Defibrilators

Using technology to amplify care

As technology continues to advance and accelerate, one can only imagine where defibrillator technology will be in another generation. Based upon the incredibly short lifespan of technology as a whole, and the rapid advancements the industry has already seen, the possibilities are endless.

The biggest advancement in defibrillator technology was the switch from monophasic to biphasic waveforms. In general, biphasic defibrillators successfully terminate arrhythmias at lower energies than monophasic defibrillators. Another achievement is the development of the optical defibrillation of the heart, where light is given to a patient who is experiencing cardiac arrest, and it is able to restore the normal functioning of the heart in a gentle and painless manner.

Many of the newest defibrillators now have wireless capability. This is used for recording events during codes and can be used to create reports of the actions taken during a code event. Most of the defibrillators now do automatic internal diagnostics usually once a day to ensure the defibrillator is working properly. Some also test the battery and report the status back to a central computer. Many can be used as a full-fledged patient monitor with some having 12-lead ECG, pulse oximetry, and CO2 monitoring.

Cardiopulmonary resuscitation feedback is a new advancement that most manufacturers are adopting and SpCO (carbon monoxide) measurement for pre-hospital models is also becoming popular. Along with etCO2, it is expected that wireless data transmission and daily self-test function will be features in the near future.

Newer models have the capability to transmit ECG via Wi-Fi or cellular connection to the healthcare facility before the patient arrives. Some models have improved CPR coaching and/or real-time feedback. Newer systems indicate when there is an issue with a lead or if it is not capturing pacing data, which are often missed in an emergency. Aside from ECG, SPO2, and etCO2 are also the added features.

In addition, the latest advances include, but are not limited to, having a more consistent shock with a higher confidence level. Another advancement is the ability to deliver more current. These are important because it is a matter of life and death and these devices need to be reliable.

Target-controlled, low-flow anesthesia systems have been around for a few years now, but these machines can automatically adjust flow and vaporizer settings based on end values preset by the anesthesiologist. Also, new technology for CO2 absorbers, such as the spiralith, is a lithium-based absorber that does not generate dust that traditional soda lime canisters do. Soda lime dust is a huge issue in maintenance.

As technology continues to advance and accelerate, one can only imagine where defibrillator technology will be in another generation. Based upon the incredibly short lifespan of the technology as a whole and the rapid advancements the world has already seen, the possibilities are endless.

Indian market dynamics

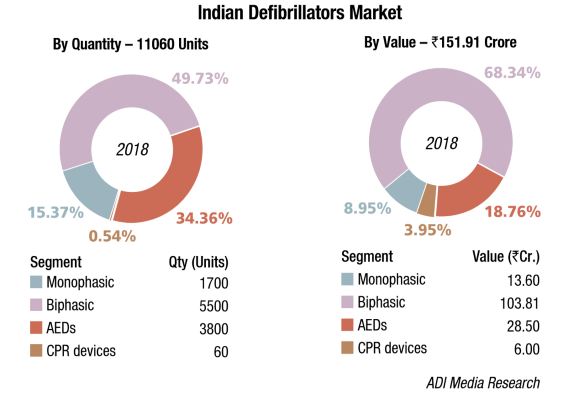

The Indian defibrillators market in 2018 is estimated at ₹151.91 crore, and 11060 units. Biphasic defibrillators, the highest priced in this segment dominate the market with a 68 percent market share by value and 50 percent market share by volume. The government (HLL), state hospitals, and DGMS (Defence) are the main buyers. Seventy-five percent of the segment, priced at an average unit price of ₹135,000 is the four-in-one design models, including monitoring, manual defibrillator, AED, and pacer with an effective IT solution avoiding manual recording, improving efficiency and reducing the workload of clinical staff. Accessories as ECG, SpO2, CO2, and NIBP may be added on to the system. Twenty-five percent of the segment is constituted by biphasic models priced at an average unit price of ₹350,000, which also offer the CPR function.

The monophasic defibrillators market continues to decline at about 10 percent every year.

Market – 2018* |

|||

|---|---|---|---|

| Tier I | Tier II | Tier III | Others |

| Mindray | Philips, Nihon Kohden, and Schiller (Biolite) | Stryker (Physio-Control) | Zoll, BPL, Skanray, Mediana, and Beijing M&B; Lifepac AEDs (marketed by Medtronics) |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian defibrillators market. | |||

| ADI Media Research | |||

The AEDs market continues to grow by 20 percent in volume terms, in value terms the segment continues to hover in the vicinity of ₹28 crore. With the airports covered now, the Indian Railways are planning to install AEDs at every railway station.

2018 saw the acceptability of mechanical CPR devices offered by Stryker (Physio-Control), which is a clear leader, Schiller and Zoll. This segment is expected to pick up in 2019. In cardiac arrest, high-quality cardiopulmonary resuscitation (CPR) is a key determinant of patient survival. However, delivery of effective chest compressions is often inconsistent, subject to fatigue and practically challenging. Mechanical CPR devices provide an automated way to deliver high-quality CPR. In situations where high-quality manual chest compressions cannot be safely delivered, the use of a mechanical device may be a reasonable clinical approach. Examples of such situations include ambulance transportation, primary percutaneous coronary intervention, as a bridge to extracorporeal CPR and to facilitate uncontrolled organ donation after circulatory death. Global market

Global market

The defibrillators market is expected to reach USD 14,806 million by 2026 from USD 9837 million in 2018 at a CAGR of 5.3 percent during 2018 to 2026, predicts Fortune Business Insights. To increase the availability of defibrillators in developed countries, the government is making amendments in their policies to make the product available at various places.

Developed countries, such as the US and the UK, are making it mandatory for certain public places, which include sports arenas, schools, government facilities, and institutes to store and maintain automated external defibrillators (AEDs), making them more cardio-friendly. The most common cause of death due to sudden cardiac arrest (SCA) is the unavailability of defibrillators. Such changes in the legislation of a country help upsurge availability and access, thereby increasing the market size of this industry.

The rising demand for handling cardiovascular conditions is leading to innovation in implantable devices as well as external defibrillators. Innovation with regards to implantable devices includes products, such as subcutaneous and transvenous patches that aim to increase the comfort level of patients. Swedish Transport Agency is running a program under test phase, which may deliver AEDs using a drone. This may reduce the delivery time of an AED, increasing chances of survival with faster treatment. Therefore, the defibrillators market is anticipated to grow because of technological advancements and product innovations.

Increasing prevalence of lifestyle diseases, such as cardiac disorders, globally, is causing an increase in non-communicable diseases (NCDs). One of the major segments of NCDs is cardiovascular diseases. The prevalence of cardiovascular diseases has increased in individuals below 35 years. Among cardiovascular disorders, SCA is one of the major causes of death in younger population. Increasing awareness about the disease and rising demand for treatment of SCA is expected to upsurge the demand over the next 7 years.

Training programs are being developed and conducted in schools, offices, and other public places to spread awareness about defibrillation. The ongoing training programs may be responsible for substantial increase in demand for home care, alternate care, and public access defibrillators.

Some of the key players in defibrillators market include Medtronic; St. Jude Medical LLC; Boston Scientific Corporation; LivaNova; Koninklijke Philips N.V.; Zoll Medical Corporation; Cardiac Science; Physio-Control Inc.; Nihon Kohden Corporation; Defibtech LLC; HeartSine Technologies LLC; Progetti Srl; Fukuda Denshi Co., Ltd.; and Schiller AG.

Vendors update

In June 2019, Philips received FDA premarket approval for its over-the-counter defibrillators, HeartStart OnSite and HeartStart Home. The devices were previously cleared for sale in the US via the 510(k) pathway, but now need premarket approval (PMA) because of regulatory changes implemented by USFDA. Securing the approvals furthers the recovery of Philips’ defibrillator business, which has been operating under a Department of Justice consent decree since 2017 because of prior-quality problems.

In June 2019, Zoll Medical signed a definitive agreement to purchase Cardiac Science in an effort to develop AED solutions for dealing with more medical emergencies and potential sudden cardiac arrest incidents.

In April 2019, Stryker launched the Lifepak CR2 defibrillator with LIFELINKcentral AED program manager. The Lifepak CR2 is an automated external defibrillator that has received PMA from USFDA.

In March 2019, Biotronik released the world’s smallest ICD and cardiac resynchronization therapy defibrillator (CRT-D) that is approved for 3-Tesla full-body MRI scans. The company’s Acticor and Rivacor families feature an ultraslim BIOshape as well as extended battery life and warranty.

Research update

The skin presents a formidable barrier to life-saving defibrillators, but a team of students from Rice University believes it has found a way around that problem, or, more to the point, though. The Zfib team of Rice senior bioengineering students created an add-on for AEDs that literally punches through the skin to help deliver a jolt to a person in cardiac arrest. With the help of advisers Eric Richardson, a Rice bioengineering lecturer, and Mehdi Razavi, MD, a cardiologist at Texas Heart Institute, the students developed a needle-laden pad that can be pressed through both a flexible AED pad and the skin to overcome the skin’s typical impedance of around 500 kilo ohms per square centimeter.

In practice, AED users would apply AED pads to the exposed skin of a patient’s chest and side, just as they are trained to do in thousands of AED/CPR classes taught in the US each year. The needles would then be pressed through a pad and the patient’s skin to bloodlessly deliver a more effective shock. By the team’s measurements, the add-ons reduce the skin’s impedance by 72 percent. That, in turn, should increase a patient’s chance of survival and reduce the odds that the patient will need multiple shocks.

The team was inspired by insulin-delivery patches that break through the skin with microneedles. The Zfib add-on is a 3-D printed plastic frame with a rubber backing that allows the user to press 180 tiny needles into a patient’s chest without having to touch the needles. The needles collect current from the side of the pad that touches the skin and deliver it to the patient. Indicators on top of the device turn green when enough pressure is applied. The needles have to do their job without interfering with the AED’s ability to monitor the heart’s rhythm and decide whether a shock is necessary, according to the team. The current also has to be kept low enough to prevent burns. Once they settled on 180 needles, the team evaluated their design with tests on artificial skin, an animal cadaver.

Cybersecurity concerns

As implantable devices increasingly go wireless to supply data to automated patient-monitoring systems and physician offices, in an era where cyberattacks on healthcare and IT systems are growing, the FDA has raised concerns. The agency said hackers could potentially target patients directly, even inadvertently when hacking into other hospital systems. So, the FDA has been monitoring cybersecurity vulnerabilities associated with the internet connection of EP devices. The FDA is concerned ICDs remotely accessed by hackers could present a life-threatening situation.

Outlook

Currently, there are over a dozen different manufacturers of defibrillators in the market. They offer constructionally similar devices. The differences between them result primarily from innovativeness supported by competition. The lack of uniformity of devices is, therefore, the main reason for the occurrence of difficulties during training processes, as well as the subsequent use of the equipment in everyday life. An effective and more common access to defibrillation, therefore, has to be harmonized. In addition to technical issues, the aspect worth paying attention to in the future is the definition of uniform standards related to the external appearance of the AED.

Industry Speak

Meeting dynamic needs of patients

N Manogaran

Vice President – Sales

BPL Medical Technologies Pvt. Ltd.

The patient-monitor market in India is growing as always owing to increase in the number of beds. Five-parameter monitoring has become standard, and market demands more additional parameters like IBP, etCO2, and the like. Larger screen size and touch options are a few more user needs.

Pre-configured monitor market continues to hold higher share compared to modular monitors. Critical parameters like AGM, BIS will be growth drivers for premium monitor segment.

The industry is observing growth in neonatal monitors as the importance for neonatal care is on the raise.

Like in any other industry, connectivity features with patient monitors have become need of the day. Wi-Fi, HL7, and remote monitoring are user-demanding features. Most monitor brands offer today multiple-connectivity solutions. Remote monitoring option can change the dynamics as it can lead to better patient care.

Defibrillator

User choice of the product is based on reliability and proven brand, being emergency and life-saving device. Ease of use and readiness to offer additional monitoring parameters are some other preferred features. Biphasic DF segment has been growing over monophasic DF in recent years.

Defibrillator with AED and pacer is generally a highly preferred configuration. Parameters like SPO2 and etCO2 are also opted for by some as built-in monitor with DF.

AED (automated external defibrillators) market is still under performing segment. Markets like India should demand a high number of AEDs as life savers in public places like malls, apartment complexes, railway stations, and the like. AED segment is yet to get higher demand, and growth of this segment in recent past is not significant.

There is also a definite need to create awareness among the buyers. Rural areas still prefer to buy monophasic defibrillators as they are cheaper than the biphasic defibrillators. Comparing the trend of the last 2–3 years, the market shows positive growth for mainly biphasic defibrillators and AED. Along with etCO2, wireless data transmission and daily self-test function will be features in the near future. Looking forward, it seems that the defibrillators market in India will see a considerable amount of growth year-on-year. With most government tenders coming up with the requirement for advanced features and biphasic defibrillators being in huge demand, the market surely looks positive.