Endoscopy Equipment

OT tables and lights see an epochal shift

With the transition from traditional operating theaters to state-of-the-art surgical facilities and the Make in India initiative gathering momentum, the OT tables and OT lights segment is undergoing a profound transformation.

In the ever-evolving realm of healthcare, there exists a profound transformation – a journey from the familiar confines of traditional operating theaters to the forefront of surgical innovation. This transition signifies an epochal shift, underpinned by the relentless integration of cutting-edge technology.

The integration of technology in operating rooms represents a significant leap forward in modern healthcare. It is not just about introducing gadgets into the surgical space; it is about enhancing safety, precision, efficiency, and ultimately, patient outcomes. Technology and ergonomics go hand in hand to create a seamless, efficient, and safe environment for both medical professionals and patients.

It is a journey that promises not only enhanced surgical precision but, more crucially, a fundamental improvement in patient outcomes, directly impacting the OT tables and OT lights segment.

Indian market dynamics

The OT tables and lights segment has been hugely impacted by the government’s Make in India initiative. The market is now being catered to by a handful of foreign brands, many having either exited the Indian market or added a couple of low-end basic models, not necessarily being manufactured in their Western manufacturing facilities. That said, the discerning customer continues to opt for the high-end models, AIIMS being a good example. Also, these brands are exploring the possibility of setting up facilities in India.

The Indian marginal players had exited in the Covid period and switched to other products. And the other larger Indian brands as Magnatek and regional brands as Palakkad and Staan are now offering high-end tables too, and have reported value growth in 2022 and 2023.

The Chinese brands have not been able to make a major dent in this segment in India. That said, Mindray continues to see traction for these products commanding good prices.

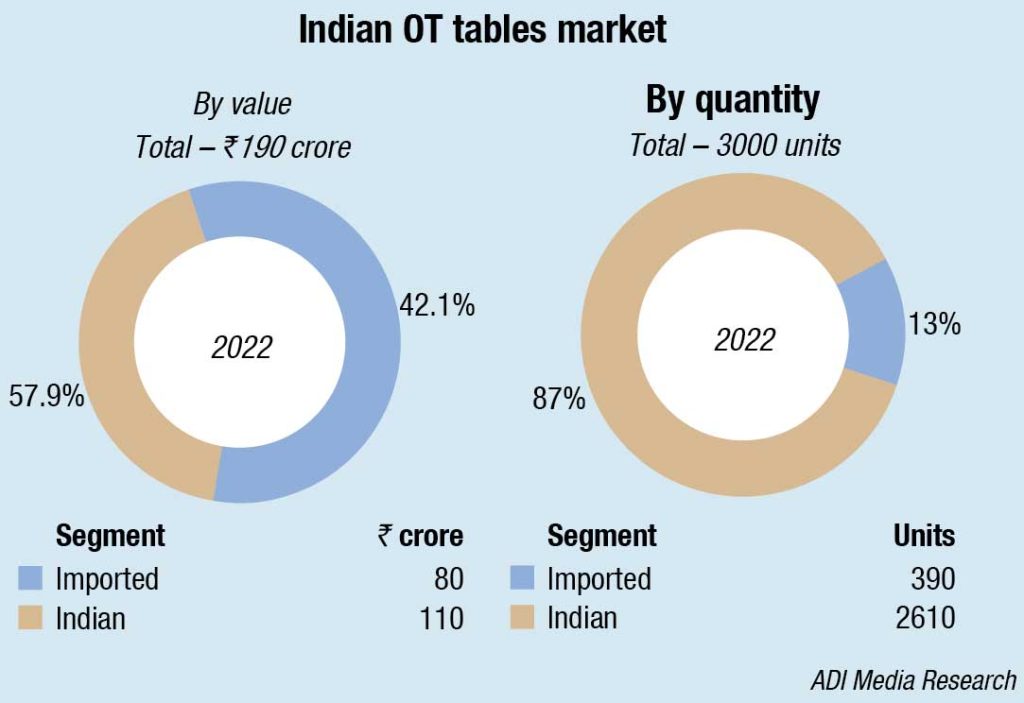

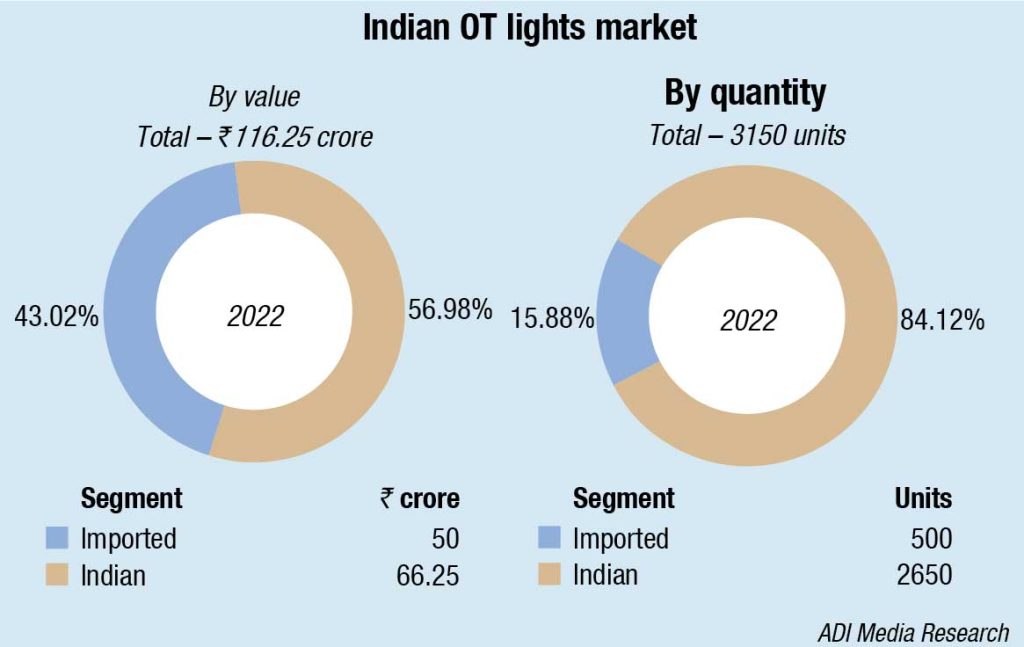

The market for imported OT tables in 2022 is estimated at ₹80 crore and 390 units, and for Indian OT tables ₹110 crore and 2610 units, displaying a steady increase in the share of the Indian tables. In line with the same trend, the market for imported OT lights in 2022 is estimated at ₹50 crore and 500 units, and for Indian OT lights as ₹66.25 crore and 2650 units.

With new hospitals, and particularly high-end operation theaters in the offing, the Indian market for OT tables and lights is expected to go north over the next couple of years.

Global market scenario

OT tables

The utilization of operating tables traces its roots to ancient civilizations, wherein rudimentary surgical tools and techniques were employed for the treatment of injuries and illnesses. Over the course of history, the continual evolution of medical technologies and advancements has given rise to the development of sophisticated and specialized operating tables.

Within the realm of the healthcare industry, operating tables play a pivotal role in furnishing a steadfast and secure platform conducive to surgical procedures. Meticulously engineered to cater to the distinct requirements of both patients and surgical teams, these tables boast features, such as adjustable height, multi-positioning capabilities, and seamless integration with medical equipment.

Operating tables find indispensable applications in various healthcare settings, particularly in hospitals, where they facilitate a diverse array of surgical procedures. These encompass, but are not limited to, general surgery, orthopedic surgery, and neurological surgery. As a cornerstone piece of equipment in the operating room, these tables deliver a stable and secure foundation, essential for the successful execution of surgical interventions.

The global surgical tables market is estimated at USD 1.2 billion in 2022. It is expected to reach USD 1.72 billion by 2032, growing at a CAGR of 3.7 percent. The increasing number of surgeries due to rising cases of trauma and injuries across the globe, adoption of advanced surgical tables by various hospitals and healthcare facilities for improved surgical experience for patients as well as surgeons, and complex procedures performed in the operating room require surgical tables to handle various positions, thereby driving the global OT tables market.

In addition, the increasing aging population across the globe creates high demand for surgical tables. According to the data released by the World Health Organization (WHO), the number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050. Moreover, the rising volume of orthopedic and bariatric surgeries across the globe is leading to a surge in demand for surgical tables.

The biggest hindrance to the market is the lack of skilled professional personnel to operate state-of-the-art surgical tables. Additionally, the high price of composite surgical tables makes it difficult to find market demand in less developed economies.

By product, the general surgical table sub-segment is expected to dominate the global surgical table market by 2031, which can be attributed to the growing utilization of these tables due to their ergonomic design, cutting-edge technologies, and safety provisions that protect patients during surgery. In terms of product type, the powered sub-segment is anticipated to hold the largest market share by 2031, given the flexibility and maneuverability, provided by powered surgical tables, and their escalating demand in healthcare facilities globally.

OT tables and lights – A vital investment in healthcare facility efficiency

M Arun Prasath

M Arun Prasath

Product Manager,

Patient Monitoring Life Support & Surgical Unit, Mindray India

The operation theater (OT) complex holds immense significance within a hospital, which requires substantial investment in costly infrastructure. The effective utilization of OT is critical to optimizing returns on investments and successful patient outcomes.

OT tables and lights are pivotal in maximizing the financial performance of hospitals and diagnostic centers. These essential pieces of medical equipment are not just about comfort and convenience but are also strategic tools that directly impact workflow efficiency.

Role of OT tables in surgical efficiency

OT tables, when designed with precision and functionality, contribute significantly to the seamless execution of surgeries. Swift patient positioning is a hallmark of well-designed OT tables, allowing medical professionals to focus on the task at hand rather than grappling with cumbersome equipment. This, in turn, minimizes surgical time and reduces the risk of complications. Additionally, modern OT tables are equipped with safety features that protect patients and healthcare personnel from injuries.

Impact of high-quality lighting technology

The quality of lighting technology in the operating room is a critical factor in ensuring the success of medical procedures. Advanced lighting systems provide surgeons with optimal visibility, reducing the likelihood of errors and improving overall precision. High-quality lighting systems also minimize eye strain and fatigue, contributing to the overall efficiency of surgical teams. When coupled with state-of-the-art OT tables, the synergy created can lead to a substantial increase in the number of surgeries conducted.

Mindray’s Hyled C Series OT lights contribute to operational efficiency beyond the operating room.

With adjustable light settings like variable color temperature and adaptive controls, these lights allow for seamless customization according to different surgical requirements. The adaptability translates into time savings, allowing hospitals to accommodate more procedures, ultimately, maximizing revenue streams.

Outlook

The investment in high-quality OT tables and lighting systems is not merely an expense but rather a strategic decision that can significantly improve the financial performance of hospitals and diagnostic centers. By optimizing surgical workflow and enhancing patient outcomes, healthcare facilities can achieve greater efficiency, maximize revenue, and establish themselves as leaders in the healthcare industry.

The metal segment that accounted for the largest revenue share of 51.1 percent in 2022, when compared to the composite tables due to their easy availability and low cost, is anticipated to grow at the fastest rate in coming years. Moreover, they are affordable and anti-microbial properties for healthcare equipment and operating room are also propelling the segment growth.

The powered segment accounted for the largest revenue share of 67.7 percent in 2022. Powered surgical tables are often battery-operated, reducing the need for electrical cords on the floor; therefore, powered surgical tables are predicted to boost segment growth.

North America generated the highest revenue in surgical tables market with 35.4 percent share in 2022. This can be attributed to the aging population, the prevalence of chronic diseases, and advancements in surgical techniques. The increasing number of surgeries drives the demand for surgical tables in both hospitals and ambulatory surgical centers.

Asia-Pacific region is projected to witness rapid growth with 6.8 percent CAGR as a result of rising disposable income, along with the presence of a large patient pool in China and India, which are the factors driving the market in the region. Moreover, the increasing healthcare expenditure in China and Japan is expected to drive the product demand.

The latest released mobile operating tables market is anticipated to grow at a faster pace due to the increasing number of hospitals with well-equipped infrastructure, rise in the number of surgical procedures and the disposable income are some of the major factors driving the growth of this market. The mobile operating table market size is estimated to increase by USD 1.19 billion at a CAGR of 5.2 percent by 2029.

Some of the leading companies in the surgical table industry include Hill-Rom Holdings, Inc., Steris Plc., Stryker Corp., Getinge AB, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Mizuhok Corporation (Mizuho OSI, Inc.), Skytron LLC, Alvo Medical, and Allengers Medical Systems Ltd.

|

Major players in Indian OT tables market |

|

| Imported Tier 1 | Getinge, Steris, Stryker, Magnatek, and Mindray |

| Imported Tier 2 | BenQ (Bet Medical), Trumpf, Mediland |

| Imported Others | Mizuho, Scharer, Takeuchi, Schmitz, and Medifa |

| Indigenous | Cognate, Galaxy, Magnatek, Midmark, Pallakad, Staan, and many other regional players |

| ADI Media Research | |

OT lights

Surgical lighting was first introduced in the mid-1850s, approximately 8000 years after the earliest forms of surgery. At the turn of the 20th century, the initial form of lighting was the filament bulb, which presented with issues concerning a lack of illumination and later in 1960s they were replaced with halogen bulbs as being a more luminescent alternative, and having been patented 70 years ago. In the 1990s, halogen lamps were replaced by light-emitting diodes (LEDs) as they allowed for heat reduction, reduced energy consumption, increased durability, and compact design.

The surgical lights market has been steadily growing over the past few years, driven by technological advancements, rising demand for minimally invasive surgeries, and an increase in the number of surgical procedures being performed. The global operating lights market was worth USD 3179.09 million in 2022. It is expected to reach USD 4624.84 million by 2031, growing at a CAGR of 4.03 percent.

The surgical lights market is expected to continue growing in the coming years, driven by technological advancements, rising demand for minimally invasive surgeries, and an increase in the number of surgical procedures being performed. LED surgical lights are expected to remain the most widely used type of surgical lights due to their energy efficiency, durability, and color temperature control.

The adoption of LED lights in the surgical light market may be accelerated by efforts to address the cost barrier through technological improvements, cost-cutting measures, and enhanced market competitiveness.

In spite of the tremendous technological advancements in surgical lights, it has certain disadvantages, which are likely to hamper the market growth. LED lights are expensive when furnishing a new setting or facility on a tighter budget, even though they provide long-term value. Routine inspections are also necessary to check the performance of LEDs and ensure that all LED bulbs deliver the right amount of light for the demands of operating rooms.

|

Major players in Indian OT lights market |

|

| Imported Tier 1 | Dr Mach, Getinge, Vivid (BenQ), and Draeger |

| Imported Tier 2 | Steris, KLS Martin, Simeon, Stryker, Magnatek, and Mindray |

| Imported Others | Brandon among some small Chinese brands |

| Indigenous Tier 1 | Bharat Surgicals and United Surgicals |

| Indigenous Tier 2 | Matrix, Cognate, Staan, Confident Dental, Technomed, and Galaxy |

| Indigenous Others | Many small Indian unorganized manufacturers mainly in Delhi, Bhiwani, and southern Indian states |

| ADI Media Research | |

Another issue is sterility. Repetitive manual repositioning of surgical light handles can compromise sterility in the operating room. Sterile light handles are designed to minimize the risk, but studies have shown that they can still contribute to surgical site infections (SSIs). In one study, 36 surgical handles were screened for bacterial contamination and cultured for ten days. 50 percent of cultures were positive for bacterial presence, including S. Epidermidis and S. Aureus. SSIs are a significant concern as they are the second-most common hospital-acquired infection and can lead to post-operative complications, including mortality.

Extended exposure to surgical lighting in the operating room poses health concerns for OR staff, especially in terms of eye strain. This occupational hazard can lead to symptoms, such as headaches, blurred vision, and reduced concentration.

Automated lighting

To overcome such issues, automated lighting is a logical solution in which lighting system could be automatically operated by the surgeon or team, allowing for greater sterility and swifter transitions of light repositioning. Some technical approaches used in automated lighting system:

Artificial intelligence (AI) plays a crucial role in various aspects of surgery, including robotics, pre-operative planning, and remote procedures. However, the application of AI in surgical lighting has been relatively overlooked. AI can enhance surgical lighting by utilizing tissue feature tracking algorithms, which adapt lighting to the specific tissue characteristics. For example, when operating on anatomically diverse areas, the AI system can automatically adjust lighting for optimal visibility without manual intervention. While successful tissue tracking algorithms exist for larger structures, implementing them in operating microscopes (OMs) with higher precision requirements presents challenges.

The integration of 3D tracking systems, such as the Microsoft Kinect in surgical lighting holds promise for enhancing the precision and automation of lighting adjustments in the operating room. The Microsoft Kinect’s ability to calculate segment position and 3D joint angles is valuable in determining the surgeon’s position and the optimal lighting angle required at the surgical site. Multiple Kinect sensors can track the surgeon’s movements and triangulate them with the static surgical site, offering an opportunity to automate lighting adjustments based on the surgeon’s actions. This approach can be achieved through physical gestures that represent different lighting settings, allowing for more efficient control.

While this technology shows promise, it currently relies on the user’s experience and familiarity with the system, which can affect its effectiveness during surgery.

Utilizing thermal imaging for tracking in the surgical setting has been considered due to the static nature of the surgical site. Thermal imaging offers the advantage of differentiating areas of the surgical site, based on thermal radiation levels. When combined with 3D tracking algorithms, thermal imaging can locate the surgical site in 3D space, automatically adjusting the camera’s focus and lighting angle as needed. This approach reduces the need for external devices near the patient, lowering the risk of surgical site infections and reducing physical strain on surgeons caused by headlight use. However, the current drawback is the relatively higher cost of thermal cameras compared to traditional operating room lighting.

Regional highlights

The North American surgical lighting system market dominates the rest of the globe and is estimated to exhibit a CAGR of 3.8 percent. The key factors in this region are technological developments and well-established competence in specific therapies for diseases like cancer and neurological problems. Another factor that draws the attention of medical tourists to North America is their perception of the excellent quality of medical care, cutting-edge technology, and medical service competence.

The European market is estimated to exhibit a CAGR of 4.5 percent and is attracting more medical tourists due to well-established healthcare systems. Increased government focus on developing healthcare infrastructure and countries like France and Germany, offering specialized medical treatments supported by cutting-edge technology, are attracting many patients seeking brain and spinal procedures, valve replacements, and heart bypass surgery. In addition, specialized services are available in Europe at far lower prices than in North America, which also draws several medical tourists to Europe, increasing the need for surgical lights in this region.

Major players in the surgical lights global market are Steris plc., A-dec Inc., BihlerMED, CV Medical, Skytron, Herbert Waldmann GmbH & Co., Getinge AB, Hill-Rom Services, and S.I.M.E.O.N. Medical GmbH & Co. KG.

Outlook

The integration of advanced technologies has revolutionized surgical precision, patient outcomes, and the overall healthcare landscape. From the use of robotics and artificial intelligence to the advancements in surgical lighting and telemedicine, these innovations have ushered in a new era of healthcare. As technology continues to advance, the synergy between medicine and technology promises a brighter and healthier future for all.