Industry

Betting big on healthcare

If history is any indication, in 2023, healthcare private equity will remain strong.

The Indian healthcare sector has seen an investment of ₹32,000 crore in FY23. Investors are showing confidence in the sector and targeting various segments, including multi-specialty hospitals, regional healthcare providers, and super-specialty hospitals. Additionally, there have been investments in single-specialty healthcare providers, including eye care, dental care, and infertility chains.

The private healthcare addressable market is pegged at ₹3.85 lakh crore, growing at 12–14 percent per annum, by PwC. Overall, 2022 was a year of recalibration for private equity and venture capital (PE-VC) investments in India. The country’s share of PE-VC investments in Asia-Pacific grew from ~15 percent to ~20 percent from 2021 to 2022, as China+1 tailwinds and India’s macro robustness made it a bright spot for investing, amidst decelerating capital flow in the region.

While healthcare is currently a top sector for private equity funds in India, some experts have expressed caution that the pipeline for fresh funds may be slowing down, indicating there could be potential challenges in finding suitable opportunities in the future. Estimated at ₹60,000 crore in the last five years, it has constituted 5 percent of entire private capital outflow into the country. The increase may be attributed to Covid-19; it was less than 2 percent before the pandemic.

A Grant Thornton Bharat Report estimates the overall deal values in the healthcare and life sciences sector at ₹35,000 crore (USD 4.4 billion) in H1 2023, an 85-percent increase compared to H1 2022. However, deal volumes remained marginally low with a 17-percent decline from 89 in H1 2022 to 74 in H1 2023.

Mergers and acquisition (M&A) landscape. During Q2 2023, M&A activity saw a 60-percent increase in deal volumes over Q2 2022, recording 16 deals. Value surged 97 percent to reach USD 487 million, resulting in an average ticket size of USD 30 million, compared to USD 25 million in Q2 2022. Serum Institute of India’s domestic acquisition of minority stake in Biocon Biologics for USD 150 million and IPCA Laboratories’ acquisition of Unichem Laboratories for USD 126 million, contributed to 57 percent of overall M&A transactions. For H1 2023, the M&A volumes saw an increase of 47 percent as compared to H1 2022, with a total of 25 deals, with values of USD 628 million.

Private equity (PE) landscape. Despite a fall in the number of deals from 32 to 19 from Q2 2022 to Q2 2023, PE activity recorded a 158-percent growth in deal value, raising the average ticket size from USD 32 million in Q2 2022 to USD 139 million in Q2 2023. Temasek Holdings’ 41 percent stake in Manipal Health Enterprises for USD 2 billion marked the largest fundraise in the sector in the last 13 years. Healthtech drove PE deal volumes activity in the quarter, followed by those in the wellness and hospital space. While H1 2023 saw a decline in deal volumes from 72 to 49, as compared to H1 2022, values soared a 110-percent with values totaling USD 3.8 million, led by hospitals segment.

Arjun Oberoi

Arjun Oberoi

managing director,

Everstone Group

“India took a long time to wake up, but we’re starting to see real shifts in market policies and technology related to local MedTech manufacturing. There’s a lot of work happening now in a sector that was once subscale with little innovation, and we’re already seeing some market leaders emerge.”

FY23 is a year, when healthcare delivered a commanding 16 percent of total exit value, at ₹28,000 crore, according to Bain & Company’s annual India Private Equity Report 2023, released in collaboration with Indian Venture and Alternate Capital Association (IVCA).

“The healthcare sector is seeing continued potential upside with a low beta, and headroom for growth with large players driving scale through greenfield expansion to Tier-II cities, brownfield expansion, and consolidation initiatives,” said Aditya Shukla, partner, Bain & Company and co-author of the report.

Ewan Davis

Ewan Davis

partner,

Quadria Capital

“India benefits from a deep pool of specialist doctors, which is why you’ve seen large specialty care hospital networks scale across the country – whereas in Southeast Asia, you’ve yet to see similar models emerge at similar scale – we will get there, but the region needs to invest resources in growing its specialist talent pool.”

While pharma saw a slowdown in PE activity in 2022, long-term outlook is positive, led by a deep pharma ecosystem with consistent improvement in quality, compliance, reliability, cost; regulatory enablers to boost manufacturing, such as PLI 2.0 being expanded to high-value goods, government investment in bulk drug parks to boost local API manufacturing; and tailwinds from global sourcing diversification, and the opportunity for generics where India has the largest share in global supply by volume.

Somenath Chatterjee

Somenath Chatterjee

co-founder,

Versatile Healthcare Advisory LLP, Member of NATHEALTH

“The overall healthcare sector has received heightened interest from investors recently. They have started to recognize the potential of the Indian healthcare market, and the government’s intensified focus on healthcare.”

The global healthcare investment outlook is shifting

In 2023, healthcare private equity (HCPE) investors face greater competition, higher interest rates, and uncertainty surrounding recent banking disruptions.

Around the world, leaders are discussing a prolonged recession. Investors are grappling with inflation and increased debt. The war in Ukraine has brought about an energy crisis, and socioeconomic disparity remains a problem.

These factors may cause investors to panic – yet most are in it for the long haul. Some investors may feel uneasy about the current downturn, but healthcare is resilient. Despite the economic disruption and geopolitical conflict in 2022, the HCPE market completed its second-strongest year in history. Buyout volume fell by more than 35 percent in the second half of 2022, compared with the first half of the year, and the fourth quarter had the lowest quarterly HCPE deal activity since 2017. Yet, even with the slowdown in the second half, 2022 was still the second-best year on record for healthcare private equity by many measures. Total disclosed deal value reached around USD 90 billion, down from USD 151 billion in 2021 but still over USD 10 billion more than the next-closest year. Deal volume in North America and Europe was the second highest on record. Asia-Pacific reached new heights for disclosed deal values, despite the slowdown in China.

The S&P 500 healthcare index recovered in the fourth quarter and closed in 2022, down only 4 percent from where it ended in 2021. Amgen’s USD 28-billion acquisition of Horizon Therapeutics and CVS Health’s USD 8-billion acquisition of Signify Health highlight impressive enterprise values of 20 to 30 times EBITDA.

Healthcare industry consolidation is driving momentum – particularly as firms and corporations continue to capitalize on their investments. Even with low 2022 EBITDA values for businesses, private equity firms may hold their investment through the downturn in 2023 and experience success in the long term. If history is any indication, HCPE will remain strong in a downturn. Stakeholders are hopeful, for several reasons.

Bain & Company’s Global Healthcare Private Equity and M&A Report 2023 went over some of the possibilities for 2023 and beyond in detail. From the life sciences to debt financing, this year’s HCPE growth trajectory includes trends such as:

Growing interest in early-stage assets. More investors are looking at early-stage assets that focus on research and early development. Clinical research organizations (CROs) and specialized contract development and manufacturing organizations (CDMOs) are just two examples – but that is not all. Contracted biopharma assets focusing on commercial-scale manufacturing (and those focused on late-stage drug development work) also attract investor interest due to their comparatively bright futures.

Rising investments in healthcare IT. In 2022, the healthcare IT buyout was the second-highest on record. Provider IT, meanwhile, remains a driver in this space. Given the labor shortages and inflation issues, providers are searching for new ways to relieve margin pressure. Provider IT solutions that help healthcare providers optimize their resources and ultimately strengthen their margins have become more appealing in 2023.

An increase in opportunistic opportunities. The current downturn has increased competition in distressed assets like SMID-cap biopharma companies. Investment in these assets will continue to grow. However, sponsors will be mindful of how they structure deal terms. They must have conviction in these assets’ key strengths in order to get a high return when they are ready to exit. Acknowledging the nuances of macro uncertainty is essential in the interim.

A rise in public-to-private deal opportunities. Public markets continue to fluctuate. When being a publicly-traded company no longer seems beneficial, shareholders may opt to go private. We saw several examples in 2022, including Clayton, Dubilier & Rice, and TPG announcing plans to acquire animal-health tech giant Covetrus for approximately USD 4 billion in May. Similarly, Patient Square Capital made Hanger private last October in a deal worth USD 1.25 billion.

More carve-outs and spinoffs. As companies pivot in a downturn, we can expect a growing number of HCPE carve-outs and spinoffs. Several deals illustrate this key 2023 trend. For example, companies like Medtronic, Johnson & Johnson, and 3M all announced plans to divest certain parts of their portfolio – and some are creating standalone healthcare companies. The goal here is to streamline portfolios and quicken the speed of revenue growth. Other corporations will likely follow suit.

A focus on minority recapitalization. The benefits of minority recapitalization are extensive. Minority investments let buyers avoid refinancing their existing leverage. Instead, they can benefit from lenders’ familiarity with the business. Sellers, meanwhile, can use this approach to increase returns for their current limited partners – all while letting them hold a stake in the asset and focus on future growth. It is no wonder this approach has become so popular in 2023.

A sustained downturn could change the exit landscape

Exit size, exit type, and holding period could all be affected if financing remains tight and public equity markets remain depressed.

Exit size. Average sponsor-to-sponsor exit size declined 38 percent from the first half of 2022 to the second as large-check financing became increasingly difficult to secure. European and North American sponsor-to-sponsor exits felt this more acutely, declining average size by 45 percent and 52 percent, respectively, between the first and second halves of the year. On the other hand, average strategic exit value increased by 150 percent between the first and second halves of 2022 as corporate buyers seized the chance to acquire assets with less competition from private equity. Aligned with the decline in average sponsor-to-sponsor exit size, this increase was felt particularly in Europe and North America.

Exit type. IPOs will remain less attractive in the face of depressed public equity markets, and strategic exits are likely to keep driving exit volume, especially if corporate buyers continue to have excess cash on hand. Partial recapitalizations and continuation funds could become more popular in a prolonged downturn as a means of providing returns to limited partners while also holding on to assets with more upside potential.

Holding periods. In the years following past downturns, we have seen holding periods extend as sponsors wait for favorable market conditions. While it is too early to tell how much of an impact the current macro uncertainty will have on holding periods, continuation funds and partial exits triggered by a prolonged downturn could contribute to longer holding periods.

Reasons for optimism vary across geographies

Despite these challenges, there is optimism across markets:

North America. Nearly 25 assets that transacted four to five years ago for at least USD 500 million have yet to retransact. More than half of these assets are provider businesses or provider-related services businesses. Additionally, 15 of these assets traded at valuations of at least USD 1 billion when they last transacted.

Europe had a record year when measured by total exit volume, with mega-exits – those in excess of USD 1 billion – continuing to drive exit value as they did in previous years. The share of European exits greater than USD 1 billion in disclosed value decreased from the first half of the year to the second half, both in terms of exit volume and value. However, in all, 2022 saw more USD 1 billion-plus exits in Europe than any other year aside from 2021. Looking ahead, roughly 10 European healthcare assets that were acquired four to five years ago for at least USD 500 million have yet to retransact.

Asia-Pacific region saw more USD 1 billion-plus exits than in any other year. The region produced the four largest sponsor-to-sponsor exits in the second half of 2022, totaling over USD 6.6 billion in value despite challenges in the macro environment. The region is on track for a record year when measured by total exit value, likely surpassing 2020’s USD 7.6 billion total value, provided that deals announced in December transact. Looking ahead, at least 10 Asia-Pacific healthcare assets that were acquired four to five years ago for at least USD 500 million have yet to retransact.

Though initial public offering (IPO) and special purpose acquisition company (SPAC) exit outlooks faltered in 2022, experts believe IPOs will return to healthcare in the very near future.

In closing, 2023 has introduced a shift in healthcare private equity. Yet investors who act strategically will continue to profit – and so will the companies that innovate in this space.

Medical equipment industry

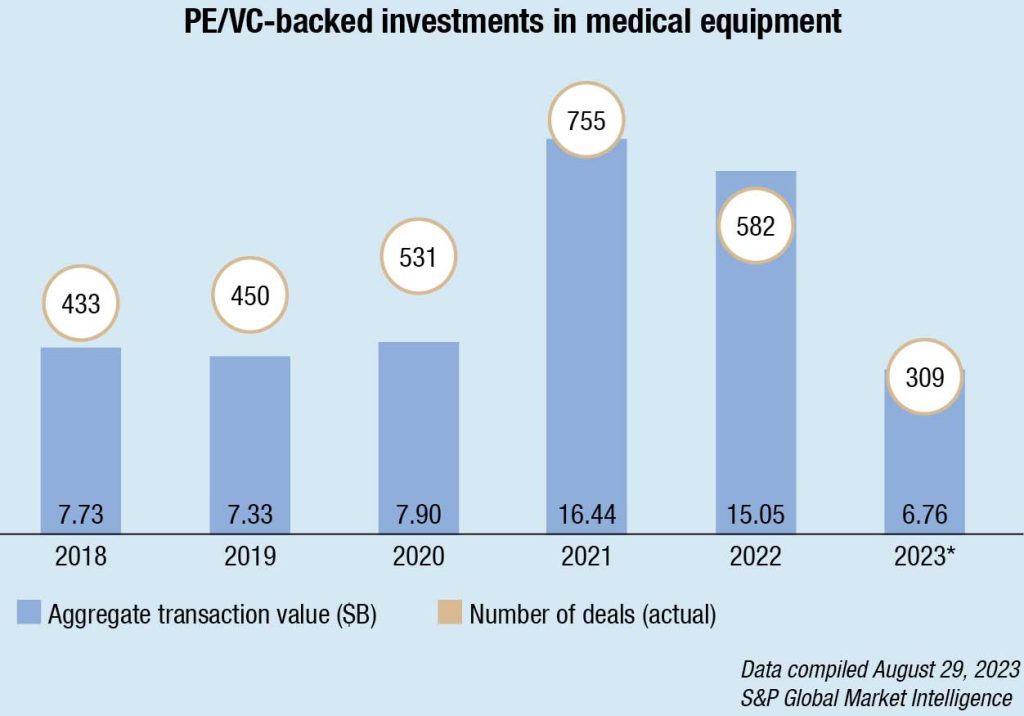

The value of private equity deals in the healthcare equipment industry is on track for a second straight year of decline.

Total announced investment in healthcare equipment companies globally stood at USD 6.76 billion for the year to August 2023, according to S&P Global Market Intelligence data.

The number of deals seems to be heading for a two-year annual drop. During the measured period, the data shows 309 transactions in the sector worldwide compared to full-year 2021 and 2022 totals of 755 and 582, respectively.

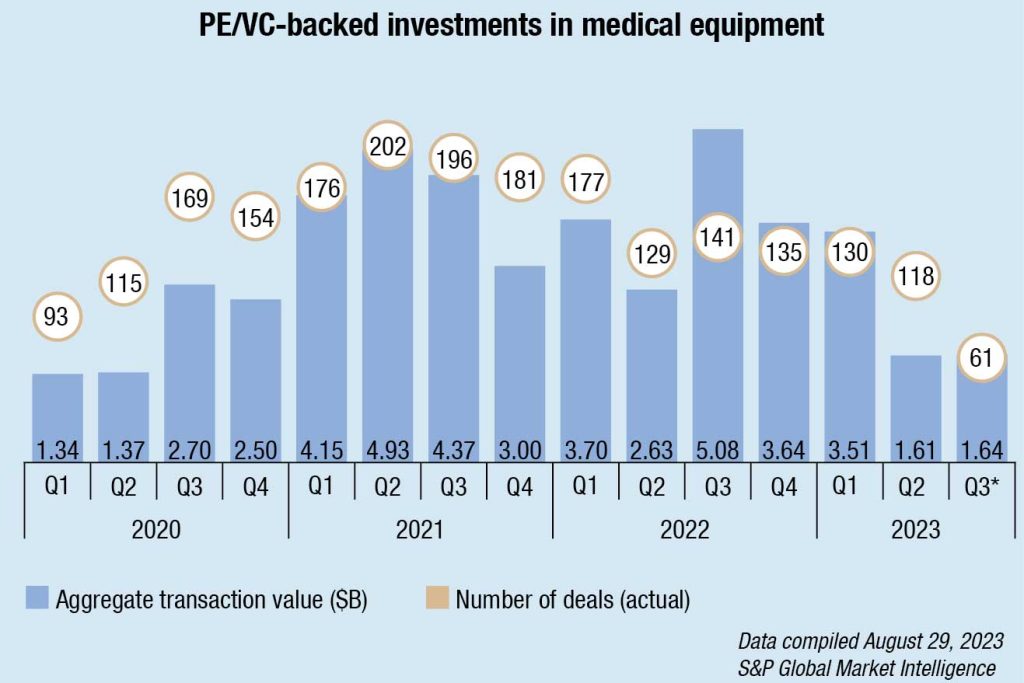

In H1 2023, investment value dropped 19.1 percent, compared to the same period the previous year, and the second quarter marked three consecutive quarters of decline.

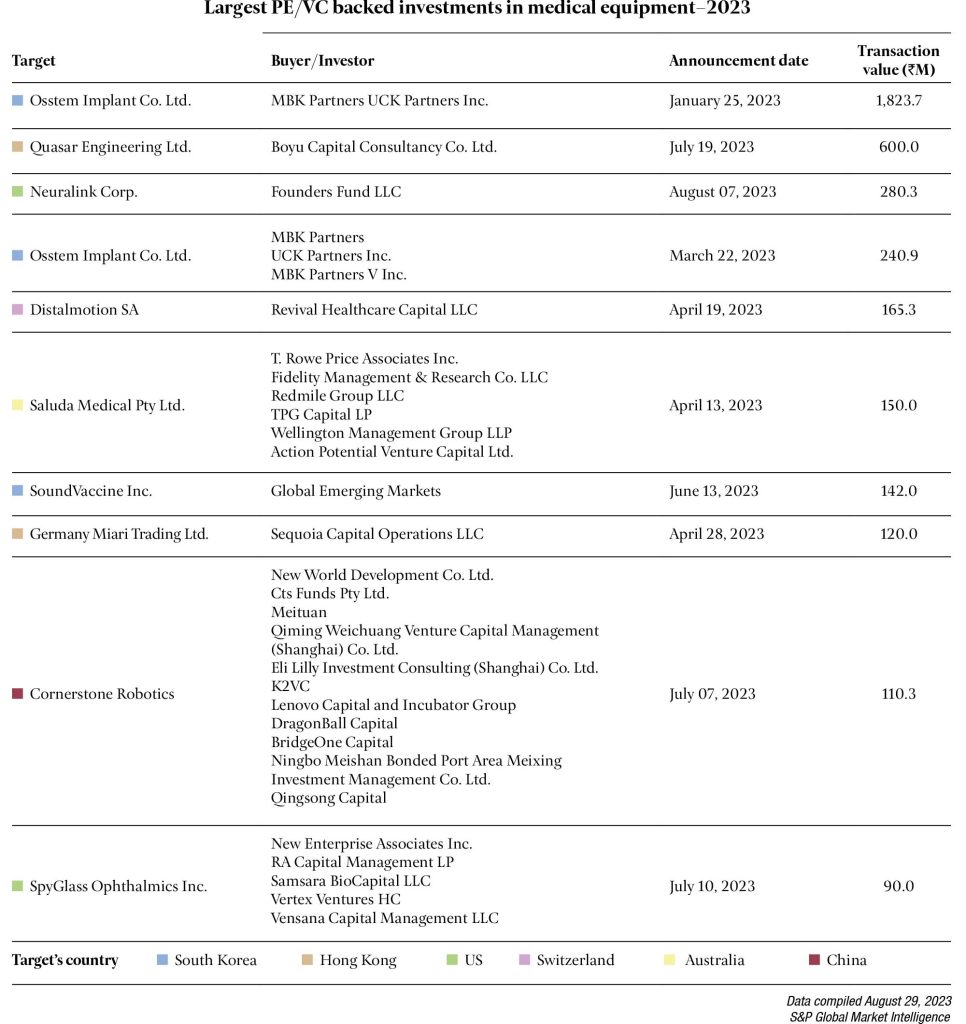

However, investment for the partial third quarter was USD 1.64 billion as of August 2023, slightly surpassing the full total for the prior quarter. The rebound was in large part due to one deal – Boyu Capital Consultancy Co. Ltd.’s USD 600-million acquisition of Hong Kong-based Quasar Engineering Ltd., which manufactures medical devices.

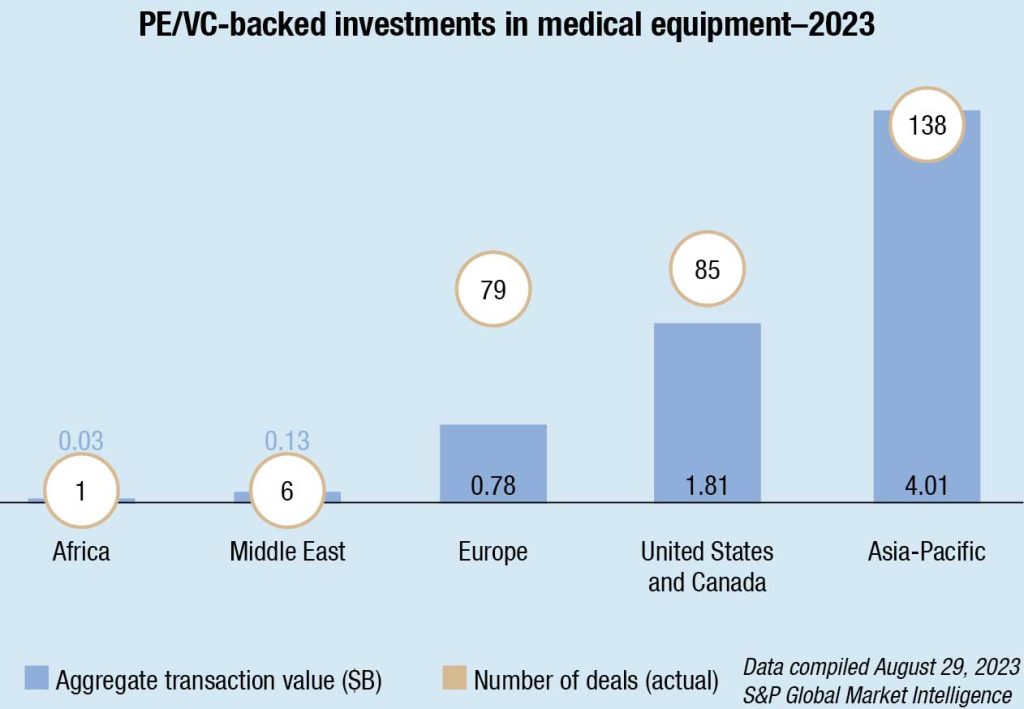

Asia-Pacific takes center stage in terms of investment in healthcare equipment companies, accounting for nearly 60 percent of global private equity deal value. The region picked up USD 4.01 billion across 138 deals. North America followed with USD 1.81 billion of investment and Europe with USD 780 million.

Top transactions. For the largest private equity investment in the sector year to date, MBK Partners and UCK Partners Inc. acquired a majority stake in South Korea-based Osstem Implant Co. Ltd. in a deal valued at USD 1.82 billion. It is the only deal above USD 1 billion for the year so far.

Boyu’s acquisition of Quasar marked the second-largest deal thus far in 2023, followed by The Founders Fund LLC’s investment in Neuralink Corp.’s USD 280.3-million series D round of funding.

That said, private equity tends to get a bad rap when it comes to healthcare. Some see it as a disruptive force that prioritizes profits over the patient experience, and that it is hurting the industry by creating a more consolidated marketplace. Others, however, see it as an opportunity for innovation, growth, and more movement toward value-based care.

A systematic review of private equity healthcare service takeovers across eight countries including the US, UK, Sweden, and the Netherlands published in BMJ medical journal had some startling revelations. Private equity (PE) ownership of healthcare services, including hospitals and nursing homes, is linked to a harmful effect on cost and quality of care.

The authors of the review, which was led by the University of Chicago, said, “The most unequivocal evidence points to PE being associated with an increase in healthcare costs. Evidence across studies also suggests mixed impacts of PE ownership on healthcare quality, with greater evidence that PE ownership might degrade quality in some capacity rather than improve it.”

No consistently beneficial effects of private equity ownership were identified, the researchers said. “The current body of evidence is robust enough to confirm that PE ownership is a consequential and increasingly prominent element in healthcare, warranting surveillance, reporting and possibly increased regulation,” they wrote.

The researchers identified 1778 studies, of which 55 met the inclusion criteria. They looked at the impact of private equity takeovers on costs, quality of care, and health outcomes.

Nine of 12 studies revealed higher costs to patients or the funders of healthcare at services owned by such firms, three found no differences, and none showed lower costs.

Cat Hobbs, the director of the public ownership campaign group We Own It, said, “This important new study is sadly no surprise. When vital services are privatized, patients get the worst of both worlds – higher costs for worse quality care.

“Private equity firms will always put their duty to make a financial return first – that’s their job. But these incentives are in direct conflict with the public good. Healthcare is not just another investment opportunity. It’s a crucial public service, which we all need at some point in our lives.”

She added: “Private equity ownership in the healthcare sector is on the rise fast, and the public need to know the risks it poses to care quality and access.”

David Rowland, the director of the Centre for Health and the Public Interest, a think tank, said regulators and politicians needed to get a grip of how private equity takeovers impact healthcare. Policymakers must prioritize public funding and provision of healthcare if they are to avoid damaging consequences for patients.

However, PE firms and physician practices agree that PE investments do not affect clinical autonomy – at least yet. But the jury is still out on whether these firms – like many other physician practice funders – will need to reduce clinical autonomy in the longer term to achieve standardization and ROI.

There are also mixed reviews on the effects of changing managerial operations. More evidence is needed to determine the extent at which patient care is changed. Most likely, we need more nuance to the evidence to understand the characteristics of PE-physician practice partnerships that are more likely to lead to both positive and negative outcomes.

PE firms currently have access to large amount of capital. Despite talk of a bubble bursting, it is not visible on the immediate horizon. In healthcare specifically, an ageing population with more complex needs means that the demand for healthcare is only going to increase. Physician practices, especially specialty care rollups, are a safe bet for PE at this point, with a proven model for ROI.

On top of that, the trend is toward secondary buyouts, where PE firms sell to another firm. In fact, it is quite common for the leading firms that invest in physician practices to swap investments back-and-forth, and we do not see this trend stopping anytime soon.

While, PE sponsors will likely flock to a subset of investment strategies in 2023 as they continue to adapt to macroeconomic challenges, they may use this moment of disruption to revisit their fund strategies and reconsider the subsectors they focus on, and the investment themes they plan to prioritize.