Devices & Utilities

Back to the future – Use DCB instead of DES

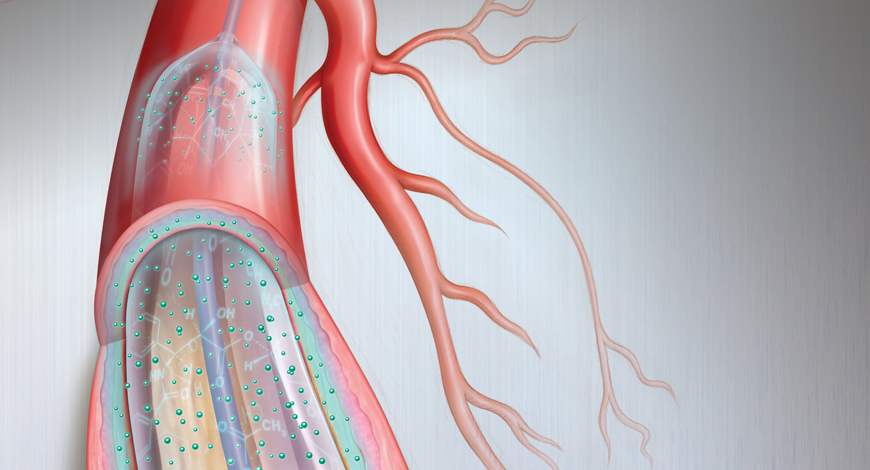

Drug-coated balloons have become an important tool to replace stent placement in specific situations, such as small coronary artery disease and in-stent restenosis.

Healthcare infrastructure has seen some major changes over the past decade as technology proliferation increased, and research on healthcare has also seen a substantial boom. Rising obesity, increasing geriatric population, and growing prevalence of coronary artery diseases are some of the factors propelling demand for drug-eluting balloon. When a stent is used with a balloon catheter, it is called a balloon expandable stent, which differs from a self-expandable stent, and it is normally made from nitinol alloy.

Adoption of angioplasty balloons for patients, who do not benefit from percutaneous coronary intervention (PCI), is also favoring growth of the drug-eluting balloon (DEB) catheter market. Increased support from the government and other institutions, backing research and granting funding to further develop drug-eluting balloon catheters, is being witnessed.

The usage of drug-eluting devices is majorly associated with cardiac conditions, and these are used to reduce the rate of restenosis. The peripheral drug-coated balloon catheter market is poised to rise at a steady CAGR over the next ten years. Use of drug-eluting balloon catheters for peripheral artery procedures is anticipated to increase as their benefits are realized, and procedures become more affordable.

Under the indication segment, demand for coronary artery disease drug-eluting balloon catheters is anticipated to account for nearly 80-percent market share in terms of value. Despite minimal market share, demand for peripheral vascular disease drug-eluting balloon catheters is anticipated to rise at a steady CAGR over the next 10 years.

As more angioplasty balloons are being researched and developed, it is estimated that sales of peripheral drug-coated balloon catheters will also see an upward trend.

The global drug-eluting balloon market is estimated to be valued at USD 616.6 million in 2022 and is expected to exhibit a CAGR of 8.3 percent during 2022–2030. Various technological advancements in manufacturing and the development of advanced drug-eluting balloon catheters for minimally invasive surgeries are set to drive the market growth over the projected timeframe.

The rise in the number of patients suffering from atherosclerosis, obstructive coronary artery disease, peripheral vascular disease, etc., has promoted the use of drug-eluting balloon catheters and is anticipated to drive the market growth in the coming years.

Further, the rising prevalence of chronic diseases and the demand for minimally invasive surgical procedures have increased the demand for technologically advanced products across healthcare settings. Increasing life expectancy and faster diagnostic procedure among geriatric population base due to the use of advanced products for surgeries has driven the market growth in the past few years.

The high cost of advanced drug-eluting balloon catheters, coupled with increasing risk of infection associated with the product, may have a negative impact on the industry growth. The product demand is significantly increasing at a steady pace due to the rising number of coronary artery disorders, cardiovascular, and other chronic diseases.

Costly catheterization procedures associated with cardiovascular and peripheral diseases may hamper the adoption rate of drug-eluting balloon catheters in underdeveloped countries. According to a recently published article, the average cost of a cardiac drug-eluting balloon catheterization procedure ranges from USD 3074 to USD 3854 in the US. The high prices of these products and associated devices may act as a barrier to market growth.

Due to the high costs related with drug-eluting balloon catheterization treatments, market expansion in emerging economies with low-income levels may be hindered. As a result, countries with low economic development may struggle to adopt such high-priced products. As a result, the high cost of these sophisticated drug-eluting balloon catheters may impede market expansion throughout the forecast timeframe.

The peripheral vascular disease drug-eluting balloon catheters segment held a majority market share in 2021, and is expected to witness a 10.1-percent CAGR through 2028 due to rising acceptance of advanced products by various medical professionals and healthcare facilities to perform complex interventional surgeries. These peripheral vascular balloon catheters help in drug administration, inhibit neointimal growth of vascular smooth muscle cells, and prevent restenosis, thereby increasing patient safety during surgical procedures. The rising prevalence of atherosclerosis among adults is one of the important driving factors for the increasing adoption of the product.

The hospital and clinics segment held a dominant market share in 2021, and is anticipated to expand at a 10.1-percent CAGR between 2022 and 2028 owing to the increasing number of in-patient admissions in hospitals for catheterization procedures, along with surging preference for minimally invasive procedures, which is anticipated to spur the market demand. The rising number of geriatric patients and end-stage chronic diseases associated with them require complex interventional surgeries. The rising adoption of drug-eluting balloon catheters for intake of various drugs during surgical procedures is an effective method of drug administration and is preferred by surgeons. Moreover, the enhanced post-surgical care provided by the caretakers and nursing professionals is surging patient preference for hospitals and clinics. The rise in the incidence of vascular and urological diseases, arrhythmia, etc., coupled with availability of highly skilled medical and healthcare professionals, are some of the driving factors for market expansion. Furthermore, the emphasis on health infrastructure development in the emerging countries will result in the establishment of a wide hospital network that will increase product acceptance rate in the coming years. Therefore, the increasing number of chronic diseases, coupled with growing hospital admissions, is expected to fuel the drug-eluting balloon catheters market share in the estimated analysis timeframe.

Sales of polyurethane drug-eluting balloon catheters are expected to rise at the fastest CAGR as far as raw material is concerned. However, the demand for nylon drug-eluting balloon catheters is expected to account for a majority of share among all. Benefits, such as soft nature, foldability, and easy withdrawal are propelling sales of nylon drug-eluting balloon catheters.

Covid-19 impact on the market. The Covid-19 pandemic massively affected healthcare infrastructure, and how it was handled. Treatment for every disease became secondary as the focus was only on combating coronavirus. The Covid-19 pandemic affected research and development related to drug-eluting balloon catheters and caused major disruptions in demand-and-supply chains. However, in the post-pandemic era, demand for drug-eluting balloon catheters is anticipated to see rapid rise. Even though the pandemic caused a major drop in sales, the market is expected to recover the losses over the coming years as research speeds up.

Major players operating in the market are focusing on getting approval for new products and launching new products in the market. For instance, in February 2021, according to the US Food and Drug Administration, it continues to acknowledge a possible mortality risk with paclitaxel-coated balloons and stents intended to treat new or recurring atherosclerotic lesions in the femoropopliteal artery. A study of paclitaxel-coated stents and balloons, used to treat peripheral artery disease in the legs, found no evidence of harm associated with the devices, appearing to contradict an earlier mortality signal from a meta-analysis that FDA recommended physicians factor into treatment decisions. The USFDA is still monitoring safety signal with paclitaxel stents in PAD.

Research in the drug-eluting balloon catheter space by key players is anticipated to bolster development and sales of more precise and efficient drug-eluting balloon catheters.

In March 2021, MedAlliance announced that it had received FDA approval for its drug-eluting coronary balloon. The product is called the Selution SLR sustained limus release drug-eluting balloon catheter. It received a go-ahead for its design, which improved luminal diameter in individuals affected with atherosclerotic lesions.

In February 2021, L2Mtech GmbH was awarded its first CE mark on six products. This marks a milestone in the company’s history, and proves the efficacy and safety of its innovative cardiovascular and endovascular applications. The company is planning to commercially launch the products with the CE mark recognition.

The US represents the largest market for drug-eluting balloons in North America, followed by Canada. The nation has been seeing a surge in cardiac cases due to rising prevalence of obesity, poor lifestyle choices, rise in aging population, presence of key players, and high spending potential. This is propelling sales of drug-coated balloon (DCB) catheters in the US.

Europe dominates the market and is anticipated to continue its domination throughout the forecast period. The UK is anticipated to lead the European market, surging at a stellar CAGR of around 20 percent.

North America is anticipated to be the second-largest market. The market in Asia is anticipated to rise at the fastest CAGR through the forecast period. India and China are anticipated to lead the demand in the APAC region.

Adoption of drug-eluting balloon catheters in MEA is expected to pick up pace as healthcare infrastructure develops across the region.

Asia-Pacific region has the highest number of patients suffering from peripheral artery disorders and the numbers are surging at an unprecedented rate. Hence, the increasing prevalence of peripheral and cardiovascular diseases among adults and geriatric population at an unprecedented pace will accelerate the drug-eluting balloon catheters market sales in the coming years.

China has a massive population and the geriatric population in the nation is on the rise, which, in turn, is increasing instances of cardiovascular diseases and disorders. Government-backed research initiatives are helping reshape and bolster the healthcare infrastructure in the nation. Rising medical tourism, high prevalence of cardiovascular diseases, and rapidly developing healthcare infrastructure are some of the factors driving demand in China.

In the past few years, there has been an increase in the clinical and anatomical complexity of coronary artery disease (CAD).

A large number of patients, who present with moderate to high-risk anatomical classification (SYNTAX) but associate also high peri-procedural mortality risk measure by EuroSCORE II and STS score, have been classified as ineligible for coronary artery bypass grafting surgery, causing a growing number of patients requiring complex percutaneous coronary interventions (PCIs). Unfortunately, such patients who are treated daily in our catheterization laboratories were not previously included in adequately powered randomized clinical trials.

There is a necessity to achieve a complete or near-complete revascularization in order to improve the clinical outcome of patients. In the particular case of CHIPs, the attempt to reach these goals carries a high amount of metal implantation (drug-eluting stents). Conversely, drug-coated balloons are an emerging technology, which nowadays should aim at significantly decreasing the use of stents in such complex scenarios, thanks to the fact that they have demonstrated to be easy-to-use, safe, and with good clinical outcome in some groups of patients with CAD.