Industry

On the road to recovery

The worst seems to be over for the hospitals and labs

The COVID-19 pandemic has shaken the very foundations of India’s healthcare system. The private healthcare sector, albeit concentrated in tier I and II cities, accounting for about 60 percent of inpatient care rose admirably to the occasion, providing all the support needed, including testing, isolation beds for treatment, medical staff, and equipment at government COVID-19 hospitals and home healthcare. This involved significant investments to prepare facilities for controlling and preventing the infection, building infrastructure for quarantine and treatment, and equipping the facility with suitable medical supplies and additional workforce. And it came at a price.

It eroded the revenue of the hospitals that reported losses in 2020-21. Quarter by quarter results revealed an absymal low in Q1FY20 (AMJ 2020), when the performance of hospitals was severely impacted due to postponement of elective surgeries and preventive healthcare, in addition to travel restrictions and curbs on COVID-19 treatment by private hospitals. In the second quarter the sector started functioning again, and by the third it had recovered completely, as elective surgeries and preventive healthcare treatment increased and COVID -19 treatments were permitted for most private hospitals. This helped limit the overall revenue decline, by Crisil estimates, to 12 percent for the full year.

2021-22 is expected to sharply better. Higher occupancy due to surge in COVID-19 cases, will help private hospitals post 15-17 per cent revenue growth this fiscal year, a shade higher than what they attained in 2020-21. The growth will aid recovery of operating margin by 100-200 basis points to 13-14 per cent, but still fall short of the 2020-21 mark due to higher proportion of COVID-19 treatments, which are less profitable.

“While the second wave lashed again in April 2021, the first quarter this fiscal has been sharply better on-year, with occupancy of 75 percent, almost double on-year. This is largely on account of a surge in COVID-19 treatments more than offsetting the deferral of elective surgeries and outpatient footfalls. As the second wave recedes in the second quarter, we expect pent-up demand for non-COVID treatments to rebound and support occupancies. Overall, higher occupancies of 65-70 percent this fiscal versus ~58 percent in the last, would drive rebound in revenue growth,”said Manish Gupta, Senior Director, Crisil Ratings.

Diagnosing COVID

Diagnosing COVID

Thomas John

Managing Director,

Agappe Diagnostics Ltd.

COVID-19 has been an eye opener to the IVD industry. The changes that it brought upon each of us had left us stunned and confused initially, but we have now accepted this as new the normal. The sudden and drastic changes that came with the pandemic made us all evaluate our position and make the needful changes to stay alive in this pandemic. With the onset of COVID-19, the drop in regular diagnostics tests due to the constraint of movement and lockdown had created a gap initially. However, this pandemic has created demand for various other segments.

The molecular diagnostic segment has gained prominence in this short span of time. We have witnessed a sudden increase in demand and diverted our attention to this segment. Our molecular diagnsotics segment was launched in May 2020 with the RNA extraction kit, Agappe Chitra Magna, developed under the knowhow from Sree Chitra Tirunal Institute of Medical Science & Technology, a step that made us relevant at the time. We have also developed the COVID-19 detection assay based on LAMP technology that proved to be quicker and more efficient in diagnosis compared to RT-PCR. Agappe has stood firmly on its vision to be the best partner of diagnostics, a vision that has developed our mantras of quality, innovation, and affordability, a trait visible in all our instruments. We have also made it a point to supply to the sudden surge in demand for the prognosis parameters. More than 30 million tests of D-dimer, Ferritin, and CRP were supplied to the market, supporting close to 80 percent of the total Indian demand. These activities have made us stay relevant in this pandemic era.

We at Agappe are preparing ourselves to provide a suitable solution for our nation for this COVID-19 crisis. We have recently been granted the manufacturing license for the rapid antigen test and the automated RNA extraction kit. As with these steps, we are paving the way to a faster and more accurate process for identification of the virus. A progressive step to curb the spread of COVID-19 by giving the accessibility to everyone for effective, quick, and reliable testing.

Higher occupancy should, in turn, drive recovery in operating margin as well, but remain short of the pre-pandemic level of 15 percent. Much of the revenue increase would be on account of COVID-19 beds, which can realise only 50-60 percent of average revenue per bed for non- COVID treatments, as state governments cap the charges. Additionally, hospitals have to pay higher incentives to para-medical and support staff amid the second wave of the pandemic. This will weigh on margins.

Says Rajeswari Karthigeyan, Associate Director, CRISIL Ratings, “Recovery in revenue and margins will nevertheless spur hospitals to resurrect capex, which had almost halved on-year last fiscal. Much of the CapEx this fiscal is expected to be brownfield in nature, towards bed addition and related infrastructure including oxygen plants, and funded significantly through accruals. The ₹50,000 crore liquidity window offered by the RBI to augment healthcare infrastructure is expected to help in this regard – the three-year loan tenure will suit brownfield expansions and low-cost funding will particularly help mid- and small-sized hospitals.”

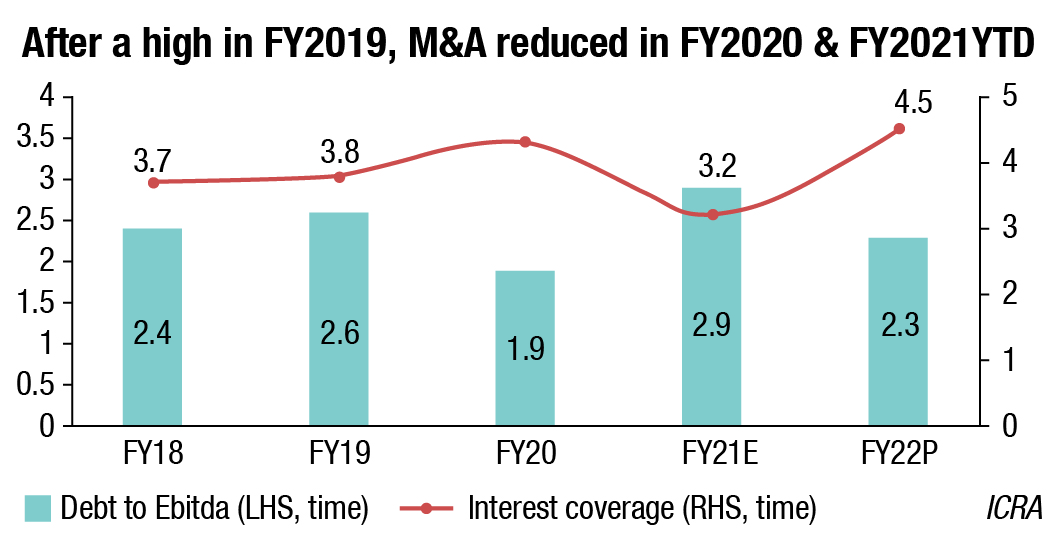

Backed by improved profitability, we expect to see better debt protection metrics after the temporary dent last year. Interest cover and debt to Ebitda ratios are seen improving to 4.5 times and 2.3 times from 3.2 times and 2.9 times, respectively, last fiscal – both reaching close to pre-pandemic levels. This would support stablecredit profiles.

This is based on the expectation of COVID-19 cases declining from the second quarter onwards, an intense third wave and stringent regulatory control over the cost of COVID-19 treatments will remain monitorables.

FINANCIALS

Fortis Healthcare. The company has reported total income of ₹4076.68 crore during the 12 months period ended March 31, 2021 as compared to ₹4684.96 crore for the last fiscal, a decline of 12.98 percent.

The company has posted net loss of ₹109.76 crore for the 12 months period ended March 31, 2021 as against net profit of ₹57.94 crore for the last fiscal, a decline of 289.44 percent.

The company has reported EPS of ₹(1.45) for the 12 months period ended March 31, 2021 as compared to ₹0.77 in the last fiscal.

The hospital business revenue for the year ended March 2021 were at ₹3124 crore versus ₹3754 crore for the previous fiscal, as a result of occupancy declining to 55 percent versus 68 percent in financial year 2020, primarily due to a weak H1.

The diagnostics business fared relatively better as compared to the hospital in 2020-21 as a result of increasing demand for COVID and non-COVID related tests, as also a faster rebound in non-COVID test volumes in the second half of financial year, October 2020-March 2021. The business recorded revenue of ₹306 crore, a growth of 32 percent despite the challenging environment. COVID contribution to business revenue stood at 23 percent for 2020-21. More importantly, the non-COVID business revenues have surpassed pre-COVID levels in the quarter.

| Financials–Hospitals Revenues (₹cr) |

||

| Hospital | Apr 2020-Mar 2021 | Apr 2019-Mar 2020 |

| Apollo Enterprise | 10,605.00 | 11,273.77 |

| Narayana Health | 2,610.52 | 3,151.57 |

| Fortis Healthcare Ltd. | 4,076.68 | 4,684.96 |

| MAX | 2,619.41 | 1,107.11 |

| Aster DM | 768.17 | 874.93 |

| HCG | 1,013.40 | 1,095.60 |

| Shalby | 439.95 | 504.22 |

| Profit after tax | ||

| Apollo Enterprise | 136.77 | 431.80 |

| Narayana Health | -714.30 | 118.91 |

| Fortis Healthcare Ltd. | -109.76 | 57.94 |

| MAX | -137.55 | 58.99 |

| Aster DM | -68.78 | 60.61 |

| HCG | -194.70 | -106.70 |

| Shalby | 42.36 | 27.59 |

The pandemic has seen a significant uptick in tele and video consults, and the diagnostics business has also witnessed a 2-to-3-fold increase in home collection revenues.

Narayana Hrudayalaya Limited. The company has reported total income of ₹2610.52 crore during the 12 months period ended March 31, 2021 as compared to ₹3151.57 crore for the last fiscal, a decline of 17.17 percent.

The company has posted net loss of ₹714.30 crore for the 12 months period ended March 31, 2021 as against net profit of ₹118.91 crore for the last fiscal, a decline of 112.03 percent.The company has reported EPS of ₹(0.70) for the 12 months period ended March 31, 2021 as compared to ₹5.86 for the last fiscal.

Max Healthcare Institute. The company reported total income of ₹2619.41 crore during the 12 months period ended March 31, 2021 as compared to ₹1107.11 crore for the last fiscal, an increase of 136.6 percent.

For the fiscal year ended March 2021, the company posted a loss of ₹137.55 crore as against a PAT of ₹58.99 crore in 2019-20, a decline of 333.18 percent.

Net debt during the quarter reduced by ₹1323 crore to ₹544 crore on account of net proceeds of QIP and cash flow from operations.

The company has reported EPS of ₹(1.59) for the period ended March 31, 2021 as compared to ₹1.01 for the period ended March 31, 2020.

Aster DM Healthcare. The company reported total income of ₹768.17 crore during the 12 months period ended March 31, 2021 as compared to ₹874.93 crore for the last fiscal.

During the financial year ended March 2021, Aster DM Healthcare’s consolidated net loss was 68.78 percent as against a PAT of ₹60.61 crore in 2019-20.

The company has reported EPS of ₹(1.38) for the period ended March 31, 2021 as compared to ₹1.21 for the last fiscal.

HealthCare Global Enterprises. Consolidated income from operations (revenue) was ₹1013.4 crore as compared to ₹1095.6 crore in the previous year, reflecting a year-on-year decline of 7.5 percent.

Operating EBITDA for existing centers was ₹142.3 crore, a decline of 6 percent year-on-year, reflecting an operating EBITDA margin of 17.4 percent.

Operating EBITDA loss from new center was ₹15.7 crore, as compared to loss of ₹24.7 crore in the previous year.

Consolidated profit after taxes and minority interest (PAT) was a loss of ₹194.7 crore, as compared to loss of ₹106.7 crore in the previous year, including current year exceptional items of ₹84.7 crore.

Shalby Ltd. The company has reported total income of ₹439.95 crore during the period ended March 31, 2021 as compared to ₹504.2 crore during the period ended March 31, 2020.

The company has posted net profit of ₹42.36 crore for the period ended March 31, 2021 as against net profit of ₹27.59 crore for the last fiscal.

The company has reported EPS of ₹3.92 for the period ended March 31, 2021 as compared to ₹2.55 for the last fiscal.

The pathology labs and diagnostic centres report a different story. All reported higher revenues in 2020-21 over the last fiscal. In particular, Q4FY21 performance was above estimate with strong growth recovery in the ex-COVID business and higher revenue from COVID-19 related tests. Though, COVID-19 and allied tests contribution dropped, the base business has seen good recovery QoQ since Q2FY21 and healthy growth in coming quarters is expected to continue. The second wave of COVID-19 may have some impact on base business in Q1FY22, however the longer term outlook remains strong.

As COVID-19 cases declined after the first wave, a recovery of walk-in patients and rise in collection centres and smaller labs (less crowded) is observed. And in the second wave, a rise in COVID-19 related tests (IL-6, D-Dimer, etc.) was seen. D- dimer and IL-6 tests are generally doctor prescribed for COVID-19 positive patients and they are being done at 60-70 labs across India.

| Financials–Labs Revenues (₹cr) |

||

| Diagnostic chain | Apr 2020-Mar 2021 | Apr 2019-Mar 2020 |

| Lal Pathlabs | 1,632.60 | 1,385.40 |

| Thyrocare Technologies | 507.05 | 440.93 |

| Metropolis Healthcare | 1,010.03 | 864.97 |

| Vimta Labs | 211.50 | 183.73 |

| Morepen Lab | 1,200.12 | 862.55 |

| Profit after tax | ||

| Lal Pathlabs | 290.80 | 224.80 |

| Thyrocare Technologies | 113.14 | 88.41 |

| Metropolis Healthcare | 183.09 | 127.32 |

| Vimta Labs | 21.40 | 6.84 |

| Morepen Lab | 97.09 | 33.57 |

Average realisation per patient is higher due to contribution of COVID-19 tests. Take the case of Dr Lal Pathlabs in Q4FY21 (JFM 2021). Dr Lal’s average realisation per patient at ₹733 in Q4FY21 and was up 7.2 percent YoY. This rise in realisation was due to contribution of COVID-19 tests. Sequentially it has declined 11.0 percent with falling realisations of COVID-19 tests. Ex-COVID realisation is higher by 4.1 percent YoY to ₹712 due to higher samples per patient of 2.69 vs 2.54. Overall revenue per sample grew 6.0 percent YoY.

The large chains acquired small but high quality laboratories to enter newer markets. Opening a reference lab in say, Mumbai or Bangalore to expand the feeder labs for these reference labs is the way to go. And the new reference labs would have higher degree of automation.

FINANCIALS

Lal Pathlabs. The company has reported total income of ₹1632.6 crore during the 12 months period ended March 31, 2021 as compared to ₹1385.4 crore for the last fiscal, an increase of 17.84 percent.

The company has posted net profit of ₹290.8 crore for the 12 months period ended March 31, 2021 as against net profit of ₹224.8 crore for the last fiscal, an increase of 29.36 percent.

The company has reported EPS of ₹35.25 for the 12 months period ended March 31, 2021 as compared to ₹27.37 for the for the last fiscal, an increase of 28.79 percent.

Thyrocare Technologies. The company has reported total income of ₹507.05 crore during the 12 months period ended March 31, 2021 as compared to ₹440.93 crore for the last fiscal, an increase of 15 percent.

The company has posted net profit of ₹113.14 crore for the 12 months period ended March 31, 2021 as against net profit of ₹88.41 crore for the last fiscal, an increase of 27.97 percent.

The company has reported EPS of ₹21.37 for the 12 months period ended March 31, 2021 as compared to ₹16.71 for the last fiscal, an increase of 27.89 percent.

Metropolis Healthcare Ltd. The company has reported total income of ₹1010.03 crore during the 12 months period ended March 31, 2021 as compared to ₹864.97 crore for the last fiscal, an increase of 16.77 percent.

The company has posted net profit of ₹183.09 crore for the 12 months period ended March 31, 2021 as against net profit of ₹127.32 crore for the last fiscal, an increase of 43.8 percent.

The company has reported EPS of ₹35.79 for the 12 months period ended March 31, 2021 as compared to ₹25.25 for an increase of 41.74 percent.

Vimta Labs. The company has reported total income of ₹211.50 crore during the 12 months period ended March 31, 2021 as compared to ₹183.73 crore for the last fiscal, an increase of 15.11 percent.

The company has posted net profit of ₹21.40 crore for the 12 months period ended March 31, 2021 as against net profit of ₹6.84 crore for an increase of 212.87 percent.

The company has reported EPS of ₹9.68 for the 12 months period ended March 31, 2021 as compared to ₹3.10 for an increase of 212.26 percent.

Morepen Lab. The company has reported total income of ₹1200.12 crore during the 12 months period ended March 31, 2021 as compared to ₹862.55 crore for the last fiscal, an increase of 39.14 percent.

The company has posted net profit of ₹97.09 crore for the 12 months period ended March 31, 2021 as against net profit of ₹33.57 crore for an increase of 189.22 percent.

The company has reported EPS of ₹2.15 for the 12 months period ended March 31, 2021 as compared to ₹0.75 for an increase of 186.67 percent.

Driven by better healthcare awareness, rise in incomes, increased access to insurance and lifestyle-related diseases, India’s healthcare market is expected to reach USD 372 billion by 2022. The Indian government aims at increasing the healthcare spending to 2.5 percent of the GDP by 2025. The COVID-19 pandemic has also transformed the way the government and private players are planning to bring change in the healthcare system. There has been an increased focus on telemedicine services and the government also issued new guidelines to make telemedicine a legal practice in India. Furthermore, the government has also launched the NDHM (National Digital health Mission) to address the country’s health crisis.

The biggest health emergencies of our times have not just laid bare the myriad challenges and gaps in our health system but also highlighted the importance of investing in well-being at both personal and system level. It has ushered in an era of digital and technological innovations and advancements that will help communities fulfil those requirements at a much faster pace.