Company News

Astrana Health, Inc. reports Q4 and year-end 2023 results

Astrana Health, Inc. announced its consolidated financial results for the fourth quarter and year ended December 31, 2023.

“We are proud to announce another year marked by rapid scaling of our unique care model to empower providers and improve healthcare for local communities at Astrana Health. We coupled that with robust financial achievements, ensuring that our growth efforts are sustainable and maintaining a focus on profitability. We continue to execute against our strategic roadmap: 1) focusing on expanding our membership base across existing and new geographies, 2) increasing the level of accountability and risk we are responsible for in our value-based care contracts, 3) empowering our providers to achieve superior patient outcomes, and 4) executing strategic acquisitions to further accelerate our growth trajectory for the foreseeable future,” said Brandon K. Sim, President and Chief Executive Officer of Astrana Health.

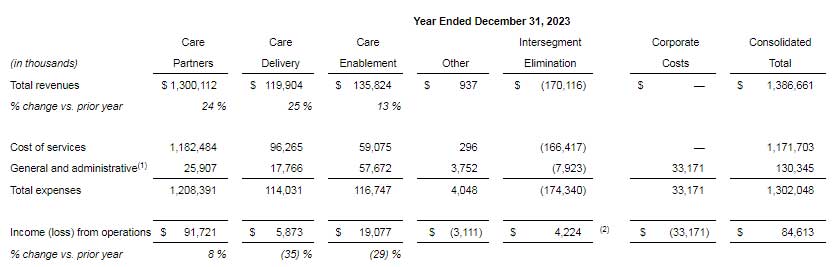

Financial highlights for the year ended December 31, 2023:

All comparisons are to year ended December 31, 2022 unless otherwise stated.

- Total revenue of $1,386.7 million, up 21% from $1,144.2 million

- Care Partners revenue of $1,300.1 million, up 24% from $1,051.5 million

- Net income attributable to Astrana of $60.7 million, up 34% from $45.2 million

- Earnings per share — diluted (“EPS — diluted”) of $1.29, up 30% from $0.99 per share

- Adjusted EBITDA of $146.6 million, up 5% from $140.0 million

Financial highlights for fourth quarter 2023:

All comparisons are to the quarter ended December 31, 2022 unless otherwise stated.

- Total revenue of $353.0 million, up 20% from $294.2 million

- Care Partners revenue of $333.7 million, up 24% from $269.3 million

- Net income attributable to Astrana of $12.4 million, compared to a loss of $3.7 million

- EPS — diluted of $0.26, compared to $(0.08) per share

- Adjusted EBITDA of $29.0 million, up 23% from $23.7 million

Recent operating highlights

- On February 26, 2024 the Company changed its name from Apollo Medical Holdings, Inc. to Astrana Health, Inc. Alongside the corporate name change, the Company’s common stock is trading under the new symbol “ASTH” on the NASDAQ.

- In November 2023, the Company entered into an Asset and Equity Purchase Agreement (the “Purchase Agreement”) to acquire the partnership interests of Advanced Health Management Systems, L.P. (“AHMS”) and certain assets of Community Family Care Medical Group IPA, Inc. (“CFC”), which acquisitions the Company expected would occur in two separate closings. In November 2023, AHM (as defined below) also entered into a Stock Purchase Agreement (the “I Health Purchase Agreement”) to purchase 25% of the outstanding shares of common stock of I Health, Inc. (“I Health”). On January 31, 2024, the first closing under the Purchase Agreement occurred, and the Company completed its acquisition of CFC’s assets. CFC IPA manages the healthcare of over 200,000 members in the Los Angeles, California area, serving patients across Medicare, Medicaid, and Commercial payers. The Company expects to complete the second closing under the Purchase Agreement and acquire the outstanding general and limited partnership interests of AHMS during the first quarter of 2024, subject to obtaining required regulatory approvals. It is currently expected that the I Health Purchase Agreement closing will occur during the first quarter of 2024.

- On January 29, 2024, the Company announced its strategic long-term partnership with BASS Medical Group, one of the largest multi-specialty medical groups in the Greater San Francisco Bay Area. Together, the two organizations will aim to bring high-quality care via value-based arrangements to patients of all insurance types, including Medicare, Medicaid, ACA Marketplace, and Commercial. Astrana has provided BASS Medical Group with a $20 million senior secured promissory note (“BASS secured promissory note”) which is intended to be used, in partnership with Astrana, to continue to grow their footprint and invest in high-quality, high-value, and accessible primary and multi-specialty care for communities across California. The BASS secured promissory note matures on January 11, 2031 and has an interest rate per annum equal to 2.9% plus the Secured Overnight Financing Rate as administered by the Federal Reserve Bank of New York (or a successor administrator) compounded annually.

- Effective January 19, 2024, the Company had the following leadership changes:

- Thomas S. Lam, M.D., M.P.H., previously Co-Chief Executive Officer and President and a director, was appointed Vice Chairman of the Board;

- Brandon K. Sim, M.S., previously Co-Chief Executive Officer, was appointed Chief Executive Officer and President; and

- Chan Basho, M.B.A., previously Chief Financial Officer and Chief Strategy Officer, was appointed Chief Financial Officer and Chief Operating Officer.

- In addition, Dinesh Kumar, M.D., was appointed Chief Medical Officer effective January 23, 2024.

- On January 1, 2024, the Company’s Employee Stock Purchase Plan (“ESPP”) came into effect. The Company’s ESPP allows eligible employees to contribute up a portion of their eligible earnings toward the semi-annual purchase of the Company’s common stock at a discounted price, subject to an annual maximum dollar amount.

- On January 1, 2024, in addition to participating in the ACO REACH Model, one of our other ACOs will participate in the Medicare Shared Savings Program (“MSSP”). The MSSP was created to promote accountability and improve coordination of care for Medicare beneficiaries. Unlike the ACO REACH Program, CMS continues to pay participant and preferred providers on a fee-for-service basis for Medicare covered services provided to MSSP Aligned Beneficiaries. Our shared savings or losses in managing our beneficiaries are generally determined on an annual basis after reconciliation with CMS.

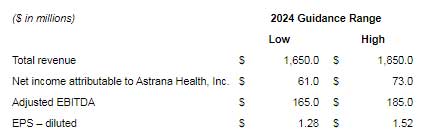

Guidance:

Astrana is providing the following guidance for total revenue, net income attributable to Astrana, Adjusted EBITDA, and EPS — diluted. These guidance assumptions are based on the Company’s existing business, current view of existing market conditions and assumptions for the year ending December 31, 2024.

MB Bureau