Hematology Instruments and Reagents

Automated hematology analyzers are gaining prominence

The adoption of automated hematology analyzers in the healthcare sector is gaining prominence as these analyzers help in minimizing human error and improve laboratory productivity.

Automation of cell counting and characterization has revolutionized the results of hematology analysis since its initial development in the 1960s. Although many detection methods are still in use, optical technology has represented a key innovation in automated hematology analysis since its introduction.

Light, scattered and detected in specific angles, captures an array of information about cell size, structure, inner complexity, nuclear segmentation, and cytoplasmic granulation. In particular, innovative expansions of optical flow cytometry have enabled laboratories to obtain higher-quality results, for more accurate and rapid clinical decision making.

The most common technologies are electrical impedance, radio-frequency (RF) conductivity, optical light scatter (optical flow cytometry), cytochemistry, and fluorescence. Optimal combinations of these detection methods provide an accurate automated complete blood count (CBC), including white blood cell (WBC) differential, in a short turnaround time.

Increasing adoption of automated hematology instruments, rising technological advancements, and integration of basic flow-cytometry techniques in modern hematology analyzers are some of the key factors driving the growth of the global hematology analyzers and reagents market. In addition, rising future demand for high-throughput hematology analyzers and development of high-sensitivity point-of-care (POC) hematology testing are also fueling the growth of the global hematology analyzers and reagents market. However, the high cost of hematology analyzers and intense competition among existing players are restraining the growth of the global hematology analyzers and reagents market. In addition, stringent and time-consuming regulatory policies for hematology instruments also impede the market growth.

Usage of microfluidics technology in hematology analyzers and introduction of digital imaging system in hematology laboratories could open up opportunities for new players in the global hematology analyzers and reagents market. In addition, increasing focus toward emerging markets, such as India and China, could also open up opportunities for new players in the global hematology analyzers and reagents market.

The global hematology analyzers and reagents market is valued at USD 3654.18 million in 2018 and is expected to reach USD 6344.23 million by 2025, with a CAGR of 8.20 percent in the period, 2018–2023, predicts Brand Essence Market Research. North America dominates the global hematology analyzers and reagents market, followed by Europe. This is due to the regions’ high disposable income and increasing adoption of automated hematology instruments by diagnostic laboratories in these regions. Asia is expected to be the fastest-growing market in the next 5 years. This is due to the developing healthcare infrastructure and increasing funding toward the development of hematology products in this region. Moreover, rising awareness about better healthcare and a large patient population base are also driving the growth of the hematology analyzers and reagents market in Asia.

Indian market

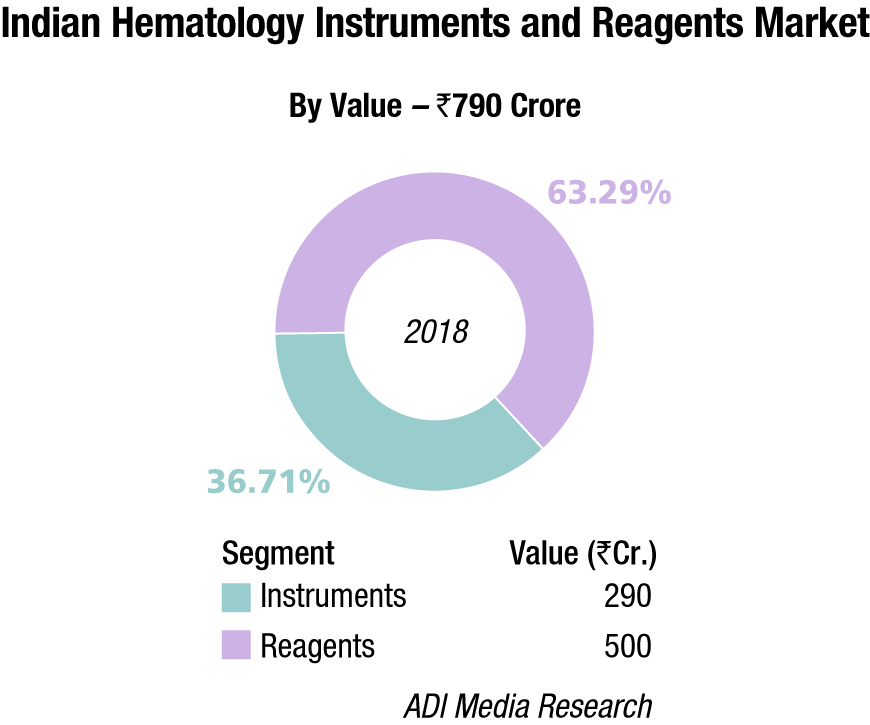

The Indian hematology instruments and reagents market in 2018 is estimated as Rs 790 crore. Reagents constitute 63.3 percent of the market at Rs 500 crore, and instrument the balance at Rs 290 crore.

The hematology instruments market may be segmented as 5-part and 3-part analyzers. By quantity, in 2018, the 3-part analyzers dominated with an estimated 85 percent market share, albeit the margins continued to come from the 5-part analyzers. Within the 3-part analyzer segment, the single-chamber is a dying breed and the laboratories are opting for its double-chamber counterpart. Within the 5-part analyzers, the entry-level analyzers are more popular. The maximum growth is being seen by the 5-part entry-level analyzers.

In April 2019, Sysmex reinforced direct sales and support network in India to expand its hematology business. By offering direct sales and support, the company aims to foster direct customer communications, enabling it to provide solutions to the diverse issues customers face. This approach should also allow Sysmex to step up its activities involving scientific seminars – an area of strength – as part of its aim to be a comprehensive supplier in India.

Since Sysmex selected Transasia Bio-Medicals Ltd. as its Indian distributor in 1993, the two companies have worked together to expand sales and support networks in India. In 1998, Sysmex established a joint venture with Transasia Bio-Medicals (now, Sysmex India) and began manufacturing reagents. In 2007, the company established a reagent factory in Baddi, and in 2008 Sysmex converted the company to a wholly owned subsidiary. In this manner, Sysmex established a business base in India, centered on the field of hematology, and promoted sales and support through local distributors.

Just recently, Transasia has introduced its latest range of 3- and 5-part fully automated hematology analyzers, which have been developed at Erba Europe, the global R&D facility of Transasia. These instruments are set to provide affordable diagnosis to cater to the masses.

Reagents Market – 2018* |

|||

|---|---|---|---|

| Tier I | Tier II | Tier III | Others |

| Transasia | Beckman Coulter, Mindray, and Horiba | Abbot, Siemens, and Nihon Kohden | Roche, Dirui, Meril Diagnostics, Shenzhen Prokan, URIT, Labindia, and many small importers |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian hematology instruments and reagents market. | |||

| ADI Media Research | |||

At the buyer end, consolidation is inevitable. A case study of Neuberg Diagnostics sets the trend. Neuberg, which has 60 diagnostic labs and close to 500 collection centers in India, is planning to set up 40 more labs across the country with an investment of Rs 200 crore. Most of the investment will be done through internal accruals, and by its partners. The company wants to decentralize its reference lab model and have localized presence for advanced tests in proteomics, metabolomics, and genomics. The five labs that are now under Neuberg are Anand Diagnostic Laboratory, Supratech Micropath, Ehrlich Lab, Global Labs, and Minerva Labs, present in Karnataka, Gujarat, Tamil Nadu, South Africa, and UAE respectively. Neuberg has three global reference laboratories located in Bangalore, Ahmedabad, and Durban (South Africa).

Key players active in the hematology analyzer market are introducing new and innovative products to maintain or increase their market share. In addition, several companies are manufacturing and marketing miniature instruments with high accuracy. Analyzers are converging multi-parameter tests into single platforms through these miniaturized instruments, thereby helping labs and hospitals to save on heavy investments.

Technological advances

Some current hematology analyzers still rely on impedance technology, although with additional technologies to improve the differential white cell count. The utilization of a high-frequency signal, defined as RF conductivity, allows the discrimination between different WBC subpopulations. RF signals pass through the cell, producing a response that is related to nuclear composition, cytoplasmic density. and other differences in internal structures.

WBC differentials. WBC differentials are usually performed on automated hematology analyzers. Although the automated WBC differential is highly accurate and reliable in the absence of pathological cell types, a manual differential is often required to confirm the presence of immature or reactive

cells, blasts, and other pathological cell types.

Optical technologies. Optical flow cytometry provides several advantages over traditional impedance methods. During optical light-scatter measurement, a beam of laser light is passed through a diluted blood specimen stream that is projected into the flow cell by hydrodynamic focusing. As each cell passes through, the focused light is scattered in various directions and is detected by photodetectors, which convert the signal into an electric pulse. The electronic signals are transmitted to a computer for storage and analysis.

MAPSS technology. Multi-angle polarized scatter-separation (MAPSS) technology uses four light-scatter detectors to determine various cellular features. The application of a depolarized light detector is a unique characteristic of this method, and allows for specific identification of eosinophil granulocytes.

Way forward

There have been numerous promising directions that could positively impact the future of the automated WBC differential. The International Council for Standardization in Hematology (ICSH) has proposed a new reference method for the leukocyte differential based on the use of monoclonal antibodies (mAbs) and multicolor flow cytometry. This would provide manufacturers with accurate and reproducible WBC classification for the development and improvement of automated technologies.

Another opportunity for improvement is the incorporation of additional light scatter measurements in the characterization of blood cells, with the aim of more accurate classification of WBC subpopulations and potential identification of immature or pathological cell types. For example, advanced MAPSS technology can enable the differentiation of seven subpopulations of nucleated cells including neutrophils, lymphocytes, monocytes, eosinophils, basophils, IGs (including metamyelocytes, myelomyelocytes, and promyelocytes), and NRBCs (if present), by utilizing seven light-scatter detectors and fluorescent flow cytometry.