Hospital Watch

Capacity expansion and geographic diversification to drive synergies

In the backdrop of major planned expansions, both brownfield and greenfield by hospitals and diagnostic centers, the MedTech and IVD companies can afford to be upbeat and look toward a robust 2024.

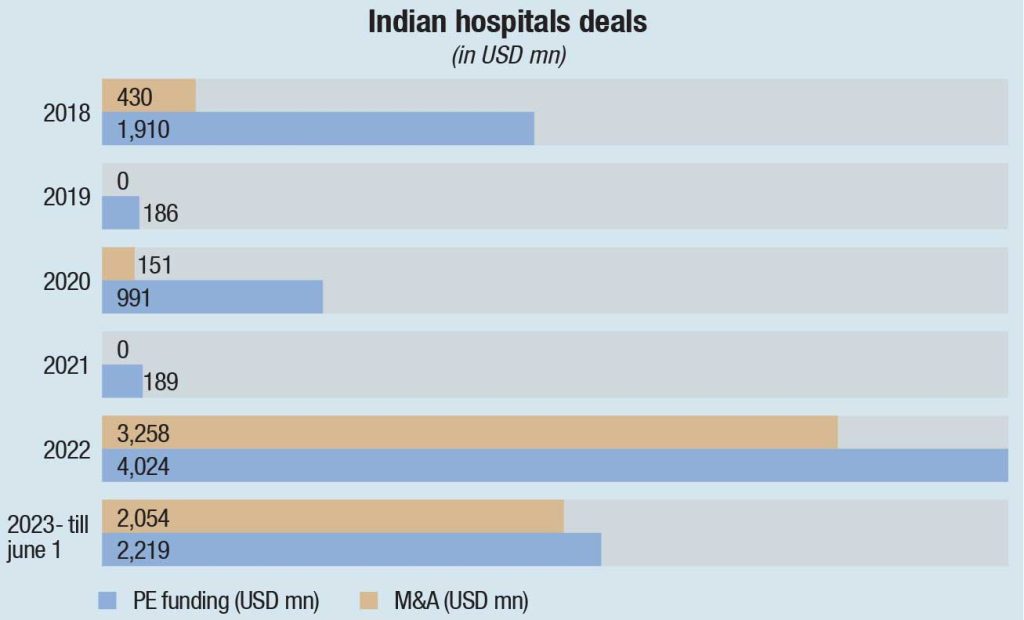

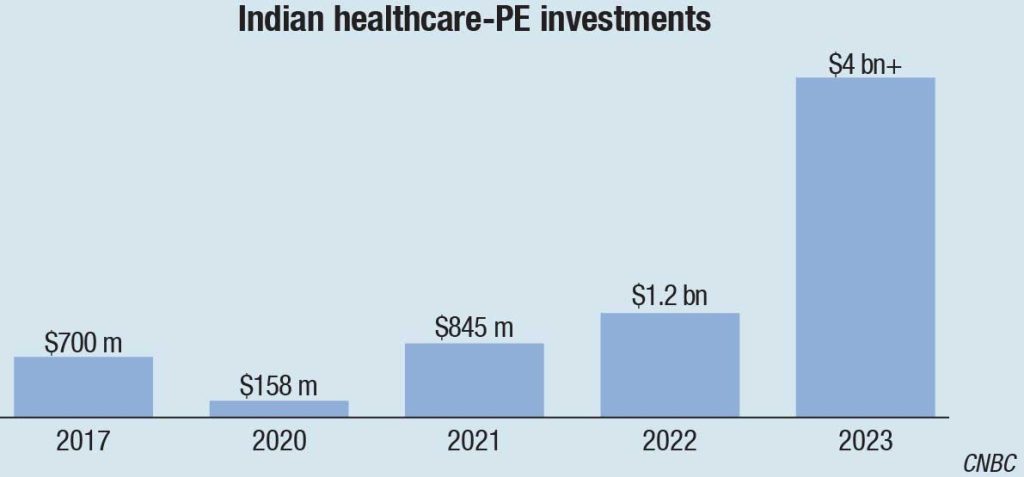

The healthcare sector in India witnessed a historic surge in investments with over USD 4 billion inflows in 2023. Hospitals, spanning healthcare technology, medical devices, and diagnostics, dominated the investment scenario, with over 20 private equity deals amassing USD 3.8 billion. Private equity investments jumped 9–10 percent, a substantial leap from the pre-Covid-19 era’s 2 percent and last year’s 5 percent.

The preceding year had seen deal values reach USD 4.3 billion in 2022, at approximately 8 percent of total investments. 2022 was a year when healthcare had delivered, expanding to nearly 16 percent of total exit value at USD 3.5 billion. In a year that saw marquee public market exits, IPOs, and secondary sales, KKR’s exit from Max Healthcare grabbed headlines with an exit value of USD 1.6 billion in 4 years driven by a significant EBITDA expansion, followed by other large exits, such as Everstone’s exit from Sahyadri Hospitals and Carlyle’s and British International Investment’s IPOs of Medanta Medicity (Global Health) and Rainbow Hospitals.

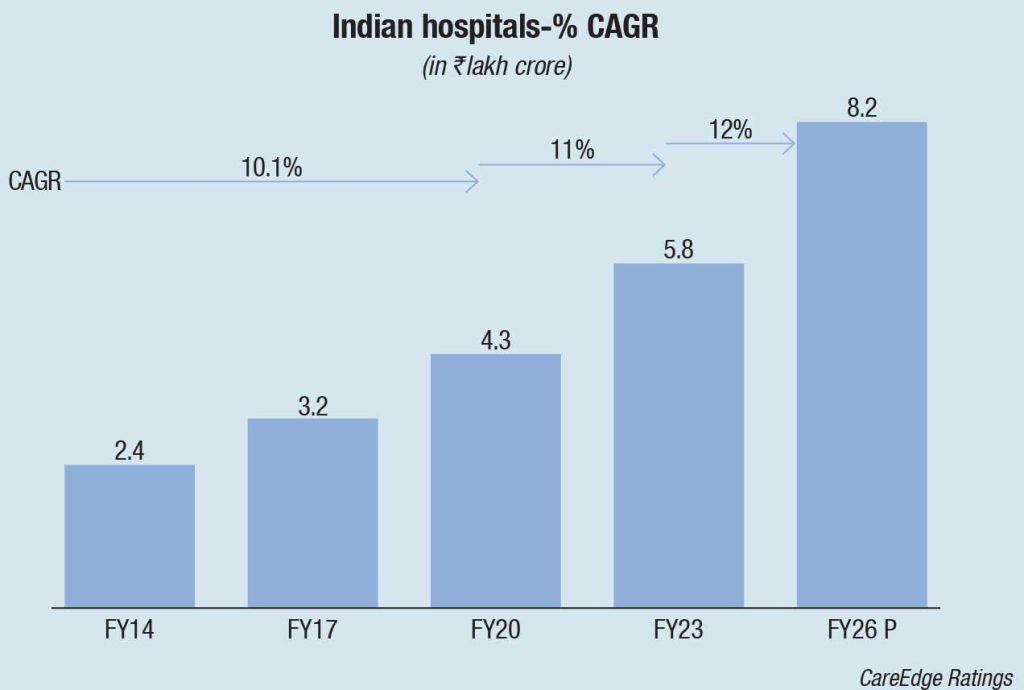

The Indian hospital industry accounts for about 80 percent of the total healthcare market. It is expected to close at USD 132 billion in 2023, growing at a CAGR of 16–17 percent. There are currently 70,000 hospitals in the country, of which the private sector accounts for 63 percent.

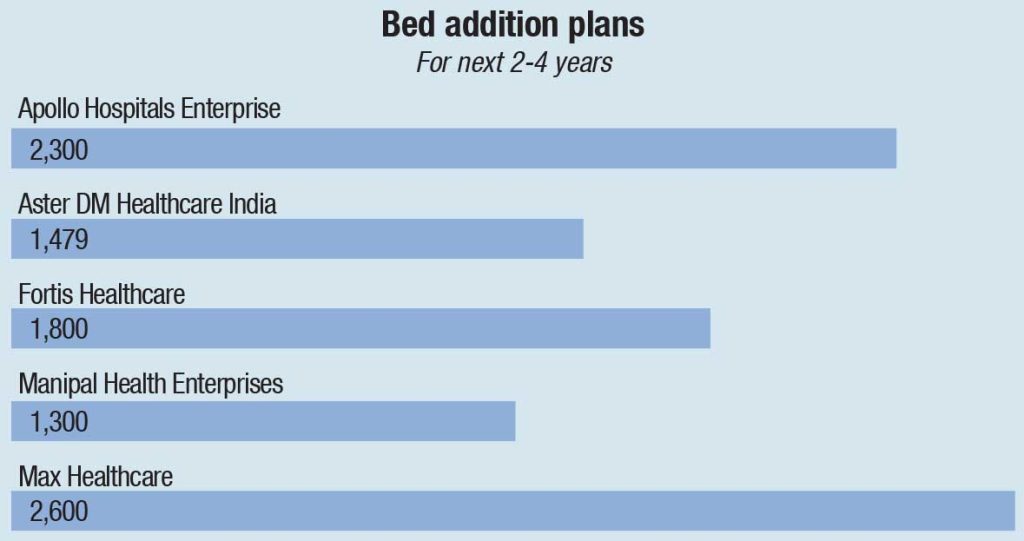

The sector is expected to see a significant jump into new capacities, leading to a sharp rise in net income. Hospitals are gearing up for significant capacity expansion over the next 12–15 months, projecting an increase of 3–10 percent. This will deviate from the linear trend observed in the past three years. They are together expected to necessitate an investment of USD 245 billion over the next 20 years.

2024 is expected to see continued consolidation. This trend is already evident. Various factors are contributing to this, including lack of succession planning among the promoters of family-owned private hospitals, profitability impacted due to compliance with EWS reservations in hospital beds, an overall challenge in competing with larger players for purchase of medicines and equipment, and lack of quality workforce. PE firms, MNC players, and large national hospital chains are focusing on acquiring smaller standalone private hospitals, both in large centers and in Tier-II and Tier-III cities.

PE. Investors are showing confidence in the healthcare sector. They are targeting various segments, including multi-specialty hospitals, regional healthcare providers, and super-specialty hospitals.

The Indian hospital sector has experienced a substantial increase in investments, particularly from private equity firms. Over the past six years, investments have grown by nearly six times, reaching a total of USD 4 billion this year. This marks a significant milestone, with the sector witnessing billion-dollar investments for two consecutive years.

The private healthcare market in India is estimated to grow at an annual rate of 12–14 percent as per PWC, making it a lucrative sector for investors. The market is valued at around USD 48 billion.

Valuations in the healthcare sector have expanded significantly. The EV/EBITDA multiples have increased from 10–15× before the COVID-19 pandemic to 15–20× at present. Well-located multi or single-specialty healthcare providers can command even higher valuations, with some reaching 15–25× EV/EBITDA. For example, Manipal was over 25×. Valuations have also been aided by EBITDA growing 5–10 percent post-Covid-19, along with other factors, such as the scarcity premium. That said, experts suggest that the pipeline for fresh investments may be slowing down, indicating there could be potential challenges in finding suitable opportunities in the future.

Another trend being seen is a move toward smaller centers and facilities. In response to the challenges posed by escalating real estate costs and limited urban space, major hospital chains, with Manipal and Fortis leading the way and moving away from constructing facilities with 600–700 beds, are focusing on smaller units ranging from 250–350 beds. Infrastructure challenges in large metro cities, compounded by traffic issues, are giving strength to this move. While Fortis Healthcare is adapting to volatile real estate prices by focusing on brownfield sites for expansion, Manipal is embracing the smaller-is-better approach in metros like Hyderabad and Pune, along with Tier-II cities in Kerala, Andhra Pradesh, and Maharashtra. Apollo Hospitals and Rainbow too are expanding into Tier-II cities, such as Mysore, Varanasi, Andhra Pradesh, and Tamil Nadu, with long-term build-to-lease contracts being preferred having decided to adopt asset-light strategies.

Some recent PE investments

US-based private equity major Blackstone, through private equity funds managed by it, has entered the healthcare space in India with two acquisitions in a deal valued at around USD 1.3–1.5 billion, of which Blackstone’s commitment is around USD 1 billion to build one of the largest hospital platforms in the country.

Blackstone has inked a pact to acquire a majority stake in Hyderabad-based CARE Hospitals from Evercare, a platform of TPG RISE funds, for USD 700 million (around ₹5827 crore), thus foraying into the country’s healthcare services sector. Private equity funds managed by Blackstone have acquired 72.5 percent in Quality Care India Ltd. (QCIL), which operates a network of Care Hospitals at an enterprise value of ₹6600 crore (USD 800 million). TPG will continue to hold the remaining stake of 27.5 percent in QCIL.

In a separate deal, QCIL has signed a definitive agreement to acquire around 80 percent in KimsHealth, entailing an outgo of around USD 400 million. Blackstone will put in USD 300 million and TPG the rest USD 100 million as part of the arrangement. The acquisition of Care Hospitals by Blackstone and, in turn, of KimsHealth by Care Hospitals would create one of India’s largest hospital platforms spread over 11 cities, with 23 facilities and 4000 beds. KimsHealth runs four hospitals in Kerala with around 1400 beds. Dr MI Sahadulla, chairman and managing director of KimsHealth, would continue to hold around 20 percent in the hospital chain, and also continue to run the business.

Global investment firm General Atlantic (GA) is looking to acquire about 51 percent of Amar Ujala’s, Ujala Cygnus Healthcare Services, for ₹1600 crore. This includes stakes held by the existing investors Eight Roads Ventures India, Evolvence India Fund, and Somerset Indus Healthcare Fund. In addition to this, GA will also obtain a small minority stake from the promoters and a primary stake. The deal is currently in the documentation stage, and is expected to be finalized within the next few weeks. EY’s investment banking arm is advising on the stake sale.

Ravleen Sethi

Ravleen Sethi

Associate Director,

CareEdge Ratings

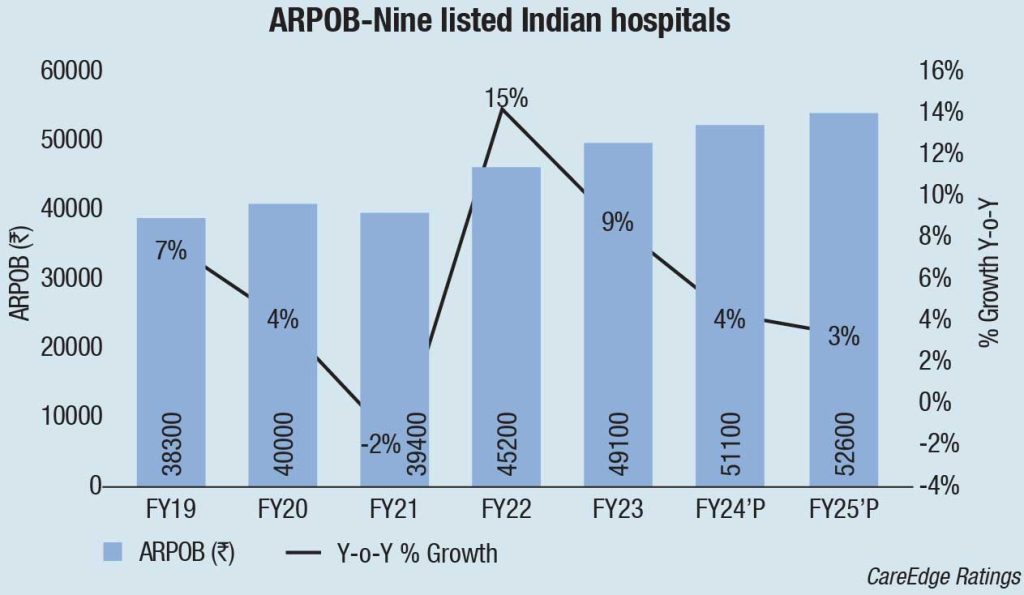

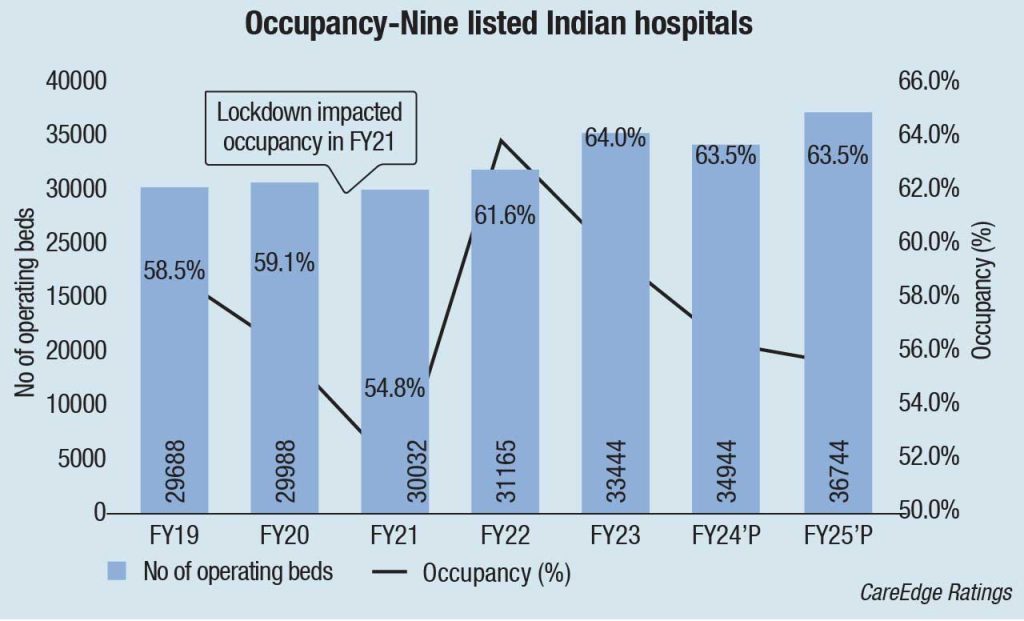

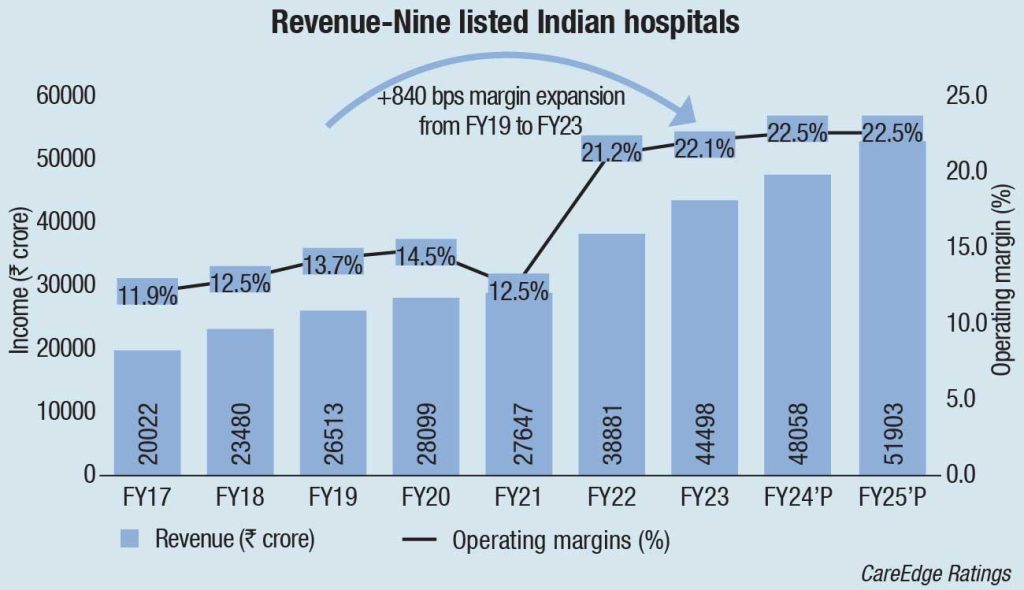

In FY23, the hospital industry thrived with mid-teen revenue growth driven by improved ARPOB, higher occupancy, expanded capacities, and shorter average length of stay. Operating margins exceeded pre-pandemic levels, fuelled by increased ARPOB, surgical volumes, and cost optimizations. Post-Covid, there’s a surge in capital expenditure for capacity expansion and geographic diversification. Despite rising leverage from CapEx, industry players remain financially robust, having significantly reduced leverage over the past two years through strong cash accruals.

Established in 2011, Ujala Cygnus Healthcare Services, presently operates 19 hospitals across Tier-II and Tier-III cities in Haryana, Uttar Pradesh, Uttarakhand, Jammu & Kashmir, and Delhi, with over 1800 beds capacity. The hospital chain is projected to generate ₹600 crore in revenue, with an EBITDA of around ₹120 crore in FY24. The company’s forward trajectory involves expanding primary and preventive healthcare accessibility across an additional 10 hospitals within the next couple of years, in Madhya Pradesh, Rajasthan, and Bihar. GA has established a presence in the Indian healthcare sector through investments in Rubicon Research, ASG Eyecare, and KIMS Hospitals.

Singapore sovereign wealth fund GIC Pte. Ltd. and Texas-based private equity firm TPG have acquired around 70-percent stake in India’s Asian Institute of Nephrology and Urology for ₹6 billion. (USD 72.4 million). The investment was made via specialty investment firm Asia Healthcare Holdings, a company funded by GIC and TPG. Asian Institute of Nephrology and Urology operates seven hospitals across the cities of Hyderabad, Visakhapatnam, Siliguri, and Chennai.

International entities, such as Canada’s Ontario Teachers’ Pension Plan Board (OTPP) is acquiring regional and multi-specialty play Sahyadri Hospitals and IIFL PE investing in Kauvery Hospitals are underlining the global interest in this sector.

Singapore state investment firm, Temasek Holdings is looking to deepen its ties and accelerate plans to deploy USD 10 billion in the country over the next three years. The firm, which has invested an average of USD 1 billion to 1.5 billion annually in India over the last 19 years, now aims to triple that amount.

In April 2023, Temasek sealed the biggest-ever private equity deal in the Indian healthcare sector – the acquisition of a majority stake in Manipal Hospitals. The firm paid USD 2 billion for an additional 41-percent stake in Manipal Hospitals, increasing its total shareholding from 18 percent to 59 percent. Thirty percent is owned by promoter Ranjan Pai and his family, with the remaining 11 percent held by TPG Growth.

Manipal Health Enterprises and Medica Synergie Pvt. Ltd. (in which Temasek now has a share of 90 percent) are likely to merge soon and operate as a single entity under the Manipal brand, heading toward becoming India’s largest hospital chain. Manipal Health Enterprises has a capacity of 9500 beds in 33 hospitals across 17 cities in India, while Medica with presence across five hospitals in east India, plans to increase its bed capacity from 1200 to 1500 beds at an investment of ₹400 crore in Kolkata, Siliguri, Asansol, and Kalinganagar. By 2025, Medica plans to offer 2000 beds through greenfield projects or acquisitions, possibly exploring opportunities in Guwahati or Varanasi.

Mitesh Daga

Mitesh Daga

Managing Director,

TPG Capital

The awareness toward the need for more healthcare capacity being built in the country is increasing and there is almost about USD 200 billion of capital that is required to bridge the demand-supply gap that exists in quality healthcare supply today. Private equity is playing an important role to bridge that gap. We will see more and more private equity participation in the hospital sector. Next year may see lower deal activities than this year because most of the larger chains have traded recently and there will be some gestation period.

Manipal Hospitals added 1200 beds through its acquisition of 84-percent stake in AMRI Hospitals for ₹2300 crore in September 2023. AMRI Hospitals operates hospitals in Dhakuria, Mukundapur, and Salt Lake (all in Kolkata) and another in Bhubaneswar, Odisha. (Emami Group continues to hold 15 percent stake in AMRI Hospitals, while the Government of West Bengal holds approximately 1 percent stake).

It is interesting that while Manipal acquired 1200 beds from AMRI at roughly ₹2.28 crore per bed, Temasek paid around ₹4.81 crore per bed for Manipal.

Manipal Hospitals plans to add 750 beds with three more hospitals – two in West Bengal and one in Odisha over the next 3–5 years through both greenfield and brownfield projects, expanding its footprint in the East. And it has three ongoing greenfield projects in Bengaluru and one in Raipur, with a combined bed capacity of 1000 and one hospital in Raipur with 400 beds. For greenfield projects, the hospital typically aims for a minimum of 250 beds, with an approximate investment of ₹300 crore, excluding land and building costs.

In November 2023, Manipal Hospitals announced expansion of its partnership with real estate developer Vaishnavi Group to develop a built-to-suit hospital in South Bengaluru. This development assumes significance as there has been a significant uptick in the demand for quality infrastructure in the medical and wellness sector to cater to the growing medical needs of citizens. Spread across a super built-up area of 3.3 lakh square feet, the proposed tertiary care hospital is being designed with 250 beds.

Private hospitals in India are going in for both greenfield and brownfield projects

Apollo Hospitals has retained its growth guidance and has a CapEx outlay plan of ₹3435 crore, which will be spent over 3 years to add a capacity of 2860 beds. FY25 plans include a total outlay of ₹1435 crore for bed capacity of 1170 (940 operational); greenfield (asset-light) addition of 375 beds in Gachibowli, Hyderabad, at a cost of ₹370 crore, brownfield expansion of 150 beds in Bangalore for ₹150 crore; acquire a hospital in Sonarpur Kolkata that will have 220 beds for ₹240 crore; and a 425-bedded hospital from Royal Mudhol Hospital in Pune for an estimated ₹675 crore. The total outlay for FY26 is ₹700 crore for an expansion in bed capacity of 690 (940 operational), 550-bed hospital acquired (₹550 crore) in Gurgaon will be on stream, brownfield expansion of SSPM and Mysore expansion will add 140 beds (₹150 crore outlay). For FY27, the group has planned a total outlay of ₹1300 crore for a bed capacity of 1000 (800 operational), greenfield expansion of 600 beds at OMR Medicity (₹725 crore), and greenfield expansion of 400 beds in Varanasi (₹575 crore).

Fortis Healthcare is on track to add 250 beds in H2 FY24 across Anandpur, BG Road–Bengaluru and Ludhiana. The management is also exploring opportunities in Delhi NCR and Punjab, along with evaluation of brownfield opportunities in Mohali and Shalimar Bagh. The Mohali unit got approval for adding additional 400 beds. With Mohali and Manesar expansion, the total bed expansion plan is for 2200 beds in 3–4 years.

In a move to strengthen its position in its core market of the North, Fortis earlier this year invested ₹225 crore to acquire a hospital in Manesar to focus on the Delhi NCR and Punjab region.

Marking a strategic move to entirely exit the Chennai market and focus on specific geographies, particularly in the North, Fortis sold its two south-based hospitals, 110-bed Arcot facility to Kauvery Hospitals for ₹152 crore and its 140-bed Fortis Malar to MGM Healthcare for approximately ₹128 crore.

Narayana Health’s CapEx guidance for FY24 is ₹1110 crore. The management is looking at brownfield expansion in Bengaluru Health City and expansion in Kolkata. The company is planning to set up a 1000-bed super specialty hospital in Kolkata in the next 2 years.

Max Healthcare Institute’s CapEx incurred for ongoing projects was ₹130 crore for H1 FY24. Its expansion plans include 300 beds at Dwarka, has applied for OC and on track to commission in Q4 FY24; 329 beds at Nanavati, the project is on track; excavation and related work has been completed along with steel fabrication work, ground level structure work is expected to be completed in Q3; 300 beds at Sector 56, Gurgaon, site excavation is almost completed; 190 beds at Mohali; all statutory approvals to start construction have been received and also appointed EPC contractor; 350 beds at Max Smart, the project is back on schedule to start construction from December 2023. Out of total 2700-bed expansion plan; 1000 beds will not have EWS obligation, which includes Dwarka and Gurugram units.

Max Healthcare Institute has acquired Starlit Medical Centre Pvt. Ltd. for an enterprise value of ₹940 crore, thereby giving it the ownership of 550-bed Sahara Hospital in Lucknow. The current operational bed capacity of Sahara Hospital is around 250 beds, with FY24 revenue run rate of ₹200 crore. The acquisition will take Max Health’s bed total to 4083, a 16-percent increase in its existing capacity.

Krishna Institute of Medical Sciences (KIMS). Expansion plan across Thane, Bangalore, and Kondapur unit has been slightly delayed and pushed back by 3–6 months. Recent acquisitions of Sunshine, Nashik, and Nagpur are value accretive, which will continue to aid growth momentum. In Telangana, the management undertook onetime expense toward hospital renovation in Telangana units and guided 31-percent sustainable margins from this cluster. KIMS requires cash of ₹500 crore to increase its stake to 100 percent in Kondapur unit. The Thane hospital work is in progress; was delayed on account of signing MoU as delayed from partner’s end to arrange funding. Management cited capital allocation of ₹430 crore in case KIMS enters on its own; expected to be operational by Q4 FY25. At Sunshine, the management anticipates ₹7–8 crore cost toward shifting of Secunderabad unit, which will be reflected in Q3 FY24. At Nagpur facility, further margin expansion expected post operationalizing of incremental 80 beds would result in higher occupancy and ARPOB growth. At Bangalore and Nashik, 415-bed expansion plan for one hospital in Bangalore is expected to be operational by Q4 FY25 with CapEx of ₹350–400 crore. Terms for another hospital (+300 beds) are expected to complete by Jan–Feb 2024. Nashik is expected to be commercialized by Q1 FY25.

Vishal Bali

Vishal Bali

Executive Chairman,

Asia Healthcare Holdings (AHH)

There is a reverse migration of talent from Tier-I cities to Tier-II and Tier-III towns, fuelled by technology availability, modern hospital infrastructure, and improvement of other social parameters like primary and secondary school education. Clinicians are open to migrating to Tier-II cities from metros because they also see potential opportunities to become leading consultants in those cities rather than being a number eight or a number ten in a large metro. Hospitals would be equally profitable in Tier-II cities as compared to metros on the back of lower CapEx/bed and lower OpEx cost of execution, although lower OpEx cost advantage may not continue to be a huge differential since overall fixed costs are increasing exponentially in Tier-II cities.

Global Health (Medanta) aims to invest ₹1000–1100 crore in the next 3 years, mainly focusing on expanding capacities in Lucknow, Patna, and Noida. Additionally, ₹60–75 crore will be allocated for equipment and technology upgrades at the Gurugram facility as part of maintenance CapEx. Patna Hospital plans to expand from 358 to 410–420 beds by year-end, focusing on increasing critical care capacity with an addition of 50 beds, mostly ICU beds, totaling over 130. Operating theaters have increased from 4 to 8 in Q2 FY24. Lucknow Hospital currently operates 600 beds, including 200 ICUs, with plans to add 120–150 beds by the end of FY24.

India’s leading real-estate developer DLF is forming a company with Global Health Ltd. to launch a multi-specialty hospital. Both Global Health, which runs the Medanta chain of hospitals, and DLF will own 50:50 equity in the new company and the hospital, with about 400 beds, will be located in the capital city of New Delhi.

Aster DM Healthcare sold its Middle East or GCC (Gulf Co-operation Council) business to Alpha GCC Holdings Ltd. in October, for around ₹8000 crore and shifted focus to India operations. Aster DM, which has six hospitals in Kerala and five each in Karnataka and Andhra Pradesh, is planning to add 1500 beds by FY27. Aster plans to allocate about ₹1500 crore for expanding the chain in India. Besides, once the GCC business’s separation is completed, an estimated ₹1500–2000 crore from the total sale proceeds will be used for inorganic growth over the next 3 to 5 years. So far, the focus was on South India, but now the chain will explore opportunities for inorganic growth, especially in North India.

Kauvery Hospital, a Tamil Nadu-based multi-speciality hospital chain, is planning ₹2000 crore of CapEx, as it plans to scale up its capacity to 3500-plus beds across South India in the next 3 years and intends to tap the public market (IPO) in the next 36 months. In March, Kauvery Hospital announced that it has raised USD 70 million (₹560 crore) in investment from a private equity fund managed by IIFL AMC for a minority stake. Kauvery Hospital has a network of 15 hospitals with over 1500 beds spread across six cities, including Chennai, Tiruchi, Bengaluru, Salem, Hosur, and Tirunelveli.

HealthCare Global Enterprises acquired a 50-bed hospital from SRJ Health Care and radiation business of Amrish Oncology Services to foray in Indore for ₹61 crore. It will further add 100 beds in Indore over the next 2 years. It has also entered into a partnership transfer agreement to acquire the balance 24-percent stake in HCG NCHRI, Nagpur. Over the next 2 years, it will add 100 beds for a CapEx outlay of ₹40–50 crore. Expansion projects in Ahmedabad and Bangalore are also on track to be operational in FY25.

Shalby Hospitals is planning a new hospital building housing 175 beds at Santacruz, Mumbai. Other than hospital business, the group’s growth platforms are SOCE franchise business and implant business. It currently operates a chain of 10 multispecialty tertiary hospitals and four orthopedic centers under Shalby Orthopedics Center of Excellence (SOCE) across India with an aggregate bed capacity of over 2000, and has also diversified into knee and hip implants manufacturing in the US.

Jupiter Life Line Hospitals, a recently listed healthcare provider, is gearing up for a transformative phase as it strategically deploys its substantial cash reserves. Currently, the ₹300 crore-plus that the hospital has as net cash on the balance sheet, it plans to use for land acquisitions in western India and the cash that it expects to save month-on-month by virtue of becoming debt-free, is also planned to be ploughed back into construction of the new hospitals. The company plans to add two more units in western India over the next couple of years, other than the under-construction project at Dombivali on the outskirts of Mumbai.

Rainbow Children’s Hospital is embarking on a significant capacity expansion in the second half of FY24. The plan includes the launch of four new children’s hospitals, adding a total of 270 beds across Hyderabad, Bengaluru, and Chennai. Rainbow Children’s Hospital currently boasts a capacity of 1655 beds, with 1290 beds currently operational. The expansion aligns with the company’s strategy to add 1000 beds over four years, including two greenfield hospitals in Gurgaon with 400 beds, expected to be ready by FY27 at a CapEx of ₹550 crore.

Regency Health announced that it has received an investment of ₹450 crore from Norwest Venture Partners. This funding will help drive its plan to increase the bed capacity to 2300 by the year 2027. Regency Health operates super-specialty hospitals in Kanpur, Lucknow, and surrounding cities and rural areas in Uttar Pradesh. By August 2024, the hospital is set to open a 250-bed facility in Gorakhpur, followed by another 450-bed unit in Kanpur in January 2025, a 350-bed unit in Varanasi in January 2026, and another 375-bed unit in Lucknow by February 2027. In this round of funding, Regency Health’s existing investors, International Finance Corporation (IFC), HealthQuad, and Koi Ventures, will get an exit from the company. These investors came on board in 2017.

Artemis Hospital plans to increase its capacity to 800 beds by FY24. It has 500 beds capacity at present.

The Breach Candy Hospital, Mumbai will begin its operations from a ₹300-crore new 11-storey building on its premises next year, while a kilometer away, the 161-bed Jaslok Hospital has embarked on similar expansion plans.

The Nyishi Baptist Church Council (NBCC) in Arunachal Pradesh has decided to construct a 100-bed Arunachal Christian Hospital (ACH) in Papum Pare district.

The top eight private hospital chains in the country together own 5 percent of the bed capacity in the country. The remaining 95 percent is quite fragmented and spread across thousands of hospitals. So that presents a case for consolidation, and now that the large chains have got traded, regional platforms will become attractive for private equity. The expectation is that single hospitals will start folding up into regional platforms, and eventually regional platforms folding up into the national chains. This industry seems to be poised for major consolidation.

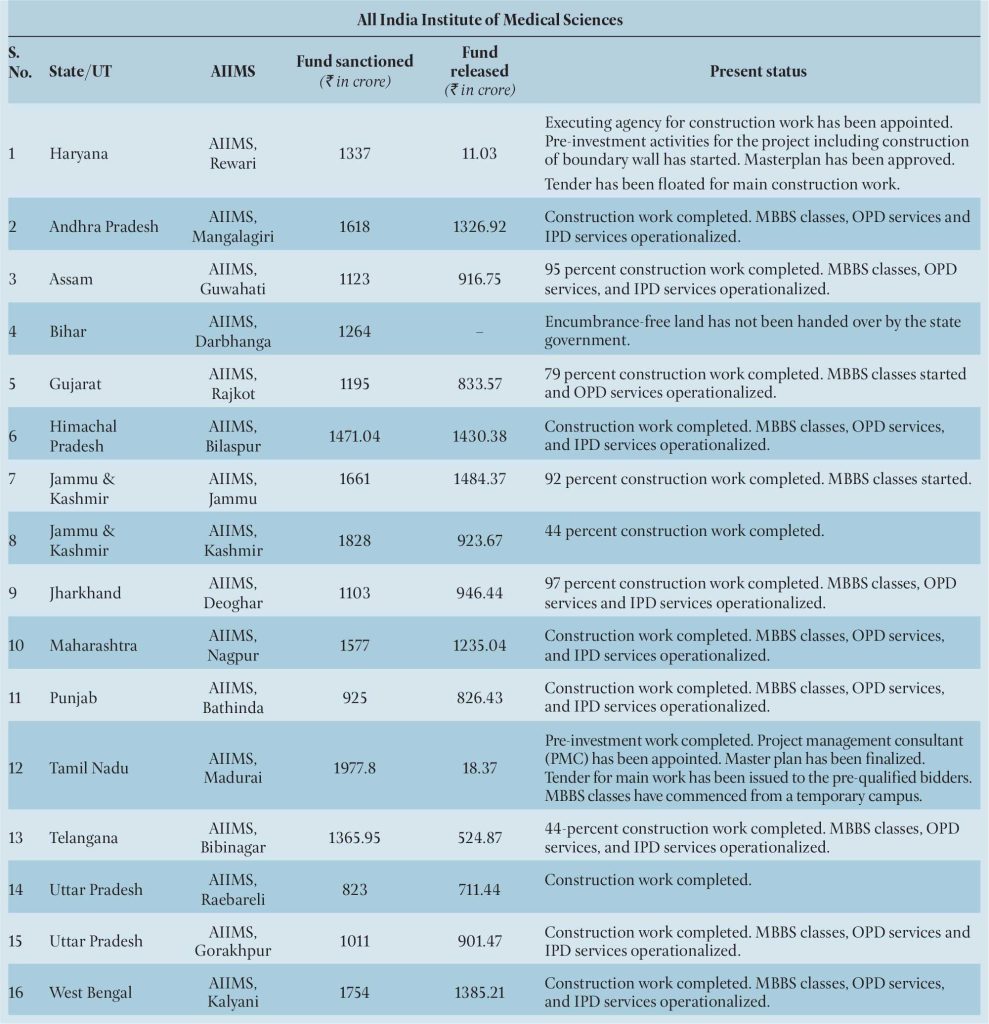

Government hospitals

AIIMS is the top medical institution in the country. Out of the sanctioned 22 AIIMS, 6 AIIMS at Bhopal (Madhya Pradesh), Bhubaneswar (Odisha), Jodhpur (Rajasthan), Patna (Bihar), Raipur (Chhattisgarh), and Rishikesh (Uttarakhand) became operational in 2012. Status of 16 new AIIMS is given.

State governments have announced expansion plans for 2024 too.

The Maharashtra state government has proposed funding of ₹2500 crore for the construction of three 400-bed hospitals each attached to a medical college in Ratnagiri, Sindhudurg, and Nandurbar. The state will fund 50 percent of the money. The medical colleges are being constructed as greenfield projects and are thus being funded by the Asian Development Bank. The state government has also given its nod to nine hospitals with the incurring and non-incurring costs of over ₹4400 crore. Some funding is also being done by Japan International Cooperation Agency (JICA). The state government is also tapping the idea of raising funding from the private players on a private-public-partnership model for the upgradation of the existing medical colleges and for the tertiary care facilities at the hospital, and expressions of interest have been invited for it. Other projects as a 100-bed multi-specialty hospital near the highway in Kashimira recently commissioned by Mira-Bhayandar Municipal Corporation (MBMC), offer cashless treatment. And a 200-bed hospital for women is being set up in Gadchiroli, located on eastern side of Maharashtra. The town already has a 100-bed women’s hospital. However, the number of beds is inadequate. Women patients are referred to private hospitals in Buldana for want of facilities. Pune has also planned an 850-bed multi-specialty hospital in Moshi for the convenience of the villages included in the boundary. An eight-storey building will be constructed on 15 acres of land, and approval has been secured from the PCMC standing committee.

Haryana plans to reconstruct 162 PHCs and civil hospitals. The foundation of Pandit Deen Dayal Upadhyay State Tuberculosis and Cardio-Respiratory Disease Institute in Ambala City, ₹56 crore 100-bed hospital, was laid recently.

Andhra Pradesh has announced plans to set up a kidney research center in Prakasam district and modern children’s hospitals in Vijayawada, Guntur, and Visakhaptatnam. Additionally, in a bid to enhance healthcare services, development initiatives totaling ₹500 crore under the Nadu Nedu scheme are being taken. A 450-bed hospital is planned at a cost of ₹180 crore, in addition to a medical college. After sanctioning ₹500 crore to the Government General Hospital in Guntur for making available improved services on December 22, the YSR Super Specialty Hospital in Kadapa has been inaugurated on December 24. Built on 230 acres in the premises of the RIMS (Rajiv Gandhi Institute of Medical Sciences) complex in Kadapa, the super-specialty hospital comprises medical, dental, and nursing colleges constructed with ₹200 crore, a 452-bed super-specialty wing built with ₹125 crore, a 100-bed YSR Institute of Mental Health worth ₹40.81 crore, and the 100-bed YSR Cancer Care Block with ₹107 crore.

Telangana is set to commission a 1000-bed government hospital at Siddipet. The hospital has been constructed with state-of-the-art facilities within the premises of the Government Medical College in the suburbs of Ensanpally village in Siddipet constituency. The foundation stone for the construction of a medical college in Medak, with an estimated cost of ₹180 crore, has also been laid.

The West Bengal state health directorate has approved a ₹33-crore exclusive critical healthcare block at Asansol District and Super Specialty Hospital. The new critical healthcare block will be inside the campus of the main building of the Asansol Super Specialty Hospital and will be G + four-storied building.

The Odisha government has accorded in-principle approval for the establishment of a 100-bed sub district hospital (SDH) at Begunia of Khurda district.

In the state of Jharkhand, Ranchi Municipal Corporation has signed a sub-lease agreement with Apollo Hospital Enterprises for the construction of a new hospital in the Ranchi Smart City. An area of 2.75 acres will be used to construct a new 250-bed hospital.

Assam Cabinet has sanctioned ₹135 crore for constructing 10 cancer hospitals, three in the first phase in Silchar, Guwahati, and Diphu and seven in the second in Dhubri, Nalbari, Goalpara, Golaghat, Nagaon, Sivasagar, and Tinsukia.

Arunachal Pradesh has announced plans for building a full-fledged cancer hospital for the state in addition to a 10-bed tertiary cancer hospital at Gyati Takka General Hospital.

Karnataka’s large and medium industries and infrastructure development ministry has extended an invitation to Temasek Holdings and ABG and Temasek Holdings Advisors India Private Limited inviting them to invest in its KHIR City.

Jammu and Kashmir’s healthcare is on the cusp of change due to investments over the past four years. This influx of capital, due to an attractive investment policy by the Union Territory administration, is poised to revolutionize the sector. The government allocated land for three medi-cities in Kashmir – Bemina in Srinagar, Sempora in Pulwama, and Lelhara Kakapora in Pulwama. The proposal includes building hospitals, medical colleges, and allied facilities. This initiative targets creating 5000 hospital beds and 1000 spots for medical students. Apart from the medi-cities, the Center has approved seven medical colleges for the Union Territory.

Indian healthcare is not just witnessing tremendous growth, it is undergoing remarkable transformation. The ubiquitous influence of artificial intelligence (AI) in healthcare is expected to increase further, impacting not just drug development, but also disease diagnosis, treatment planning, and patient care management. The Internet of Medical Things (IoMT) is expected to grow rapidly, connecting medical devices through wireless networks, remotely monitoring the indicators/symptoms of health, and allowing people to care for their health. Insights from vast data sets will revolutionize decision-making and provide a deeper understanding of patient behaviors and market trends.

With over 750 million smartphone users, telemedicine is facilitating online consultations with doctors. It provides accessible and convenient care, thereby addressing the gap in healthcare between urban and rural areas.

5G, which is currently in use in certain parts of the country, is also expected to have a significant impact on the healthcare industry. With ultra-low latency internet powered by 5G, a healthcare professional could operate on a patient located even in a different continent, (remote surgery). This would be done through equipment that instantly imitates the action/movement of the healthcare professional.

The future of healthcare in India is expected to be more technologically innovative. In the upcoming few years, artificial intelligence (AI), data, and IoMT, will be grading up from the simple devices designed for tracking vital signs like heart rate and blood oxygen levels to smart watches capable of complex scans, such as ECGs and smart textiles tracking blood pressure and predicting the risk of heart attacks.

Rapid digitization, the expanding innovative health-tech platforms, partnerships between start-ups and established companies, and favorable funding environments for viable business models, supported by government initiatives, will be among the major growth drivers in the digital healthcare arena.

Numerous healthcare startups have recognized the need for improved accuracy and precision in diagnosis and treatment. They have launched affordable digital devices and software to synthesize digitization in medicine. More than 4000 health-tech startups are currently working in India.

No doubt, India has a long way to go. The country’s existing bed-to-population ratio is 1.3 beds per 1000 people, a deficit of 1.7 beds per 1000 population, as the WHO recommended ratio is 1:3; translating to a requirement of an additional 2.4 million beds. This anticipated bed expansion is expected to complement the rise in average revenue per occupied bed (ARPOB), acting as catalyst for the overall earnings growth trajectory in the healthcare sector. Since it takes time for new capacities to break even, ranging from 6 to 18 months, operating leverage is expected to kick in once this critical breakeven point is reached.

According to CBRE, India will require 1.3 billion square feet of additional healthcare space by 2030. This assumes significance as India is fast becoming a popular destination among medical tourists, coupled with a strong demand for private healthcare providers in both rural and urban centers, and the shift from disease cure to prevention and wellness are expected to drive this sector to greater heights in the future.

India remains an attractive destination for healthcare tourism (i.e., medical tourism), as it offers quality medical procedures at a relatively low cost.

The financial outlook for the healthcare sector remains optimistic. The large, listed hospitals are expected to register a robust EBITDA growth of 14–21 percent during the fiscal years 2024–2026. About 582 potential investment opportunities worth USD 32 billion have been identified by the Indian government in medical infrastructure, including hospitals.

As indicated in the Attitudes Survey, nearly one-fourth of India’s ultra-high-net-worth individuals have expressed their intent to invest in healthcare-related assets in 2023.

Additionally, there is a growing opportunity to invest in medical research and development to facilitate the discovery of new medications to combat any future outbreak of pandemic-related ailments.

The industry continues to be an attractive investment option for investors exploring long-term income-generating investments and ventures.