Additionally, the rising geriatric population and growing disease incidence are the major factors driving the market growth in the country. According to the latest report on the geriatric population, in 2020, around 264 million people are over 60 years of age and around 191 million people are over 65 years of age. The old-age population is frailer and more susceptible to diabetes, which is leading to the growth of the market in China. This can mean diabetes-associated complications are most common and difficult to manage, thus leading to growth of the market in China.

Demand for infusion pumps in India is expected to rise at around 7.8 percent CAGR over the next 8 years. The Indian market is anticipated to develop at a considerable rate owing to the surging adoption of specialty infusion systems, growing private-sector and government funding, and improving healthcare expenditure. Rapid advancements in technology is expected to favor companies to launch more user-friendly and technologically smart infusion systems. Furthermore, reimbursement value increases for private payers, if infusion therapy is done at home rather than at a hospital, as associated charges are less. This is expected to promote revenue growth from the home infusion end-user segment.

Technological advancements and emerging trends

Purushothama R

Purushothama R

Assistant Manager, R&D,

Skanray Technologies

Syringe infusion pumps are medical devices used to administer/infuse fluids such as medicines or nutrients into patients’ circulatory system.

The global market for infusion pump is growing at rapid pace. Factor influencing the growth of the market are; increased use of infusion syringe pumps for delivery of drugs and other fluids, increase in geriatric population, rising prevalence of chronic and fatal diseases, and majorly the technological advancement in device technology and efforts in innovating products to meet the safety of patients, with increase in the adaption of the device leading to broadening application of infusion pumps.

The Smart pumps, are the new generation syringe infusion pumps which mark the major stake in the rapid growing infusion pump market. This new technologically advanced and emerging trend syringe infusion pumps are built with many smart features. These pumps are equipped with pre-determined clinical guidelines, dose error reduction systems (DERSs), advanced program mode and drug libraries that provide a comprehensive list of medicines and fluids with dose, volume and flow rate details.

The new technologically advanced pumps are designed to address the programming error that traditional pumps are susceptible to by notifying a use, when there is a risk of an adverse drug interaction or when pump’s parameter are set outside of specified safety limits for the medication being administered. Clinical advisories provide information about medications within the administering facility’s drug library, including prompts for correct administration, which are pre-programmed into the pump by the facility or larger organization. Soft Stops notify user that a selected dose is outside of the anticipated range for a specific medication. These alerts can be over-ridden without changing the pump’s settings. Hard stops alerts the user that a dose is out of the institution’s determined range and prohibit the infusion from being administered unless the pump is re-configured.

The new advanced pumps are configured with all connectivity solutions which contribute their data to clinical information system. In turn, both CIS (Clinical information system) and HIS (Hospital information system) are connected to have complete data access. With central control facility, multiple pump data is readily available on the computer. This provides infusion details on the patient in real time. With the help of this monitoring system, nurses can plan their work at the nurse station. The central control facility provides complete information on even record, liquid balance, treatment history and complete patient details. This greatly reduces the work of medical staff on documentation activities.

In hospitals and operating rooms, medication mishaps were raising worry. More than half of all drug errors that result in patient harm happen during the administration phase. Clinical decision support technologies could now be integrated into the medicine delivery process, thanks to the introduction of smart infusion pumps. This dosage error reduction software (DERS) is found in the majority of infusion pumps on the market today and provides minimum and maximum alarms for dose, concentration, duration, and rate alerts. Mis-programming of pumps or typing errors can be avoided with this decision support.

Smart pumps have played a key role in reducing intravenous medicine administration errors, especially in terms of dosage for the most vulnerable patients. Smart pumps with drug libraries have increasingly gained adoption in acute care patient settings including the perioperative area.

In acute care patient settings, particularly the perioperative region, smart pumps with medication libraries are becoming more popular. They can also generate weight-based dosing regimens automatically and give a bolus dosage over a predetermined time interval.

The decision support capabilities of a dosage error-reduction system, which are made up of institution-specific ranges for each drug, are most crucial. When the programmed dose (or concentration or time of infusion) deviates from the preset minimal or maximal parameters, the user is notified.

As a result, smart pumps can provide real-time feedback, reducing medication infusion errors and improving patient safety. Smart infusion pumps have been found to prevent patient injury from injectable drugs, but to reap the full benefits of the technology, safety features must be ensured.

The infusion industry is constantly evolving as our healthcare system shifts to meet new demands. It is incumbent upon the infusion industry to ensure that it not only advances but focuses on the way in which care is delivered to provide better, safer, and more effective treatments.