MB Stories

Closing the patient monitoring gaps with connected technology

Despite technology innovation, gaps still exist that affect clinicians’ ability to provide the highest-quality patient care. Technology – and the infinite amount of data it produces – comes with its own set of challenges in the hospital and when patients transition home.

As the healthcare industry adapts to a value-based care model, health systems are feeling pressure now more than ever to deliver care efficiently, effectively, and consistently in hospital acute environments. With patient safety as a top concern, providers look to innovative technology in patient monitoring to track patients’ treatment and recovery. Patient monitoring has evolved from ad hoc to continuous monitoring of multiple parameters, causing a surge in the amount of unprocessed and unorganized data available to clinicians for decision making. To extract actionable information from this data, healthcare providers are turning to big data analytics and other analysis solutions. Predictive analytics is becoming a particularly important technology, as it not only presents the current state of the patient’s health but also predicts future illnesses. The success of this technology, among many others, attracted USD 566.3 million in investments in 2018, estimates Frost & Sullivan.

In the future, patient-monitoring data will be combined with concurrent streams from numerous other sensors, as almost every life function will be monitored and its data captured and stored. The data explosion can be harnessed and employed through technologies, such as artificial intelligence (AI), machine learning, and the like, to deliver targeted, outcome-based therapies.

In addition to machine learning and AI, patient-monitoring solution developers will look to incorporate disruptive technologies such as:

Brain-computer interface (BCI). From treating and monitoring users with mobility or speech disabilities, BCI now monitors and measures health metrics for healthy people and uses the information to analyze a person’s psychological state or emotional, cognitive state.

Wearables/embedded/biosensors. An increase in the chronic disease population and a shift in focus from treatment to prevention drive this technology. Continuous glucose monitors, blood pressure monitors, pulse oximeters, and electrocardiogram monitors are some of the main applications.

Smart prosthetics/smart implants. These are crucial for patient management post-surgery or rehabilitation. They help in measuring the key parameters to support monitoring and early intervention to avoid readmission or complexities.

Nano-robotics/digital medicine. Digital pills and nanorobots are designed to monitor medicine intake to address the expensive, long-standing issue of non-adherence.

Advanced materials/smart fabrics. This emerging field focuses on wound management, cardiac monitoring, and mental illness.

Interoperability patient monitoring. This technology is the upcoming new technology in the field of patient monitoring system. The interoperability between patient-care devices and hospital information systems help in reducing complexity and cost by enhancing efficiency. Product developments are targeted toward improving patient experience, and reducing the occurrence of adverse events. There is significant movement to improve patient care, despite continuing restrictions in healthcare budgets. Data integration, brand standardization, low-acuity monitoring, and mobile solutions remain key trends to help improve the cost efficiency of patient-monitoring solutions.

All these technologies and innovations are focused on providing real-time measurable value to the patient and healthcare institution. Future innovations will be aimed at mass personalization and availability.

Despite technology innovation, gaps still exist that affect clinicians’ ability to provide the highest-quality patient care. Technology – and the infinite amount of data it generates – comes with its own set of challenges in the hospital and when patients move back home.

Indian market dynamics

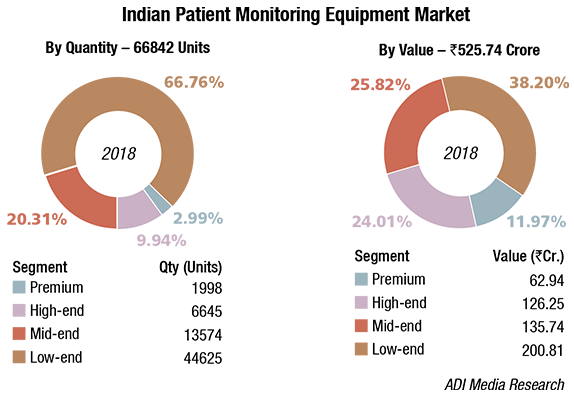

The Indian market for patient monitoring equipment in 2018 is estimated at ₹525.74 crore, and 66842 units.

The premium segment has an 11.97 percent contribution by value and a 2.98 percent contribution by volume. The 100 units of super premium systems, selling at an average unit price of ₹130,000 have been clubbed with the premium segment. High-end systems constitute 24 percent share in value terms and 9.94 percent in volume terms. Although the belly of the segment continues to be competitively priced systems, the mid-end and low-end segment, and dominates with a combined share of 87.06 percent in volume terms and 64 percent in value terms, there is a gradual shift in favor of mid-end equipment.

Mindray has had an excellent 2018. Philips is now sharing the Tier-I rank with the company, albeit Mindray has to still catch up with Philips. The success in tenders invited by the state governments was a major contributor. Mindray was awarded 1146 units by HLL, 200 units by OMSCL, 200 units by IGIMS, 150 units by BMSCL, 125 units by APSMIDC, 400 units of high- end and mid-end by KMSL (BPL was awarded the low-end 200 units), and 350 units by MPMSCL, among others. Medanta, Gurgaon procured 285 units from Mindray too. The company is one of the bidders for 2500 units re-tendered by UPMSCL, which is expected to be placed end October. Nihon Kohden too had a good 2018.

Market – 2018* |

||||

|---|---|---|---|---|

| Tier I | Tier II | Tier III | Tier IV | Others |

| Philips and Mindray | GE and Nihon Kohden | BPL and Schiller (incl Biolite) | Skanray,Edan,Drager, and Spacelabs | Medtronic,Nidek,Yonker,GMI,Shenzhen Biomed,and EMCO |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian patient monitoring equipment market. | ||||

| ADI Media Research | ||||

The government hospitals continued to be large buyers in 2018, as they equip the MCH hospitals planned by the government. The trend is expected to continue in 2020.

Advent of remote patient monitoring has served as a major landmark to improve patient outcomes and reduce hospitalization costs. These tools consist of mobile technologies that extend the patient-caregivers beyond a traditional clinical setting, keeping an eye on chronic illnesses and helping consumers track their symptoms. With the recent significant rise in the number of individuals suffering from heart related disorders, there is an increased importance of maintaining health. Also, there has been a rise in the number of speciality clinics and home healthcare business, which is anticipated to offer significant growth opportunity, due to an increase in the disposable income as well as the rate of urbanization in India.

Industry Speak

Patient monitoring – Fast track growth

C K Murugan

National Sales Manager, Patient

Monitoring & Channel Management,

Mindray Medical India

Today the patient monitoring market is shifting from box selling to the complete-solution selling. While we speak on the patient monitors evolution, in last 5–6 decades, the ECG monitoring which was considered the patient monitor initially grew leaps and bounds like etCO2 (micro, main, and side stream), BIS, AGM, CO, PICCO, ICG, SVo2, Scvo2, NMT, EEG, and respiratory mechanics. Today, advancements in the patient-monitoring industry are making strides to address clinician needs. For quick decision, they require complete patient data 24×7, and it should be accessible on the move whether in (or) out of hospital, and for that matter anywhere in the world.

Technological advancements in patient-monitoring systems are making it easier and faster to diagnose, decide, and treat as appropriate with the help of clinical tools – CAA (clinical assistive applications). Taking the lead from the above, let us discuss on the three topics – product innovation, data accessibility, clinical decision based on clinical applications.

Product innovation. Patient monitors are designed in such a way that they are promoted by highlighting compactness, weight of the unit, design, and multi-purpose utilizations, such as (a) transport monitor with long battery hours and option of second battery to enhance it further. (b) Multi-parameter modular monitor with multiple modules, and the latest in the innovation of insertable single-width modules, are rSO2 (cerebral oxygen measurement), ICG (non-invasive cardiac output). (c) Multi-parameter module-cum-monitor for seamless data continuity and transport as well. These monitors enter the hospital from the ambulance and move with the patient throughout the various care areas to provide uninterrupted data acquisition from the patient monitor to central station to hospital information system (HIS), operable through Wi-Fi (or) hardwired communications (or) both combinations. Telemetry devices Wi-Fi based patient monitoring systems are developed along with basic ECG, optional NIBP, and SpO2 monitoring allows the patient to freely walk in the areas enabled with Wi-Fi within the hospital. This telemetry device works as an independent patient monitor on the network. The device communicates to the central station, so patients are continuously monitored and the data backup is never compromised too.

Data on the HIS. In the hospital internet, data is ready to be accessed on the move from various devices like computers, laptops, and the like, and the innovation has gone to the level of mobile phones. The complete patient-monitoring data, including the waveforms and vitals, is viewed in the Android or iOS mobiles, which in turn helps clinicians for a quicker decision remotely. Question arises in the mind? Is it very expensive? Comparing the technological advancement, accessibility of data through your own mobile phone on the move and quick decision to save patients’ lives – it is definitely not.

Let us switch back to in-hospital environment, where the clinical decisions are made, based on the developments in the patient monitoring in different care areas like in operating rooms in which tools to balance anesthesia effectively, in the neonatal care area oxy-crg, which is an indicator of breathing efficiency and brain maturity, and for the ICU/post-OP newer tools to identify sepsis and management of sepsis effectively, early warnings are scored based on the monitored data on various patient conditions/deterioration, and more. In the cardiology ICU, CAA-like rescue mode and CPR dashboards are developed for patients undergoing resuscitation/CPR. These drastically empower clinicians to make more accurate, faster, and proactive clinical care decisions. The industry is beginning to understand the present-age needs, and with the available huge patient data collated through various technologies, which goes through Big Data analytics to get refined and utilized for developing newer tools. The newer tools in turn facilitate the clinicians to take a faster and accurate decision for better outcomes.

Way forward. As initially discussed, patient-monitoring business is clearly shifting gears from standalone box selling to networked clinical-information environment. Enhanced patient loads are the trigger points for the industry to come out with newer technologies, understanding the pain points of the clinicians. Very hopeful that in the coming years there will be exciting developments in the patient monitors on innovative products, newer measurements, and with introduction of AI backed with Big Data analytics, the CAA will take a bigger leap for much faster decisions and better treatment outcomes.

Global market

The global patient-monitoring equipment market is expected to reach USD 28,460 million by 2025 from USD 19,053 million in 2018, at a CAGR of 5.90 percent, predicts Brandessence Market Research. The major driving factors for the growth of patient monitoring devices industry are rise in the prevalence of lifestyle diseases such as diabetes, cancer, and atherosclerosis, and increase in the adoption rate of remote patient monitoring devices. Moreover, increase in the geriatric population is expected to fuel the patient-monitoring devices market growth as elderly people are more prone to suffer from chronic and lifestyle diseases that require the use of these patient-monitoring devices to assess their health. However, the cost associated with this technology and issues related to government regulations and reimbursements are expected to hamper the global patient-monitoring devices market growth. With the advancement in wireless technology, these devices are used to remotely monitor the physiological parameters of patients, such as blood glucose level, blood pressure, heart rate, and more, and provide appropriate treatment to the patients. Thus, technological advancements in these devices and the presence of untapped market in the developing region are expected to open new avenues for patient-monitoring devices market opportunity.

The vital-parameter-monitoring equipment market accounted for the largest share of the patient-monitoring devices market in 2018 at 44.3 percent. The remote patient-monitoring equipment market is expected to be the fastest-growing segment going forward.

North America accounted for the largest market share in 2018 and is expected to retain its dominance in coming years. However, Asia-Pacific possesses high market potential for growth of the patient-monitoring devices market with rise in the geriatric population and increase in the purchasing power of populous countries, such as China and Japan. The surge in the use of these devices has led to rapid developments in the patient-monitoring devices market trends. Some of the major global players include Philips, GE Healthcare, Nihon Kohden Corporation, Medtronic, Biotronik, Masimo Corporation, Honeywell International Inc., Siemens Healthcare, Lifewatch AG, Care Innovations, LLC., Smiths Medical, Mindray Medical, Spacelabs Healthcare, and St. Jude Medical, Inc.

Major trends influencing the patient monitoring devices market include:

Medical body area network (MBAN). Technological advances in wireless communications have enabled the development of small, intelligent, and cost-effective medical sensor nodes. These nodes can be strategically placed on a patient’s body to create a wireless medical body area network (MBAN). This network can continuously monitor various physiological signs and provide real-time feedback to the user and medical staff through SMS/e-mail. MBAN is particularly useful in large-scale in-field medical and behavioral studies and for patient monitoring in mass-casualty disasters.

Wearables and mobile applications. Medical devices manufacturers, technology companies, and other investors have invested heavily in health monitors, glasses, wearables segments, and mobile apps. In 2015, Google launched the prototype of a wearable watch that will test blood sugar levels in a patient’s blood without the use of a needle or lancet. In 2015, DexCom received FDA approval for Dexcom G5 mobile continuous glucose monitoring (CGM) system. This is a small, flexible, bandage-like, wearable device that monitors glucose levels in a patient’s blood and provides accurate, real-time glucose readings every five minutes to their smart device.

To take advantage of opportunities, patient monitoring devices manufacturers should consider strategies like investing in new technologies, such as MBAN to increase profit margins, developing portable devices to cater to the growing demand for compact and smaller devices, adopting strategic M&A approach to widen the product range and strengthen the market position, collaborating with technology companies to develop AI integrated devices to deliver more accurate and efficient service to patients, targeting the aging population by improving home monitoring, focusing on personal emergency response systems (PERS) and personal health services, and investing in research and development activities.

Vendors update

In September 2019, Baxter International Inc. entered into a definitive agreement to acquire Cheetah Medical to improve clinical outcomes with an established patient-monitoring technology to better inform and guide clinicians’ treatment decisions. The partnership will approach to enhance medication delivery and patient monitoring and clinicians will be better able to manage patients with sepsis, acute kidney injury (AKI) and other critical conditions, as well as patients undergoing surgery.

In December 2018, Spacelabs Healthcare subsidiary won a USD 450-million contract to provide patient-monitoring systems, accessories, and training services to US military branches and federal civilian agencies. The Defense Logistics Agency awarded the indefinite-delivery/indefinite-quantity contract that contains a five-year base period and one five-year option.

In August 2018, VitalConnect Inc. launched VistaTablet, a mobile interface platform that provides real-time patient monitoring with discreet and comfortable monitoring solution to enhance patient care.

In August 2018, Royal Philips acquired Xhale Assurance Inc. and expanded its monitoring and analytics business. Xhale Assurance’s disposable pulse oximetry sensor is placed on the wing (ala) of the nose, and can reliably measure and transmit a patient’s heart rate and blood oxygenation under low-perfusion conditions that are challenging for conventional fingertip pulse oximetry sensors.

In May 2018, Skanray Technologies launched TruSKAN series six-channel multi-parameter patient-monitoring system, which is capable of monitoring ECG (3L/5L), SpO2, respiration, temperature, NIBP, two-channel IBP, capnography with microstream technology from Medtronics ST, segment analysis, and arrhythmia detection.

In March 2018, Nihon Kohden launched the NK-HiQ wireless patient monitoring system, a smart, secure data-acquisition and management platform that leverages Wi-Fi technology to provide safe continuous patient monitoring in the hospital setting.

Way forward

As the healthcare industry shifts its focus to improve the patient experience across the healthcare continuum, providers are looking for programs that make seamless transitions for patients leaving the hospital, keeping the patients’ health and safety at the top of mind. Since reducing readmissions continues to be a focus for health systems, clinicians need to leverage remote monitoring technologies to ensure that when patients are discharged, they will recover in the comfort of their own home with minimal risk of complications.

Remote monitoring technologies, such as connected sensing, can help ensure that a patient’s vital signs are being consistently monitored even outside of the hospital, enabling clinicians to contact the patient remotely from the hospital to address any irregularities. Connected sensing technology cannot only improve the patient recovery time, but also keep the patient safe at the point of care.

Industry Speak

Linear inflation iNIBP measurement technology

Anil K Srivastava

Director – Sales & Marketing

Medical Equipment

Nihon Kohden India Private Limited

Non-invasive blood pressure (NIBP) is commonly used as an important vital sign parameter to evaluate a patient’s hemodynamic status. However, many anesthesiologists, intensivists, and emergency clinicians are unsatisfied with NIBP measurement. Specifically, after induction of general anesthesia, after tracheal intubation, or in situations such as unexpected bleeding or trauma, they want to know the patient’s blood pressure right away, and get frustrated waiting for a measurement result. Every second counts in clinical anesthesia, in emergency, and a small delay of a few seconds is a long time.

In the traditional oscillometric NIBP measurement using the conventional step-deflation method, a cuff placed on the patient’s limb is rapidly inflated to a target pressure greater than systolic, and then deflated step-wise while sensing the oscillations of the arterial wall created by pulsatile blood flow through the artery.

On the other hand, iNIBP is Nihon Kohden’s new and unique algorithm to measure a patient’s NIBP using inflation technology. iNIBP inflation method completes the measurement while inflating a cuff. Therefore, when compared to the conventional method, the iNIBP measurement time is shorter and target inflation pressure is lower, maximizing patient comfort while preserving the accuracy of this important parameter.

The conventional step-deflation method sets the target inflation pressure based on the previous systolic blood pressure (SYS). When the patient’s blood pressure increases compared to previous measurements, the target inflation pressure may be set to a level which is insufficient for the measurement. In these cases, another inflation-deflation cycle is required, and may be repeated, increasing both the measurement time and potential for patient discomfort. When the patient’s blood pressure has dropped since the previous measurement, the target inflation pressure is set significantly above the previous systolic pressure, which again leads to longer measurement time and excessive pressure applied to the patient. With iNIBP technology from Nihon Kohden, the algorithm effects a slow inflation of a cuff while simultaneously detecting oscillations, and then deflates the cuff as soon as SYS is determined.

In addition to connected sensing, the healthcare industry is turning to connected care technology and AI as increasingly critical components to understanding and treating patients at home. This remote monitoring technology offers numerous benefits for both caregivers and patients by providing collaborative technology platforms, patient data, and monitoring tools. With these comprehensive data, providers are able to focus on patient outcomes, while focusing on those that require immediate response and attention. Providers can now stay in better touch with their patients, while also focusing on those who require immediate response and attention. This technology allows clinicians to better understand a patient’s therapy and troubleshoot issues early on to help increase therapy adherence.

Connected care is critical for patients with chronic conditions, such as sleep apnea and COPD, as it can lower the cost burden associated with these conditions, as well as help increase the patient’s adherence to treatment. By staying connected with their providers, connected care allows a patient management or engagement service to motivate the patient to stay adherent to their treatment regimen in the comfort of their own home. These insights allow patients to track their progress or set reminders to take action, as well as receive motivational messages from their physicians to encourage them to stay on track.

Having solutions in the healthcare industry that offers remote monitoring, coaching, and engagement is important for adherence, but combining all three applications is what makes the difference in patient compliance, and can ultimately change how we deliver personalized care.

The move toward value-based outcomes puts heightened emphasis and expectations that quality patient care is continued in the hospital up till when a patient is discharged. Providers today need accurate, transparent processes and smarter, integrated solutions to help clinical staff make faster, more consistent decisions based on patient condition and history.

Second Opinion

Patient monitors and technical advancements

J. Indhumathi

Superintending Engineer

Dept. of Biomedical Engineering

Christian Medical College

Patient monitors started with a single parameter ECG and soon more parameters were incorporated like NIBP, SPO2 temp, respiratory rate, ETCo2, and more. Patient monitoring now relies on technologies of electronics, robotics, computers, and telecommunication.

New sensors are capable of recording a multitude of physiological variables in a precise and non-invasive manner. Miniaturization of system allows to store high volume of information, i.e., complete history of the patient in a smart card.

Development of telecommunication allows enormous amount of data transfer almost instantaneously, but which requires standardization of the interconnection of medical devices in the ICUs – medical device communication standards. HL7 (health care7) is a standard communication protocol for person-to-machine or machine-to-machine information communication.

Interconnection of medical devices in ICUs makes centralized supervision possible, thereby increasing the efficiency of ICU staff. Increasing mobility is an important feature stressed in current monitoring system.

Monitors may be configured in different ways to suit the needs of operation theaters and intensive care units, adults and newborns, and integration of monitoring system into the information system. Thus information from bedside instruments can be viewed alongside other information like lab results and radiological images, resulting in better and more complete all-round patient monitors. Accessing the patient information like lab results and radiological images on the patient monitor is also made possible nowadays.

Mobility is not restricted to monitoring system; it applies to patient also. Telemetry is one such technology. Continuous monitoring is possible only with the help of non-invasive sensors, lighter and compact monitors, and through the use of information and communication technologies, even during transfer in ambulance to operating room and after discharge.

Introduction of artificial-intelligence techniques in patient monitoring system is in near future. The intelligent monitoring system will reproduce the experts’ skills.

Connected care technologies can help with this by providing continuous monitoring throughout the hospital, aggregating data into clinical-decision insights, implementing smart alarms, and improving patient’s recovery at home. Once the current gaps are closed in patient monitoring with connected technology, industry will experience more consistent patient care, seamless patient transitions, improved outcomes, and one step closer to a value-based care ecosystem.