Industry

Digitalisation opens avenues for a transformed healthcare ecosystem

Digital technology is transforming healthcare. MedTech innovation must evolve to take advantage of this opportunity.

Healthcare is experiencing unprecedented pressure and disruption. Challenges range from affordability issues to shifting patient expectations. Costs continue to rise. Pressure is mounting to find innovative solutions. The healthcare ecosystem must help alleviate these concerns.

MedTech and pharma are under pressure to improve R&D, service models, and treatment. The goal is to reshape the industry with a modern approach that involves digital technology and one that delivers significantly more ambulatory and at-home care.

No doubt, medical devices are vastly more sophisticated today than they were a decade ago. They are increasingly digitized and able to capture, process, and communicate far more information, leading to better efficiency and improved outcomes for patients, providers, and healthcare systems. However, innovation and development processes for MedTech products have not kept pace.

A recent BCG report recommends that MedTech firms shift from individual products to evergreen platforms so that product development is treated as long-term journey, during which platform teams are accountable beyond the initial release; innovate more closely with end users; redesign their legacy innovation processes to be faster and more iterative; and apply the management strategies of tech organizations by empowering forward-thinking leaders to govern the strategy for the portfolio and the evolution of the underlying systems.

By focusing on these four priorities, MedTech companies can get new products to market faster and more efficiently and ensure that they are fulfilling their mandate of improving patient lives.

As we bid adieu to 2023, it appears that MedTech this year has been characterized by cutting-edge advancements in various domains, including artificial intelligence (AI), wearable devices, telemedicine, and precision medicine. The convergence of these technologies has paved the way for more personalized and accessible healthcare solutions, ultimately improving patient outcomes and reducing the burden on healthcare systems worldwide.

Furthermore, MedTech is fostering collaboration among clinicians, researchers, and technology developers, leading to ground-breaking discoveries and the development of novel medical devices and therapies. As we welcome 2024, we anticipate transformative breakthroughs that will reshape the future of healthcare, making it more efficient, cost-effective, and patient-centric.

In India, as in other parts of the world, major MedTech companies have started with the careful development and implementation of a digital strategy roadmap to make small yet immediate changes to select processes within the industry. This was followed by developing and retaining a digitally savvy workforce, adopting agile methodologies and addressing possible cyber threats. As a result, major MedTech companies have seen success in the areas of inventory management, logistics and distribution, device maintenance, product development, and warehouse operations.

MedTech Industry 4.0. The integration and realization of the digital transformation into production facilities throughout their operations, has paved the way for quality improvement and standardization of outcomes. Some of the areas that have seen successful implementation are Internet of Medical Things, advanced design engineering, and cloud computing.

Large MedTech organizations that have already implemented these aspects have reaped the benefits associated with these implementations. This has not only aided in increased productivity but reduced quality issues and more importantly opened up newer vistas for exports to developed markets. As more MedTech companies in India and other parts of the world stay the course of digitization of medical devices manufacturing, the overall quality of the currently available products in the market will go up. One of the far-reaching consequences of such transformation will undoubtedly be remarkable changes in the larger healthcare ecosystem.

The current market size of the medical devices sector in India is estimated to be ₹88,000 crore and is expected to reach ₹520,000 crore by 2024. India is the fourth-largest market for medical devices in Asia after Japan, China, and South Korea, and is amongst the top 20 markets in the world.

The Indian medical devices market comprises more than 800 manufacturers, of which 65 percent of companies have a turnover of less than USD 1.5 million, 25 percent of companies have a turnover of USD 1.5–6 million and 2 percent of the companies have a turnover of more than USD 73 million. A report by NITI Aayog and the Department of Pharmaceuticals recognizes that Indian manufacturers have a 12–15 percent disability factor in manufacturing medical devices. This is attributed to lack of adequate infrastructure, supply chain and logistics; high cost of finance; inadequate availability and cost of quality power; limited design capabilities; and low focus on R&D and skill development.

As part of ensuring ease of doing business in India, foreign direct investment in medical devices manufacturing sector is permitted without any prior approval from the government, allowing business to quickly scale up existing operations by infusing capital or engage in time-sensitive strategic acquisitions. The already robust intellectual property rights regime in India has been strengthened further by allowing for grant of patents and trademarks for medical devices.

The Indian government has introduced various fiscal measures to promote research, development, manufacturing, and import of medical devices. For instance, the government has incentivized scientific research and development by providing weighted deduction for the expense incurred on that front. There is minimal or no import duty on certain medical devices.

The National Medical Devices Policy, 2023, is a policy framework approved by the Union Cabinet in India that focuses on meeting the public health objectives of access, affordability, quality, and innovation.

The policy provides a blueprint for the government to boost the medical devices sector’s growth by prioritizing innovation, research, and production capacity. Additionally, the policy will enable testing facilities, enabling quicker diagnosis of illnesses and access to more precise and cost-effective treatments.

It has set a goal to increase India’s presence in the global medical devices market from 1.5 percent to 10–12 percent in the next 10 years, resulting in a market value of USD 100–300 billion. The policy would encourage the production of 25 advanced medical technologies in India. It aims at promoting the manufacturing of critical components, related to cancer treatment and imaging technologies, such as ultrasound, MRI, molecular imaging, and PCR that are currently imported.

To achieve these goals, the government plans to create 50 clusters for rapid testing of medical devices and training experts in the field with a special curriculum prepared at the higher education level, with this policy. This initiative is expected to create more jobs and increase the competitiveness of the Indian medical devices industry, while also improving access to high-quality medical devices for citizens.

A production-linked incentive (PLI) scheme for medical devices has already been implemented. The government is also supporting the setting up of four Medical Devices Parks in states including Himachal Pradesh, Madhya Pradesh, Tamil Nadu, and Uttar Pradesh.

Under the PLI scheme, a total of 26 projects have been approved, and 14 projects producing 37 products have been commissioned. An investment of ₹1206 crore is committed for the same. Out of this, so far, an investment of ₹714 crore has been achieved.

Domestic manufacturing of high-end medical devices like linear accelerator, MRI scan, CT-scan, mammogram, C-arm, MRI coils, high-end X-ray tubes, etc., has started. The remaining 12 products will be commissioned soon. Recently, five projects have been approved for domestic manufacturing of 87 products/product components. These initiatives aim to reduce the import of medical devices and promote domestic production.

The policy calls for establishing large medical devices parks and clusters, equipped with world-class common infra in proximity to economic zones with required connectivity. It encourages private investments, and funding from VCs and pushes for PPPs.

However, like in any other country, there are certain challenges in doing business of medical devices in India. The first and foremost challenge is price control. The Government of India controls prices of certain medical devices by either fixing a price at which they may be sold under a formula or by restricting the ability of the marketer of the medical device to increase its price by more than a prescribed percentage at any given time. The second challenge is the presence of multiple regulators, which may make simple tasks, such as rectification of an erroneous declaration on the label, quite a drawn-out process. The third challenge is the presence of laws that restrict manufacturers and importers of medical devices from promoting their products directly to the customers in certain circumstances.

Few other challenges include an unfavourable duty structure in many segments/sub-segments of the industry that makes imports cheaper than manufacturing in India. This further limits the scope for local value addition, especially in segments conducive for manufacturing at present. Also, small markets for most segments/sub-segments of the medical devices industry limit investments, as any investment would require scale for viability. Insufficient human capital due to restrictive labor laws and limited trained workforce in India to install, operate, repair, and service equipment also poses a major challenge.

India’s exports of medical devices has registered a 16.15-percent growth during the fiscal year 2022-23 at ₹27,818 crore, as compared to the ₹23,950-crore exports reported in the previous fiscal year.

Among the top five countries to where India exported medical devices during the fiscal year 2022-23, exports to US was the highest at ₹5571 crore, including ₹2735 crore worth of electronics and equipment, ₹1799 crore of consumables, ₹393 crore of disposables, ₹266 crore of implants, ₹218 crore of IVD reagents, and ₹161 crore of surgical instruments.

Germany was the second major export destination, picking up ₹1468 crore of medical devices from the country, with the electronics equipment category witnessing ₹758 crore exports followed by consumables at ₹465 crore of exports. China was the third largest export destination for India in terms of value of exports at ₹1213 crore during 2022-23, followed by Netherland at ₹887 crore and Brazil at ₹691 crore.

Exports of electronics and equipment stood at ₹10,669 crore out of the total ₹27,818 crore, followed by consumables at ₹9449 crore, disposables at ₹4257 crore, IVD reagents at ₹1453 crore, implants at ₹1410 crore, and surgical instruments at ₹579 crore.

The exports of medical devices are expected to have a better growth in the near future, with the Center taking various measures, including support to infrastructure development, creation of the National Medical Devices Policy, and an Export Promotion Council for Medical Devices.

In June, this year, the Ministry of Commerce and Industry brought in amendments to the list of export promotion councils, commodity boards, and export development authorities, in the Foreign Trade Policy (FTP), 2023, to add the Export Promotion Council for Medical Devices (EPC-MD) to the list. With this, the newly launched Council can issue the registration-cum-membership (RCMC) for the items listed as falling under its jurisdiction.

The Ministry has issued a public notice announcing the amendments in Appendix 2T, which is the list of export promotion councils and other export authorities, of appendices and Aayog Niryat Forms of the FTP, 2023. This adds the EPC-MD as a new entry at series number 38 in the appendix.

Regulation and monitoring of medical devices

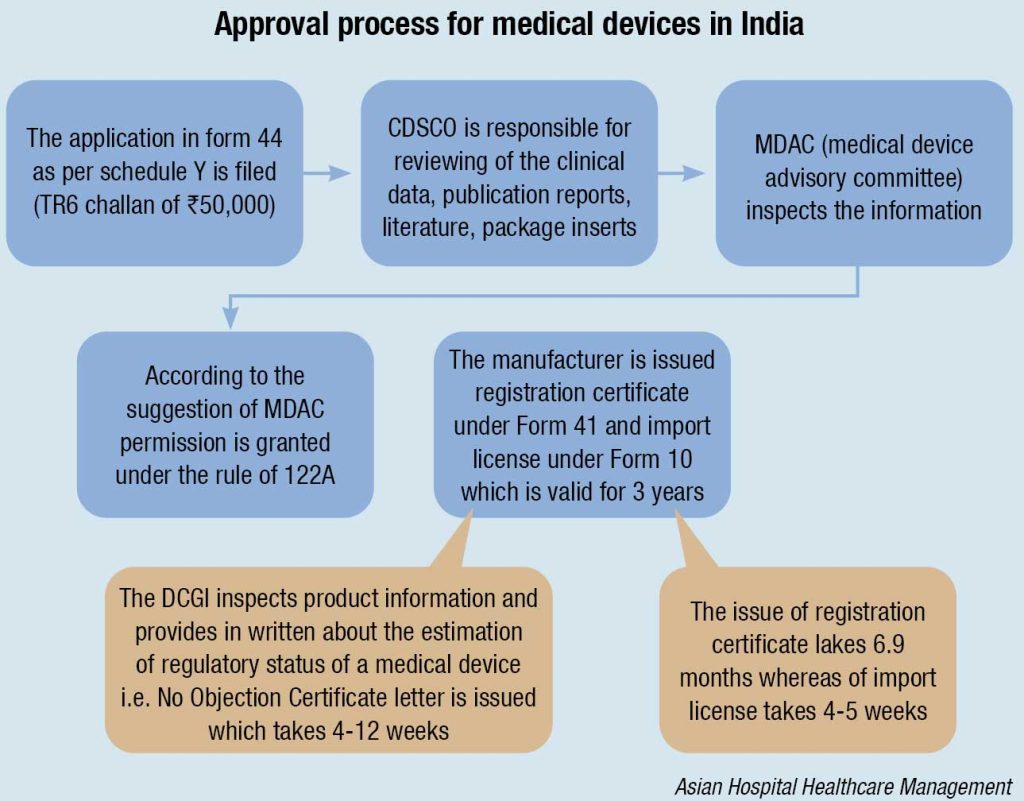

The Central Drug Standard Control Organization (CDSCO) under the Directorate General of Health Services in the Ministry of Health & Family Welfare (MoHFW) is the National Regulatory Authority (NRA), which is accountable for manufacturing, import, conduct of clinical trials, laying down standards, sale, and distribution of medical devices via enforcement of Medical Device Rules, 2017. It reviews all data submitted, which are essential for the approval of the device. The NRA is supposed to ensure the safety of public health. As the NRA, the CDSCO is responsible for conducting Materiovigilance Program of India (MvPI). The Indian Pharmacopoeia Commission acts as the NCC (National Coordination Center) for MvPI. The MvPI is supposed to furnish the collection of safety data in a systemic manner; therefore, regulatory selections and guidelines for secure use of medical devices being used in India might be based totally on the data generated. The program supervises MDAE (Medical Devices-associated Adverse Events), spread awareness among healthcare professionals regarding the significance of MDAE reporting in India, and also overlooks the advantages and negative outcomes of the medical devices. It is also intended to generate unbiased evidence-based suggestions and to communicate the findings to all key stakeholders.

The MDAC (Medical Devices Advisory Committee) is a body responsible for the overall inspection of the information. If everything is favorable the MDAC grants permission under Rule 122A and ultimately the manufacturer is issued with license under form 41 and the import license under form 10, allowing them to introduce the device into the market. The license issued is valid for only three years. The devices, which are non-notified, need not to be registered with the CDSCO, and can be imported throughout the country according to the formal custom rules.

The import and registration of medical devices occurs under Drugs and Cosmetics Rules, 1940, which specify that

- In order to file an application for the import and registration of medical devices under the prescribed guidelines, the importer is given a time period of 60 days.

- Import is not allowed without the approval of an authorized body, in case of those devices that have never been imported in the country before the date of notification.

- The devices are allowed to be sold for a particular period (up to 6 months) during which the application is being evaluated for approval or rejection. Separate committees are made for the assessment of different classes of devices. The distinct medical devices classes categorized on the basis of level of risk are:

- Class A – Low-risk devices, e.g., thermometers, tongue depressor;

- Class B – Low–medium-risk devices, e.g., hypodermic needles, suction equipment;

- Class C – Medium–high-risk devices, e.g., lung ventilators, bone fixation plates; and

- Class D – High-risk devices, e.g., heart valves, implantable defibrillators.

Regulation for the approval of medical devices across the globe is a vital requirement in order to ensure quality, safety, efficacy, and performance so that they can be introduced into the market for protecting, preventing, improving, and sustaining public health. This ultimately lifts up the customer’s faith and confidence in the device and in the manufacturer. The devices are classified on the basis of the level of risk into various classes; thus the devices in different classes have different regulatory steps for approval of the devices varying from region to region. Although different regions are diverse in the regulatory processes, charge different fee for application filing, and have their own time period in order to approve and to issue a license, at the end all are aiming at one goal, i.e., manufacturing and marketing of a device, which is safe, effective, and of good quality in order to provide their best to the public.

Absence of a specific digital health law

A recently released report Digital Health in India by Nishith Desai Associates highlights that the difficulty in the enactment of a comprehensive digital health-specific law is the lack of clarity on the potential of the emerging technologies itself. It recommends that digital health models in India must currently focus on three legal principles – data privacy, compliance with existing regulations, and conformity with medical ethics. At present, the inter-disciplinary nature of digital health applications will require restructuring of multiple legislations. Some key considerations in this respect are:

Specific data protection laws. The data protection rules are inadequate to anticipate and regulate the challenges posed by digital health. While the proposed DPB will aid in clarifying certain aspects of data protection measures to be extended to users of digital health interface, the governance of health data will require a more specific approach. Previously, a draft Digital Information Security in Healthcare Act, 2018, was released to impose significant restrictions on the use of health data as a step for controlling data flow in the digital health technology ecosystem. The implementation of a specific health data law or some form of guidelines will be beneficial for facilitating a robust system and aid the digital health entities to foresee potential challenges for the protection of health data.

EHR system. The need of the hour is for India to implement a nation-wide framework for the adoption of EHRs. Ancillary services, such as telemedicine, e-pharmacies, and even the use of big data in healthcare can be put in place once a robust EHR system is in place. Additionally, there is also a need for specific legislations to regulate telemedicine and online pharmacies.

Technical reliability and appropriateness. There are multiple challenges rooted within the technologies itself. Considerations of safety and standardization of hardware and software is necessary. This will aid in understanding legal aspects of liability and implementation of a licensing system.

Ascertaining the role of patients. Until now, the underlying legal assumption is that healthcare professionals are service providers and patients are consumers. However, in the digital revolution, these lines are blurred and m-health applications, self-diagnostics, etc., in fact make patients co-deliverers of healthcare services. In this process, patients may commit errors in reporting data, interpreting advice, or may even accidentally interfere with automated measures and transmissions. This can directly contribute to negative outcomes. Hence, the reliability on traditional approaches to liability cannot be imported in this context. Hence, the law must look into the aspects of usage standardization and the conditions of absolving liability of the digital health entities in such scenarios.

Role of healthcare professionals. Currently, the MCI Code focuses on the responsibilities, which are foreseen in the light of standard consultation and treatment scenarios. However, the ambit of these must be extended to perceive any duties, which may arise through the use of digital interventions in standard healthcare. Aspects, such as patient informatics, promotion, consent, confidentiality, etc., must be legally re-configured to suit the digital health ecosystem.

The present-day digital world is populated by various forms of technologies, which contribute to the advancement of the global society. This situation benefits humanity enormously, particularly in the health sector with the advancement of therapies, tests, and new medicines that improve our quality of life and extend our life expectancy, among other things.

The digital health market presents a lot of opportunities, but with every opportunity, there are bound to be risks involved. Innovation in this sector is yet to reach a saturation point, with new products frequently being introduced in the market. The legislative framework to protect and regulate such developments will remain one step behind, as it is yet to be seen how the industry will mature. Regardless, regulators have to anticipate and ensure that in the absence of specific laws, how existing laws can be harnessed to adequately regulate emerging technologies.

In a country where access to affordable healthcare is still a looming issue, the public stands to gain immensely from the development of the digital health industry. The Ayushman Bharat Digital Mission (ABDM) is a one of a kind strategy to unify the healthcare system in India and promote innovation in the industry. With public interest in the minds of both the government as well as the innovators, it remains to be seen how digital health will be perceived in law.

While there is a long way to go, digital health has gained a strong foothold in India over the past year and has a promising future for the industry.

There are two global concerns brought to the fore recently, that could have a bearing on the Indian MedTech industry.

FDA has mandated that manufacturers provide software bill of materials (SBOMs) for all medical devices going to market. This latest directive is to mitigate cyber security breaches in the healthcare sector. Healthcare cyber-attacks in the US more than doubled from 2016 to 2021, putting medical devices – and patients – at risk and exposing the private health information of nearly 42 million individuals. In such a digital landscape, the integration of cyber security best practices, such as the use of SBOMs comes as a welcome step forward in the fight against cybercrime.

The SBOM captures information, such as the names of the software components and libraries, versions, associated licenses, and any known vulnerabilities or security issues. In such a way, it helps healthcare organizations gain visibility into the software they are using, and identify potential security risks or vulnerabilities associated with the underlying components. The result is a better managed and secure software supply chain and a stronger cyber security infrastructure.

In addition to enhancing supply chain security, SBOMs play a vital role in healthcare cyber security by facilitating vulnerability management, ensuring regulatory compliance, enabling effective incident response, and supporting secure software development practices. They also enhance collaboration and information sharing, which in itself is a best practice that leads to continuous enhancements in security.

As critical as SBOMs are to an organization’s cyber security infrastructure, an SBOM on its own does not do anything – it needs to be vigilantly monitored and analyzed in order to detect and respond to any component-level vulnerabilities that arise across the life cycle of the hardware or software device. In this way, supply chain risk management processes are critical to SBOM implementation.

At the recently held AdvaMed’s annual Medtech Conference, October 9–11, 2023, held in Anaheim, California, medical devices leaders gathered to discuss what growth looks like for the sector now that the pandemic-driven uncertainty, supply chain snags, and financial pressures had eased and stabilized.

EY released a report at the event. Five takeaways from the report are:

M&A is practically nonexistent, but could accelerate. Mergers and acquisitions have been almost non-existent so far in 2023. The total value of deals decreased 44 percent to USD 44.6 billion for the 12-month period ending June 30, 2023. There have been just a handful of large deals this year, with the largest being Johnson & Johnson’s USD 16.6 billion purchase of Abiomed, Globus’ USD 3.1 billion purchase of NuVasive, and Thermo Fisher’s USD 2.6 billion purchase of The Binding Site.

Despite the slowdown, there seems to be an opportunity for acquisitions, particularly purchases of smaller companies. Spinoffs could drive deal-making. GE HealthCare has bought at least five firms since it was spun out into a standalone company. A Reuters report had said that the Carlyle Group may be looking to buy Medtronic’s connected patient monitoring and respiratory care businesses.

Spinoffs are still in. J&J recently spun out its consumer health business Kenvue, giving its MedTech and pharma segments more cash for acquisitions. Meanwhile, Baxter is in the process of spinning out its kidney care business, dubbed Vantive, and 3M has poached MedTech execs to lead its planned healthcare spinoff.

Revenue growth has slowed. Coming out of the Covid-19 pandemic, medical devices companies experienced revenue growth as patients began to return for procedures. That growth has slowed in subsequent years, however, leading industry watchers wondering what to expect in the future.

In 2022, medical devices revenues increased by 3.5 percent to USD 573 billion, compared to the 16-percent growth reported in 2021. The slowdown continued in the first half of 2023, with revenues for large MedTech firms essentially flat, compared to the prior year period, according to EY’s report.

Based on these numbers, 2021’s growth rates could be seen as an outlier, related to pandemic recovery, rather than a signal for the future.

EY expected industry growth going forward to be closer to a rate of 5 percent to 6 percent than historical compound annual growth rates of 9 percent to 10 percent. The reason is a lack of new devices creating billion-dollar markets, like TAVR and mitral valve devices did a decade ago.

MedTech investment fell to a seven-year low. Equity investment in medical devices companies fell to its lowest point in seven years, declining 27 percent to USD 13.8 billion, according to EY’s report. This decline could affect smaller deviceS companies, which drive innovation but rely on financing from larger MedTech companies or external investors.

Total MedTech financing rose 9 percent to USD 32.8 billion in the year ending June 30, but this was largely driven by a 72-percent increase in debt, according to the report. And unlike previous years, where debt was largely used to fund acquisitions, in the last year it went to repaying or refinancing existing debt, working capital, and stock buybacks.

There are two areas where investors continue to pour in funds – AI and robotics.

MedTech stocks and IPOs have declined. Shares of publicly traded medical devices companies have declined, following broader stock market trends. By the end of July, company valuations were just 22 percent higher than they were in January 2020, according to the report. Total market capitalization for the sector decreased by 28 percent to nearly USD 1.6 trillion.

MedTech commercial leaders identified by EY traded about on par with a composite of US and European stock indexes, while an index of digital health companies traded much lower.

In total, just four medical devices companies went public during the year ended June 2023, raising USD 40 million. For comparison, during the prior-year period, 39 companies went public, raising USD 4.4 billion.

Outlook

The Indian medical devices industry continues its upward march of growth and is strongly supported by India’s robust legal framework. Several MNCs have been increasing their manufacturing footprint and locating research centers in India to serve both the Indian and global markets. Increased funding and investments have also reflected in other supply side changes in healthcare delivery in India, such as the growth in the healthcare infrastructure post pandemic, increasing recognition to healthcare providers, and focus on availability and distribution of medical devices, etc.

There is no denying that despite the odds, the medical devices industry in India continues to offer unprecedented opportunities to present and potential investors and stakeholders, now more than ever before. With increasing investments flowing into the industry, the medical devices sector shows immense potential for growth in our country, and the proactive steps taken by the government in this regard by way of introduction of the Make in India schemes and online registration of medical devices is aiding this growth. Make in India initiative is essential to leverage the initiative to kick-start indigenous manufacturing and realize the twin objectives of accessibility and affordability.