Industry

COVID-19 has set the stage for a dramatic reshaping of the MedTech industry

India is a land of shortages, including overcrowding in medical facilities with patients jostling for attention. COVID-19 has been an absolutely new experience, eerie and tragic!

COVID-19 has presented a humanitarian crisis like no other, with nearly two million infected by the virus and tens of thousands of lives lost. Indeed, the speed and depth of disruption due to the pandemic is creating unprecedented challenges for societies and economies across the world. This is especially clear on the frontlines of healthcare delivery. As infections spread around the world, health systems have redirected substantial resources to COVID-19 response efforts.

COVID-19 has put the healthcare industry at center stage with unparalleled demand for diagnostic tests, personal protective equipment, ventilators, and other critical medical supplies. In addition to the extraordinary measures underway to rapidly ramp up manufacturing capacity and capabilities, healthcare leaders are also looking outside their normal sector boundaries to explore creative solutions to further supplement capacity, such as partnerships with companies outside the sector, open-source equipment design, and deployment of medically trained employees to support public-health needs.

While this may seem as providing a major impetus to the industry, it is not so. COVID buying in no way compensated for the absolute freeze in routine procurements replacement demand by the private hospitals. The period saw a swift shift by the government, that traditionally has prided in buying top-of-the-line models to entry-level models, and from outright purchase to rentals in the IVD sector.

This crisis has also seen the MedTech industry recalibrate across the value chain to serve healthcare’s critical needs. But beyond the immediate crisis response, MedTech companies may need to consider additional imperatives —particularly over the next three to nine months—to strengthen crisis resilience and plan for recovery. Building and stress-testing several scenarios for procedures and product demand will be critical for identifying areas of risk and opportunity and navigating through the crisis.

The planning and action taken in the short term can have significant implications, not only for MedTech’s continued resilience in the crisis, but in shaping its longer-term recovery for what is likely a significantly different future for healthcare and the MedTech industry.

Shifting gears, there have been non-COVID healthcare issues, treating COVID-19 infected patients and post-COVID issues.

As COVID gripped India, and the lockdown was implemented, there was a dramatic drop in elective medical procedures, that were either postponed or cancelled, no OPDs were held in hospitals, and almost no routine tests conducted in diagnostic centres. It was a rude shock for the medical institutions, perhaps unprecedented in human history. India is a land of shortages, including overcrowding in medical facilities with patients jostling for attention, this was an absolutely new experience, eerie and tragic!

Raised were concerns about the broad public health impact of the pandemic on non-COVID-19 populations. Some medical conditions, e.g., stroke and STEMI require effective hospital treatment to avoid adverse outcomes; therefore fewer hospitalizations for such medical conditions are almost certainly associated with patient harm. Where the impact of hospital-based care is less clear, however, longer-term studies will be needed to determine the extent to which avoiding hospitalization during the pandemic may affect patient mortality, morbidity, and quality of life.

For treating COVID-19 patients, hospitals were designated as COVID-19 hospitals, medical facilities were directed to segregate zones where treatment could be done, augment bed capacity, reserve wards, allocate beds in ICUs, healthcare workers wore complete PPE attire, and RT-PCR, rapid antigen tests and antibody tests conducted in millions.

A new chapter has emerged in the after-effects on patients post-recovery. Not just patients with severe symptoms, who have a long recovery ahead, but even those with mild symptoms, young ones included, can expect their lungs, hearts and brain to be damaged. Not uncommon is inflammation in the lungs causing deep vein thrombosis, cytokine release syndrome, acute respiratory distress syndrome, acute liver injury, acute cardiac injury among many others. Other problems are post-traumatic stress disorder, chronic fatigue, joint pains, lack of energy, low physical and mental immunity, and swallowing and taste issues. In response, large hospitals have set up post-COVID recovery clinics, manned by a dedicated team of specialists, including neurologists and immunologists, and general physicians. As they become popular, medical equipment and diagnostic tests will be required here.

Global market

No prizes for guessing the major factor impacting big-cap MedTechs’ share price performance across the first half of 2020. Ventilator manufacturers and testing specialists are up and orthopedics and cardiology groups are down, as the pandemic forces hospitals to reorder their priorities.

The MedTech arena is expected to continue to grow at a pace of more than 5 percent per year, with annual sales worldwide expected to reach USD 800 billion by 2030, according to KPMG. Over the longer term, when cases of the coronavirus finally begin to diminish, a new normal will likely be established. Patients will still be wary of hospitals, and volumes of elective procedures might take some time return to levels seen in prior years.

Many of the badly affected groups have been keen to stress that the second quarter was always going to be the toughest period of 2020 and made it clear that they expect sales to increase in the second half. But economies are struggling, and with health insurance linked to employment in countries such as the US, device makers’ 2020 sales seem likely to remain below prior years.

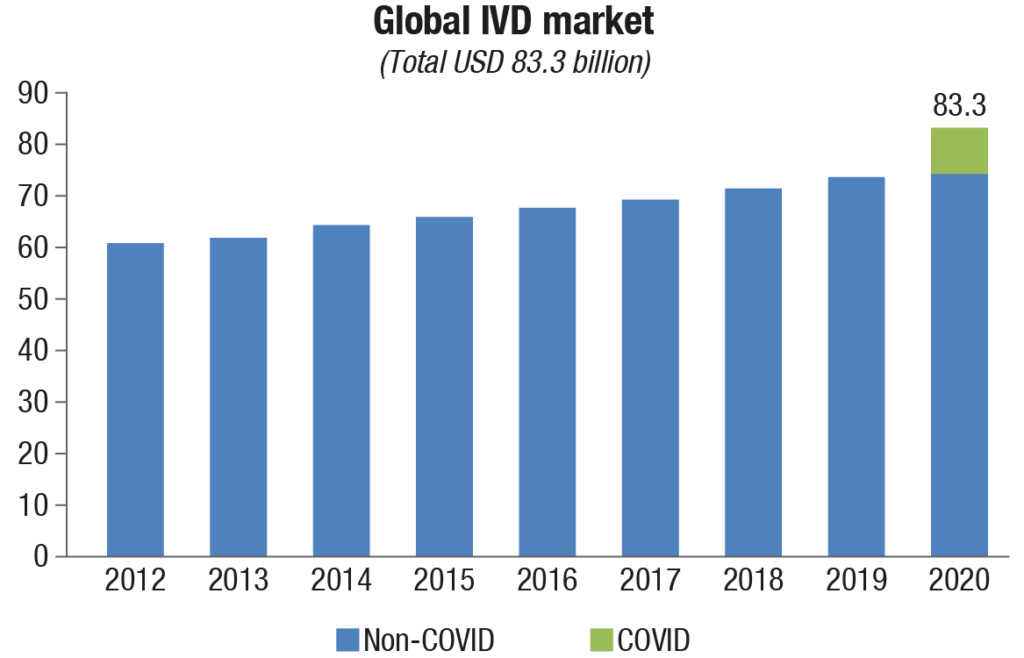

The world market for IVD is expected to close at USD 83.3 billion in revenues in 2020. The COVID-19 pandemic has dramatically shaped the market, driving growth for some IVD tests, while suppressing demand for others. IVD tests for cancer and infectious disease detection, transplant success, and pharmaceutical selection have added value to healthcare and improved clinical outcomes. Genetic tests for rare diseases and prenatal assessment are increasingly utilized. And now, the COVID-19 pandemic has highlighted how important in vitro testing is in a way that could not be imagined last year. Of the total IVD market, USD 9 billion is estimated to be COVID-19 testing, both molecular and antibody.

The world market for IVD is expected to close at USD 83.3 billion in revenues in 2020. The COVID-19 pandemic has dramatically shaped the market, driving growth for some IVD tests, while suppressing demand for others. IVD tests for cancer and infectious disease detection, transplant success, and pharmaceutical selection have added value to healthcare and improved clinical outcomes. Genetic tests for rare diseases and prenatal assessment are increasingly utilized. And now, the COVID-19 pandemic has highlighted how important in vitro testing is in a way that could not be imagined last year. Of the total IVD market, USD 9 billion is estimated to be COVID-19 testing, both molecular and antibody.

Prior to the COVID-19 pandemic, the IVD market was substantial and growing, and that portion of the market is estimated at USD 74.3 billion. Growth areas apart from COVID-19 include other infectious diseases (particularly respiratory pathogens), liquid biopsies, companion diagnostics, and critical care and hematology tests.

Some areas of in vitro testing have been negatively affected by the pandemic, however. These include noninfectious disease immunoassays, diabetes, and histology/cytology tests, which originate with doctor visits. Doctor visits have been impacted by social distancing and lockdowns during the year, though some catch-up visits and resulting tests are expected later in the year and in regions where COVID-19 has had less impact.

IVD tests based on polymerase chain reaction (PCR) make up a disproportionate share of revenue in the market this year, as PCR is the gold standard for COVID-19 detection. Where the most common type of nucleic acid test has represented approximately 10 percent of the market in past years, in 2020 it has surged to over 19 percent due to the technology’s favored use in COVID-19.

Financial results from major IVD vendors in the second quarter of 2020 have produced mixed results reflective of this topsy-turvy market. Sales of COVID-19 tests are brisk, but other test areas were down in volume. This affects different companies in different ways. Quidel, specializing in respiratory tests and point-of-care, announced that second-quarter revenue increased 86 percent and rapid immunoassay product revenue increased 270 percent.

Meanwhile, worldwide sales at Abbott Diagnostics took a hit despite the company bringing in about USD 615 million in revenues from COVID-19 diagnostic testing during the second quarter of 2020 (end-June 30). The company reported sales dropped 8.2 percent to USD 7.3 billion in the second quarter of 2020.

Bio-Rad Laboratories also experienced a setback, reporting in its second quarter that the COVID-19 pandemic negatively impacted its revenue by 6.2 percent.

How well these players perform in the full year will depend on their ability to capture test volumes from re-openings of offices and hospitals.

Molecular diagnostics will continue to drive growth in the IVD market. In 2019, there was still a degree to which vendors were persuading laboratories of the benefits of molecular approaches. In 2020, the challenge has been how fast systems can be set up and how much throughput they can offer as a war room-like mentality sets in at major IVD companies and the labs they service.

Real-time PCR systems have been highly utilized and supplies strained. Polls of labs even in July 2020 were still showing supply shortages.

New companies help to drive growth and 2020 is certainly no exception. There has also been a huge influx of product introductions from small, obscure companies. These have mostly targeted the low end of the price range and often had poor performance, while a small number of high-end automated systems are mostly limited to certain segments of the market, such as independent reference laboratories and centralized hospital laboratories.

Low-quality products from fly-by-night companies are the predictable result of shortages and the relatively basic resources needed to produce mediocre antibody test kits with a low level of quality control. The leading companies, Abbott, Roche, Cepheid, DiaSorin, Hologic, Thermo Fisher Scientific, and Quidel currently account for the majority of the COVID-19 tests being performed globally.

The effect of the publicity that IVD has received as a result of the COVID-19 pandemic is difficult to measure but should pay dividends down the road, particularly with more serious preparation for new infectious disease threats. Machines designed for COVID-19, such as Abbott’s ID Now or Cepheid’s GeneXperts, may be removed from labs if the threat is perceived to have passed, but most likely systems will be converted to other purposes. This presages strong continued growth in testing and IVD test supplies.

M&A: will the pendulum swing back in 2021?

The disruptive impact of the COVID-19 outbreak is particularly evident in the industry’s M&A performance; with M&A expenditures in the US and Europe from July 2019 to June 2020 plunging 60 percent to USD 27.1 billion compared to the previous 12-month period. An already-low total deal value was further reduced when Thermo Fisher Scientific did not go ahead with its proposed USD 12.5 billion acquisition of Qiagen in August 2020. Focused on molecular diagnostics, including in infectious disease, Qiagen saw its operating income jump 84 percent in the first 6 months of 2020 due to the impact of COVID-19, leaving its shareholders reluctant to accept Thermo Fisher Scientific’s enhanced offer.

The next-biggest deal–Stryker’s USD 5.4 billion proposed acquisition of orthopedic company Wright Medical is under regulatory review in the US and the UK as of September 2020. However, the impact on M&A is not confined to the fall in such megadeals (those worth over USD 10 billion): the total value of non-megadeals has also dropped 41 percent, while the average deal value across the industry shrank to USD 167 million (from USD 463 million in the previous year).

The slowdown in M&A, IPOs and VC funding raises concerns that a major source of innovation will disproportionately impact startups and small companies that are reliant on this capital. To sustain the cycle of innovation, larger MedTech companies may need to consider other approaches, such as partnerships, incubators and more milestone payments (a strategy these companies frequently employed during the aftermath of the 2007 and 2008 financial crisis).

Top 5 deals closed in H1 2020 |

||||

|---|---|---|---|---|

Leading players-2019 |

||||

| Completion date | Acquirer | Target | Value (USD mn) | Focus |

| Feb 12 | Laborie Medical Technologies | Clinical innovations | 525 | Gastroenterology; HIT; IVD; obstetrics & gynecology |

| Apr 2 | Align Tech. | Exocad | 420 | Dental; HIT |

| Feb 18 | Baxter International | Sepra products | 350 | General & plastic surgery |

| Feb 3 | Anika Therapeutics | Arthrosurface | 100 | General & plastic surgery; orthopedics |

| Jan 24 | Anika Therapeutics | Parcus Medical | 95 | Orthopedics |

| ADI Media Research | ||||

There are indications, however, that the big MedTech players may instead be contemplating a surge of acquisitions in the near future. A buyer’s market may be developing as smaller, and perhaps even midsize, companies question whether they can survive the economic uncertainty triggered by the COVID-19 pandemic. Meanwhile, large MedTech companies have recapitalized through debt and follow-on offerings, and now have substantial M&A firepower.

“The industry anticipates an accelerated growth cycle, with companies valued at USD 30 million to USD 40 million becoming targets, if we as an industry get some sense of normalcy into the fall, the high level of available capital could trigger an M&A acceleration” suggests an EY Americas Strategy and Transactions MedTech paper.

This is one of the areas to watch over the coming year in MedTech. The industry has retained investor confidence as reflected in its valuations and shows early signs of a rebounding from the COVID-19-related revenue hit, with the non-imaging diagnostics segment in particular thriving. There are more mixed signals in the financing and M&A data, suggesting the current uncertainty about the future. There are also substantial reasons for MedTech to be positive about the future – with COVID-19’s long-term impact not constraining the industry, but potentially driving growth and transformation.

But, the private equity (PE)–venture capital (VC) investments that went into the sector in the January-September period in India, declined 12.5 percent this year to USD 2.25 billion as against USD 2.57 billion in same period last year, according to data from Venture Intelligence, a firm that tracks private companies’ investments, financials and valuations.

Indian market

The Indian MedTech market offers a great opportunity not only by its size, but also because of encouraging policies and regulations introduced by the government over the last couple of years. It continues to record robust growth despite a hardened stance on pricing for essential devices. Currently valued at Rs 30,300 crore, it is expected to touch Rs 39,260 crore in 2021.

The Indian IVD market is forecast to grow at a CAGR of ~13 percent from 2020 to 2025, predicts ResearchAndMarkets. IVD has witnessed several changes and additions to its gamut of offerings in the recent past. There has been a paradigm shift from traditional diagnostics to a new generation diagnostic that works on the gene level. This change was possible only due to the inclusion of advanced technology, such as genetic testing, molecular diagnostics, polymerase chain reaction (PCR), and next-generation sequencing (NGS). Fast turnaround, reliability, user-friendliness, and predictability of predisposed diseases are a few significant qualities that are making these technologies attain their share in major offerings of diagnosis providers around the world.

In India, till recently, medical devices had not received appropriate attention from the policy makers. Currently, however, medical devices have come into mainstream policy making, albeit often with the absence of deep understanding about the domain, or without an adequately nuanced approach to factor for its hugely diverse range or spectrum.

One major challenge this segment faces is price control. The government controls prices of certain medical devices by either fixing a price at which they may be sold under a formula or by restricting the ability of the marketer of the medical device to increase its price by more than a prescribed percentage at any given time. The presence of multiple regulators, which may make simple tasks (such as rectification of erroneous declaration on the label) quite a tumultuous affair, remains a challenge.

Another challenge is presence of archaic laws that do not permit manufacturers and importers of medical devices to promote their products directly to the customer as cures for certain prescribed conditions and illnesses.

Even though the year 2019 witnessed significant developments, there is an urgent need for the government to accelerate further reforms and supportive measures to make India a global medical device manufacturing hub, reducing import dependency in this sector which is still at 80–90 percent, minimizing outgo of foreign reserves, and making quality healthcare affordable and accessible to the masses at large.

Healthcare, far below global norms

Over the last three decades, the Indian government has made good progress in providing essential healthcare services to the population, which has resulted in improved health indicators. For example, the average life expectancy at birth has increased from 58 to 69 years. Disability Adjusted Life Years (DALY) per 100,000 has decreased by 43 percent. Maternal Mortality Ratio (MMR) has decreased from 410 to 130 and Infant Mortality Ratio (IMR) from 80 to 30; and full immunization coverage increased from 36 percent to 62 percent. There has also been a significant drop in disease incidence such as polio, tuberculosis, malaria, and HIV.

However, India still has a long way to go in achieving broad-based healthcare improvements. India’s health outcomes are still much lower when compared to Organization for Economic Cooperation and Development (OECD) countries and suffer from high disparity across urban-rural and different states of the country.

India’s health delivery system continues to focus on episodic care with most patients avoiding routine health check-ups and visiting health facilities only when they either experience severe discomfort or co-morbid symptoms start to appear. Additionally, lack of well-defined treatment pathways and limited focus on treatment adherence for chronic care patients often leads to accelerated disease progression and the need for tertiary care treatment which is both limited and expensive.

The government’s recently launched scheme, Ayushman Bharat is expected to increase the focus on comprehensive end-to-end care through the creation of approximately 150,000 Health and Wellness Centers (HWCs). The HWCs deliver an expanded range of services that go beyond maternal and child health services to include care for NCDs, palliative and rehabilitative care, mental health services, etc. However, this scheme primarily targets the rural and sub-urban section of the society. The urban segment still requires interventions to shift from episodic care to comprehensive care.

The Indian government has built a three-tiered public health system to provide free health facilities to its citizens. The infrastructure today consists of approximately 150,000 Sub-Centers (SCs), 30,000 Primary Health Centers (PHCs), 7000 Community Health Centers (CHCs) and 2500 Tertiary Health Centers (THCs) or District Hospitals. Most of India’s rural and sub-urban population relies on this physical infrastructure to meet their healthcare needs.

However, with the prevalence of large infrastructural gaps as compared to global benchmarks, access to the health system continues to be a challenge. For example, India has 1.3 beds per 1000 population as against the WHO minimum norm of 3.5. Further, the country has only 0.69 doctors per 1000 population as against WHO recommended 1.0 and an average of 3.4 in OECD countries.

The urban-rural divide. The stark inequity in distribution of resources between urban and rural areas magnifies the prevailing challenges. Almost 65 percent of India’s population that resides in rural India has access to only 30 percent of the total available health infrastructure – consisting of 25 percent dispensaries, 40 percent hospitals, and only 20 percent doctors and 3 percent specialists. In addition, over 30 percent of the rural Indian population does not have access to an operational first point of care within a 5 km radius of their residence. In some cases, the unequal distribution extends beyond the urban-rural divide and is also visible across states. For example, Assam, Goa, Kerala, Sikkim, and Meghalaya have greater bed availability with a ratio of 1 bed to 1000 patients while Bihar and Andhra Pradesh have one bed for over 8,000 people and 4,000 people, respectively.

Consequently, people are forced to travel long distances to access healthcare. A recent estimate highlights that over 40 percent of the population in India has to commute to distant locations to access health treatments. Due to poor access, patients often tend to delay routine check-ups or avoid treatment, resulting in the late detection of health conditions or no treatment in early stages.

All these challenges reaffirm the need to fundamentally re-imagine India’s healthcare delivery system. India today has the opportunity to leverage the disruptive innovations arising from the COVID-19 crisis to do this re-imagination. For this to happen, all stakeholders, public and private, need to collaborate and utilize each other’s expertise to develop models that address these challenges. Technology and the subsequent digital revolution in the healthcare ecosystem can enable these actors to converge and efficiently collaborate to realize the common goal of universal health coverage. It can help drive an integrated health system that puts the patient at the center to deliver quality services at a reasonable cost.

National Digital Health Mission. The launch of the National Digital Health Mission (NDHM) is a significant step toward achieving a citizen-centric healthcare system. It will create an Open Digital Health Ecosystem (health ODE) that will serve as a backbone for an integrated digital health infrastructure and provide a platform for private innovations.

Five big themes are expected to emerge from the implementation of the National Digital Health Blueprint (NDHB) by NDHM. These will radically change India’s health delivery landscape and impact all stakeholders in the healthcare ecosystem. These are information transparency, interoperability, standardized claim processing, digitization of prescriptions and playground for innovations. Over next 10 years, these themes can unlock economic value worth over Rs 20,000 crore and create an incremental benefit of Rs 20,000-25,000 crore to India’s GDP.

In conclusion, the adoption of a health ODE can have a transformative impact on India’s public health system and create immense economic and market value. It can empower patients in unprecedented ways. It also calls for healthcare players to update their strategies.

For forward-looking companies, taking steps now to fundamentally reimagine the system, patient journey, and their interfaces and relationships with healthcare providers is critical. These steps could include building more agile organizations, speeding time to market, and aspiring to absolute benchmarks for product design and development, and manufacturing efficiency.

Before the COVID-19 crisis, companies were already facing pressure to localize in certain markets. After the crisis, it will continue to be important for companies to consider how to balance the pressures that can impact local supplies with the potential desires for greater flexibility in capacity. This requires companies to fundamentally rethink their supply-chain network and key suppliers.

While the crisis will necessitate tough operational choices, this is a time for all companies to live their values. Forward-thinking firms will respond with new products, services, and operating models that support healthcare organizations and the patients they serve when they need it most—now and in the future. This is both the right thing to do and will position companies for success in the years to come.