Endoscopy Equipment

Endoscopic device market returns to normalcy in 2023

After three years of restrained buying, the buyer returns and endoscopic devices segment heaves a sigh of relief.

Endoscopy, as a highly utilized imaging method in medicine, has undergone significant advancements since the introduction of the Lichtleiter by Bozzini in the early 19th century. It has evolved into a specialized image modality, tailored to meet the diverse diagnostic and therapeutic needs across various medical disciplines. To accommodate these specific requirements, endoscopic systems have been adapted in terms of shape, functionality, handling concepts, as well as integrated and surrounding technologies. The field of modern endoscopy is progressing rapidly, benefiting from ongoing developments in electronics, computing, and digitization.

Indian market dynamics

The setback from Covid-19 pandemic had impacted the Indian endoscopic devices market in 2020, 2021, and 2022, the earlier two years more from a shift in priority of procurement for Covid-related devices, and in 2022 from erratic supplies, when vendors reported that their supplies were behind schedule by about three months.

In 2023, the buyer is back and keen to improve clinical outcomes demanding technologically advanced models. The demand emanated from the government, the corporate, and individual buyers.

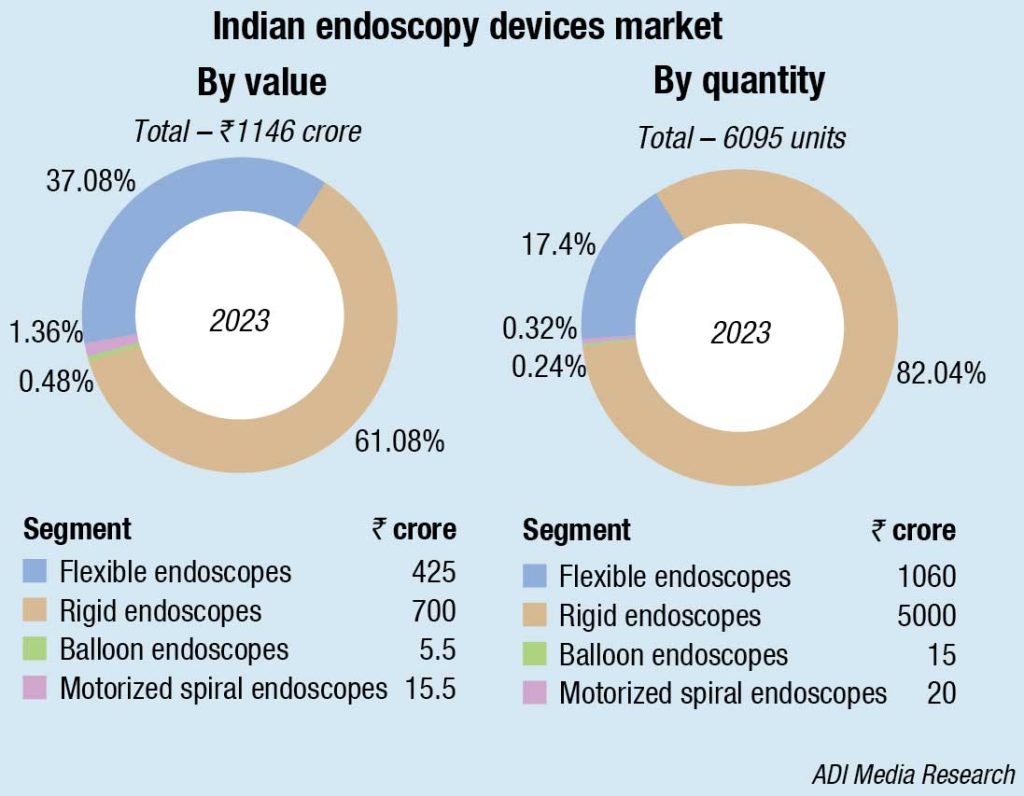

The year saw the market bounce back to normalcy, with the total endoscopic devices market in 2023 estimated at ₹1150 crore and 6110 units. The rigid endoscopes, excluding imaging, contributed ₹700 crore, at 5000 units and the flexible ₹425 crore at 1060 units. The balloon endoscopic devices segment, dominated by double balloons is estimated at ₹10 crore at 30 units. The motorized spiral enteroscopy (MSE) segment meets niche demand, as they are effective and safe in patients with major abdominal surgery, although longer procedure times are observed. A lower depth of insertion is detected in patients with gastrointestinal surgery. The Indian market for MSE in 2023 is estimated at ₹15.5 crore and 20 units.

|

Indian endoscopy devices market Major players-2023 |

|

| Segment | Leading brands |

| Flexible | Olympus, Fujifilm, Boston Scientific Corporation and Pentax |

| Rigid | Karl Storz, Stryker and Olympus; Mindray, Smith & Nephew, Richard Wolf, Arthrex and Unilab |

| Motorized spiral | Olympus |

| Balloon | Olympus (single ) & Fujifilm (double) |

| Capsule | Medtronics |

| ADI Media Research | |

The journey of capsule endoscopy in India

Capsule endoscopy (CE) is a major breakthrough technology in the field of gastrointestinal (GI) endoscopy. It was introduced in the year 2000. Since then, it has been used all over the world and is now well established, primarily in the evaluation of obscure GI bleeding. In India, we started using CE the moment it was introduced globally. Since then, it is widely available all over the country. The capsule, equipped with a high-resolution camera, travels through the digestive tract, capturing images that can enhance diagnostic accuracy and prolong battery life.

Over the years, there have been several advancements in the technology of CE. To begin with, there was only one CE system developed by the given imaging system. Currently, we have several new-generation CE systems, which are commercially available for evaluation of not only small bowel but colon and esophagus as well. The workstation has also been improvised. However, the major limitations of CE, such as nontherapeutic capability, are still there. To overcome this challenge, device-assisted enteroscopes (DAE) have been developed. So now, CE and DAE complement each other, and small bowel evaluation is no more a dark tunnel.

Additionally, the use of a spherical WCE shape has shown advantages over traditional capsule-shaped devices, allowing for easier passage and potentially benefiting patients with swallowing difficulties. Simulation experiments showed that the sphere’s velocity through the fluid was greater than the capsule’s.

From the Indian perspective, the cost of the procedure, averaging between ₹25,000 and ₹80,000 is a major challenge. Another challenge is reading time of CE without compromising the quality of the report. Artificial intelligence (AI) technology-based solutions may be applied to mitigate this challenge.

The total count of capsule endoscopy procedures performed in India was 8029 in 2022. The key segments in the India capsule endoscopy procedures market are capsule endoscopy procedures for inflammatory bowel disease (IBD), obscure gastrointestinal bleeding, Barrett’s esophagus, and for other indications. Capsule endoscopy procedures for other indications was the most performed capsule endoscopy procedures in 2022. In addition, the capsule can also be used to reconstruct 3D images.

The development of therapeutic capsule endoscope is a work in progress. India is a major technology hub and may contribute a lot in developing and designing new-generation CE system. So far, CE is an important diagnostic modality in the evaluation of obscure GI bleeding. It helps not only in the diagnosis of obscure GI bleeding, but also it acts as a guide to device-assisted enteroscopy for further therapy.

India could also explore using professional third-party endoscope repair services

Vismay Buche

Vismay Buche

Managing Director,

FBE India Pvt Ltd

Data collected for over a thousand scopes showed that the cost-of-service ratio (COSR) for a flexible scope is about 20–25 percent. Cost-of-service ratio is the cost of upkeep of a device, including spare parts and labor, divided by the procurement cost of that device, per year.

A professional third-party repair service for medical equipment is very common and easily accessible in countries like Australia, USA, or European countries. A survey conducted amongst clinical communities in India indicated that:

- Negligible professional third-party service support was available for the devices.

- Over 70 percent of the scopes are four years or older.

- A good number of existing scopes are orphaned; meaning without any support from the OEM.

- Loan scopes are provided only 70 percent of the time.

- High cost of repair.

- Turnaround time of 4–6 weeks.

Unlike other segments, where third-party repair service is common, the same was almost non-existent on professional level in India.

It is high time that the users of flexible endoscopes are provided with a quality alternate service partner. There is a dire need to provide a middle ground that can offer shorter turnaround-time, good support, and professional approach at a reasonable cost.

Many a time, customers are faced with a do-or-die situation that forces them to pay for expensive part assemblies; for example, insertion-tube assembly. If individual parts are changed rather than assemblies, the repair cost can be significantly reduced.

Another factor that plays significant role in postponing capital expenditure is by giving a lease of life to your older equipment. While the OEM’s may declare equipment obsolete, the third-party repairs can come to the rescue. The same goes when the equipment is coming out of warranty.

Important points to consider while choosing a third-party flexible endoscope service:

- Systematic well-organized workshop with proper work-flow.

- Well-trained engineers.

- Apt tools and good quality spare parts.

- Back-up scopes in case loan scope facility is to be extended and last but not the lease.

- Transparent system that allows you to have inspection done in front of you.

I would encourage the endoscopists and the hospitals to explore alternatives and use professional third-party repair services where possible to avail of the benefits.

Global market scenario

The global endoscopy devices market size was valued at USD 28.1 billion in 2022 and is expected to reach USD 44.1 billion by 2032, expand at a CAGR of 4.6 percent from 2023 to 2032. The endoscopy devices market was negatively impacted during the Covid-19 lockdown period, owing to rescheduling and delaying of procedures to minimize risks of getting exposed to Covid-19 during hospital visits. Thus, hampering the growth of the market. However, as healthcare systems adapted and the situation improved, there was a gradual recovery in the demand for endoscopic procedures. Postponed procedures were rescheduled, leading to a rebound in the market.

The endoscopic devices segment is expected to grow at the fastest CAGR during 2023 to 2030. Segmented as endoscopes, endoscopic visualization equipment, and accessories, the endoscope segment is the largest market shareholder due to the increasing number of procedures utilizing endoscopes globally for diagnosis and treatment of diseases, increasing technological advancements, and novel product launches.

Upper gastrointestinal endoscopes are the most commonly used endoscopes for the visualization of the digestive track, which is easy to insert owing to its flexibility. These endoscopes are widely utilized due to the increasing gastrointestinal disorders, such as stromal tumors. Upper endoscopy utilizes a long, thin tube with a light on the end. Endoscopic ultrasound also uses an endoscope with an ultrasound probe on the scope’s tip. The ultrasound probe utilizes sound waves to provide pictures of the tumor and its size.

The growing number of regulatory approvals, technological advancements, product launches, and research with clinical trial studies drives growth. For instance, Fujifilm Healthcare Americas Corporation announced its dual-channel endoscope, El-740D/S’s launch. EI-740D/S of Fujifilm is the first dual-channel endoscope receiving clearance from FDA for upper and lower gastrointestinal applications. The endoscope provides high imaging quality and features 3.7 mm and 3.2 mm dual-channel diameters, enabling usage of a range of endo-therapy devices.

Geographical analysis

North America holds the largest market share in the global endoscopy devices market. This is primarily due to its excellent medical infrastructure, and high-income levels. The market is expected to grow at a relatively moderate pace due to healthcare expenditure in the US.

Moreover, the growing number of product launches is responsible for the market’s growth. Many key developments, technological advancements, collaborations, and agreements are taking place in this region. In May 2022, Medtronic plc announced about completely acquiring the Intersect ENT. This acquisition will help in expansion of comprehensive portfolio of ear, nose, and throat of the company with innovative products utilized in sinus procedures for improving post-operative outcomes and treatment of nasal polyps.

In addition, investments from private and public organizations are also fuelling the market growth over the forecast period.

The growth of the endoscopy devices market is being constrained by the substantial costs linked to endoscopic procedures. These high costs serve as a barrier to the widespread adoption of endoscopy devices and hinder market expansion. Moreover, the availability of alternative diagnostic and treatment options presents an additional obstacle to market growth. The scarcity of skilled professionals, capable of operating the devices, interpreting results, and performing procedures safely, is also a notable challenge. Furthermore, concerns regarding infection transmission, a stringent regulatory environment, and limited access to endoscopy devices in certain countries further impede the growth rate of the market.

New innovations flourish the market

The advancements in procedures and emerging technologies are making drastic changes in treatment processes.

The use of ancillary equipment and new colonoscopes is intended to improve the detection of adenomas, especially by facilitating the identification of lesions hidden behind the folds or bends of the colon. With the same objective of improving the lesion detection rate, new colonoscopes have appeared on the market. However, these endoscopes are not commonly available and more clinical studies evaluating their real benefit are still needed.

The level of integrated technology into endoscopic imaging systems is already high. Besides the cutting-edge systems, nearly all providers offer less costly workhorses for daily routine or in-office applications. Nevertheless, there is a clear trend to higher pixel numbers in imaging, similar to the non-medical market. Some providers already offer 4K imaging and visualization in their high-end systems. On the other hand, the trend of minimization and integration will go on, leading to more multifunctional endoscopes with improved performance. This covers a larger focus range, zoom factors, and light options or ends up in a cost reduction or smaller diameters for these devices. 3D imaging has not made its way to broad standard applications and is reserved for distinct procedures like robotic surgeries.

Another trend already seen in first applications is advanced post-processing of the images. This can be used to correct motion, blurring, or reduce image interferences caused by smoke in the field of view or pixel defects.

The digitization and storage of diagnostic data like endoscopic images allow objective evaluation of changes over time. For example, lesions can be described and classified in a first diagnosis, and disease progression can be detected and calculated automatically in later examinations. In the near future, more and more health records will be collected over patients’ lifetimes and merged into a patient individual database and model. Even though this option counts for all digitized patient records, endoscopy, as one of the most used imaging modalities, is pioneering this trail to the digital patient, including prediction and prevention.

For some applications, external navigation is beneficial, for example, in orthopedics, neurosurgery, and ENT procedures. This opens up the option for registration to prior-acquired datasets (CT, MRI), image overlay, and virtual endoscopy to improve the identification of targets and risk structures. However, due to the effort in setting up navigation before the procedure, the application is limited and did not find its way into a routine clinical application.

For mobile use, in-office use, or in combination with tiny endoscopes, wireless camera systems and light sources are available. The missing cables provide more freedom to operate. Nevertheless, image resolution and performance are not comparable to wire- driven systems.

Single-use endoscopes are fast gaining popularity. A single-use can reduce the risk of infections or cross-contamination. Another advantage is avoiding the time-consuming and costly sterilization procedure, maintenance, and repairs needed for multi-use systems. Single-use endoscopes are significantly cheaper than traditional scopes. The camera and LED-based light source are integrated into the tip. The systems can be connected to a multi-use monitor. Depending on the application and size, HD quality is available. The manufacturers promise similar performance like multi-use scopes.

A research team out of the Center for Molecular Spectroscopy and Dynamics (CMSD) within South Korea’s Institute for Basic Science (IBS) has developed a high-resolution holographic endoscope system, which could revolutionize non-invasive imaging of internal bodily structures. The new Fourier holographic endoscopy system’s probe has a 350-µm diameter, smaller than a hypodermic needle, but still acquires high-contrast images more easily than ever before and potentially makes it possible for high-resolution imaging of previously unobservable areas like the bronchioles.

The new IBS study, led by CMSD Associate Director Choi Wonshik, produced the high-resolution holographic endoscope system, which reconstructs high-resolution images without adding lenses or other equipment to the fiber bundle’s distal end. This results in the small diameter (350 µm) of the probe. The device measures light waves reflected from the system that are then captured by the fibers.

Through their creation of a special coherent image optimization algorithm, the research team was able to remove fiber-induced phase retardations and allow for reconstruction of the microscopic-resolution images. This is what enables high-resolution results despite the small fiber size. Testing in mice villi achieved high-resolution and multi-depth 3D images despite the very low reflectivity of the tissue.

A great potential for the future of endoscopy lies in the study’s results, according to its researchers, who believe this new tool will offer patients a minimally invasive option with virtually no discomfort, possibly allow for direct observation of previously unobservable cavities like micro vessels, and even have applications in other fields.

A novel endoscopic image-guided laser treatment system has been developed, capable of accessing narrow organs with a thin tip. It employs a single fiber bundle to acquire endoscopic images and modulate laser irradiation simultaneously. Demonstrations on an artificial vascular model exhibited accurate laser targeting within a root-mean-square error of 28 µm, with static repeatability within a 12 µm dispersion radius. Measures were implemented to reduce unintended irradiation due to fiber bundle crosstalk. The system effectively controlled photothermal effects, vaporization, and coagulation in chicken liver tissue. It enables minimally invasive laser treatment with high lesion-selectivity in narrow organs like the peripheral lung and coronary arteries.

One of the promising imaging technologies on the horizon is hyperspectral imaging. For endoscopic diagnostics, it is a technology still under research. However, it allows the recording and analysis of spatial and spectral information. In addition, the light-tissue interaction, such as absorption, scattering, or fluorescence contains information about morphological and biochemical processes, and can help to improve diagnostic accuracy.

Many research works are published on advanced endomicroscopy, such as confocal microscopy, multiphoton microscopy, and optical coherence tomography. These methods use laser light to scan superficial tissue layers at a depth of 0–3 mm on a microscopic level and show great potential for non-invasive early cancer detection. Therefore, laser light with a small focus spot follows a scanning pattern sweeping over the tissue of interest. For OCT, the scattering of the tissue in comparison to a reference signal is measured.

Multiphoton imaging uses short, intense laser pulses to create fluorescence of the anatomic structures. Systems for advanced endomicroscopy are expensive and are not seen in the clinical routine for endoscopic applications now.

Endoscopic biopsy is a minimally invasive procedure, where a fiber-optic endoscope is used to examine organs and collect tissue samples for analysis. It can be performed through natural body openings or small incisions, and various companies, including technology vendors, established medical devices companies, and start-ups, are actively involved in its development and application.

According to GlobalData, there are 60 companies, spanning technology vendors, established medical devices companies, and up-and-coming start-ups engaged in the development and application of endoscopic biopsy. Johnson & Johnson is one of the leading patent filers in the field of endoscopic biopsy. Some other key patent filers in the field include Waters, Medtronic, Olympus, and Boston Scientific.

Mobile endoscopic workstations market is growing with the increasing prevalence of gastrointestinal diseases, pulmonary disorder, which require a minimally invasive surgical procedure. The LCD monitor arm enables manipulation of the monitor that allows the operator to optimize the viewing angle and position with integrated gas spring and tensioned joints for improved functionality and reduced user strain. Even all the devices in mobile endoscopic workstations are controlled by a central switch. In addition clip-in accessories are provided for cable holders to clip on to a water bottle.

In order to support CO2 insufflation in medical endoscopy, various sizes of gas bottle holder are present in the mobile endoscopic workstation. Mobile endoscopic workstations continue to advance, perhaps most noticeably with the increasing miniaturization of light source and video processing technology.

Mobile endoscopic workstations market is also expected to rise due to high adoption of technologically advanced workstations in medical facilities for easy access to other endoscopic instruments. Colonoscopes, gastrointestinal endoscopes, enteroscopes, bronchoscopes, cystoscopes, and laparoscopes are available as mobile endoscopic workstations.

Some of the players in mobile endoscopic workstations market include Aesculap, Inc., ARC Group of Companies Inc., Armstrong Medical Inc., Cura Carts, Ecleris S.R.L., Electro Kinetic Technologies, Elmed Electronics & Medical Industry & Trade Inc., EMOS Technology Gmbh, ENDO-TECHNIK W. Griesat, Olympus, SonoScape Medical Corp., GIMMI, Maxerendoscopy, HAEBERLE, Optomic, and others.

In addition to cutting-edge systems, most providers also offer cost-effective options that are suitable for daily routine or in-office applications.

Prominent players in the endoscopy devices and equipment market are incorporating three key technologies to enhance the efficiency of their devices and equipment:

3D imaging technology is being incorporated into endoscopy devices and equipment market , which allows for more detailed and accurate visualization of the area being examined.

Advanced robotics technology is being incorporated into endoscopy devices and equipment market, allowing for greater precision and control during procedures. Robotic endoscopes can also be remotely controlled, which can improve access to difficult-to-reach areas of the body.

In the endoscopy devices and equipment market, there is a growing trend among companies to develop endoscopy robotic systems, primarily due to their enhanced flexibility and effectiveness, when compared to conventional endoscopy devices. These robotic endoscopy devices offer a range of advantages, including overcoming challenges in therapeutic endoscopy, expanding the visual and operational capabilities of endoscopy, reducing labor intensity, improving communication, extending reach and vision, enhancing control, and enabling efficient endoscopic procedures.

The future of endoscopic imaging is digital and interconnected. The utilized electronics will improve in size and performance, and new technologies will be implemented.

Endoscopic imaging aims to acquire meaningful data, store and process this data for better presentation, and collect and connect data for automatized and comprehensive context evaluation. The permanent improvement of technical equipment in hospitals and practices combined with assistance systems will improve early detection and reduce the need for more extensive interventions. With the vision of the digital patient model in mind, endoscopy can provide digital and evaluable data for diagnosis and therapy, and also for monitoring. Technologies to document the procedures and for mapping the diagnostics on the digital patient model would be of interest to apply the full power of the upcoming AI in diagnostics and prevention.

Second Opinion:-

Role of endoscopy in bariatric surgery patients.

Endoscopic innovations – Exploring the latest technologies in medical imaging.