Headlines of The Day

Dr Lal Pathlabs to Thyrocare no longer have a Covid windfall

With windfall sales driven by Covid testing behind, India’s diagnostic players face a return to reality.

Companies offering pathology and radiology services recorded a dip in revenues and margins in the first half of the fiscal as demand normalises on a high Covid base. And there are concerns that low entry barriers and competitive pricing with new players will further erode investor confidence.

Still, Sriraam Rathi, India analyst-pharma and healthcare, BNP Paribas expects the diagnostic market to grow at around 13-15% ex-Covid in the next three years.

According to Aditya Khemka, fund manager at InCred PMS Healthcare, said, ”The fear of competitive intensity impacting margins is more imaginary than real and the proof is in the numbers.”

Margins at pre-Covid levels

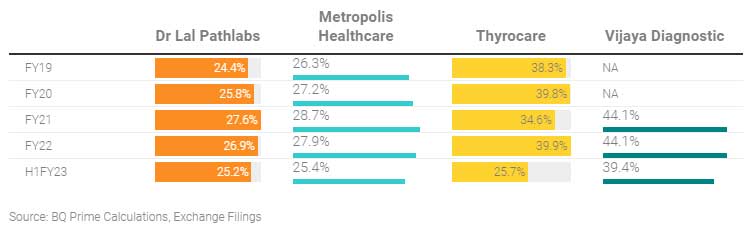

Key diagnostic players: Operating margins

For major diagnostic companies, except Thyrocare (which saw a change in management), margins in the first half of the fiscal are close to the pre-Covid levels of 2019.

“While inflation has impacted input costs across industries and sectors, maintenance of gross and operating margins at around pre-Covid levels by most diagnostic players, displays the power that these brands wield allowing them to take price hikes absolutely undeterred by the concerns surrounding price wars,” Khemka told BQ Prime.

Non-Covid revenue growth

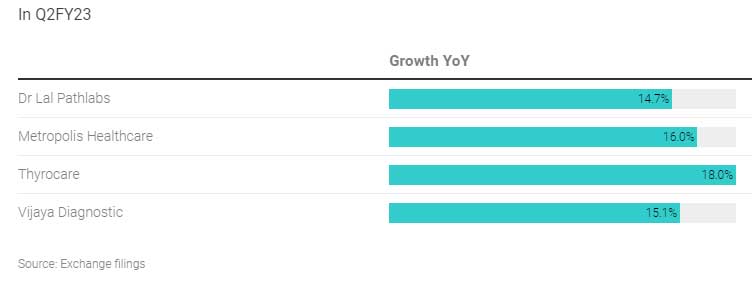

Excluding the impact of high and abnormal base, non-Covid revenues for all the players grew in mid-teens or higher in the quarter ended September over last year, Khemka said. “This indicates sustainability of business revenues.”

Diagnostic players: Non-Covid revenue growth

Sriraam Rathi in his industry report said, “We expect diagnostics firms to post double-digit revenue growth in the non-Covid business in H2FY23.”

Competitive threat

Rathi does not view online players as a major threat given ”the industry is under-penetrated and prescription-driven”.

Khemka, too, had in the past, noted that brand name and doctor-diagnostic service provider relationships are significant and that the patient might continue to choose the lab recommended by the doctor.

Rathi said timely collection and delivery are important. “While online players may take an average of 16-18 hours to deliver a report, established diagnostic players take around eight to ten hours.”

The competitive impact of these online players on established companies’ growth is temporary, he said. “So far, there is no long-term structural growth story for online players. Also, they are relatively quite small in size and therefore their growth rate would not even be comparable.”

Also, most of the switch in terms of traffic happens in the preventive or wellness space where discounted packages may be used to lure customers.

However, wellness makes up for merely 10-15% of the diagnostic industry, Rathi told BQ Prime. “For the remaining 85% of the pie, online players are finding it difficult to convert customers as trust and quality are the pillars of the industry.” Just pricing is not sufficient to make customers switch, he said.

The per patient annual outgo is not big enough to prompt customers to switch. He cited the example of Dr Lal Pathlabs where the average testing cost of a patient a year is in the range of Rs 600-900.

According to Khemka, there is also no data to suggest the newer brick-and-mortar chains would be too disruptive. With almost 85%-90% of the market unorganised, he expects the new competition will more likely disrupt the unorganised sector and the large organised chains.

”Even if there were to be a potential disruption due to online players, it is highly improbable to be significant in next five years,” he said.

Risks still exist

Vishal Manchanda, pharma analyst at Systematix, however, seeks risks despite growth potential. “Absence of entry barriers and ease of obtaining NABL accreditation makes it a level-playing field for new and existing diagnostic operators, thereby increasing competitive intensity.”

For larger players to grow, consolidation is the only key, he said. There is a regional dominance of diagnostic lab chains all over the country, according to Manchanda. Players that will reinvest profits in acquiring these local and regional chains will continue to grow better.

Preventive, wellness and routine testing is the next big market and digital players are targeting this space, leaving little scope for established players to dominate and grow here, he said.

He expects the sector to grow in “high single-digits to low double-digits”.

Rathi cut earnings per share estimates for diagnostic companies by 4.8%/2.7% for FY23/FY24.

BNP Paribas has picked Metropolis Healthcare as its top bet in diagnostics citing “attractive valuations”. BQ Prime